It's always something with this market, isn't it? Just about the time you assume that the "earnings recession" is ending and that investors are looking forward to better days, something always seems to crop up that causes the worries to return.

Although stocks have been strong in July and have managed to avoid any serious pullback since breaking to fresh all-time highs, there appears to be a handful of fresh worries in the market on this last day of the month.

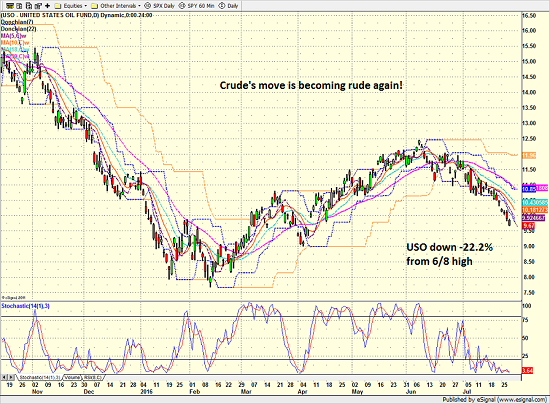

Let's start with an oldie but a goody - oil. After jumping up more than 50% from the February 11 low, the move in crude is becoming rude again. For those keeping score at home, oil has now entered what the media affectionately refers to as "bear market territory" as crude has fallen more than 20% from the recent high seen on June 8.

The recent decline has been driven by renewed supply worries. And at this stage, the questions in the energy patch become (a) how low will it go and (b) will the stock market be impacted by the renewed bear market in crude?

United States Oil Fund (NYSE: USO) - Daily

View Larger Image

Next up on the worry list on this fine Friday morning is Japan. Cutting to the chase, the BOJ (Bank of Japan) disappointed traders overnight.

While the Japanese central bank did indeed increase the size of its ETF purchase program and expanded its dollar-lending facility, the bank avoided the kind of bazooka-type move the markets had been expecting. And given that global markets have been rallying, at least in part, on the idea of more central bank intervention from the likes of the Bank of England, the ECB, and the BOJ, the softness in the early trade this morning shouldn't be much of a surprise.

And then there is the U.S. economy, which also disappointed this morning. In short, U.S. GDP growth came in at an annualized rate of just 1.2%, which, while above the initial guesstimate of 0.8%, was less than half what had been expected by economists surveyed by Bloomberg.

In addition, Q1 GDP was revised lower to 0.8% from 1.1%.

But, there was also some good news in the report. Consumer spending, which accounts for about 70% of economic growth in this country, surged 4.2% during the quarter, which was in line with expectations and the biggest gain since the end of 2014. This was up from the 1.6% level seen in Q1.

The bad news is that just about everything else in the report fell. For example, inventories were reduced by the largest amount since the third quarter in 2011 and corporate spending on what is called "fixed investment" fell at an annualized rate of 2.2%.

The problem here is that a key tenet of the bull argument for stocks has been that the economy had left the punk data from Q1 behind and would improve steadily from here. And with the Fed talking about steady improvement in the data as a reason to raise rates this year, the state of the economy is suddenly back to being a question mark.

The silver lining here, of course, is that today's weak GDP report could easily keep Yellen & Co. on the sidelines until very late in the year and perhaps into 2017.

From a stock market perspective, the key question here is if any of today's worries will be enough to change the big-picture assumption that the economy and earnings will improve going forward. And while it may take a couple weeks to determine the answer to this question, the near-term price action may provide some clues.

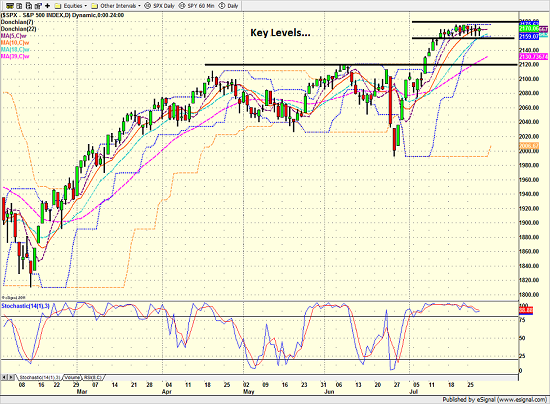

Looking at the charts, the stock market indices have been moving sideways for 11 days now and are currently in a precarious spot.

S&P 500 - Daily

View Larger Image

Personally, I don't think the short-term line in the sand at 2160 on the S&P means much and that the real key level remains the breakout zone around 2120. As such, I wouldn't panic if stocks close out the month of July on a sour note. And since I think there are a lot of folks looking to buy the dips in this market, I also wouldn't be surprised to see any near-term weakness wind up being short-lived. But we shall see.

Have a great weekend!

P.S. I'm traveling next week with several early meetings, so reports will likely be short and/or sporadic.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Central Bank Policies

2. The State of the Earnings Season

3. The State of Oil Prices

4. The State of U.S. Economic Growth

Thought For The Day:

"There is nothing to fear from truth." --Ray Dalio

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0],p=/^http:/.test(d.location)?'http':'https';if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src=p+'://platform.twitter.com/widgets.js';fjs.parentNode.insertBefore(js,fjs);}}(document, 'script', 'twitter-wjs');Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member