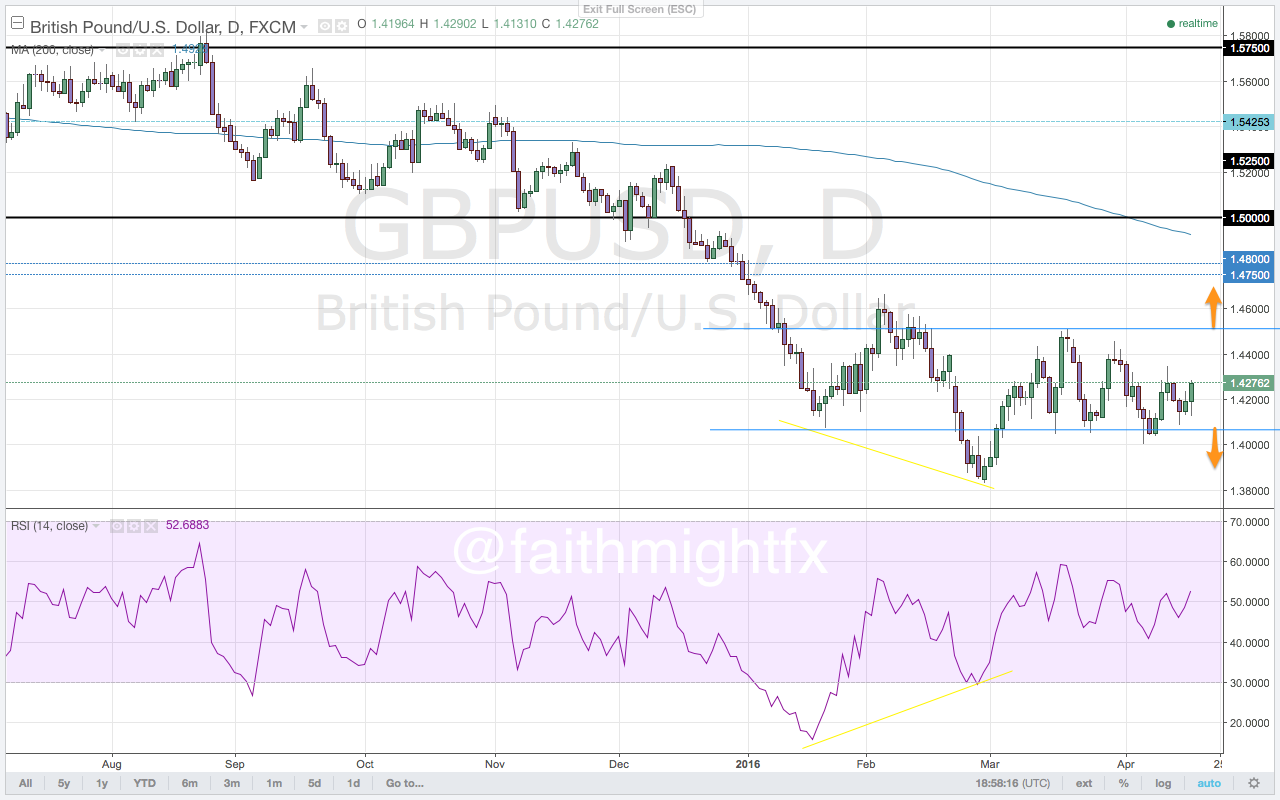

The U.S. dollar remains in consolidation after the past year’s rally. Now that the Federal Reserve has actually taken hawkish action, there is a possibility that the U.S. dollar weakens even in the face of a hawkish Federal Reserve. Therefore, the GBP/USD remains bullish for as long as price remains above the 1.4000-level. However, as the GBP/USD has attempted to move higher, price currently finds strong resistance at the 1.4500-level. While holding below the 1.4500-support level is actually a bearish signal for future price action, price has been unable to gain traction in either direction. The GBP/USD has actually become rangebound between the 1.4500-resistance level and the 1.4000/50-support levels. As price action coils in this range, the GBP/USD has actually found resistance within the greater range at the 1.4350-level. As the new trading week gets underway, there is no action to take whatsoever while the GBP/USD trades within the range. When price reaches current resistance at 1.4350, sellers will look to establish position in the GBP/USD that targets the bottom of the range at the 1.4050/00-level. Bearish bias wins this battle when the GBP/USD closes below the 1.4000-level. A close above the 1.4500-level confirms the bullish bias and a continuation of the rally to the 1.4750-level.

Premium trade setups with targets and stops are published in the GBP/USD Outlook for the Week in Volume 59, this week's Quid Report.

Recent free content from Lydia Idem Finkley

-

USD Leaves Markets in Suspense

— 6/15/16

USD Leaves Markets in Suspense

— 6/15/16

-

ECB Keeps Euro Happy

— 6/02/16

ECB Keeps Euro Happy

— 6/02/16

-

Remember, The Euro is a Safe Haven

— 4/17/16

Remember, The Euro is a Safe Haven

— 4/17/16

-

NEW: The Monday Morning Calls

— 4/11/16

NEW: The Monday Morning Calls

— 4/11/16

-

Carry is the Aussie’s Best Friend

— 2/24/16

Carry is the Aussie’s Best Friend

— 2/24/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member