Click Here for this Week's Full Letter - March 31, 2015

Greetings,

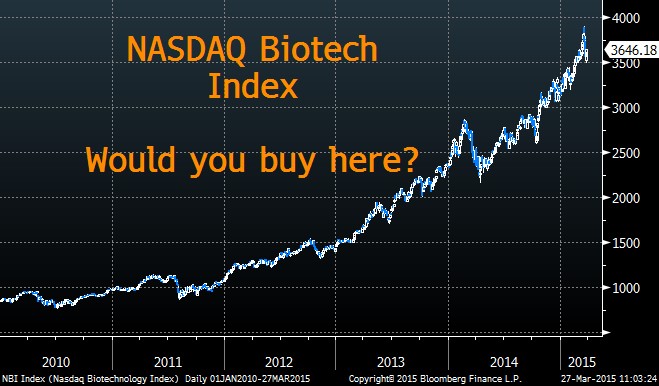

Last summer, Janet Yellen warned that valuations in certain corners of the stock market like biotech were getting “substantially stretched.” Proving yet again that she’s a better economist than market-timer, the biotech sector has proceeded to rally more than 50% since her words of caution. However, there’s no denying that valuations in this sector do seem excessive. Less than 50% of the stocks in the NASDAQ Biotech Index are expected to make money in the next fiscal year, rendering valuation metrics like price-to-earnings irrelevant. According to Credit Suisse, biotech has done something that no other sector has done before, which is outperform for 5 years in a row.

It’s impossible to have a rally of this magnitude without attracting some “weak hands,” also known as speculators. It wasn’t surprising that these speculators jumped ship last week when the broader market dipped lower. Ostensibly, the sell-off was caused by Saudi Arabia entering the fray in Yemen, which we’ll touch on later, but, in my opinion, the market simply returned to the levels it was trading before the latest Fed meeting – where there were few substantial developments. Not surprisingly, biotech shares bore the brunt of the decline.

The technical signals don’t point to an imminent rally, either. The number of stocks in the biotech index trading above their 50-day moving average (MA) plunged to 50% from more than 80% in the previous week. The last time conditions deteriorated so quickly, in February 2009, fewer than 20% of the group ultimately held above their 50-day MA.

It goes without saying that I don’t advise investors to load up on biotech shares at these levels. This is not a “buy the dip opportunity,” but it is important to monitor this sector going forward. When it’s clear that speculators have abandoned biotech, that might be a signal the broader market is headed for a correction. There are several reasons to believe the stock market is overvalued. The Office of Financial Research, the agency in charge of financial stability, released a paper last week showing the stock market is “dangerously overvalued.” The CAPE ratio, Q-ratio and Buffett Indicator are all approaching two standard deviations above their historical mean. Like market commentary from Janet Yellen, these indicators don’t say when the market will correct, but they do seem correct in their conclusion that it’s overvalued.

Editor’s note: Cup & Handle will not be published on April 7 due to a hectic schedule. Apologies in advance.

The Cup & Handle Fund was down around -1% last week, but still +13% since August. Foreign currencies is usually my go-to asset class for sustainable trends, but there are not many clear, directional bets at the moment. There is a good chance some relative value bets will start entering the portfolio, but I need time to do some homework. I still haven’t settled on a recommendation for April yet, but my track record is looking much better after my picks from February and March. If you’d like to start receiving these letters click here.

Today’s letter will cover several topics, including:

- Saudi Arabia’s Military Stimulus

- UKQE?

- Made From Concentrate

- Chart of the Week

With that, I give you this week's letter:

March 31, 2015

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member