Yesterday's unexpected rally turned out to be a one-hit wonder: the market was unable to build on those gains and ended up giving back nearly all of them today.

The market is technically in a consolidation pattern, but it is very hard to interpret recent price action as bullish. Technical damage seems to be spreading through more sectors and stocks, increasing the odds of a bigger correction.

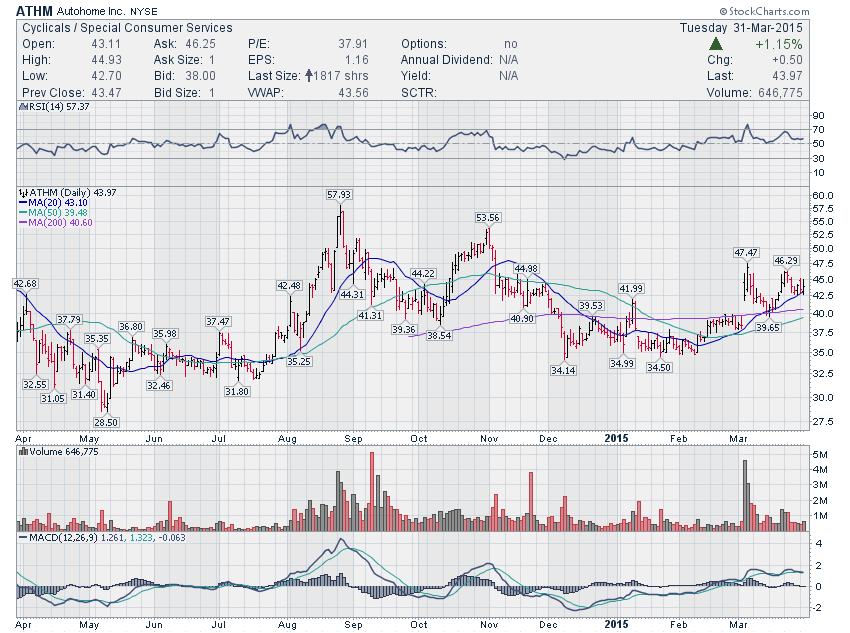

ATHM - Continues to flag fairly well and maintain good relative strength, needs to push through 45 with conviction

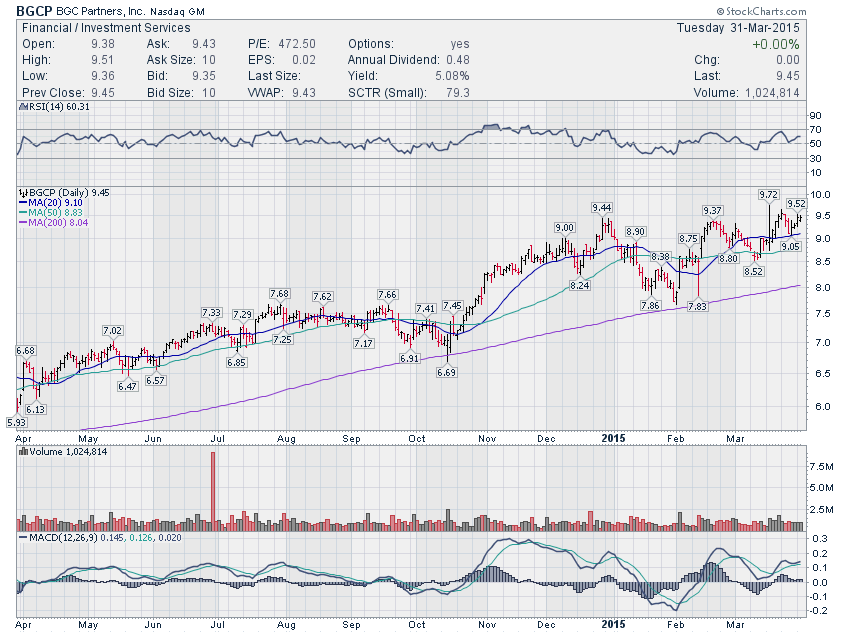

BGCP - Another stock showing good relative strength, could be getting ready for a push toward 10

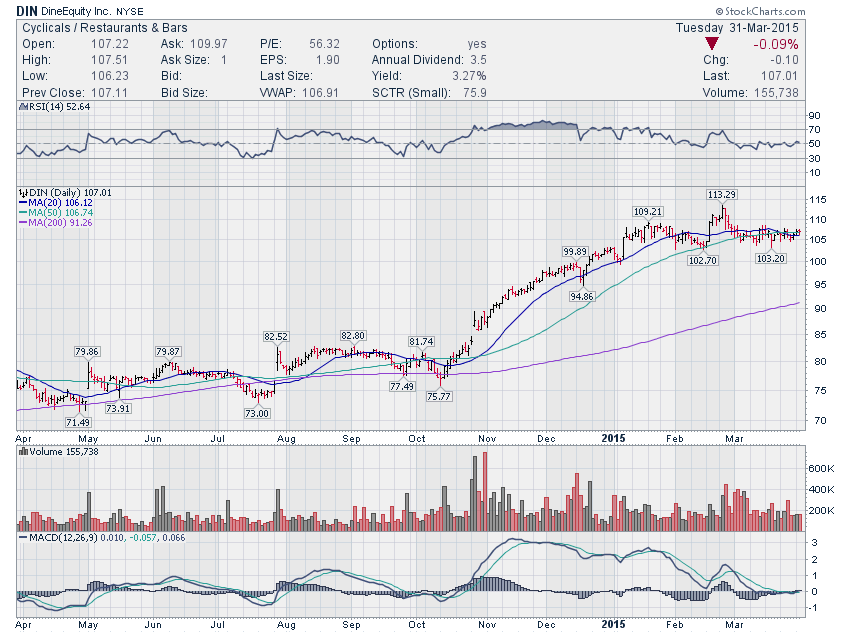

DIN - Remains neutral in a flat sideways consolidation, but the price structure could turn bullish on a push through 108

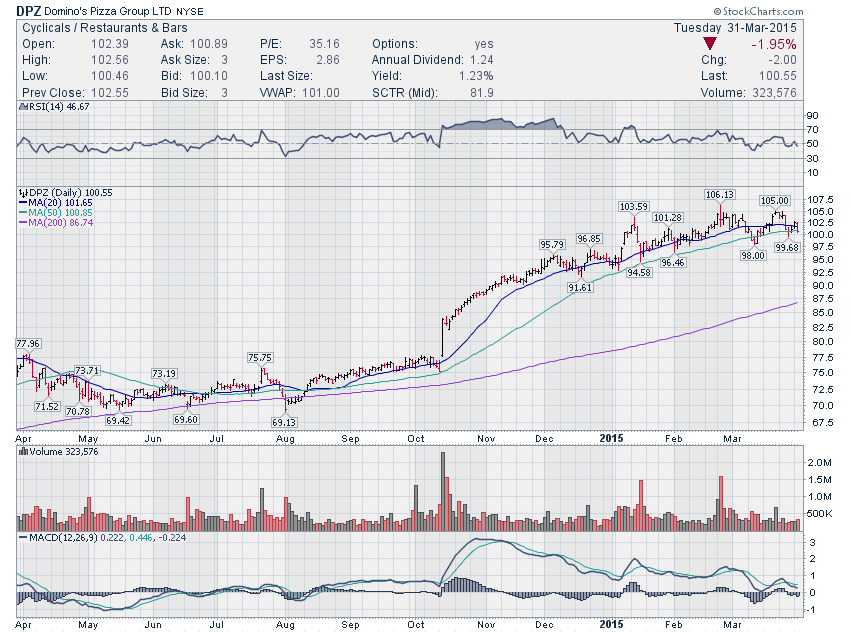

DPZ (SHORT) - Toppy daily chart with a close under 20 and 50dmas today, should 100 fail we will likely see a pullback toward 95

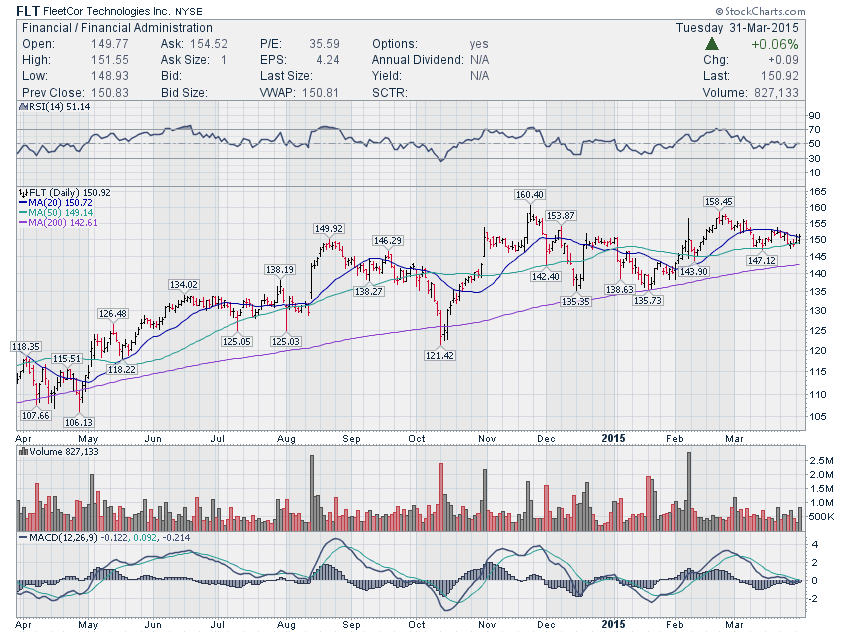

FLT - Sort of sloppy, but did manage another bounce off the 50dma and a close over 150, will be watching for continuation toward 155

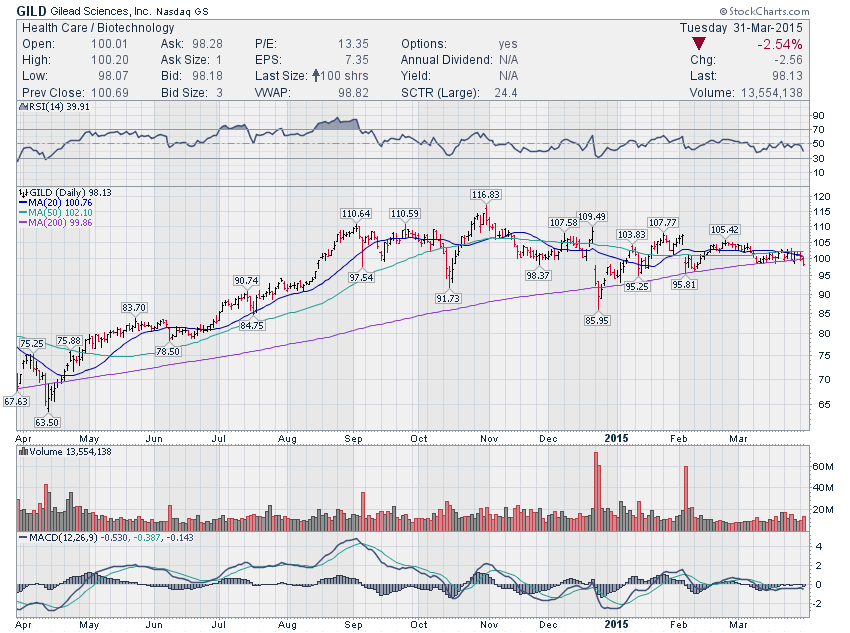

GILD (SHORT) - Today's close under 100 and the 200dma could indicate likely additional downside toward 90

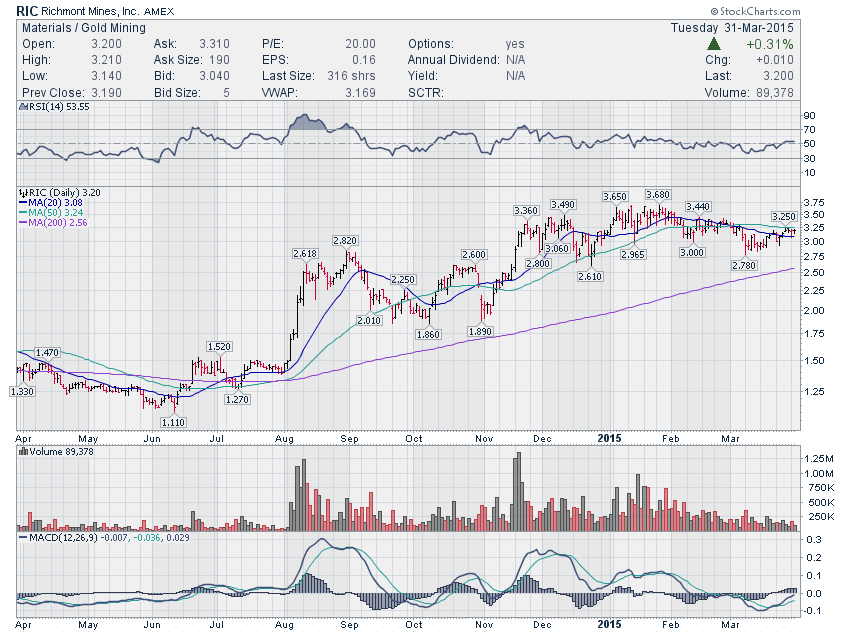

RIC - Narrow range consolidation above the 20dma and 3, could get interesting on a push through 3.25

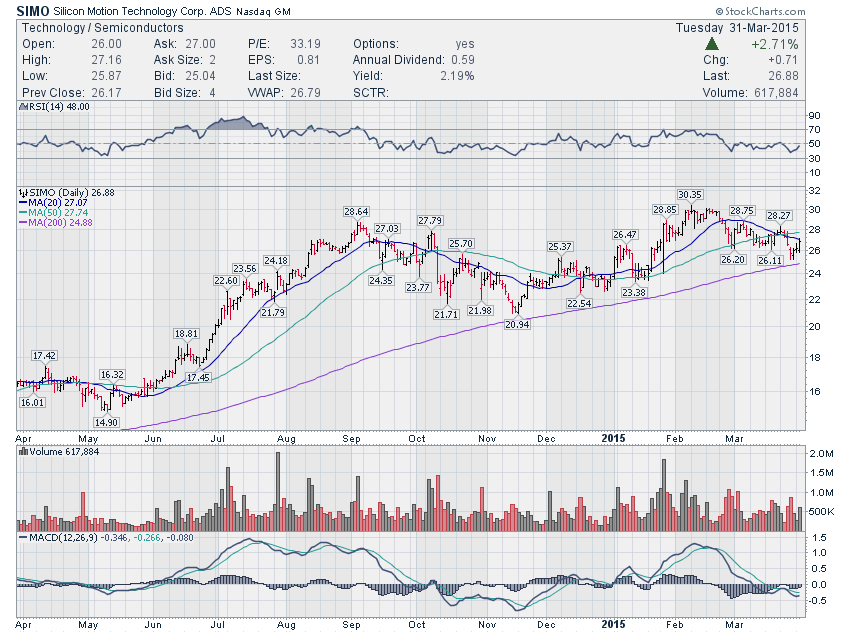

SIMO - Good relative strength and a bounce off support at 26, will be looking for continuation toward 28

Recent free content from Noanet Trader

-

Ignoring the Greco-German Noise

— 6/21/15

Ignoring the Greco-German Noise

— 6/21/15

-

June 18 Recap

— 6/18/15

June 18 Recap

— 6/18/15

-

All Eyes on the Russell

— 6/14/15

All Eyes on the Russell

— 6/14/15

-

Preparing for June

— 5/31/15

Preparing for June

— 5/31/15

-

Preparing for the Week of May 18

— 5/17/15

Preparing for the Week of May 18

— 5/17/15

No comments. Break the ice and be the first!

Error loading comments

Click here to retry

No comments found matching this filter

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member

Want to add a comment? Take me to the new comment box!