Today was a great reminder of how quickly market sentiment can change.

Last Friday morning biotech stocks were the darlings of the momentum crowd. Three sessions later they are being treated as toxic sludge: the high quality biotech names like CELG or BIIB shed 4-5% today, while many of their more speculative junior cousins were literally taken out to the woodshed and lost anywhere between -12% to more than -20%.

More worrisome for bulls is the fact that the above is just part of an overall and broad return to risk-off mode. All major indices and sectors came under significant pressure today. The Russell led the decline with a -2.4% drop on big volume.

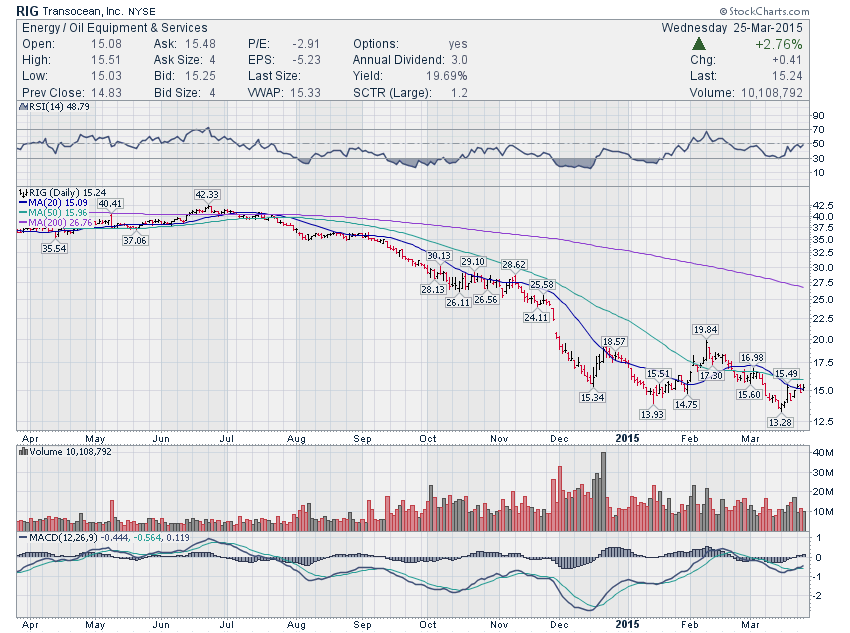

Energy was the only sector to resist today's sell-off, but it is very doubtful that this sector alone can carry the market.

Today's price action brings the "Fed" uptrend that started exactly a week ago very much into question. Today was just the first day of selling and we would be wise to expect and be prepared for additional downside.

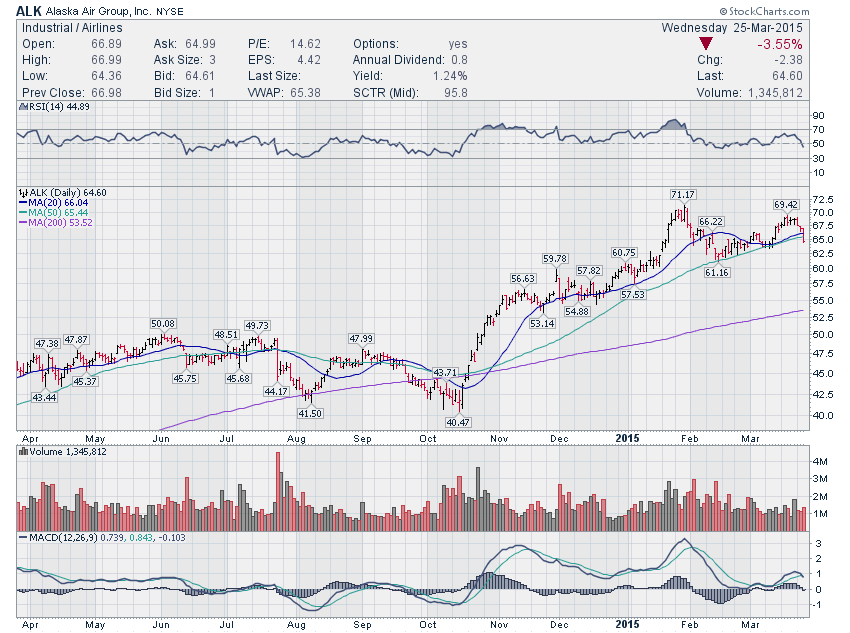

ALK (SHORT) - I profiled this one as a possible short on Monday and it had a downside follow-through today, but the selling is likely not over and we could see additional downside toward 58-60

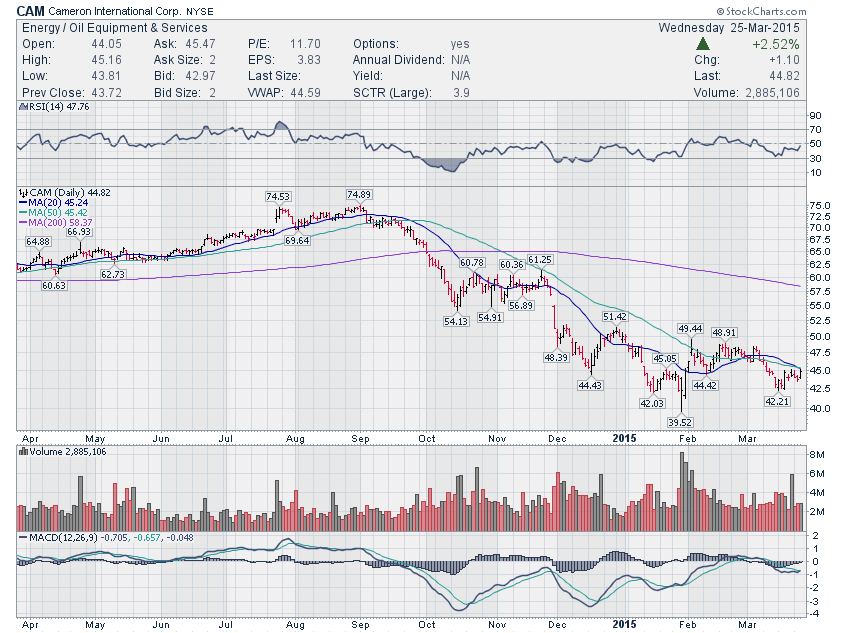

CAM - One of the energy names showing relative strength today, flagging for a possible move toward 48-50

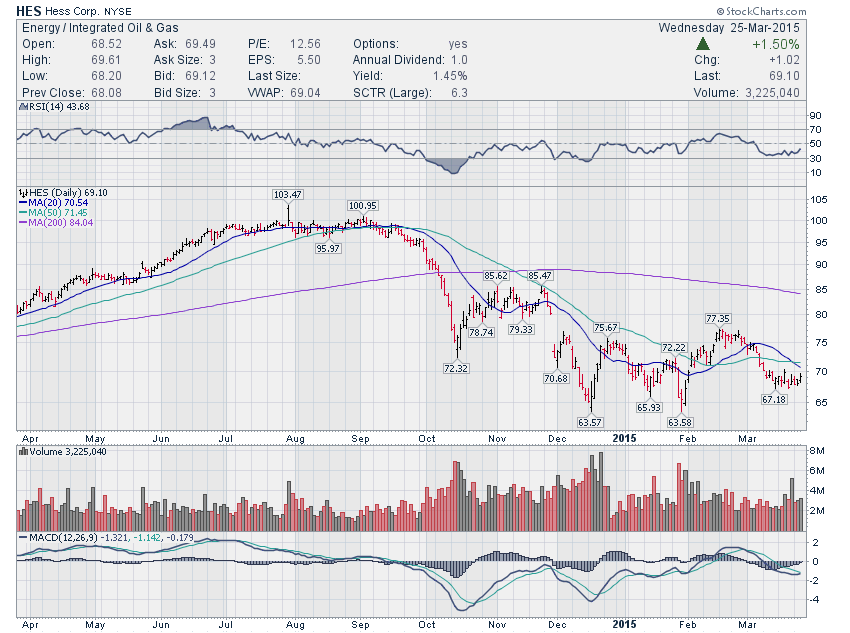

HES - Another energy stock acting constructive, short bottoming formation suggests it is getting ready for a push through 70

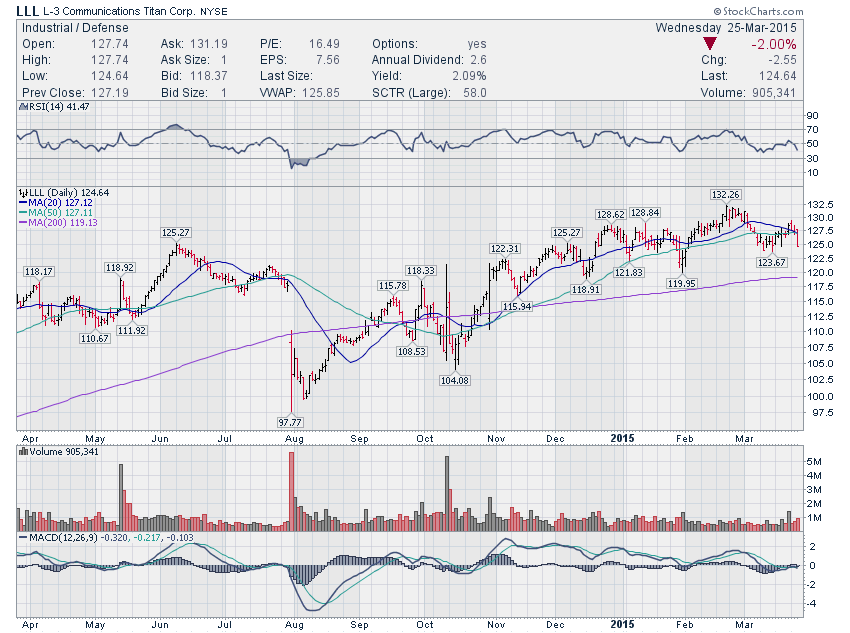

LLL (SHORT) - Bearish rejection off the 20/50 dmas, likely headed to a test of the 200dma around 118-120

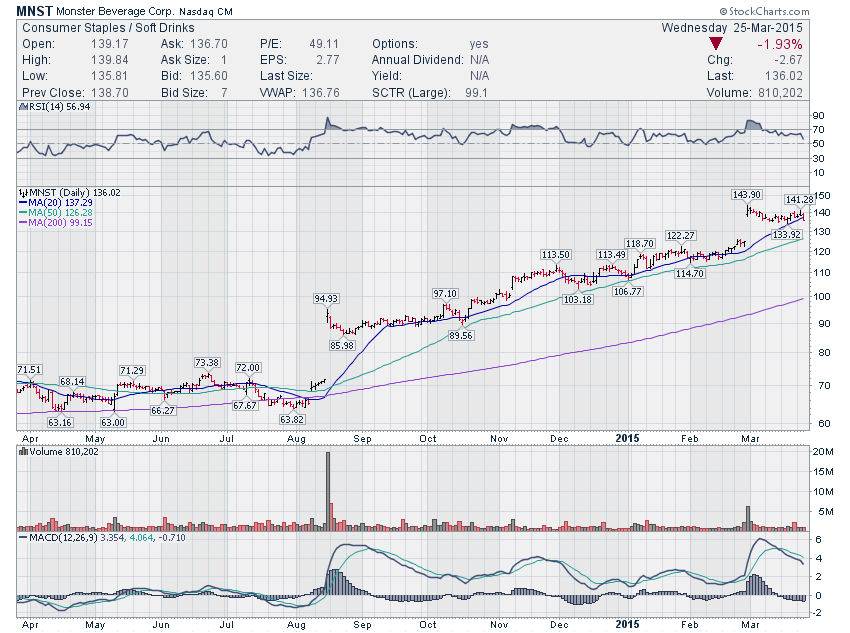

MNST (SHORT) - Bull flag failure with a rejection off the 140 level and a close under the 20dma, likely headed toward gap close in the 125-127 area

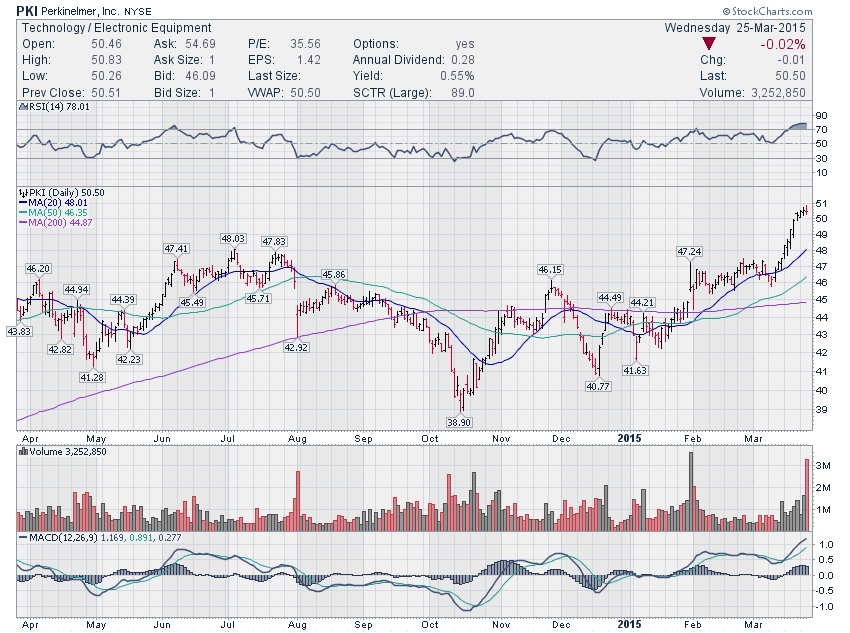

PKI (SHORT) - A rare super-stretched stock in this type of market, if the selling continues tomorrow, it will be quickly brought down to earth

RIG - Another energy stocks that looks like it's flagging for a push higher

Recent free content from Noanet Trader

-

Ignoring the Greco-German Noise

— 6/21/15

Ignoring the Greco-German Noise

— 6/21/15

-

June 18 Recap

— 6/18/15

June 18 Recap

— 6/18/15

-

All Eyes on the Russell

— 6/14/15

All Eyes on the Russell

— 6/14/15

-

Preparing for June

— 5/31/15

Preparing for June

— 5/31/15

-

Preparing for the Week of May 18

— 5/17/15

Preparing for the Week of May 18

— 5/17/15

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member