EZCORP (EZPW) is one that I have followed since 2008 and currently hold in my Top 20 Model Portfolio, with a one-year target of 31.50 based on just 10PE. There have been some execution issues and some management turnover (CFO), and the stock has lagged its rivals FCFS and CSH rather dramatically.

The trade here (a buy at 21.62), which is set to expire on 3/7 or upon hitting the target of 23.99 or the stop-loss of 21.08 (4.4 reward-to-risk), has no real near-term fundamental catalyst except that the rally in gold after the recent sell-off may help. Let's look at the charts, from a longer perspective to shorter.

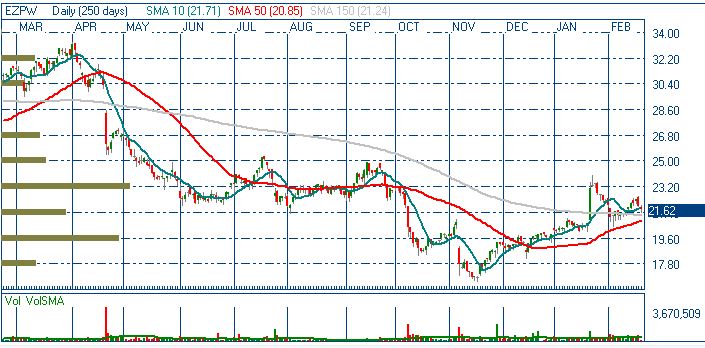

Here, we can see that the stock bottomed in the 4th quarter but has been below the 1-year moving average, which is currently 23.32 and declining. The stock has been below this line since last April, and this trade is based on support at the 50dma (10 weeks here) at 21.12 and rising. On this chart, we see resistance actually near 25 if 23.50 clears.

On the one-year chart, it looks a bit better. I prefer the 50dma and the 150dma, both a bit shorter than the longer and intermediate dma I use on the weekly. In this daily chart, the recent action is clear. After the last earnings report in January, the stock surged on big volume. It totally retraced and then rallied a bit. The small pullback here to the bottoming 150dma affords an entry in my view. The high on the day after that spike intra-day was 24.06, so our target works being slightly below the interim high.

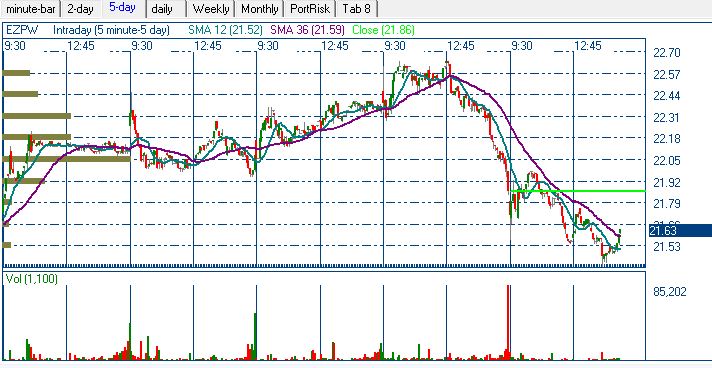

On the 5-day chart, we don't see much to go on, but I include it for perspective. There hasn't been a big volume trade down today, so I may actually be early setting this trade. I would be more confident in the trade at this point on a break to the upside of 22. Still, given how well its peers (FCFS and CSH) are doing, the bounce in gold as well plus how inexpensive it is, I think its worth the risk to a stop-loss of 21.08.

Recent free content from Cannabis Analyst

-

Trading Takeover Candidates for Big Gains [Webinar 9/9/2013]

— 9/09/13

Trading Takeover Candidates for Big Gains [Webinar 9/9/2013]

— 9/09/13

-

Long Trade 08/14/13

— 8/14/13

Long Trade 08/14/13

— 8/14/13

-

3 Earnings Season Disasters and How to Trade Them (webinar 7/29/2013)

— 7/29/13

3 Earnings Season Disasters and How to Trade Them (webinar 7/29/2013)

— 7/29/13

-

Short Trade 07/03/13

— 7/03/13

Short Trade 07/03/13

— 7/03/13

-

Webinar Slides

— 6/21/13

Webinar Slides

— 6/21/13

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member