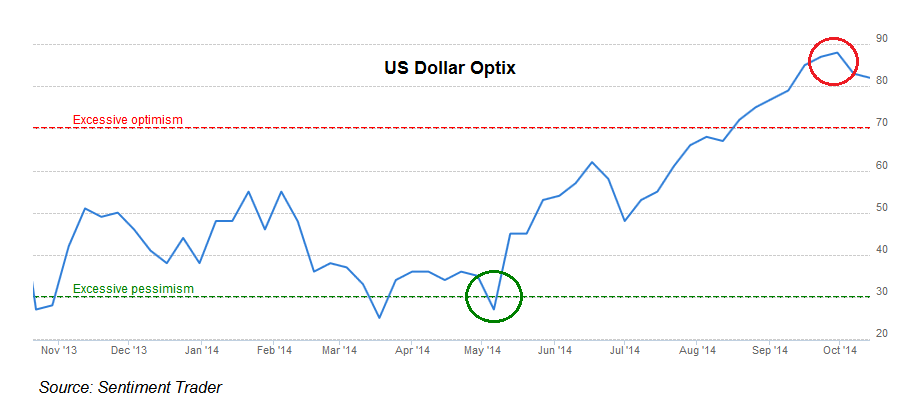

One of my favorite things about the market is watching sentiment shift from extreme bearish levels to extreme bullish levels after price has already made its big move. Market participants like to travel in packs and when those packs get to big, the unwinds can be spectacular. Most recently, this shift in sentiment can be seen in the US Dollar. They hated it in May, and after a monster rally, they now love them. Do you see how backwards that mentality is? So it’s up to us to take advantage of it.

Here we are looking at a weekly candlestick chart of the US Dollar Index. Since 2005 we have been in a symmetrical triangle well-defined by these two converging trendlines. After the epic rally since May, prices exceeded the upper of the two trendlines. But as you can see in this chart, it doesn’t seem to be holding:

Sentiment is such a powerful tool. Most members of the media caught on to this trend way too late, as usual. And with that tardiness, market participants have blindly followed along. This is why we focus on price and market behavior as opposed to “news” events. Here is the sentiment data for the US Dollar Index over the past year:

When price action and sentiment agree with one another, we generate great signals. We had a buy signal in May and have suggested selling the Dollar throughout the month of October (see here). At this point, it is really starting to look like a failed breakout. I am not interested in the reasons why, perhaps the fed, lower rates, stronger euro, whatever. Why isn’t our problem. We like to worry about the what and the when. And from where we sit today, it still looks like lower prices are coming for the Dollar Index.

From a risk management standpoint, we would really only want to be long the US Dollar Index above this downtrend from 2005. Below that and there is no reason to be involved with this thing, especially now that everyone loves it for some reason.

This is such an interesting market right now….

Make sure you are getting our weekly reports to stay up-to-date on what’s happening in the Dollar and other currencies and commodities around the world.

***

Click here for more information on Managed Assets

Click here for more information on our Premium Technical Research Packages

Tags: $UUP $DX_F $UDN $USDU $UUPT $UNDT

Recent free content from J.C. Parets

-

Here’s Way I think Rates Are Heading Lower

— 11/12/15

Here’s Way I think Rates Are Heading Lower

— 11/12/15

-

Support & Resistance 101: Apple Edition

— 11/10/15

Support & Resistance 101: Apple Edition

— 11/10/15

-

Video: Technical Analysis Webinar by JC Parets

— 10/01/15

Video: Technical Analysis Webinar by JC Parets

— 10/01/15

-

Find Your Edge: The Autumn 2015 AlphaShark Trading Symposium with a Presentation by J.C. Parets

— 9/25/15

Find Your Edge: The Autumn 2015 AlphaShark Trading Symposium with a Presentation by J.C. Parets

— 9/25/15

-

Can Financials Correct 30% From Their Highs?

— 9/24/15

Can Financials Correct 30% From Their Highs?

— 9/24/15

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member