The News – Last week ended with a 4th straight weekly advance for U.S. stocks, which sent the S&P 500 to fresh record highs, but masked the smallest market moves since 1979. The S&P 500 rose or fell less than 0.1 percent on 4 consecutive days during the week. That was the longest stretch for moves of that size since May 1979. That futility also continued into the start of this week.

Premarket action is relatively flat so far ahead of minutes of the latest Federal Open Market Committee meeting that could shed light on policy makers' thinking. The FOMC minutes are slated to be released at 2:00ET.

The Market – As stated above, the market had accomplished next to nothing since last Wednesday, that is up until yesterday.

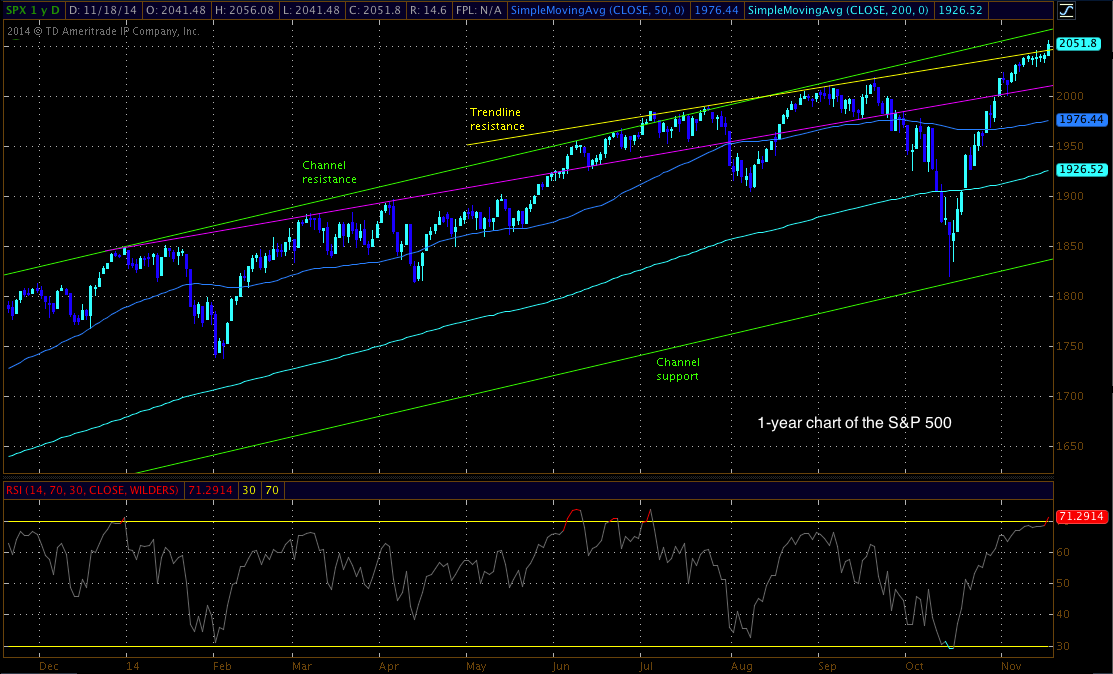

Let’s start with the S&P.

After sitting beneath it for the last week, the S&P finally pushed through its trendline resistance. This should signal higher overall prices in the near-term. The next obvious target for the S&P is its channel resistance, which currently sits near 2070. Once tested, I’d expect a pullback of some magnitude to develop.

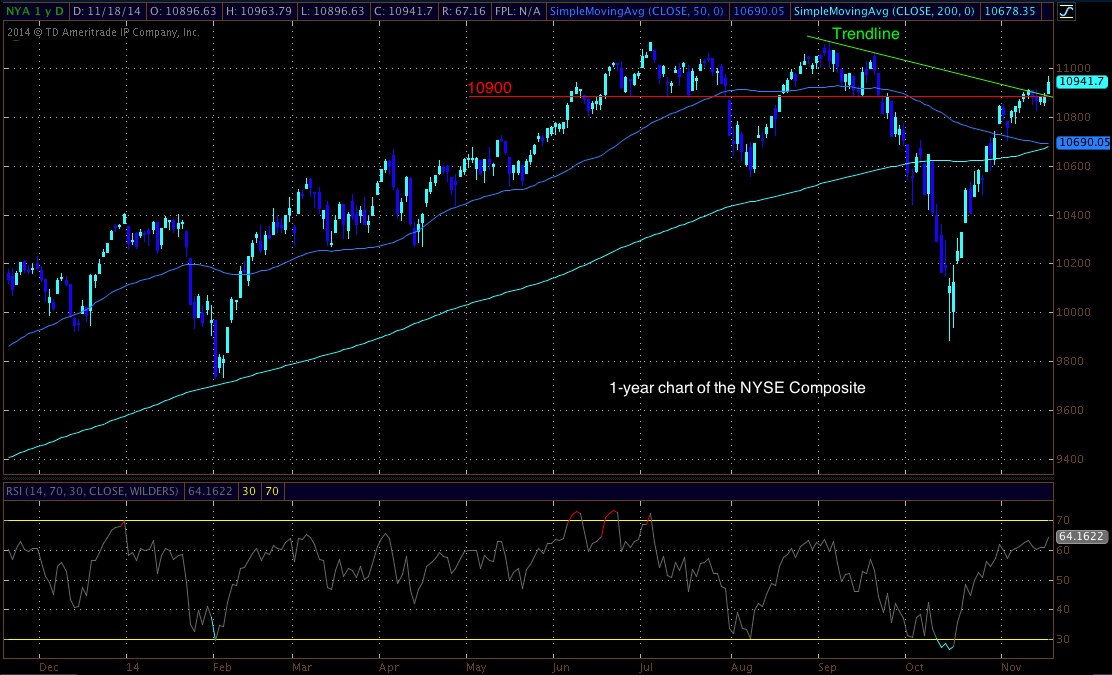

In another positive development, the NYSE Composite had also been stalling under a trendline of resistance. That resistance was sitting at the same 10900 level that had been a common support for the index in the past. Along with the S&P, the NYSE broke through its resistance and also signals higher prices.

Before making any trading decision, decide which side of the trade you believe gives you the highest probability of success. Do you prefer the short side of the market, long side, or do you want to be in the market at all? If you haven’t thought about it, review the overall indices themselves. For example, take a look at the S&P 500. Is it trending higher or lower? Has it recently broken through a key resistance or support level? Making these decisions ahead of time will help you decide which side of the trade you believe gives you the best opportunities.

No matter what your strategy or when you decide to enter, always remember to use protective stops and you’ll be around for the next trade. Capital preservation is always key!

Good luck!

Christian Tharp, CMT

@cmtstockcoach

Recent free content from Christian Tharp, CMT

-

Biotech Breakdown: Positive Signs Are Building (11/25/15)

— 11/25/15

Biotech Breakdown: Positive Signs Are Building (11/25/15)

— 11/25/15

-

Biotech Breakdown: Market Still Pulling Back (11/12/15)

— 11/12/15

Biotech Breakdown: Market Still Pulling Back (11/12/15)

— 11/12/15

-

Biotech Breakdown: Market Pullback Before New Highs (11/6/15)

— 11/06/15

Biotech Breakdown: Market Pullback Before New Highs (11/6/15)

— 11/06/15

-

Biotech Breakdown: Market Correction Over? (10/22/15)

— 10/23/15

Biotech Breakdown: Market Correction Over? (10/22/15)

— 10/23/15

-

Biotech Breakdown: Markets Up, Biotechs Finally Take Part (10/16/15)

— 10/16/15

Biotech Breakdown: Markets Up, Biotechs Finally Take Part (10/16/15)

— 10/16/15

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member