Ratio analysis is something that I do every day in order to help me find some of the best risk/reward opportunities in the world. Remember, all I care about and the only reason I’m in the market in the first place, is to make money and look for risk/reward setups that are skewed very much in my favor. To me, nothing else matters in the marketplace. This week we are presented with what I think is an excellent one and also happens to be a ratio. United Technologies $UTX is a name that really stands out from the Dow 30 components, particularly on a relative basis. I love this one.

Register Here to receive our Weekly Research Reports

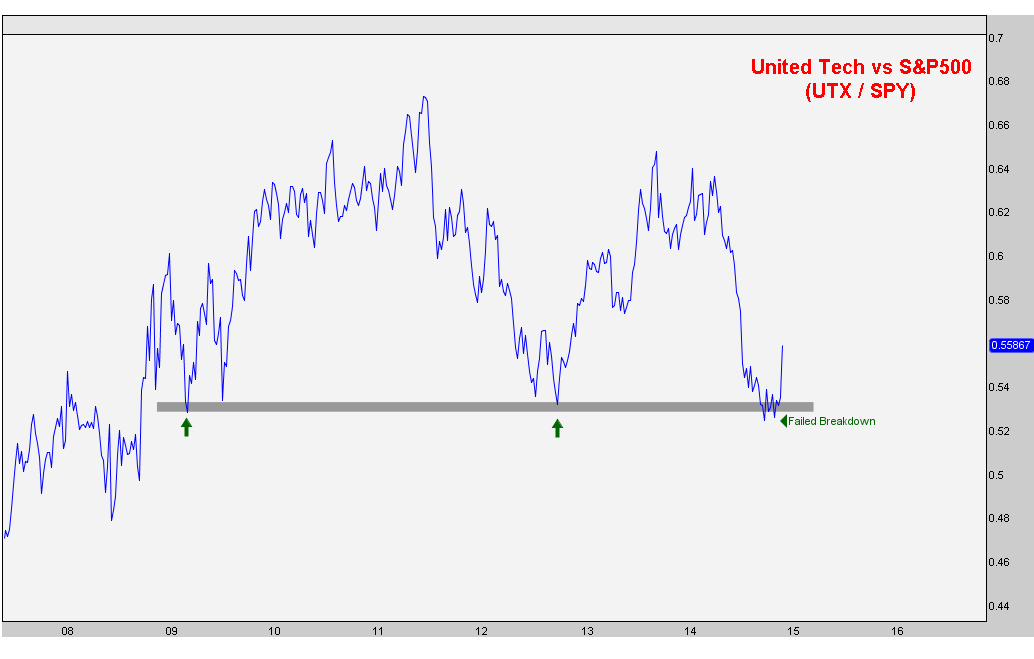

Here is a weekly line chart showing the UTX/SPY spread briefly breaking down below support that goes back to 2009 and ripping back above it. The old saying is that, “From failed moves come fast moves in the opposite direction”. In this case, higher:

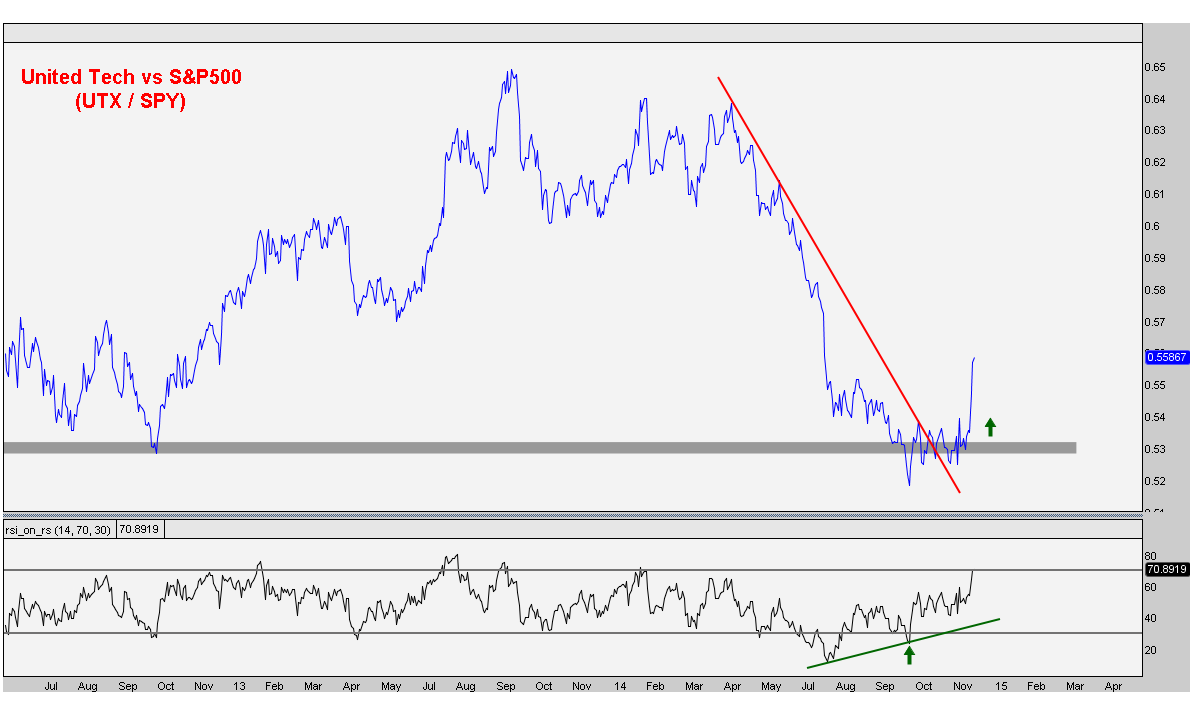

The next chart is a closer look at what is happening here. Notice the failed breakdown in September that has now reversed itself nicely to the upside. Meanwhile, momentum was putting in a beautiful bullish divergence at the most recent lows. Now we are above both former support from 2012 and the downtrend line from the highs in this ratio this April:

I don’t know what there is not to like about this spread. Everything here suggest to me that this explosive move we just got should continue. Most importantly, from a risk/reward standpoint, we only want to be long this spread above the 2012 lows. Below that and there is nothing to discuss here. Remember this spread essentially means that for every dollar that we own of UTX we are short one dollar of SPY. I think we head back to the highs from the last few years which skews the risk/reward very much in our favor.

Members of Eagle Bay Solutions receive weekly updates on this ratio along with the rest of the Dow 30 Components.

Register here start to receive our weekly Dow 30 reports.

Recent free content from J.C. Parets

-

Here’s Way I think Rates Are Heading Lower

— 11/12/15

Here’s Way I think Rates Are Heading Lower

— 11/12/15

-

Support & Resistance 101: Apple Edition

— 11/10/15

Support & Resistance 101: Apple Edition

— 11/10/15

-

Video: Technical Analysis Webinar by JC Parets

— 10/01/15

Video: Technical Analysis Webinar by JC Parets

— 10/01/15

-

Find Your Edge: The Autumn 2015 AlphaShark Trading Symposium with a Presentation by J.C. Parets

— 9/25/15

Find Your Edge: The Autumn 2015 AlphaShark Trading Symposium with a Presentation by J.C. Parets

— 9/25/15

-

Can Financials Correct 30% From Their Highs?

— 9/24/15

Can Financials Correct 30% From Their Highs?

— 9/24/15

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member