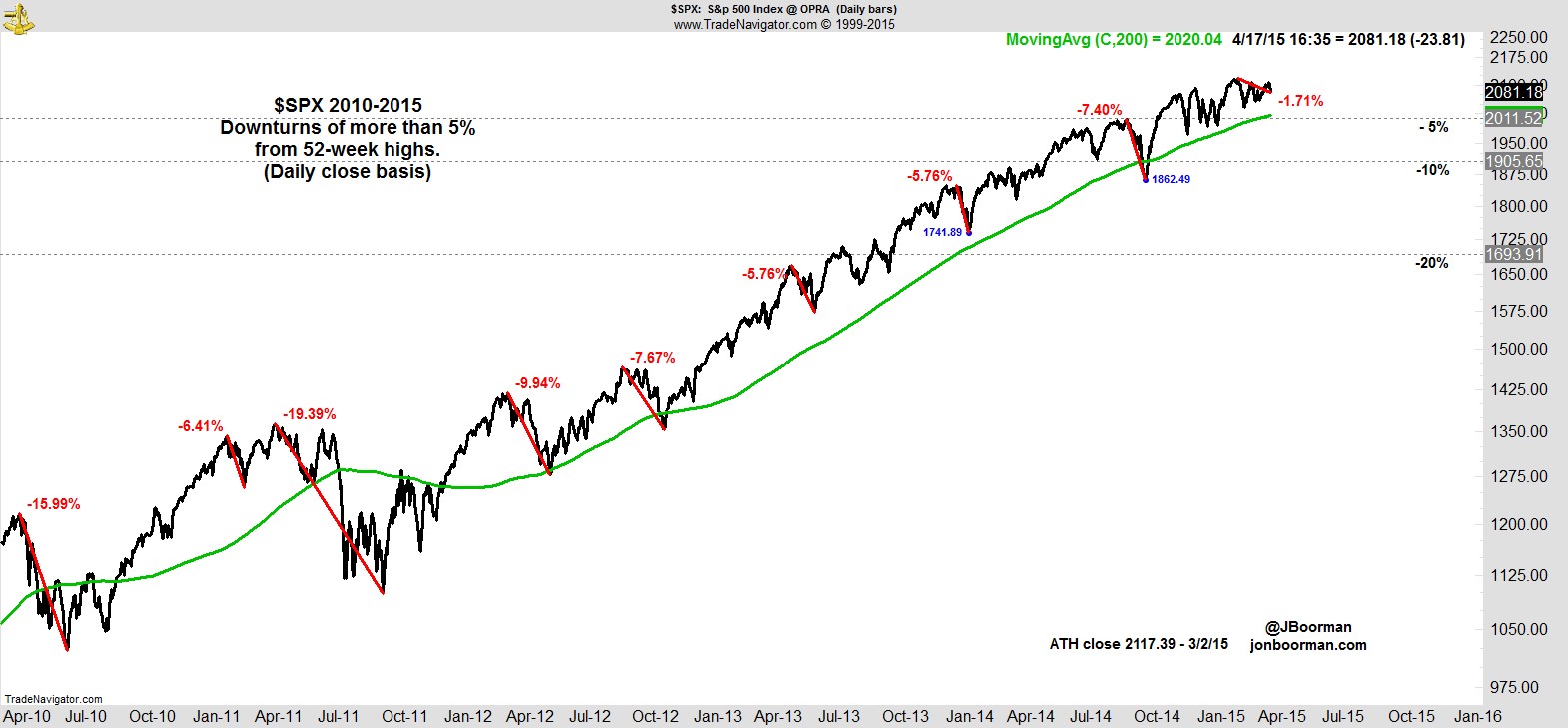

Friday's move felt bad, down days always do, but let's keep some perspective here; we're down 1.7% from the highs, and I suspect it's because we're correcting through time more than price that some market observers are frustrated. Having got so close to taking out new highs, Friday's decline felt like a rug pull, and knocked a few people off-balance.

.

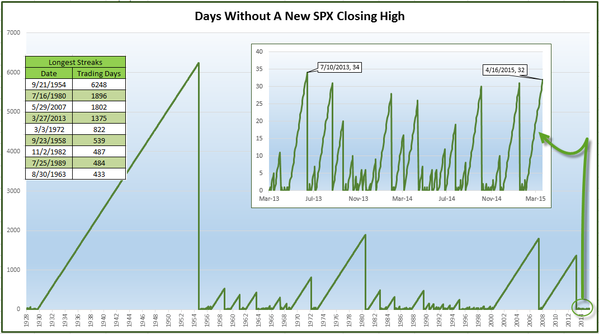

Monday will mark seven weeks since the market made its all time high, making this shallow pullback a very different experience to the V-shaped moves we've grown accustomed to. My friend @RyanDetrick's research shows this is the second longest streak in more than 2 years:-

.

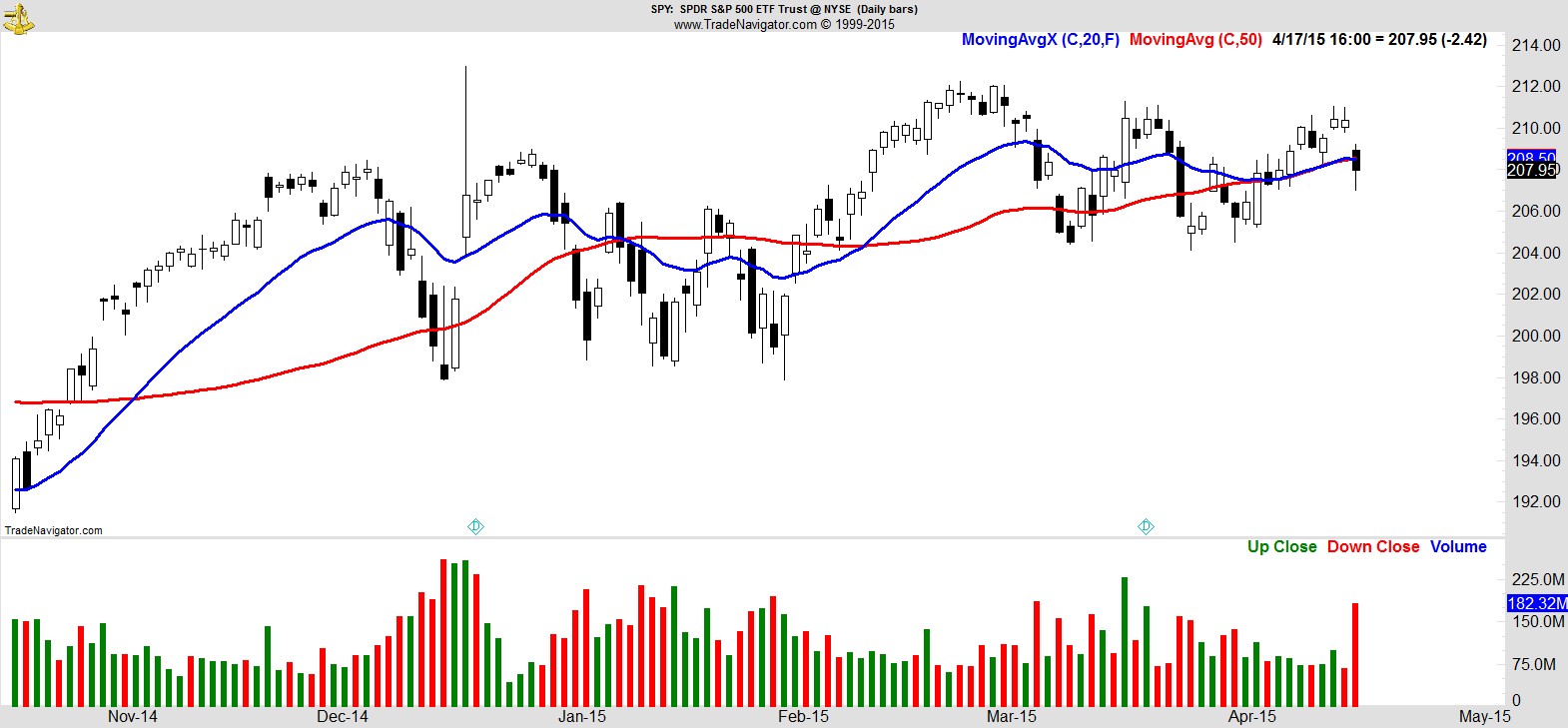

Let's briefly take a closer look at the S&P 500 via $SPY:-

As you can see we're still very much rangebound. Despite the break of the 50-day MA, there's really not too much to get worried about until this recent range is broken. That low close from 3/11 is a further 1.7% away, by which time the 200-day (not shown) will be coming into view.

I was reading some remarkably large-font headlines earlier about today's market and I was thinking they're either catering to what they believe is their partially-sighted readership, or they think today was some kind of global rout.

Now the only observation I'd make is that in my experience when truly serious down days occur, I'm talking game-changer moves that can end trends or kick-off protracted bear market declines, you'll often see multiple markets and asset classes become highly correlated, but I didn't see any evidence of that today. Gold, currencies, bonds, oil, they all had days that weren't out of the ordinary.

So yes, it was a decline in global markets, but it was isolated to equity markets, and if we're supposed to believe the causality assigned to today's move - which morphed from Bloomberg being unavailable (I kid you not, that was an explanation), to China margin restrictions (more plausible), to Greece leaving the Euro (yes, that again), - then I would expect to see the magnitude of such events extend to the domains of fixed income, currencies, and commodities. But it didn't.

So let's just stick to the facts. Equity markets were down today but remain in an uptrend.

Our Marketfy portfolio again outperformed the market, -0.5% on the week vs -1.0% for the S&P. YTD it's now +12.0% vs +1.2% for the S&P.

Turning to our watchlist, of the major S&P sectors, the notable change for me this week was the decline in Consumer Discretionary names, as it's been such a happy hunting ground and a significant contributor to performance.

As impressive as Energy's resurgence has been on a short-term basis, it's only just starting to enter my domain. It's all about what timeframes and methods you trade. Where this can become a problem though, is if you allow yourself to be influenced to any extent by the actions of others.

I know it can be frustrating to see or hear of other traders talking about the killing they've made in Energy names or whatever the trade of the week may have been. There's nothing worse than the feeling of missing out. Well, actually there is. Missing out and seeing someone else make it. That's much worse. You know what, it can happen. But don't let it distract you.

You're still riding healthcare and consumer names they wouldn't dream of holding for this long, for gains that would take them 50 trades to make. Know your timeframe. Trade what works for you. Stick to the system.

Here's a sample of 8 names from this week's watchlist:-

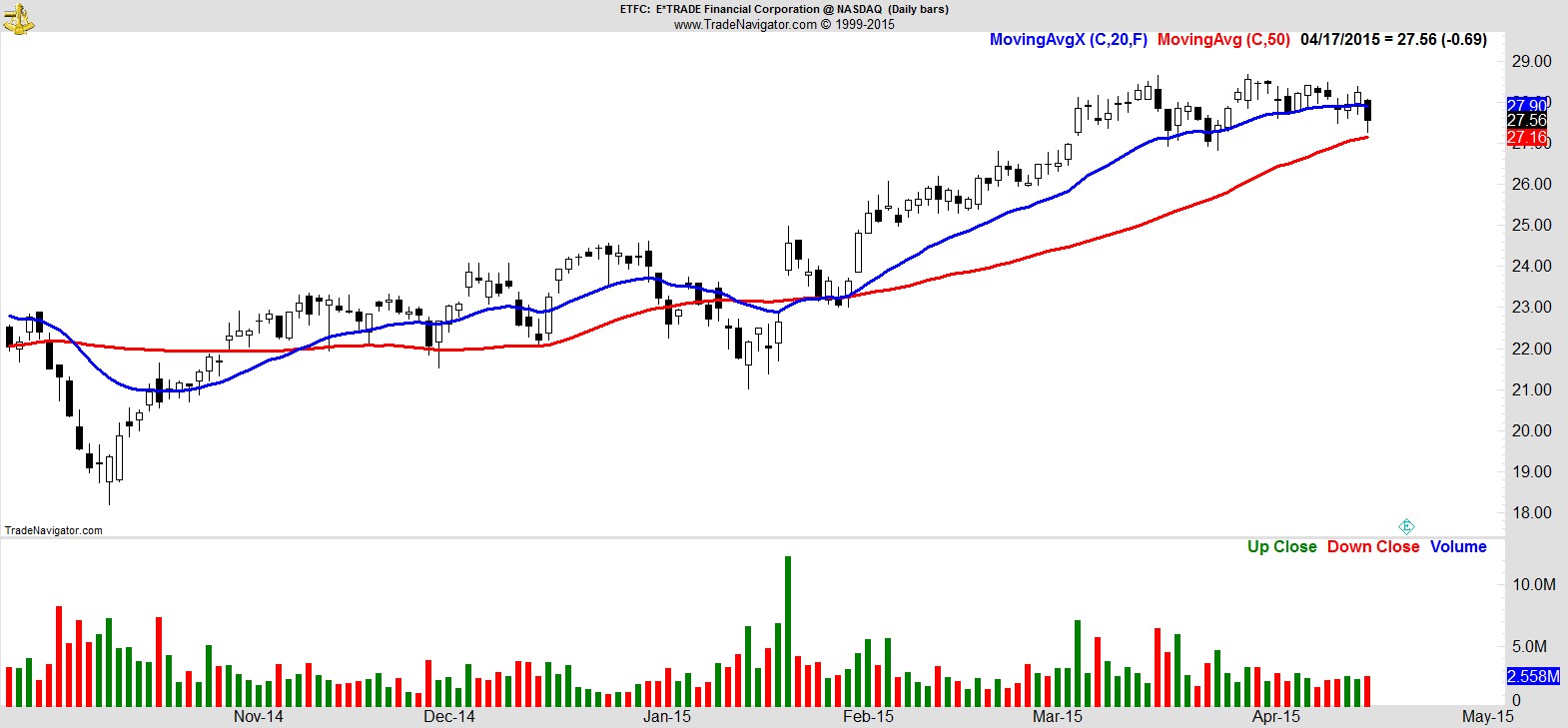

$ETFC

.

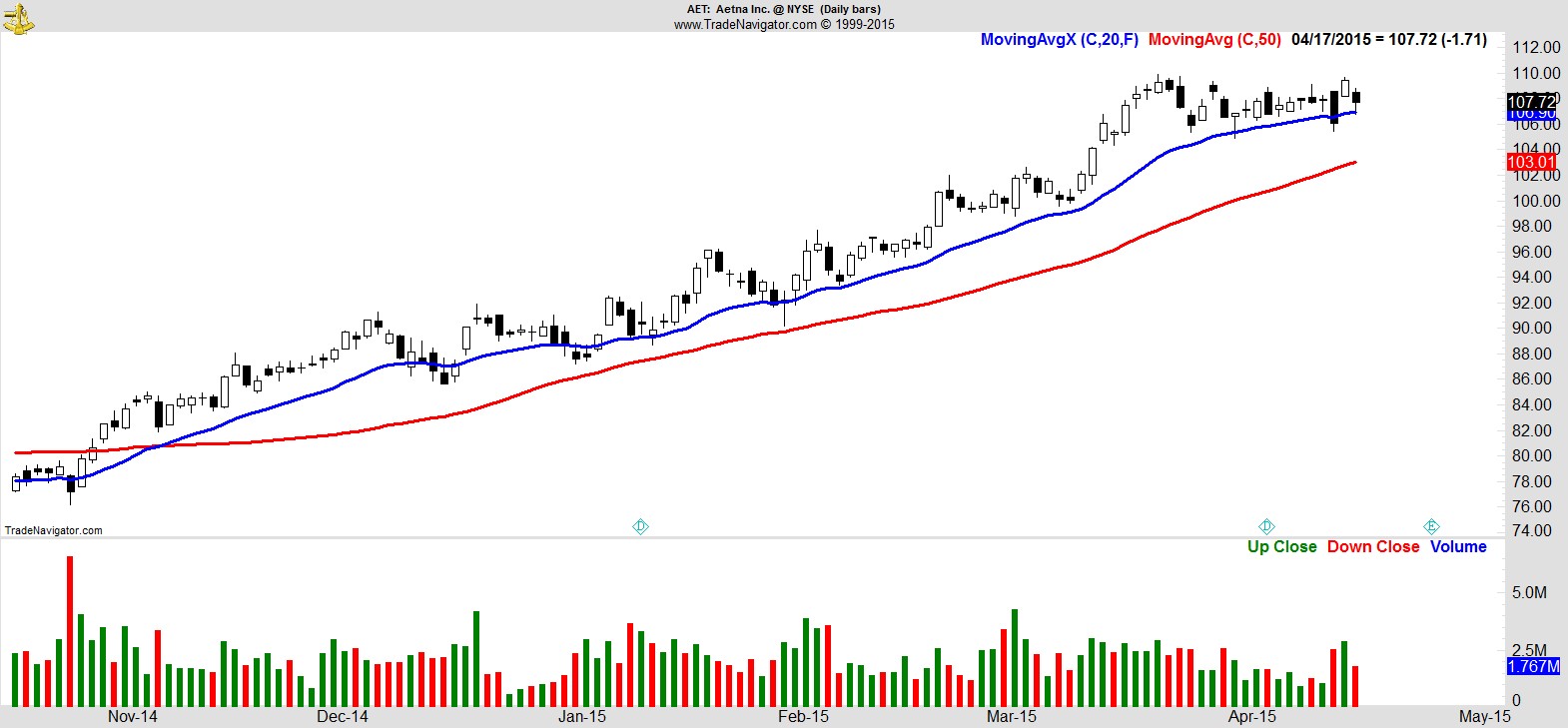

$AET

.

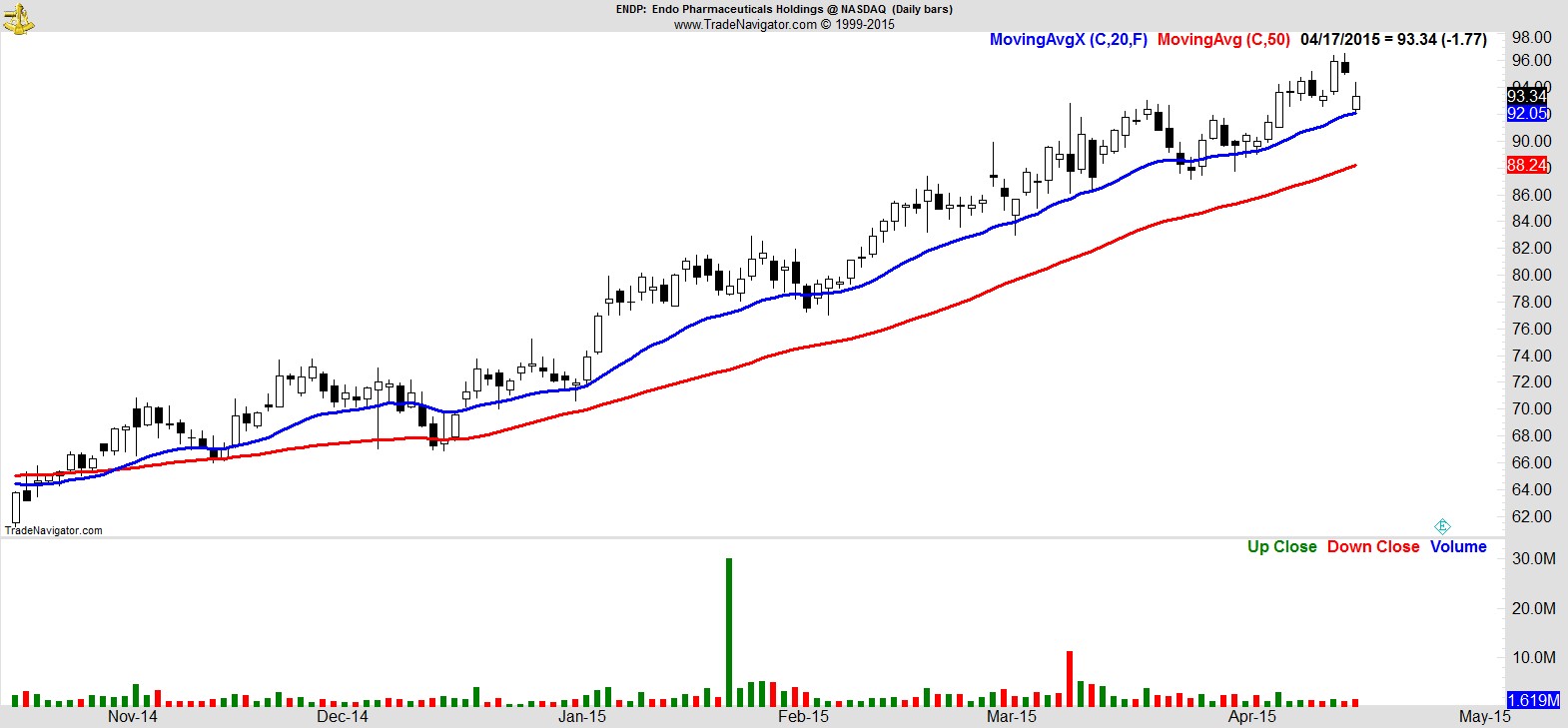

$ENDP

.

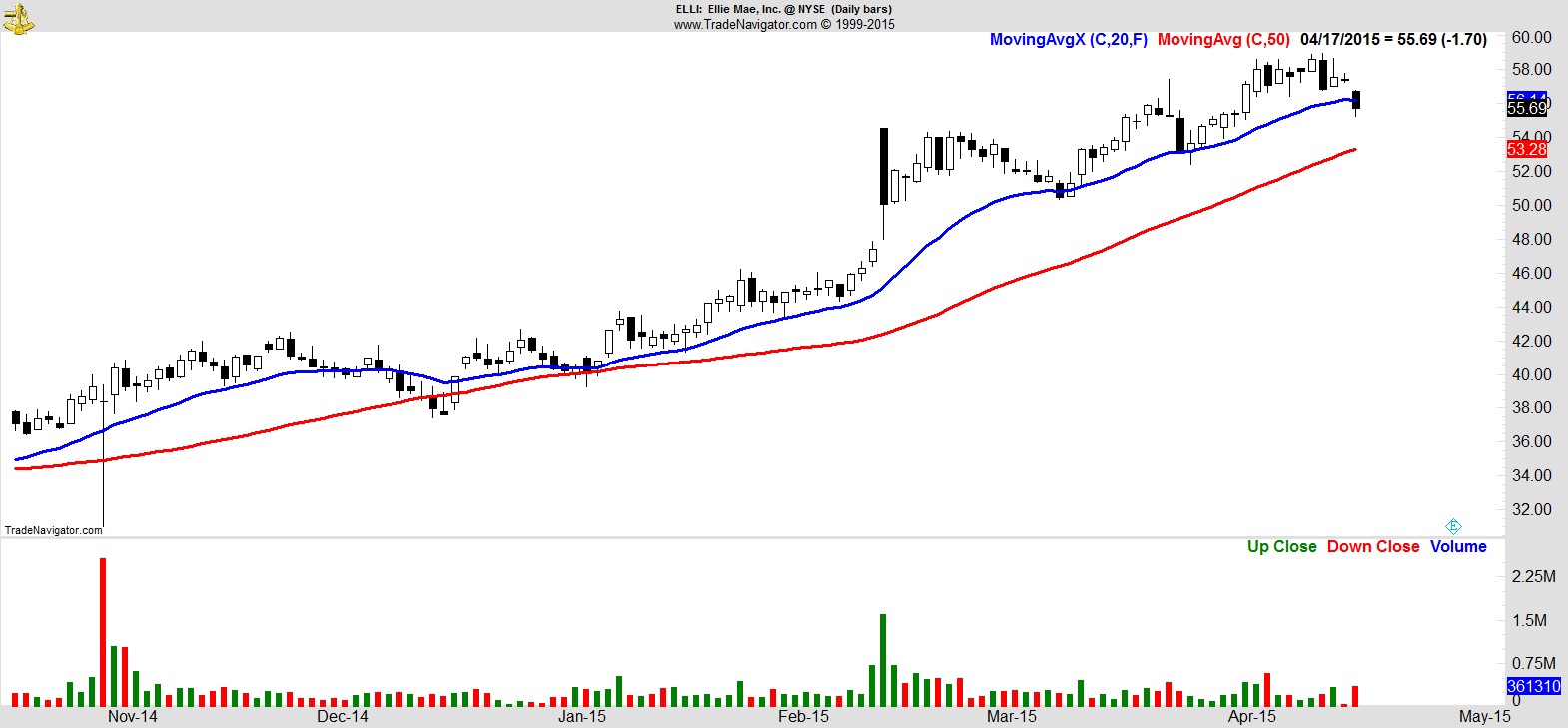

$ELLI

.

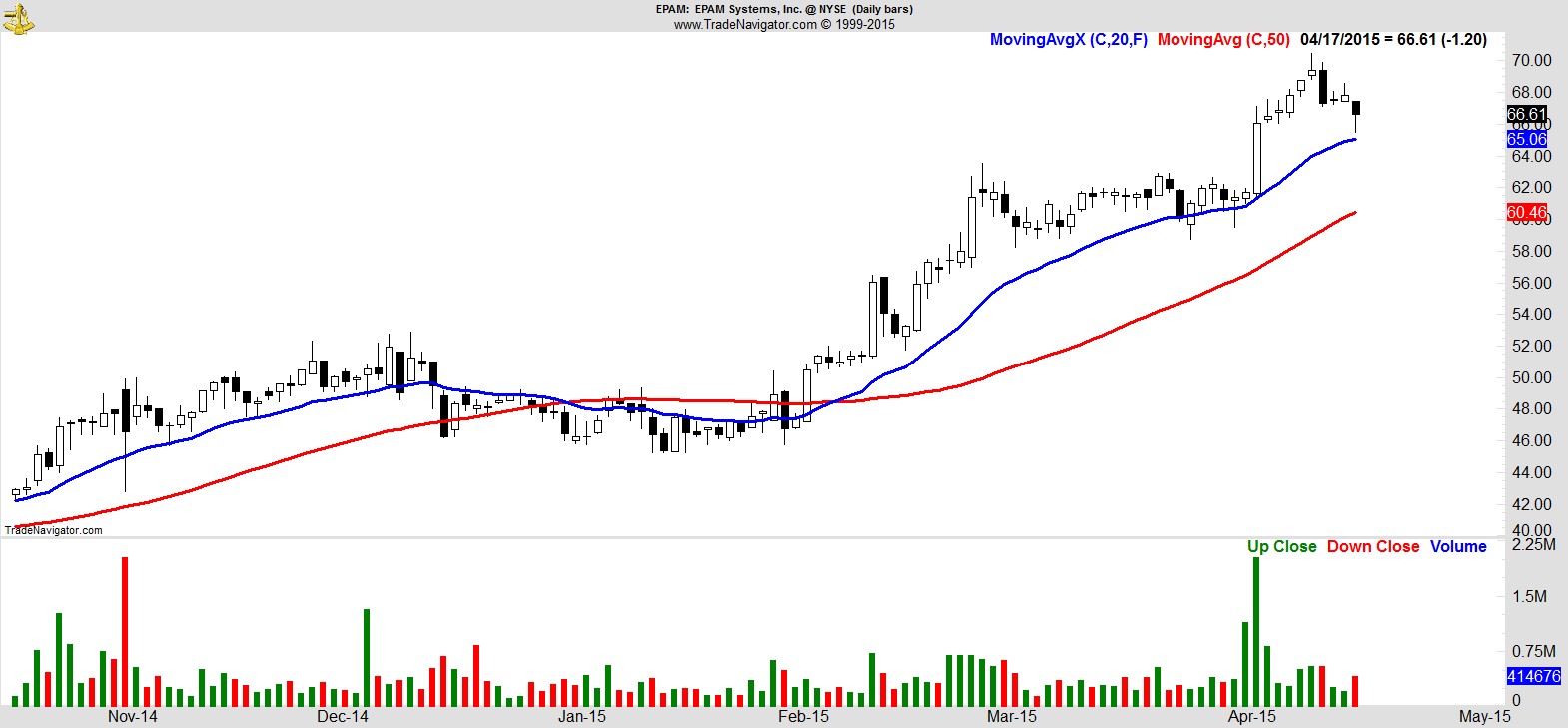

$EPAM

.

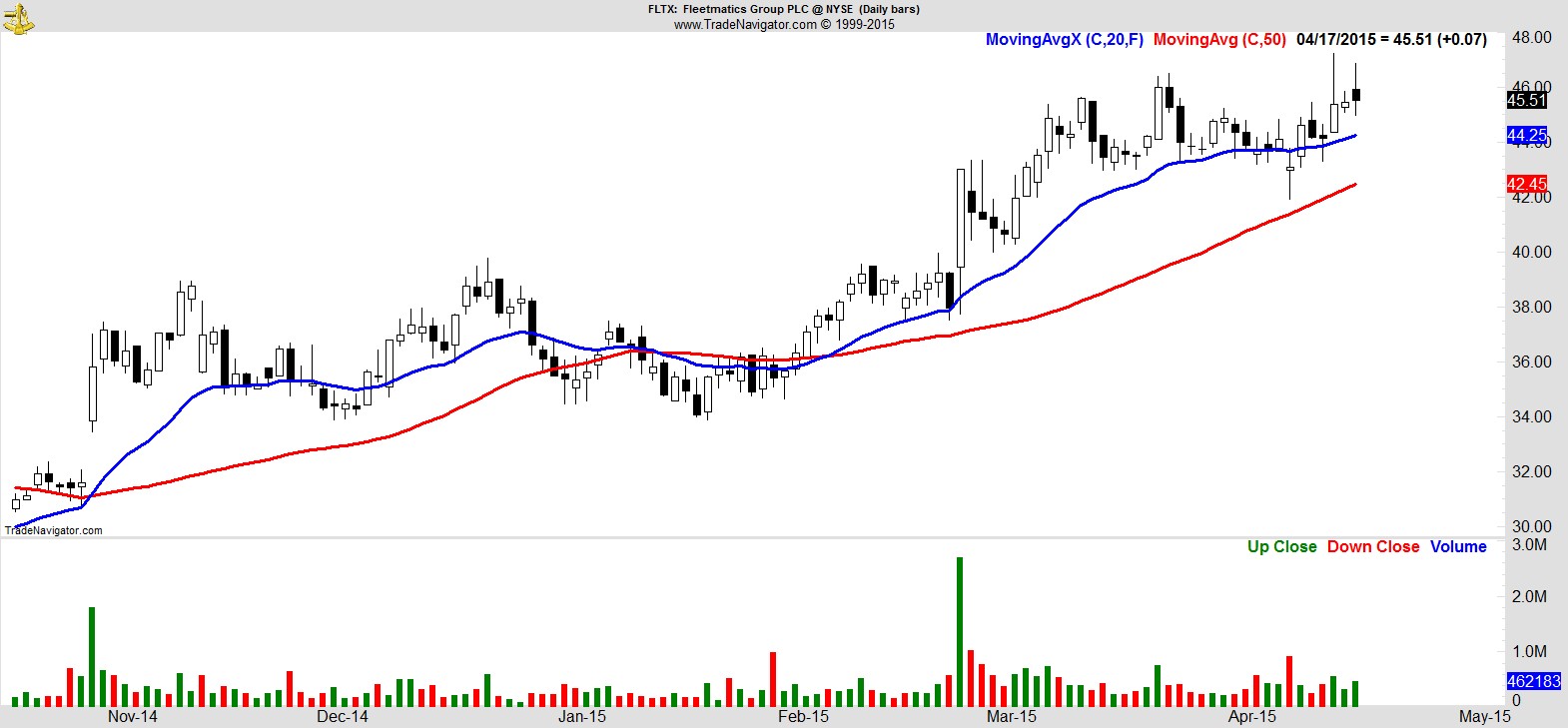

$FLTX

.

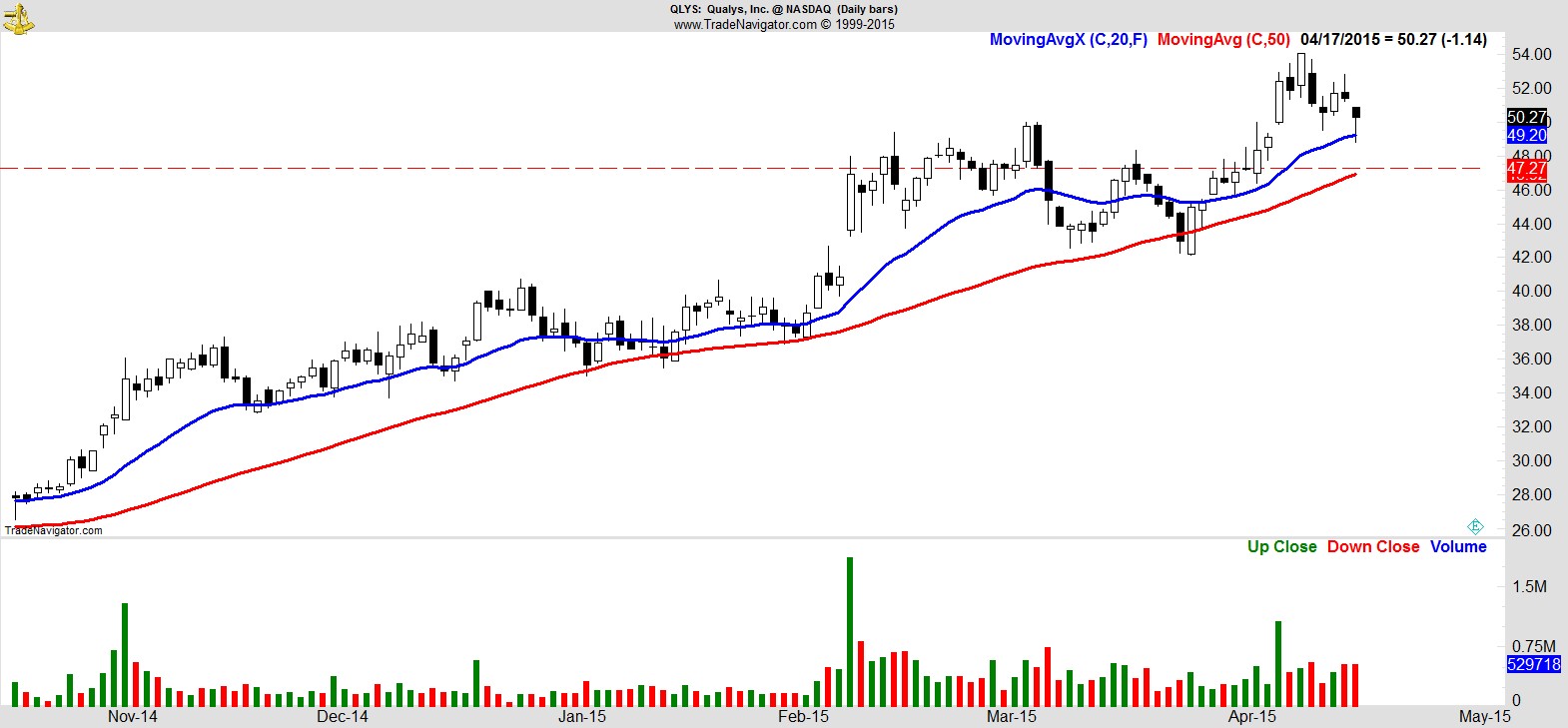

$QLYS

.

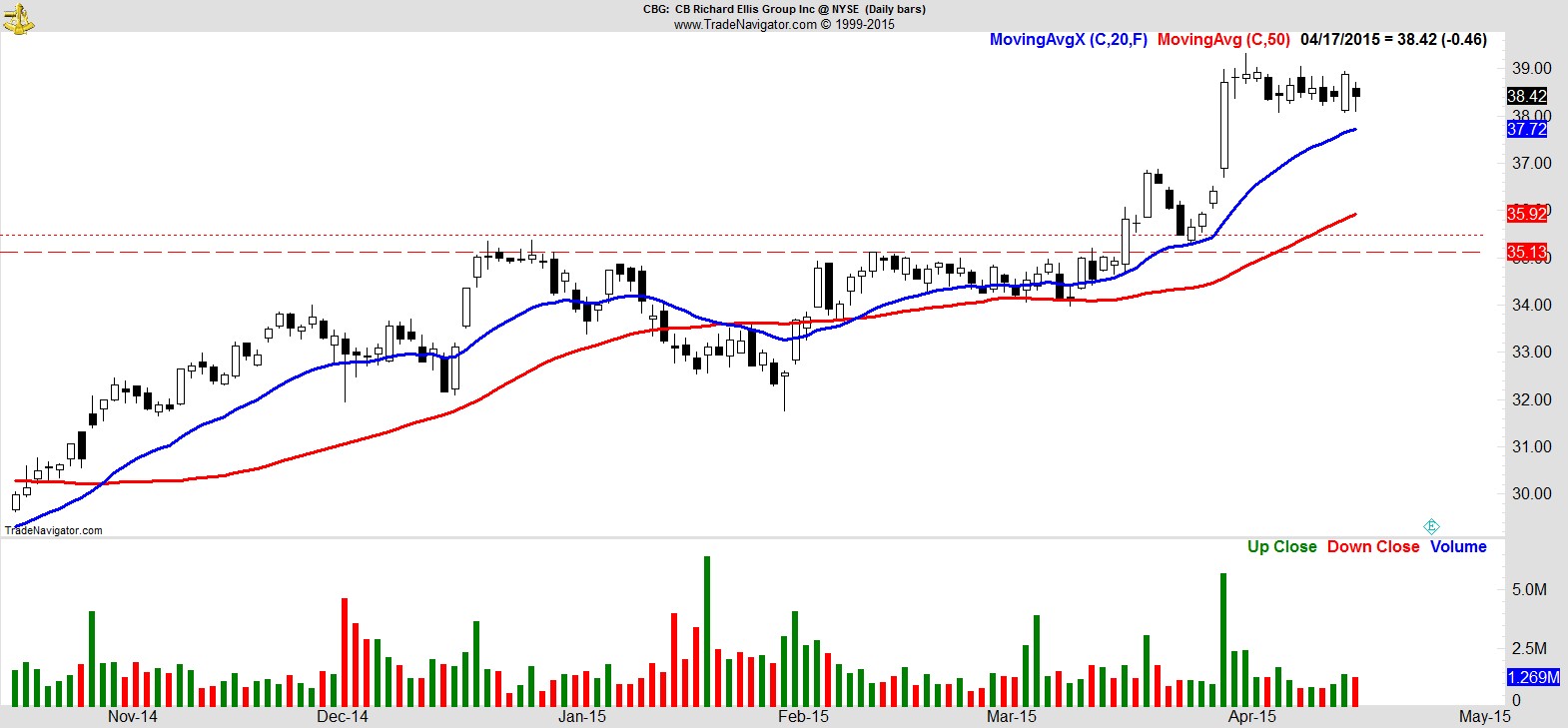

$CBG

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17