In a holiday shortened week there was still plenty of action for us with an exit signal, an addition, and some raised stops, as individual stocks continued to blaze their own trail while the broader market faltered.

Our Marketfy portfolio climbed 0.4% on the week vs a 0.9% decline for the S&P. We're now +11.3% YTD vs +2.4% for the S&P.

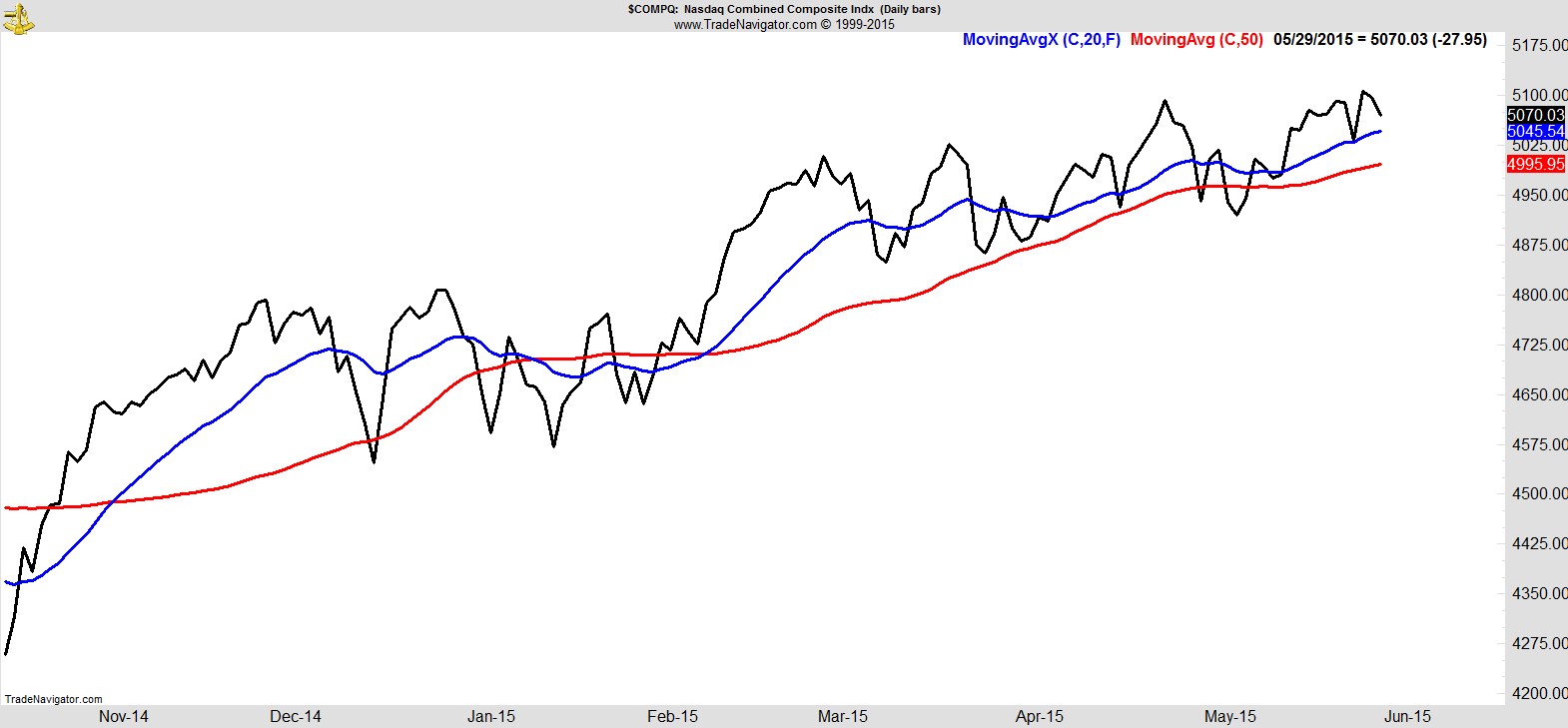

The story of the market for me this week was the continued leadership in technology and healthcare names, which helped propel the NASDAQ to a fresh all time high close on Wednesday.

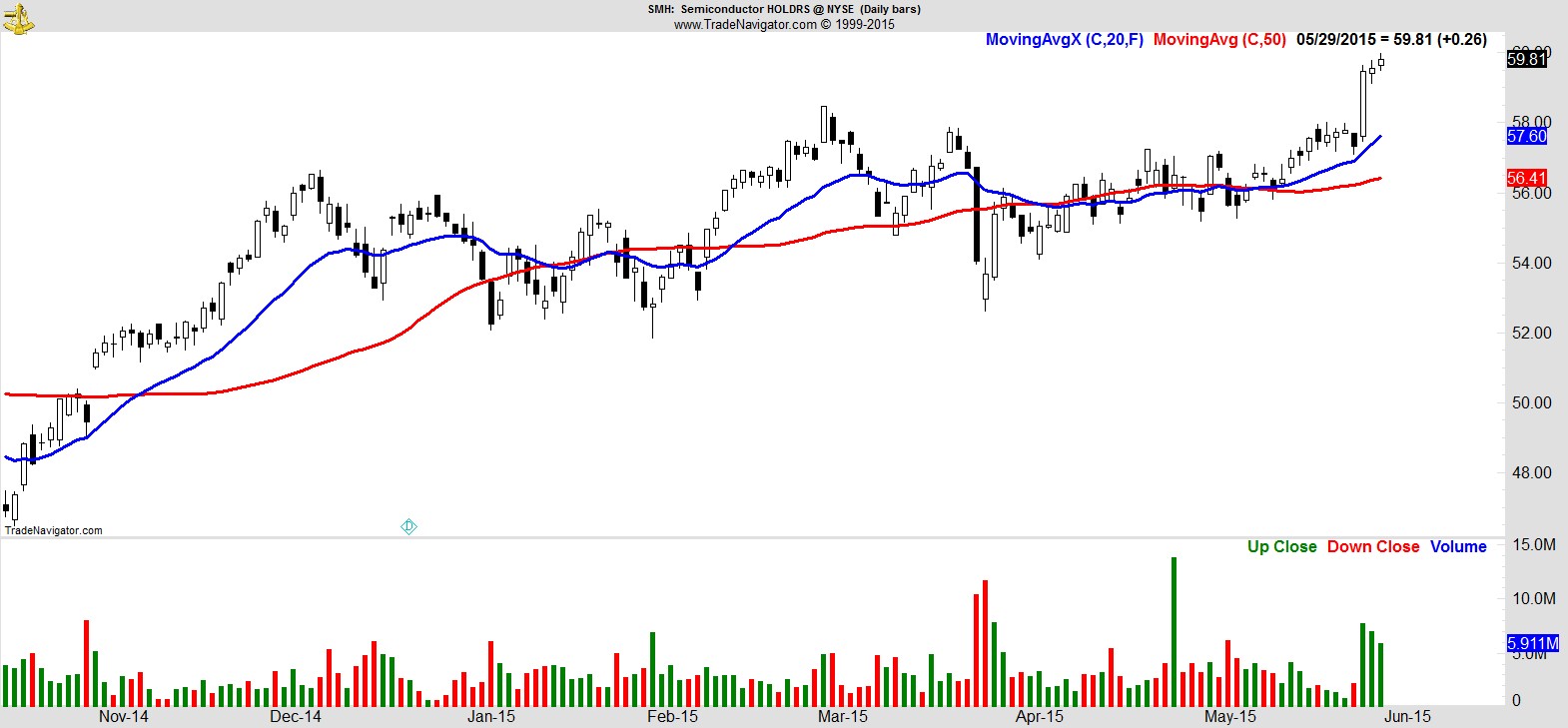

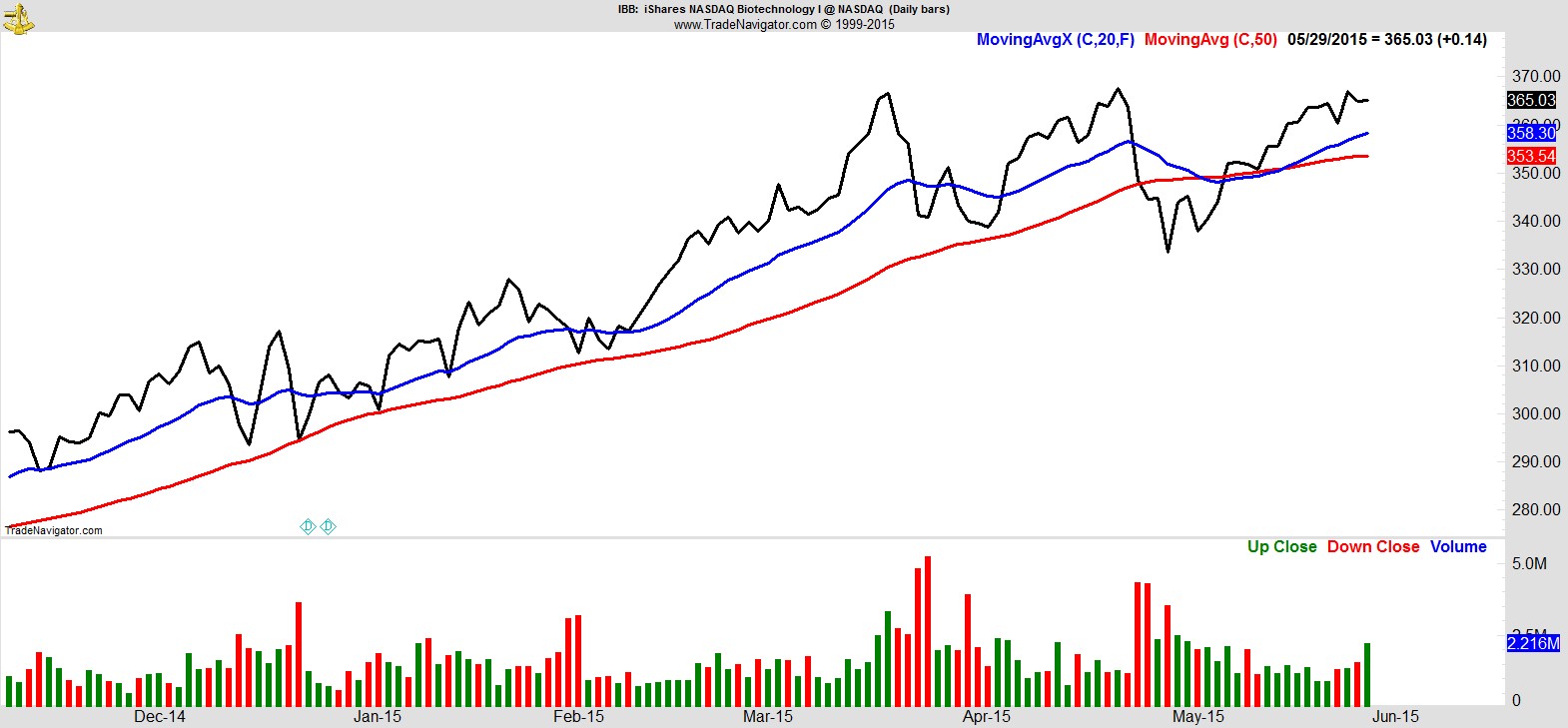

Technology and healthcare now account for 60% of our portfolio names. Specifically, within that space the real standouts this week were the semiconductor and biotech sectors, shown here via $SMH and $IBB.

.

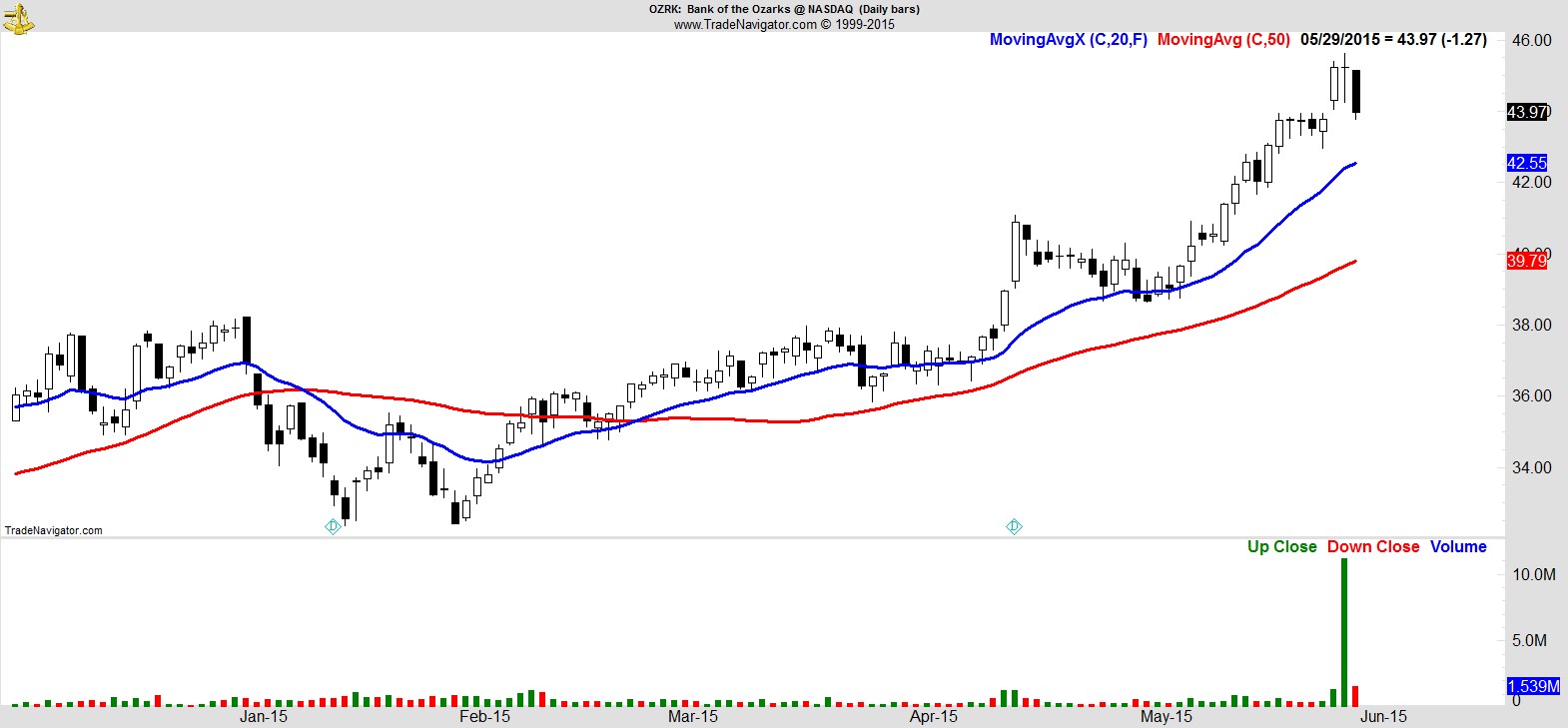

Not much has changed this week in our watchlist, as healthcare and technology continue to dominate, with consumer discretionary not far behind. Financials faded a little as did Materials, but they still show more strongly than Industrials which sank below their 50-day MA. Here's 12 of the 30 names:-

$OZRK

.

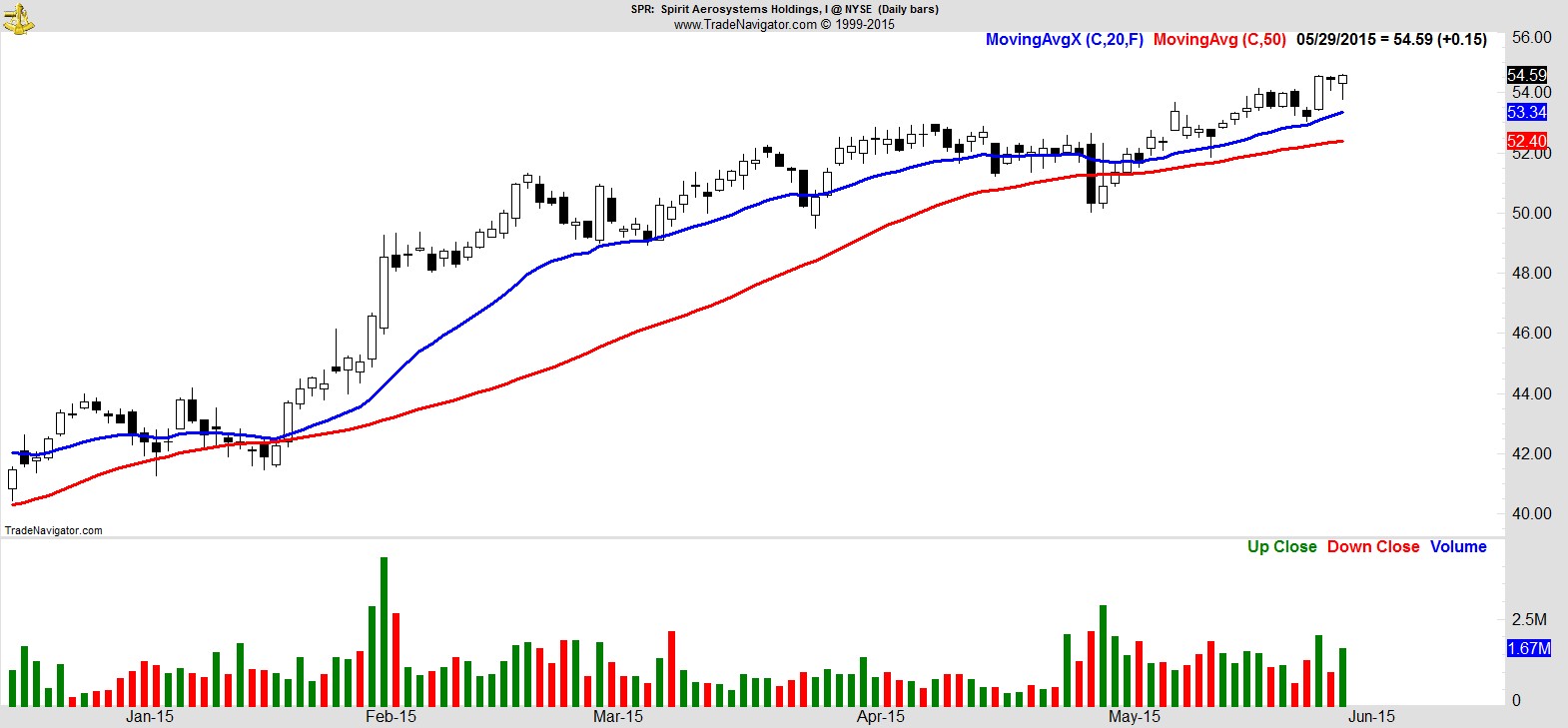

$SPR

.

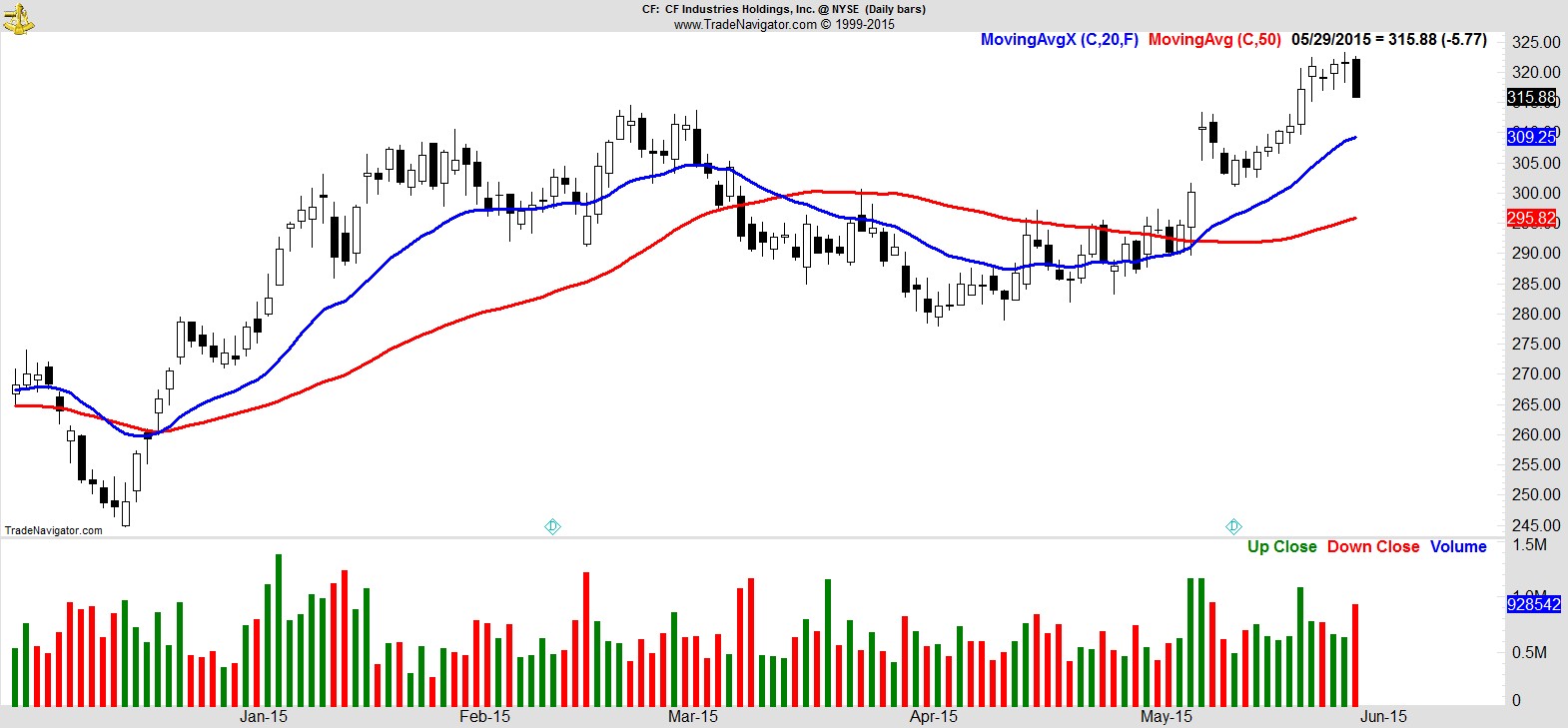

$CF

.

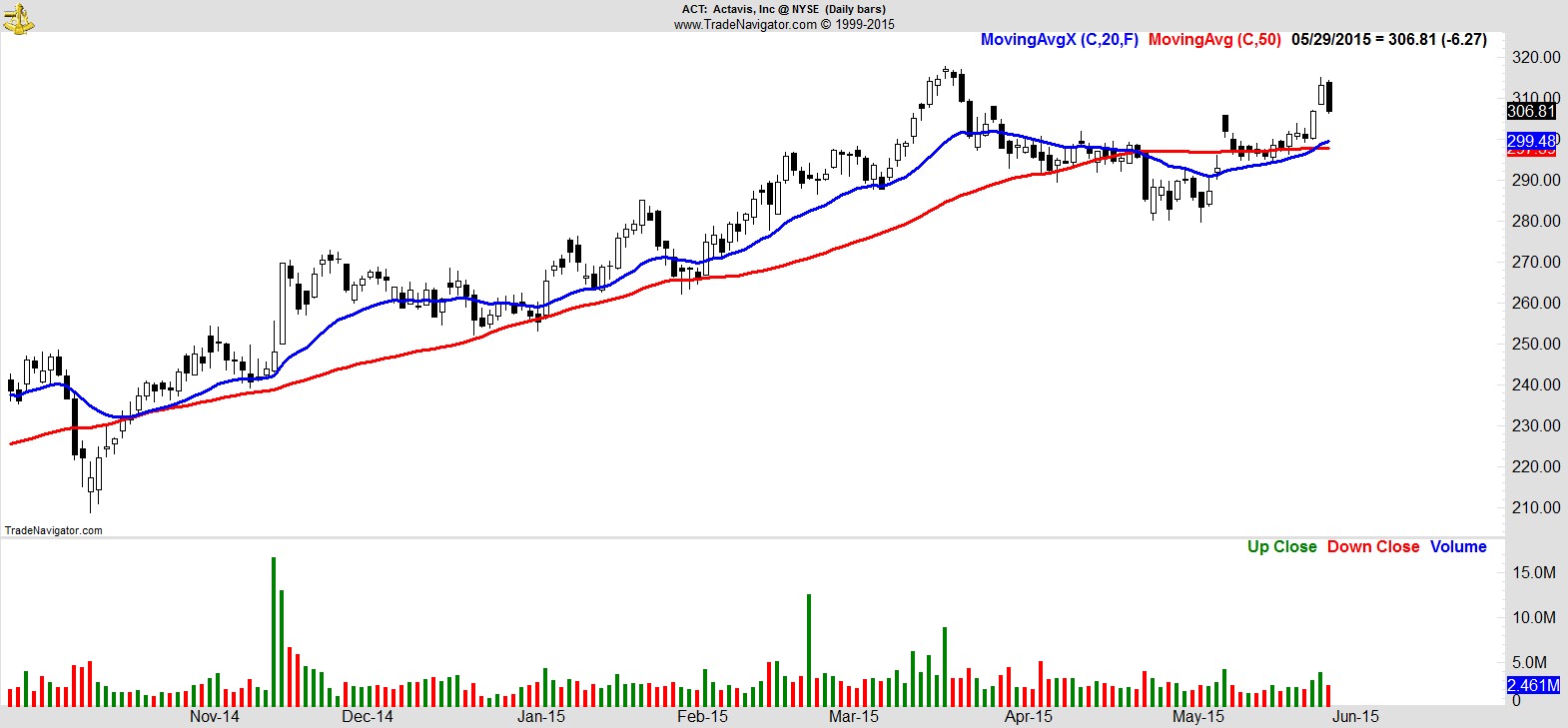

$ACT

.

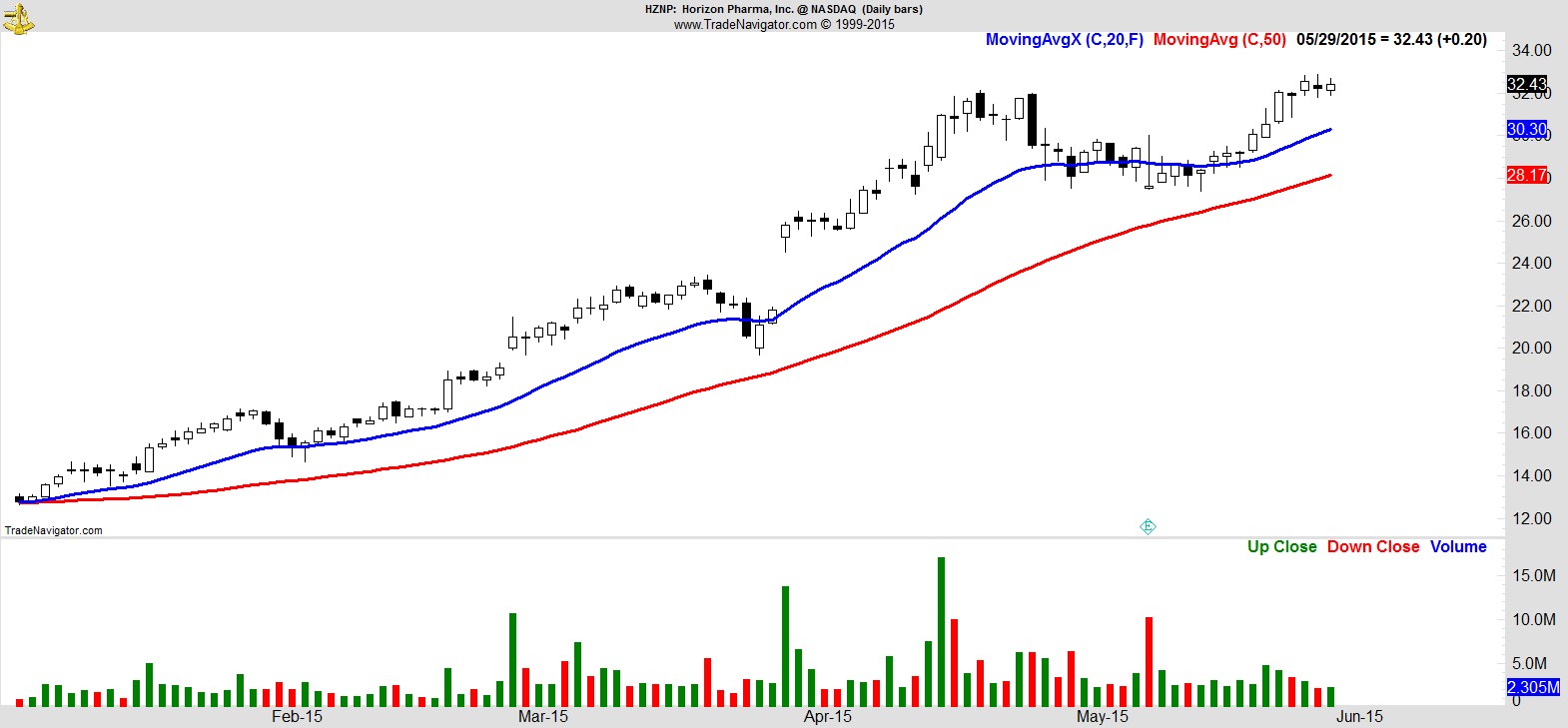

$HZNP

.

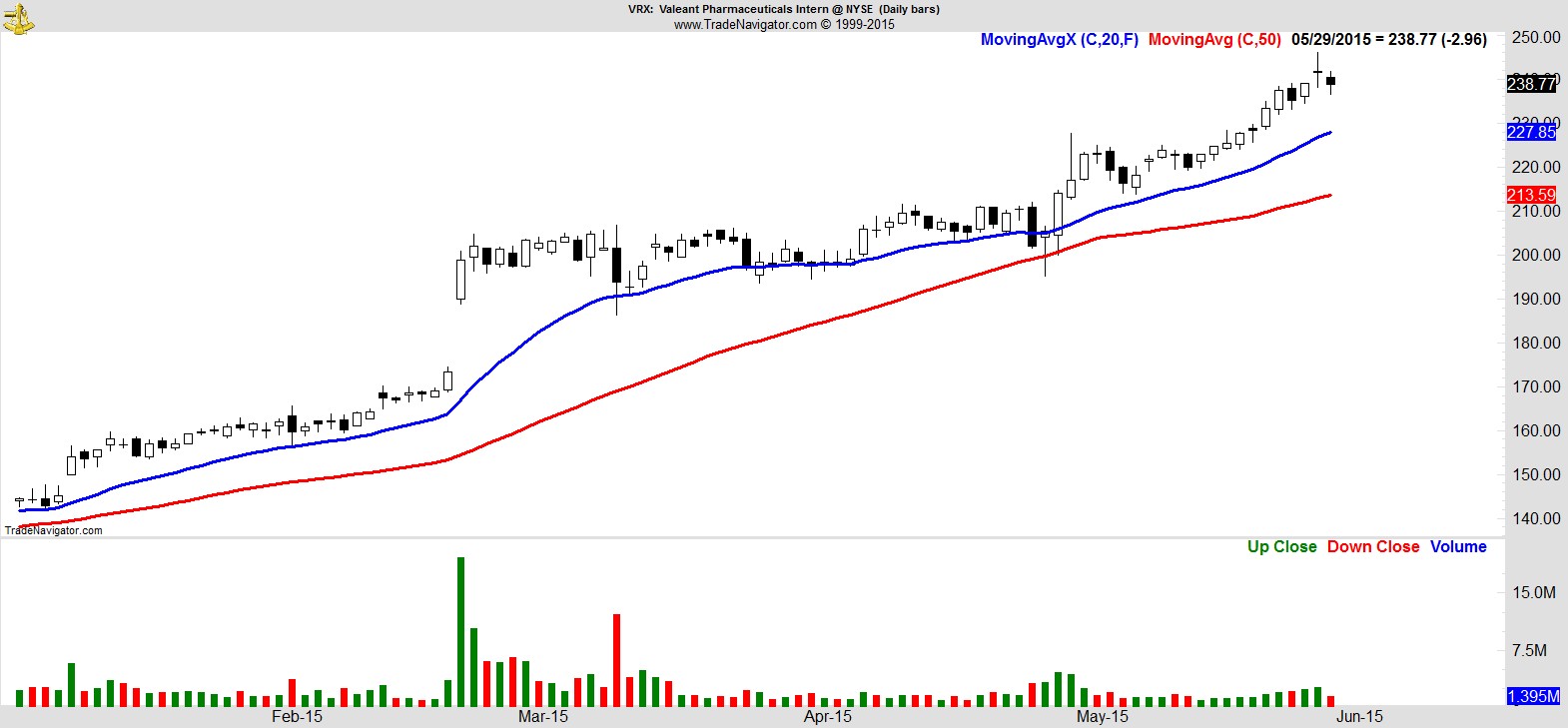

$VRX

.

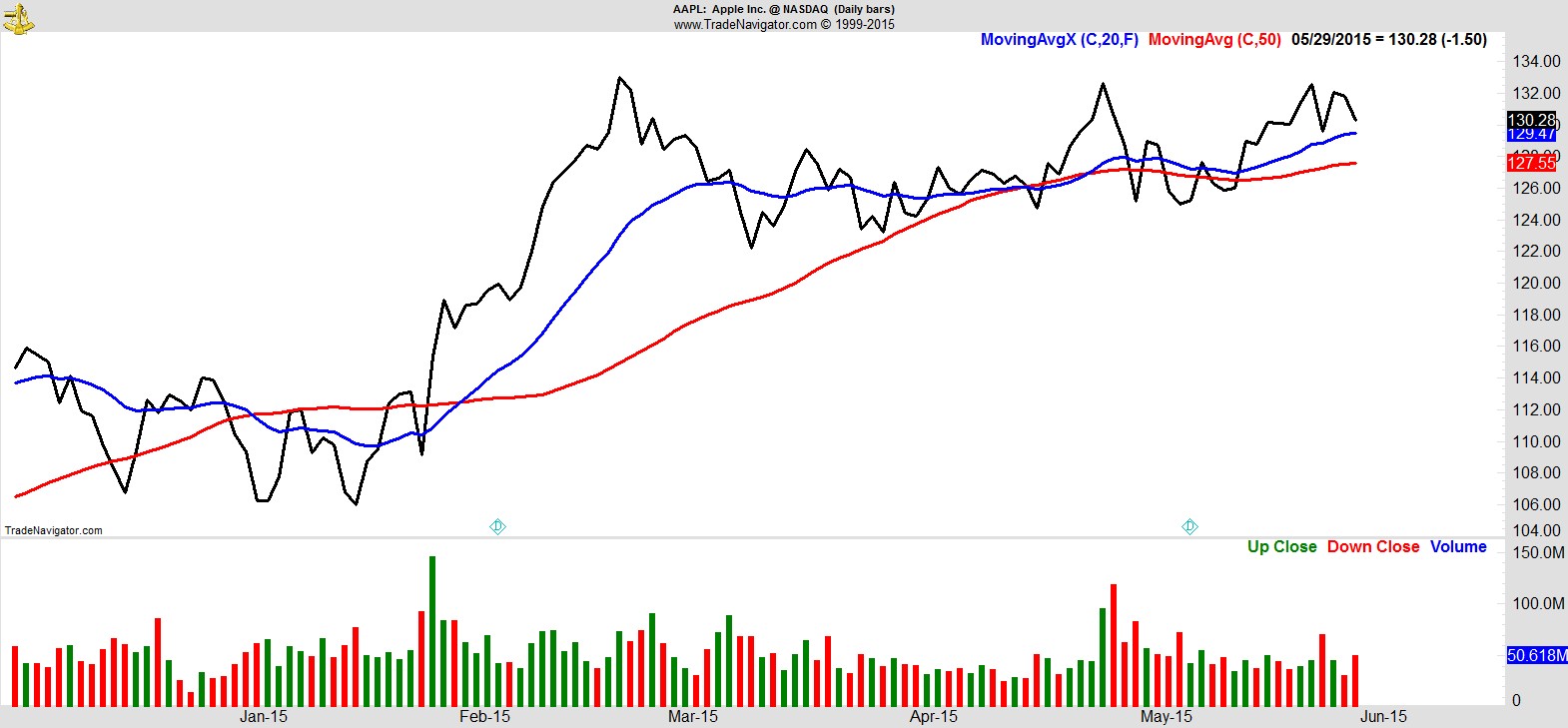

$AAPL

.

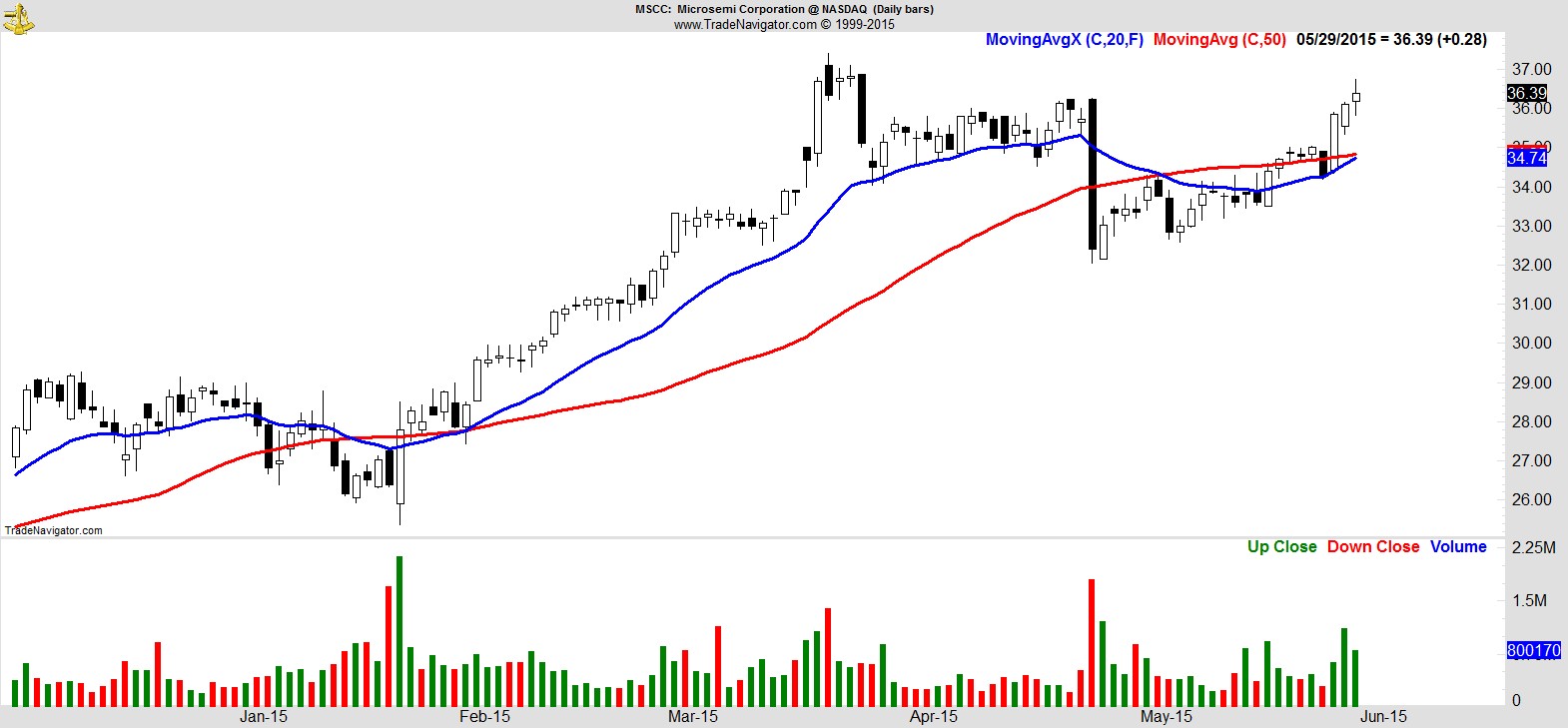

$MSCC

.

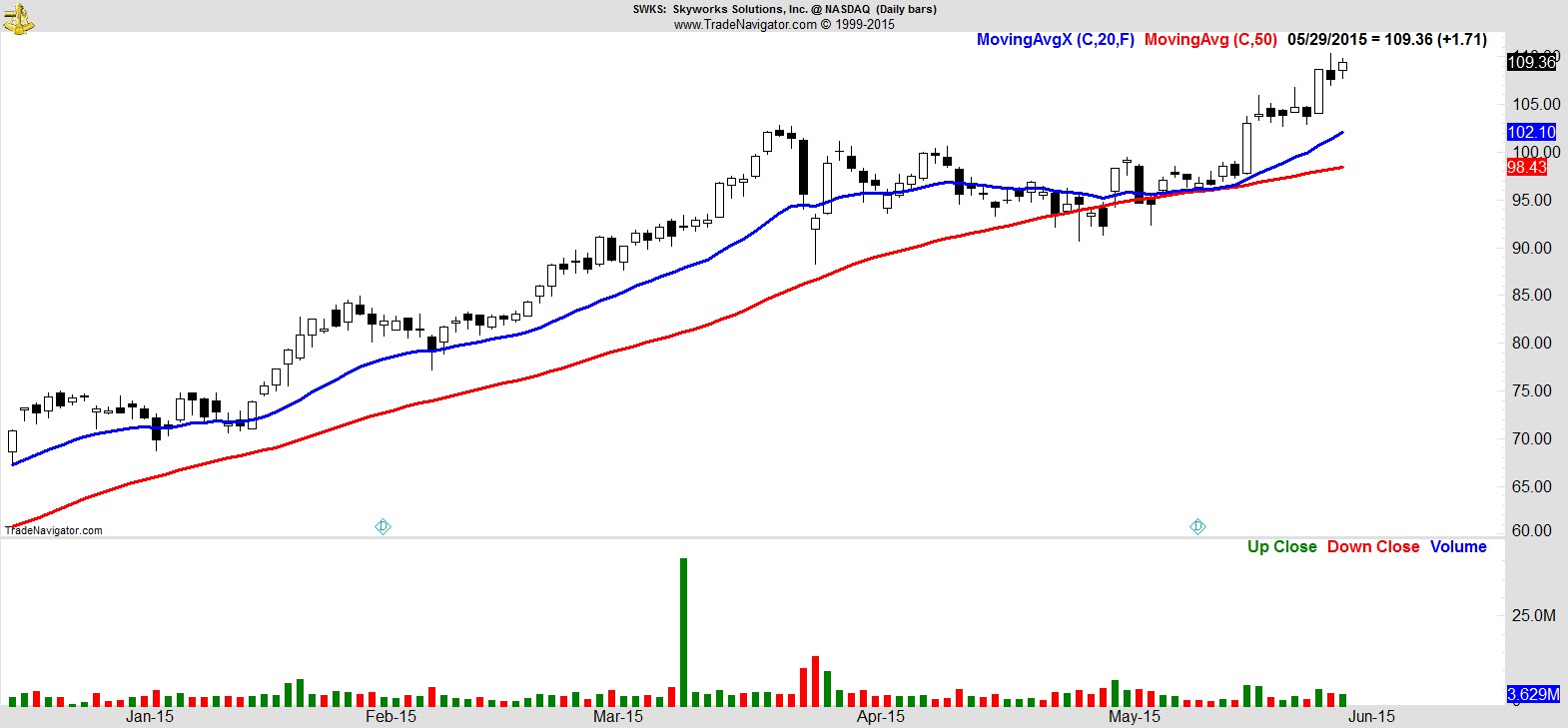

$SWKS

.

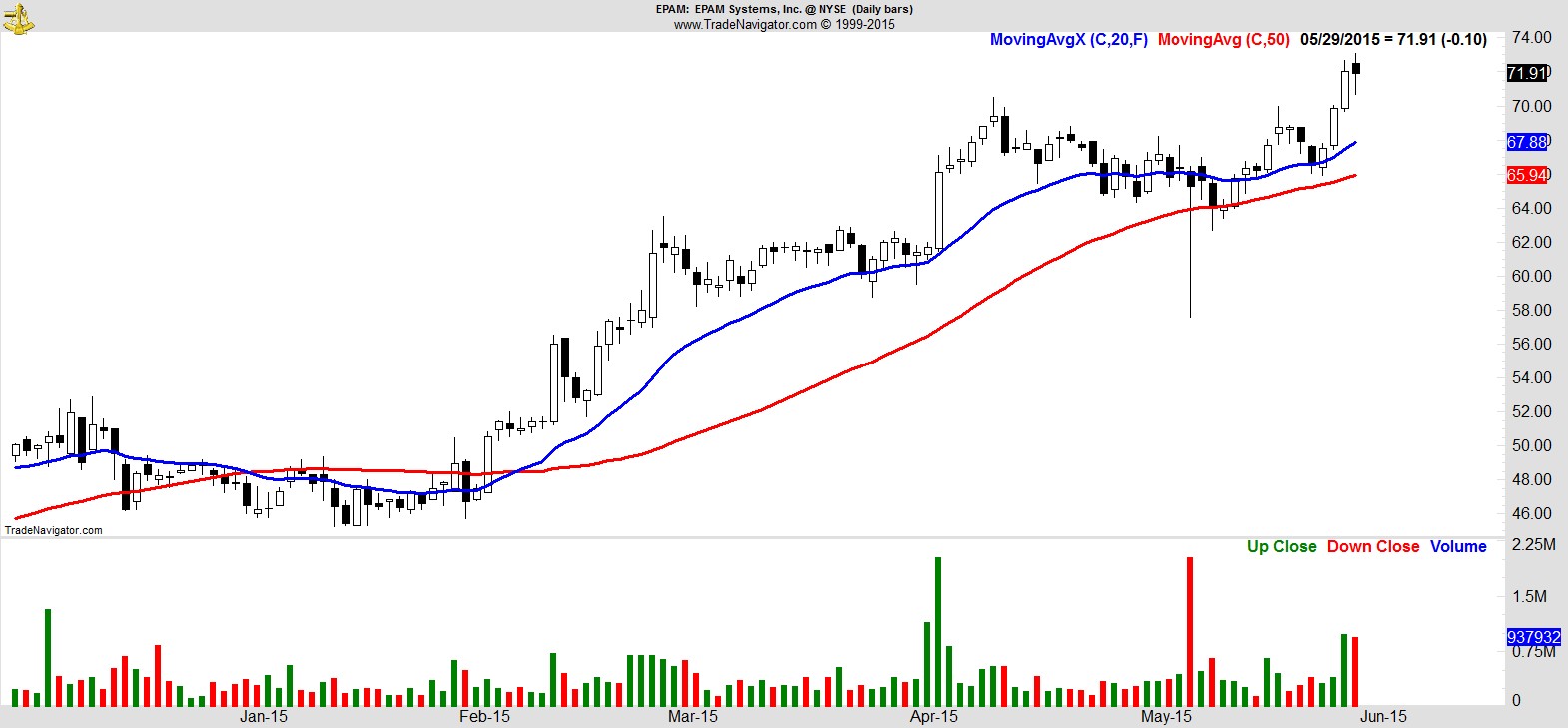

$EPAM

.

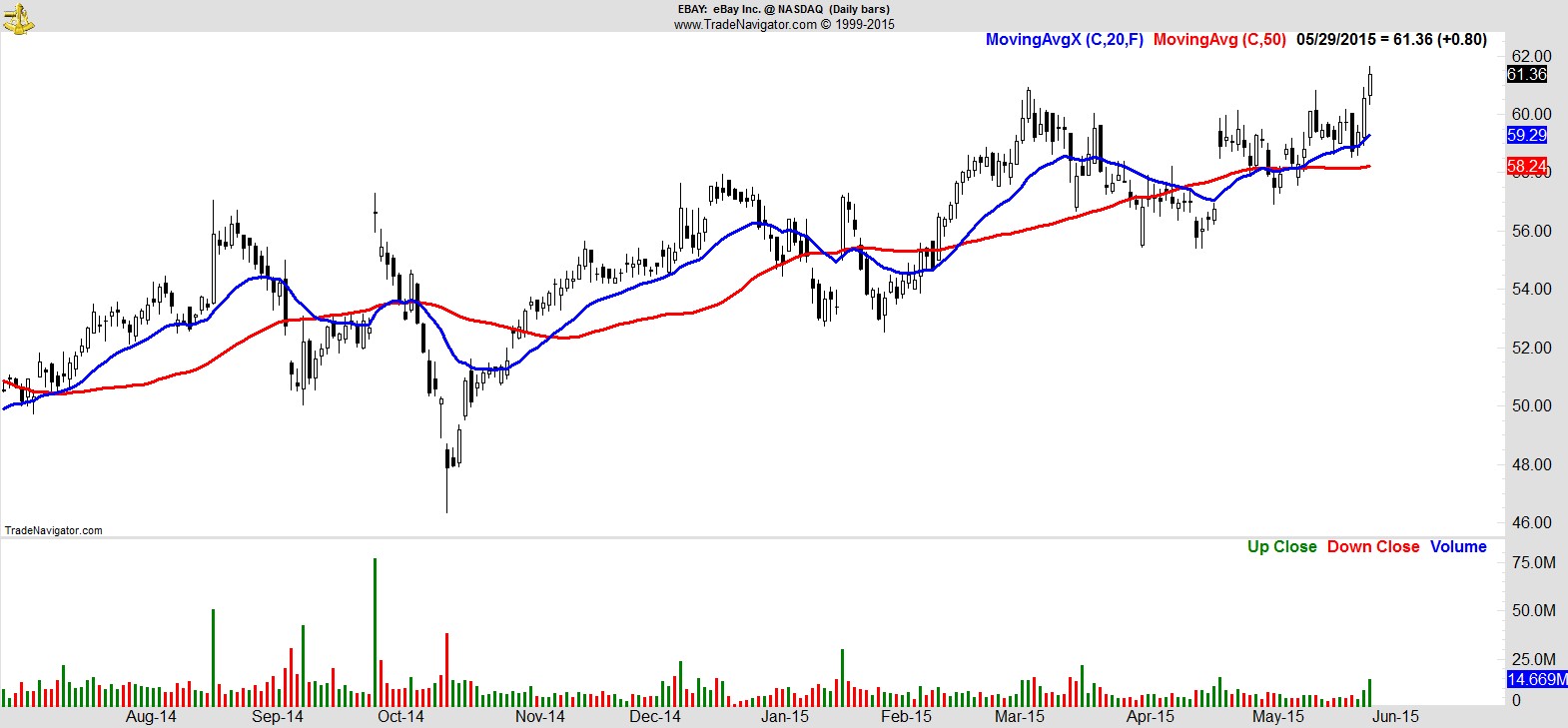

$EBAY

.

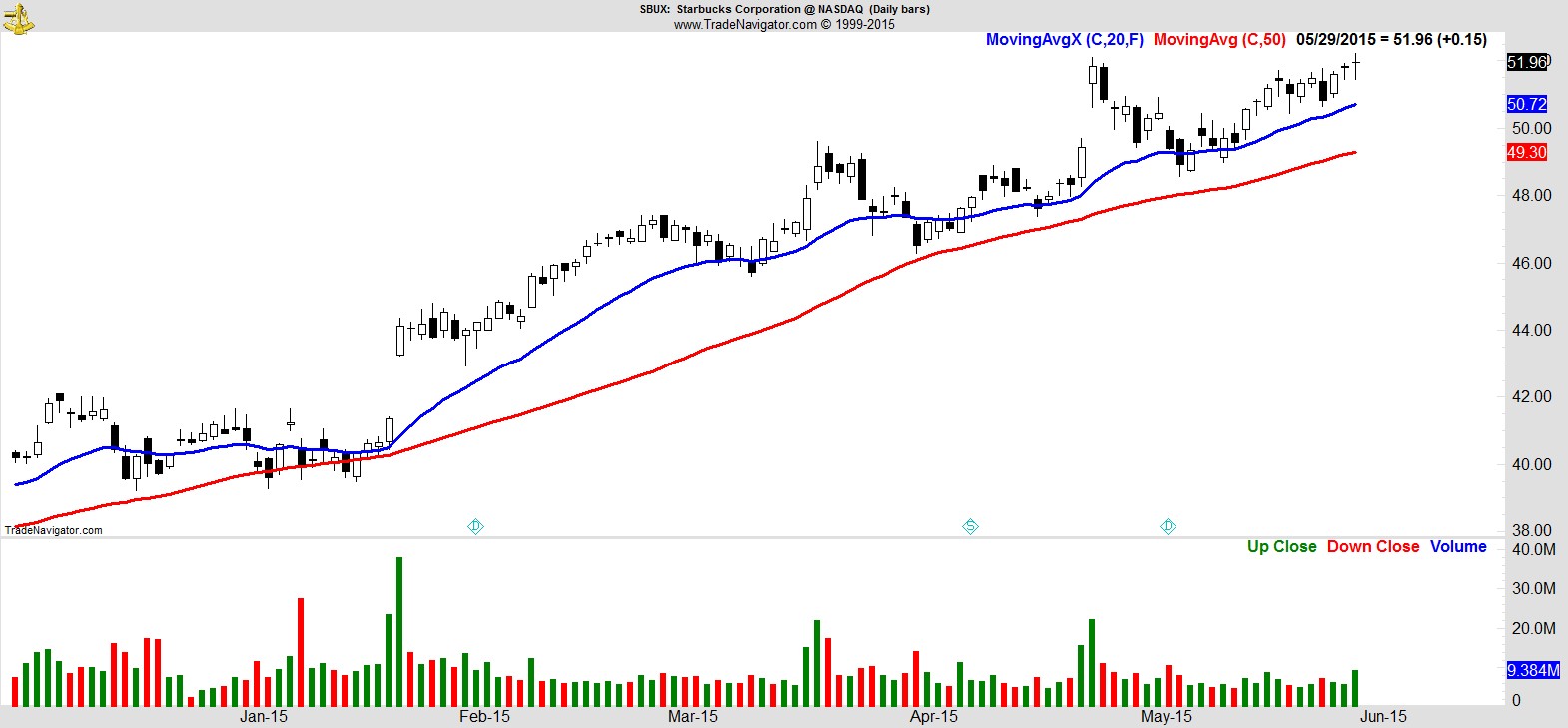

$SBUX

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17