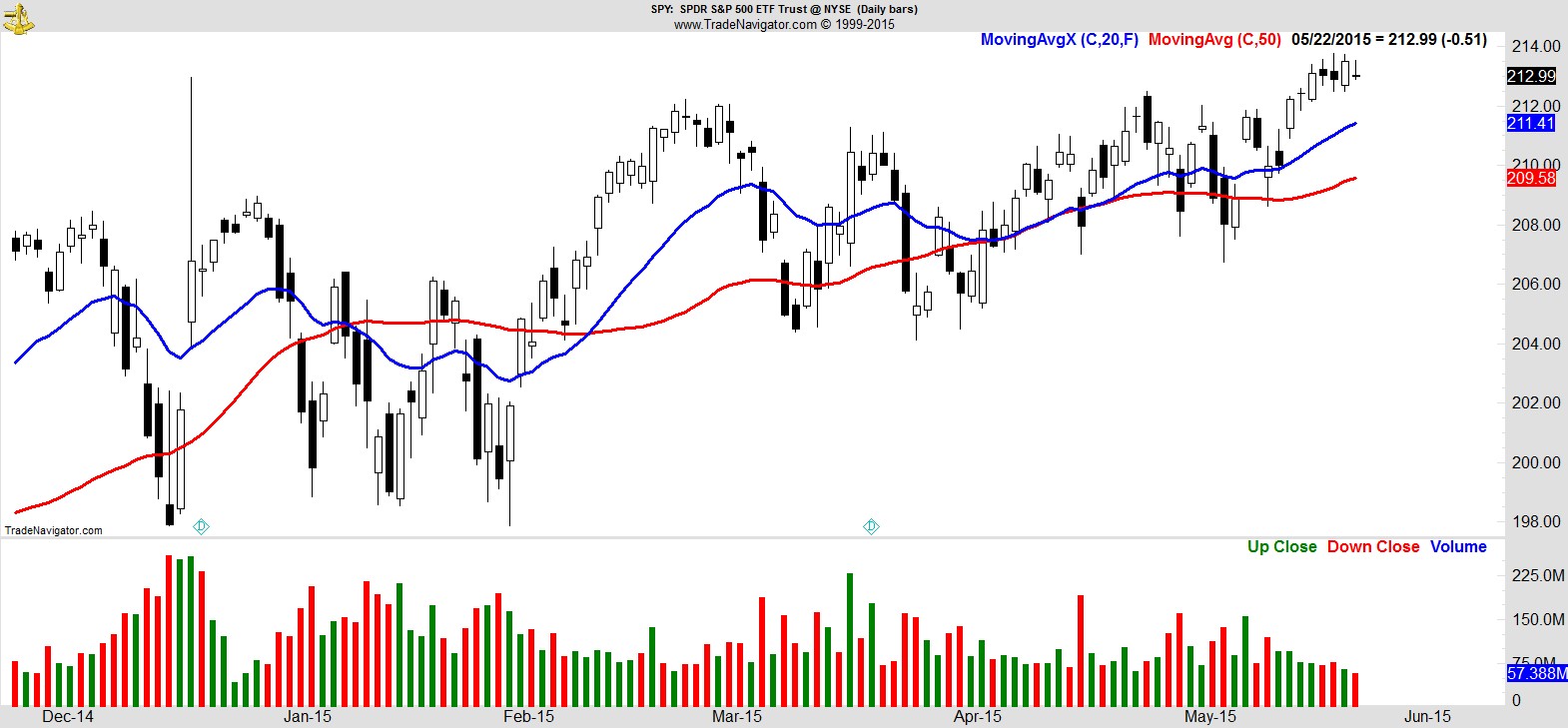

The market followed through with fresh all time highs this week, but only marginally so, continuing to frustrate bulls and bears alike with its narrow trading range. Here's the $SPY:-

Despite the higher highs and higher lows in evidence, you can see the choppy price action this year and how hard it must have been for many to navigate, crisscrossing its MA's the whole way.

Let's take a look at some other areas worth noting.

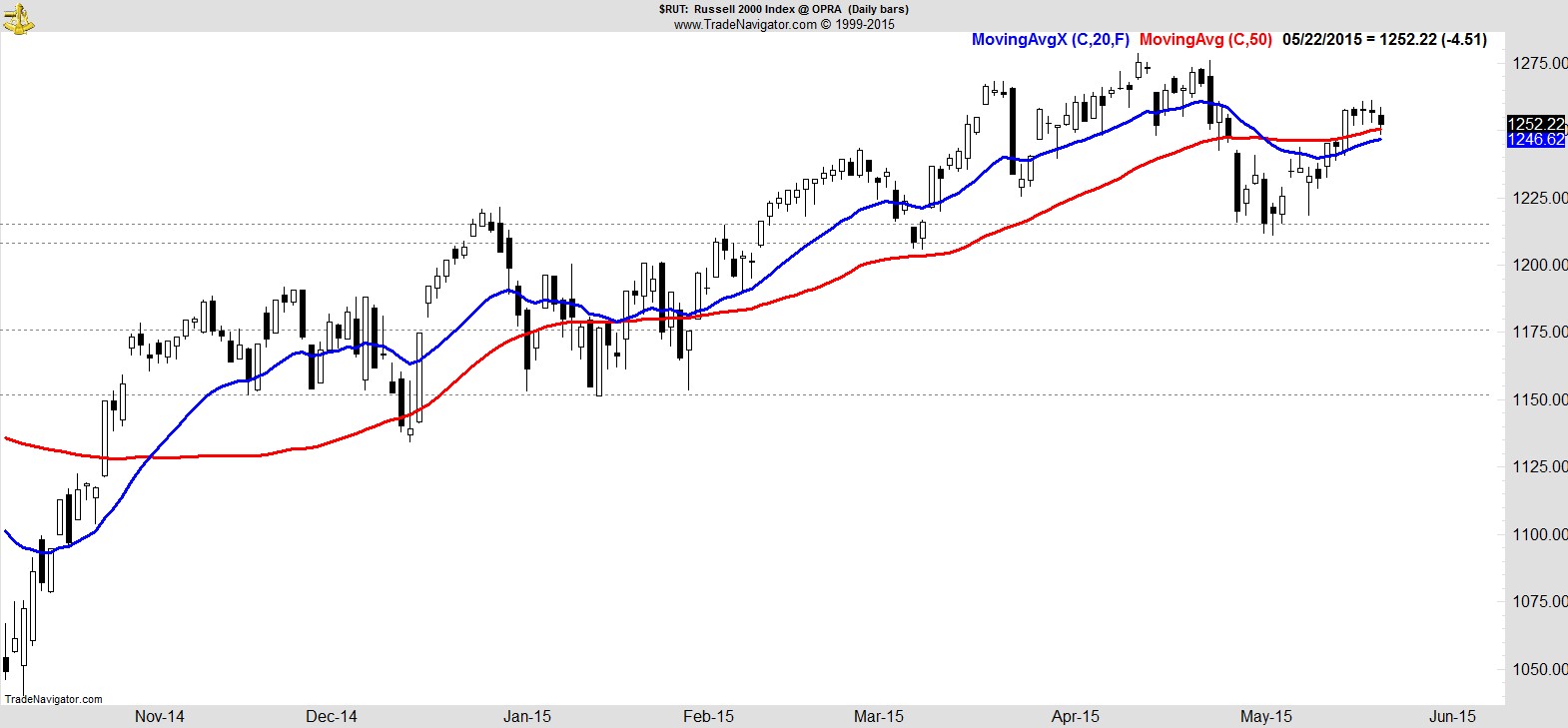

Although the Russell 2000 remains below its highs, it gained for the third straight week, making April's weakness look like a simple retest of its breakout level, with it now ready to resume higher.

.

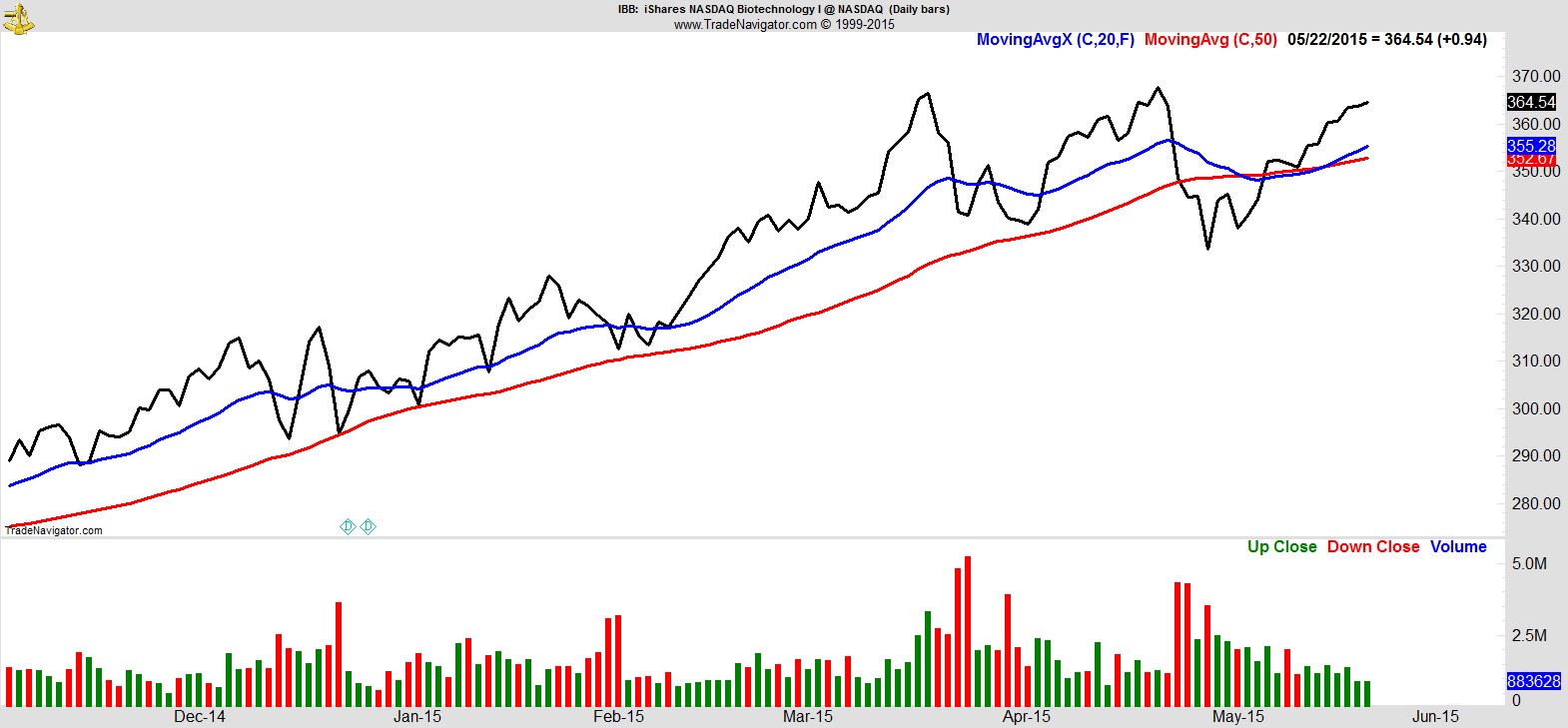

Biotech ($IBB) continues to recover very strongly and is again on the verge of new highs.

.

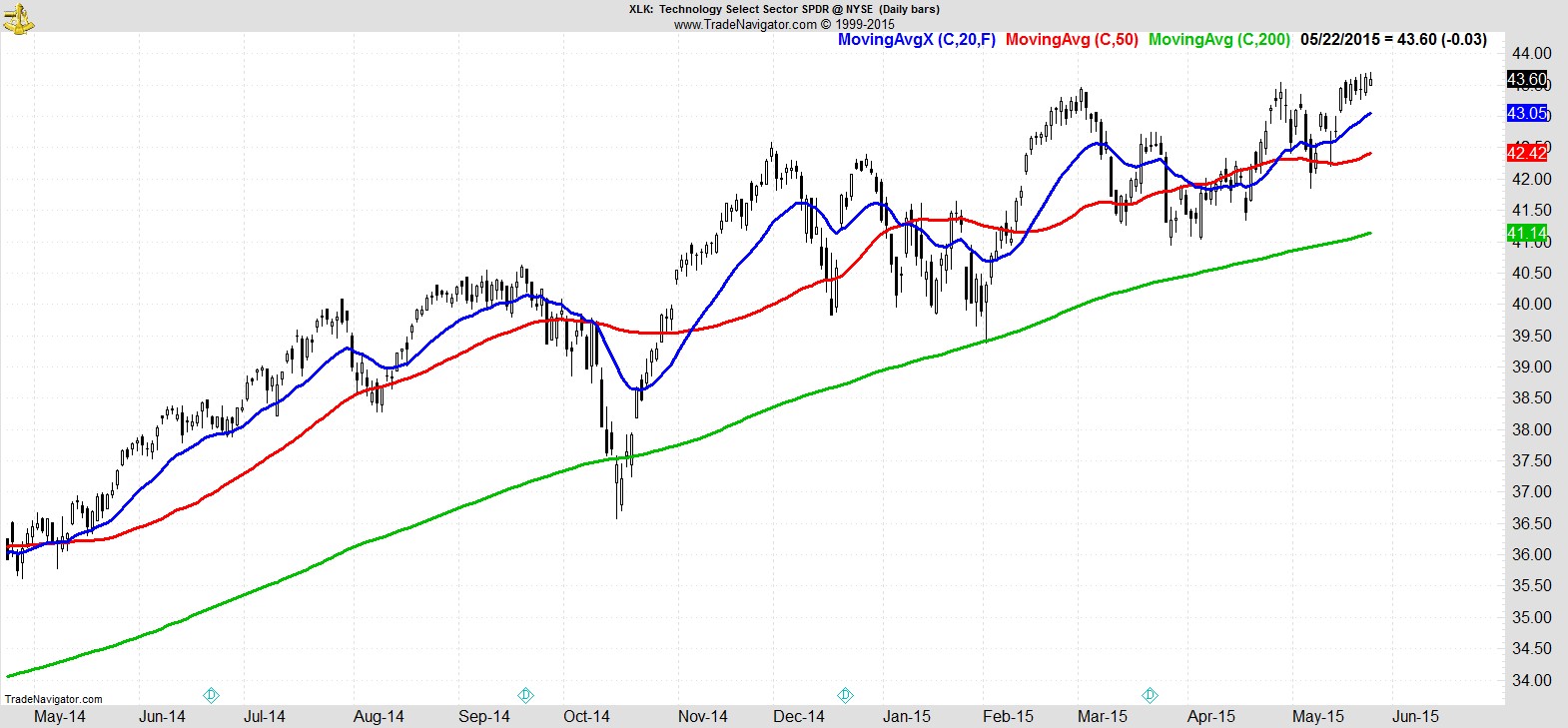

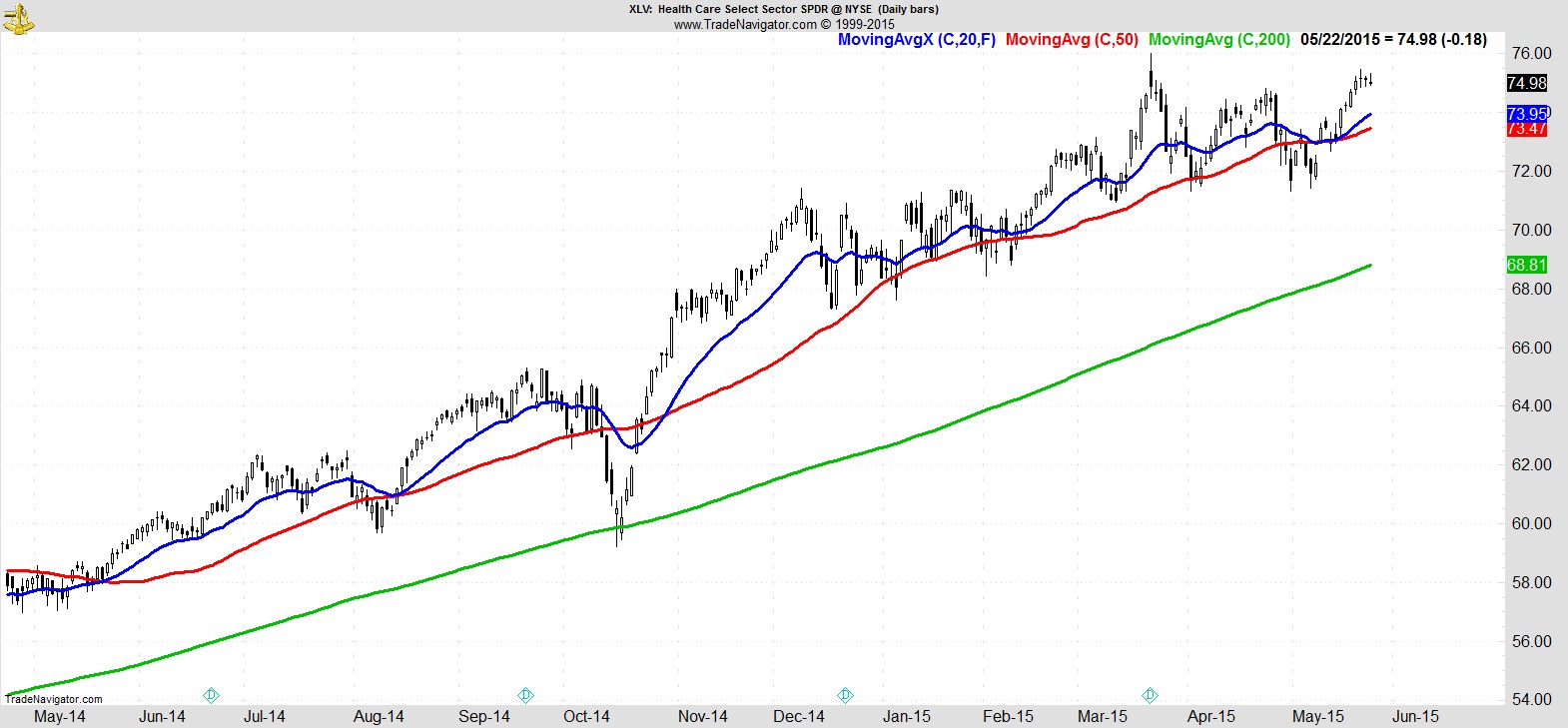

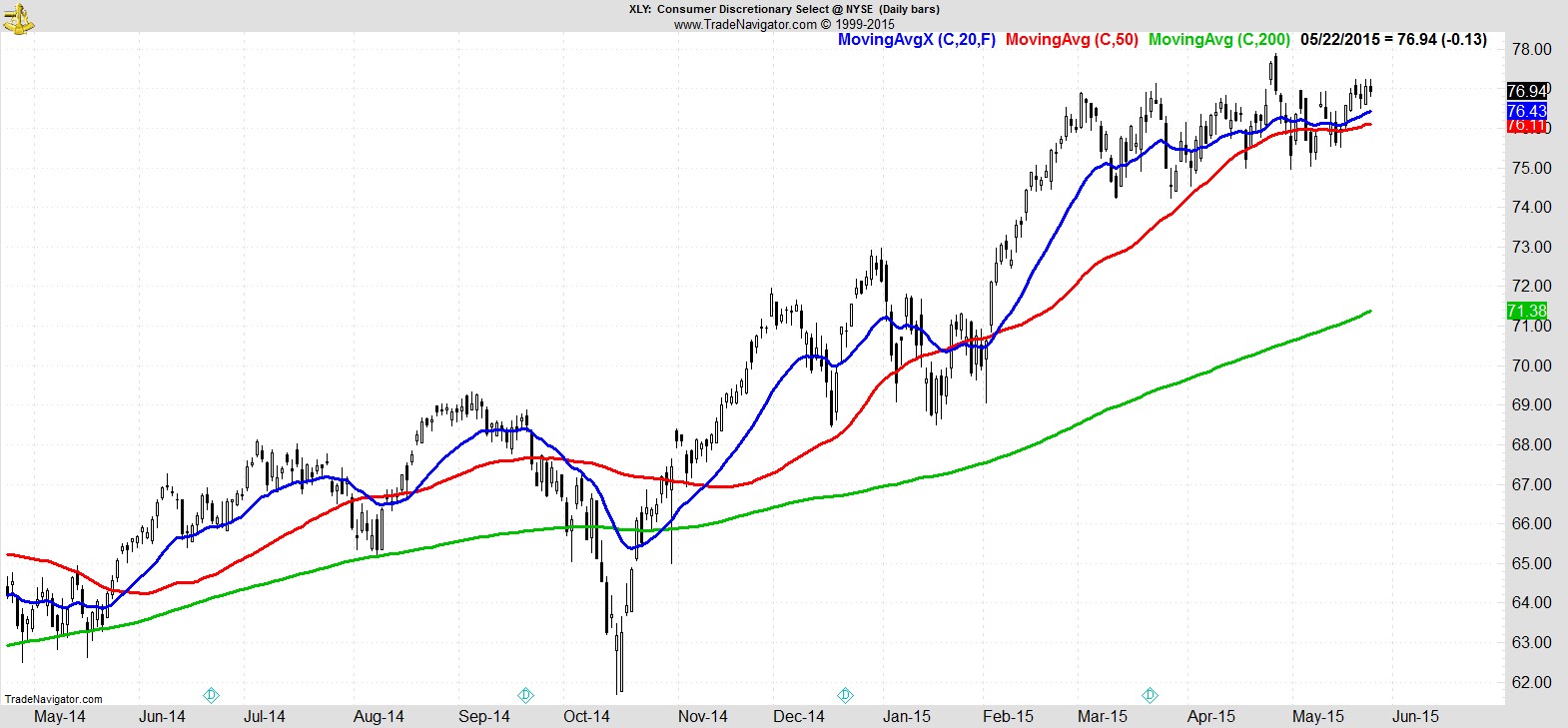

Turning to the nine S&P Sector SPDRs, Technology ($XLK), and Healthcare ($XLV) are once again leading the way, with Consumer Discretionary ($XLY) not far behind, having recovered from a break of its 50-day just over a week ago.

.

Using sectors and individual stocks as our guide rather than the market itself has certainly made it easier to identify where the areas of real strength reside and make those our focus. That paid off again this week with our Marketfy portfolio gaining 1.1% vs 0.2% for the S&P 500, almost a repeat of the previous week. Year-to-date that takes us to +10.9% vs +3.3% for the S&P.

Although there were no entry or exit signals this week, by Friday's close we had a lot of changes to our stops, either through new highs that allowed us to trail higher, or where failing to take out new highs and stalling, our invalidation point was brought that much closer, thereby reducing our risk.

I continue to believe with the market at all time highs, broad sector strength, and underlying skepticism towards further gains, the path of least resistance remains higher.

This week was all about sitting tight and letting our winners run. There was nothing to do, so we did nothing. There were no exit signals or new entry signals, either in our Marketfy portfolio or among the additional trade ideas.

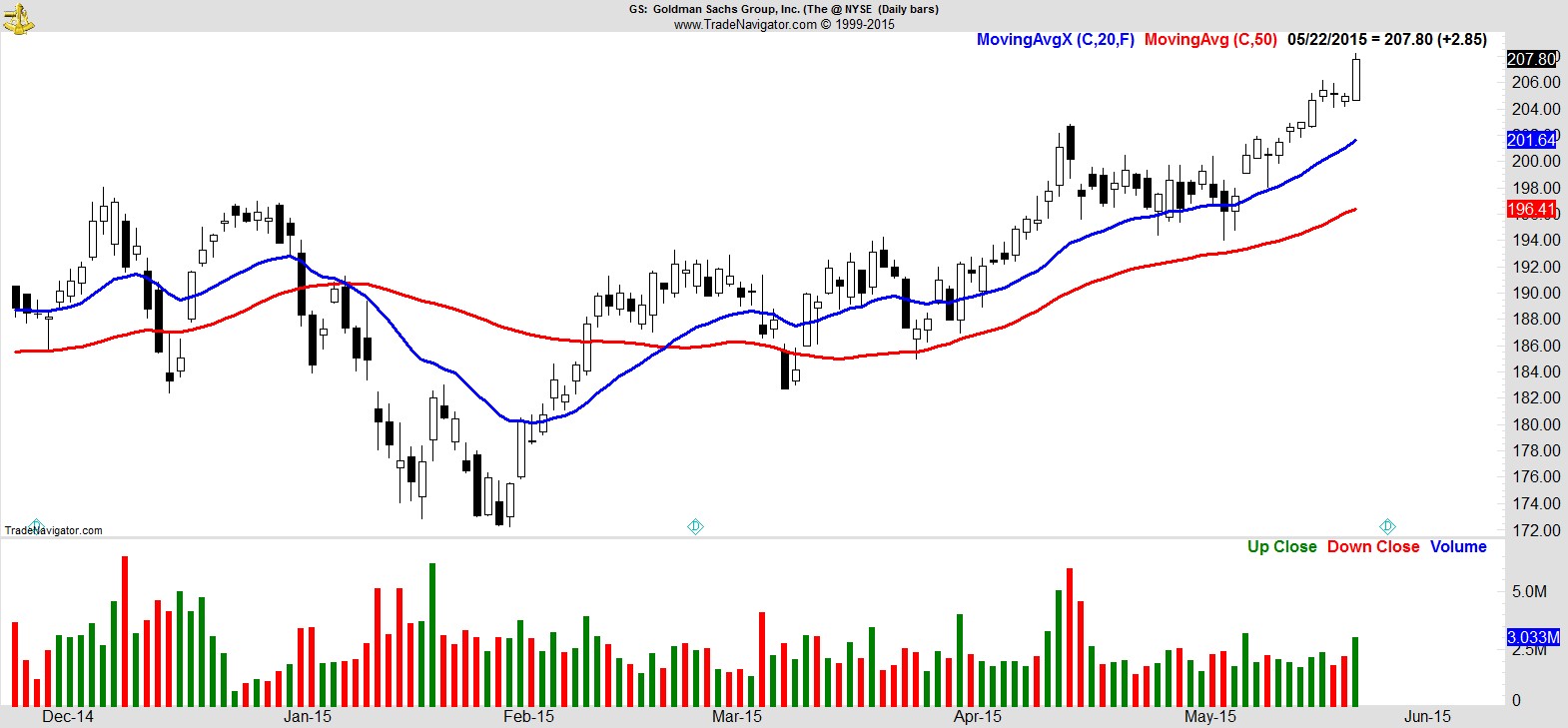

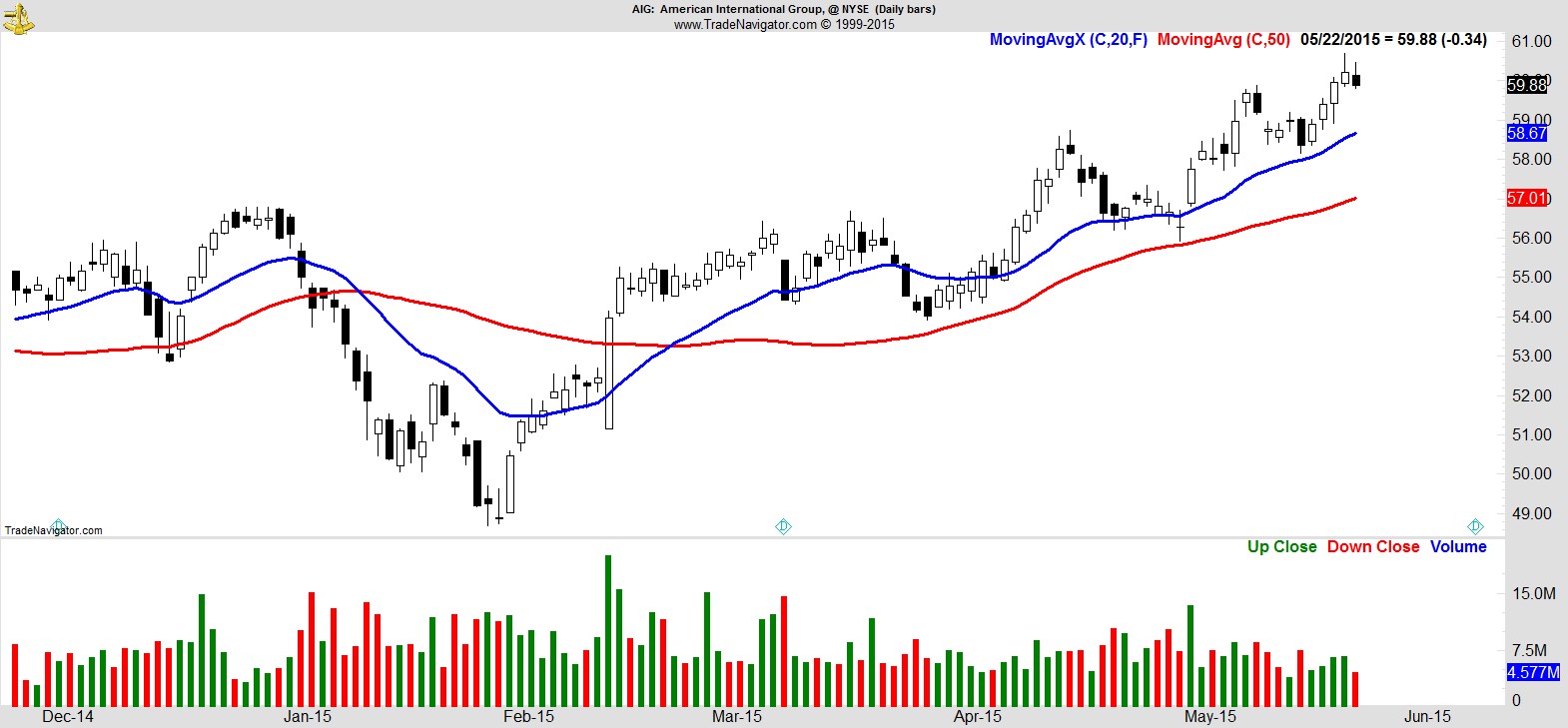

Our watchlist continues to reflect the strength in technology, healthcare, and consumer discretionary, as well as the improvement in industrials and financials.

Here's a sampling of 12 from the full list of 30 names:-

$GS

.

$AIG

.

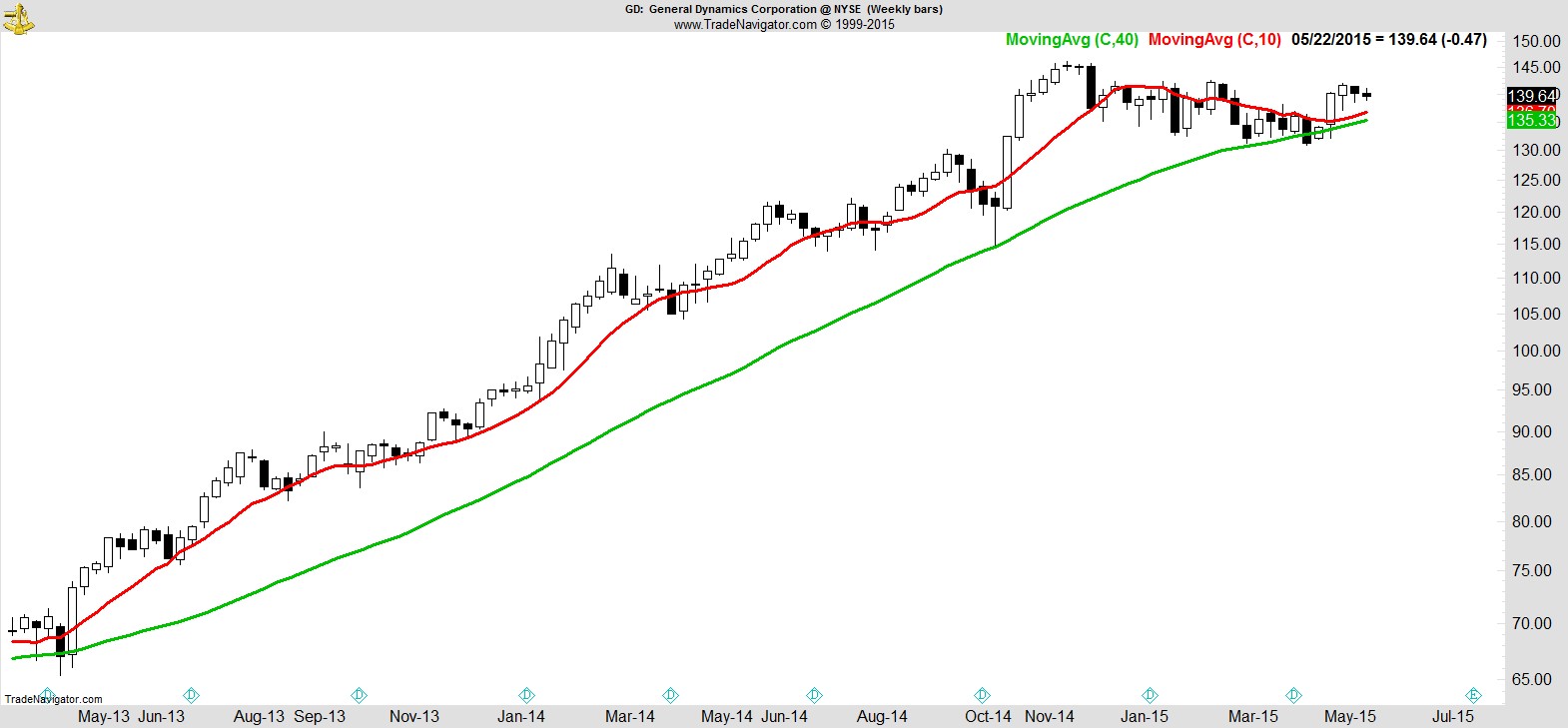

$GD

.

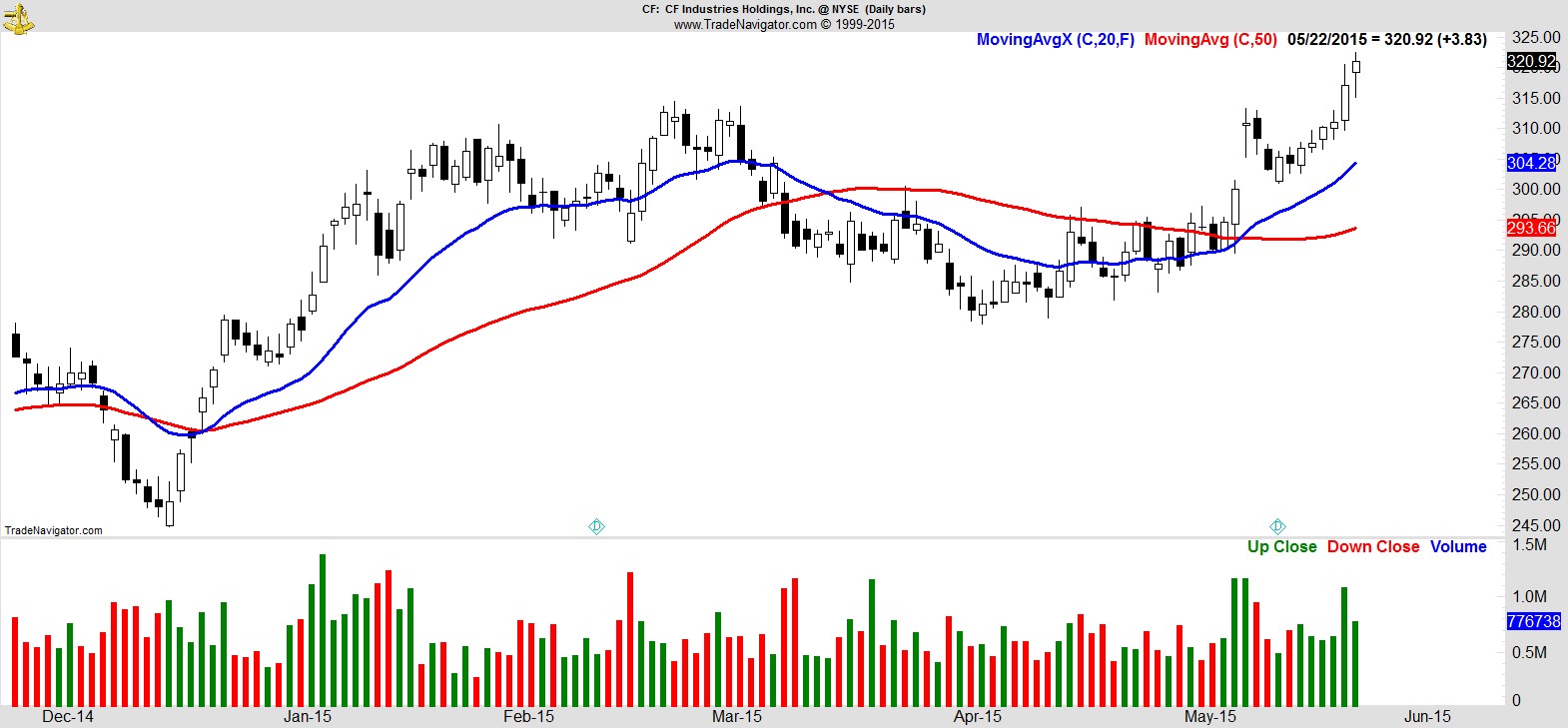

$CF

.

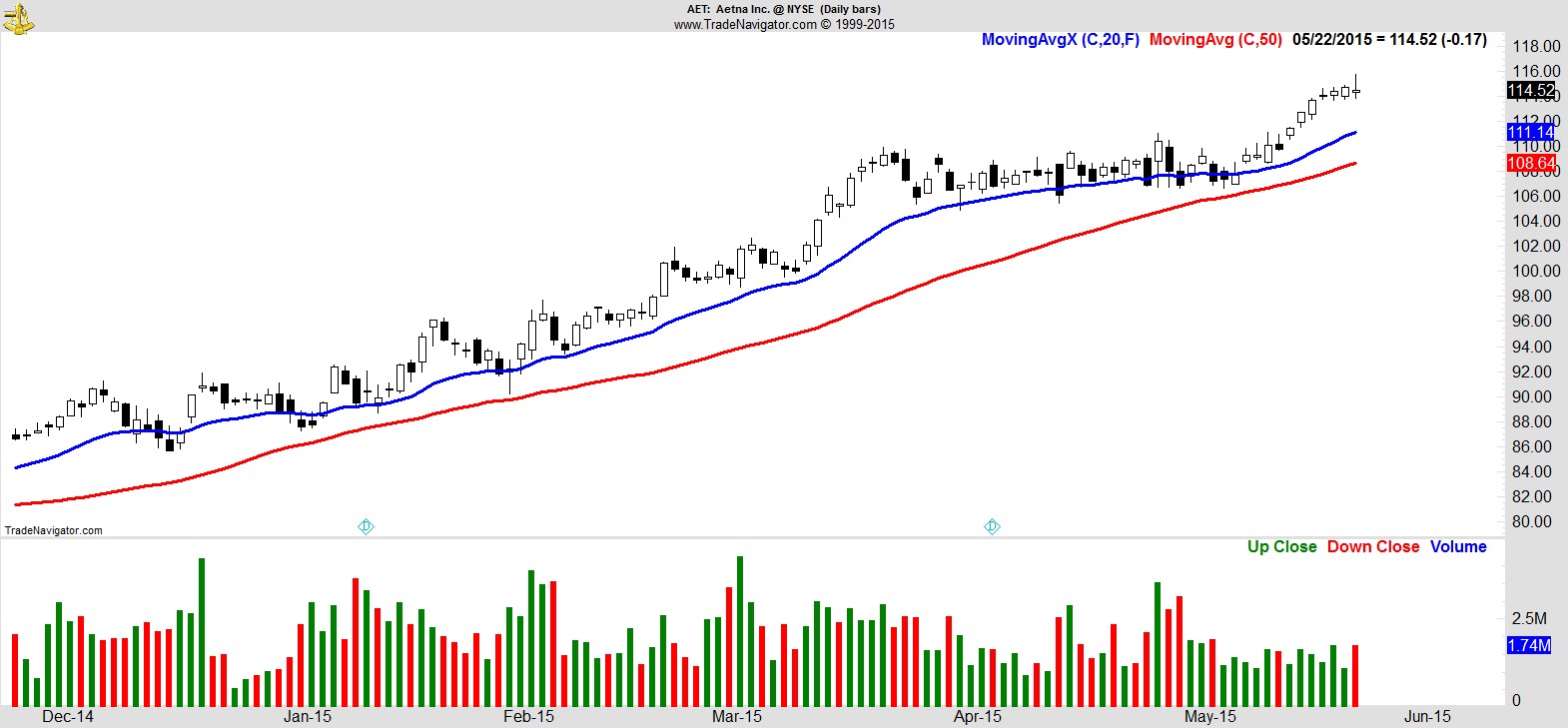

$AET

.

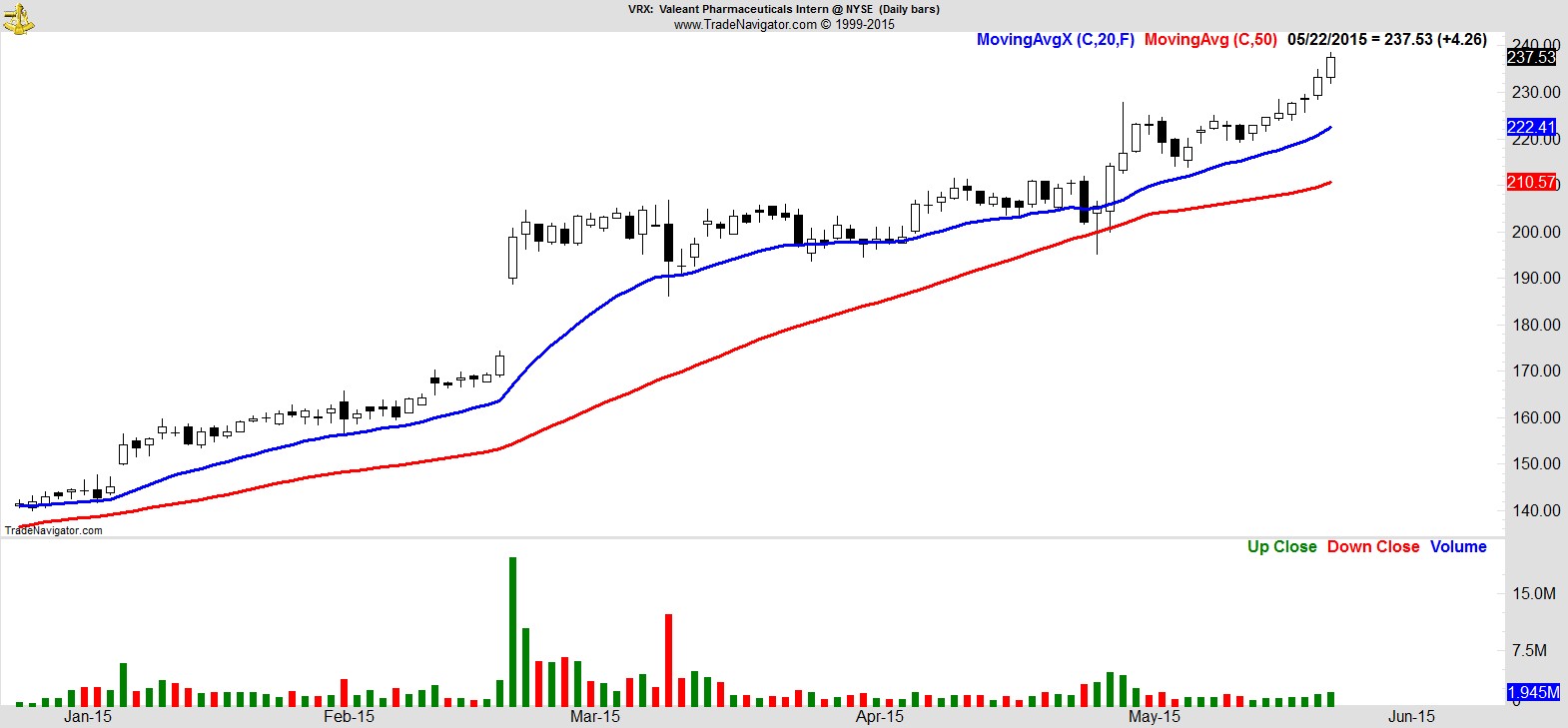

$VRX

.

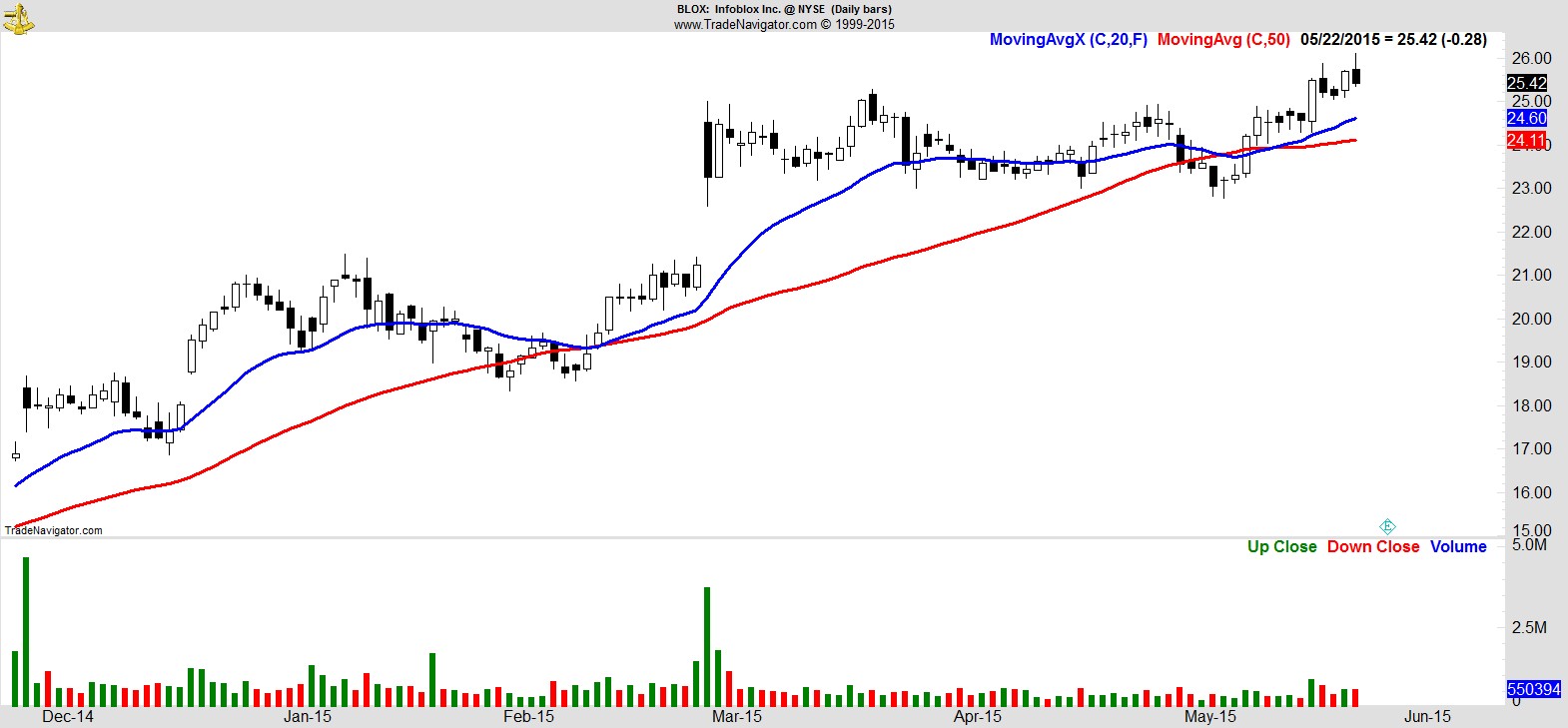

$BLOX

.

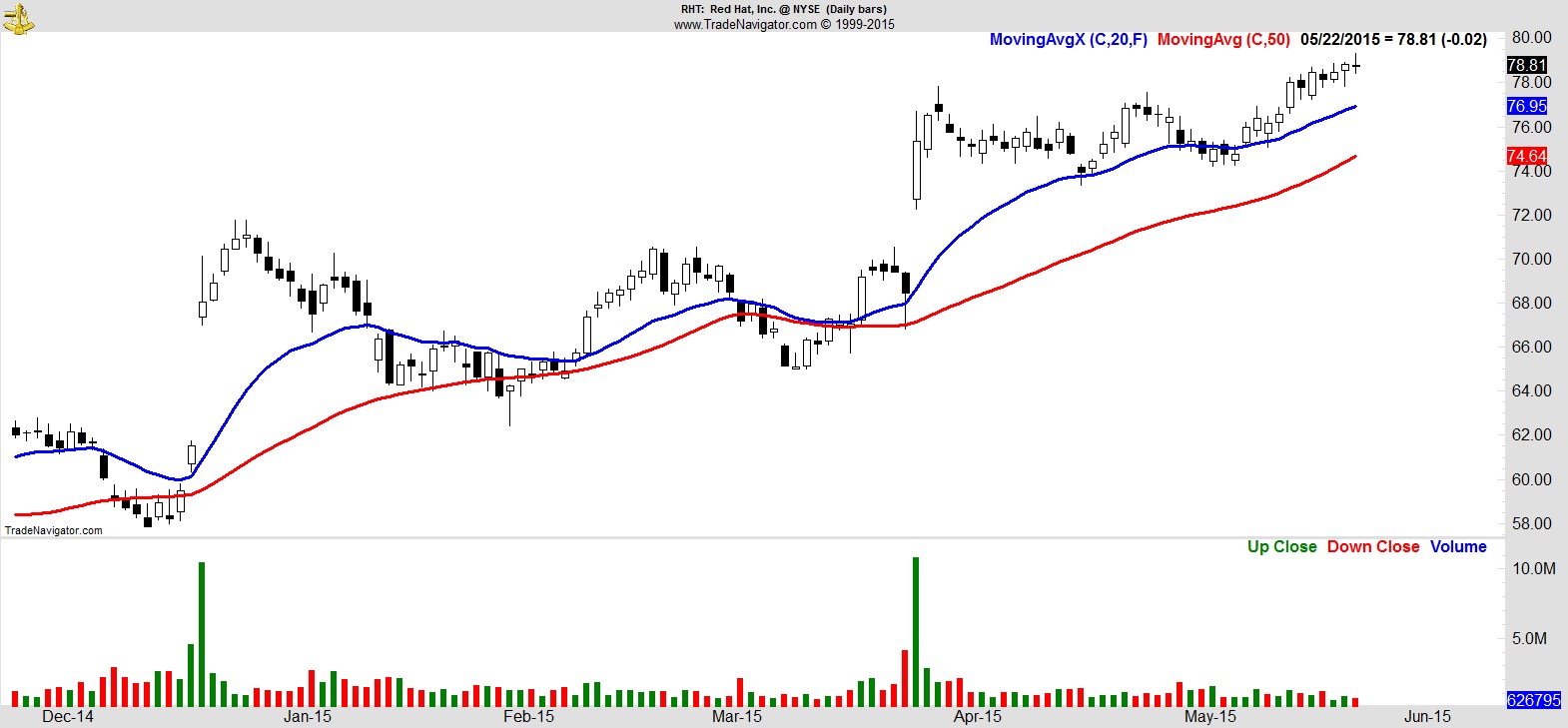

$RHT

.

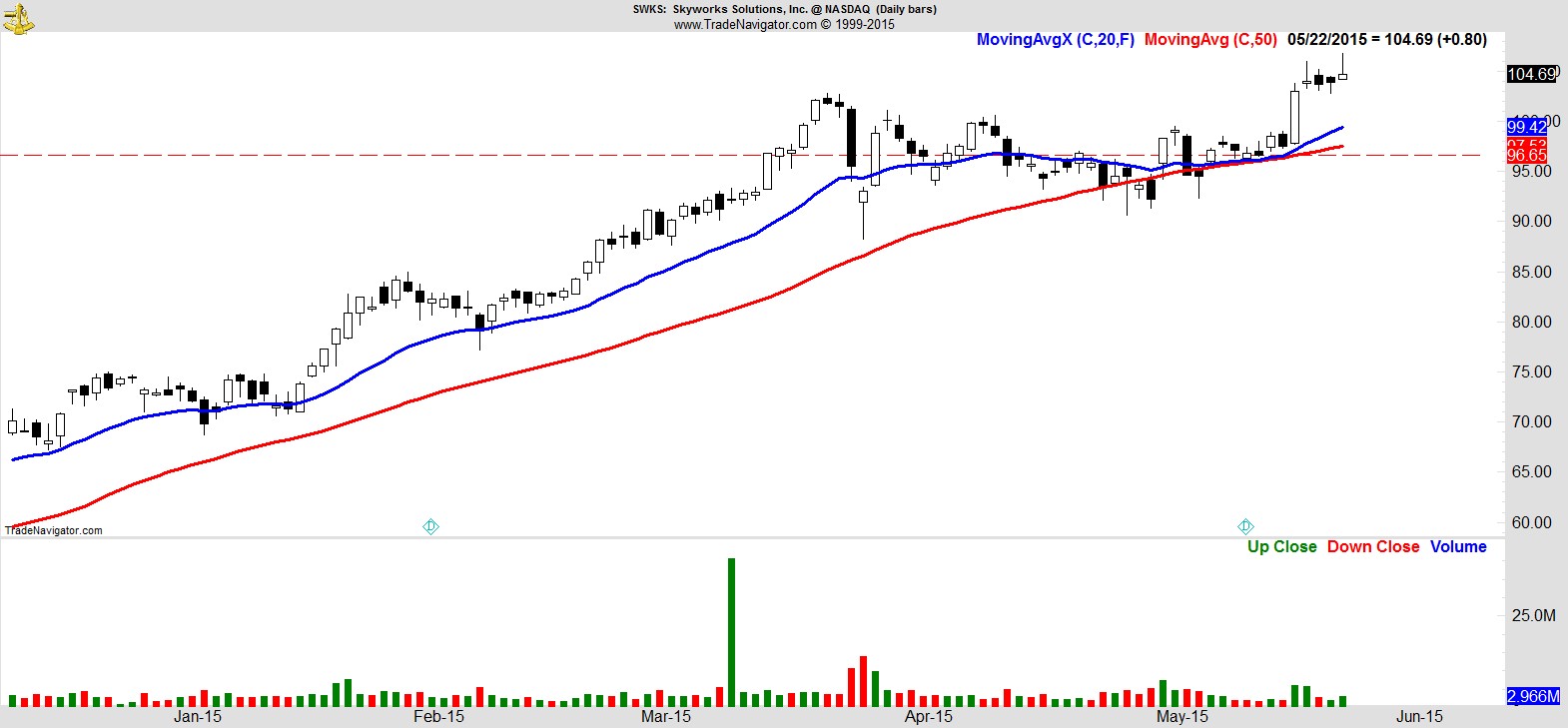

$SWKS

.

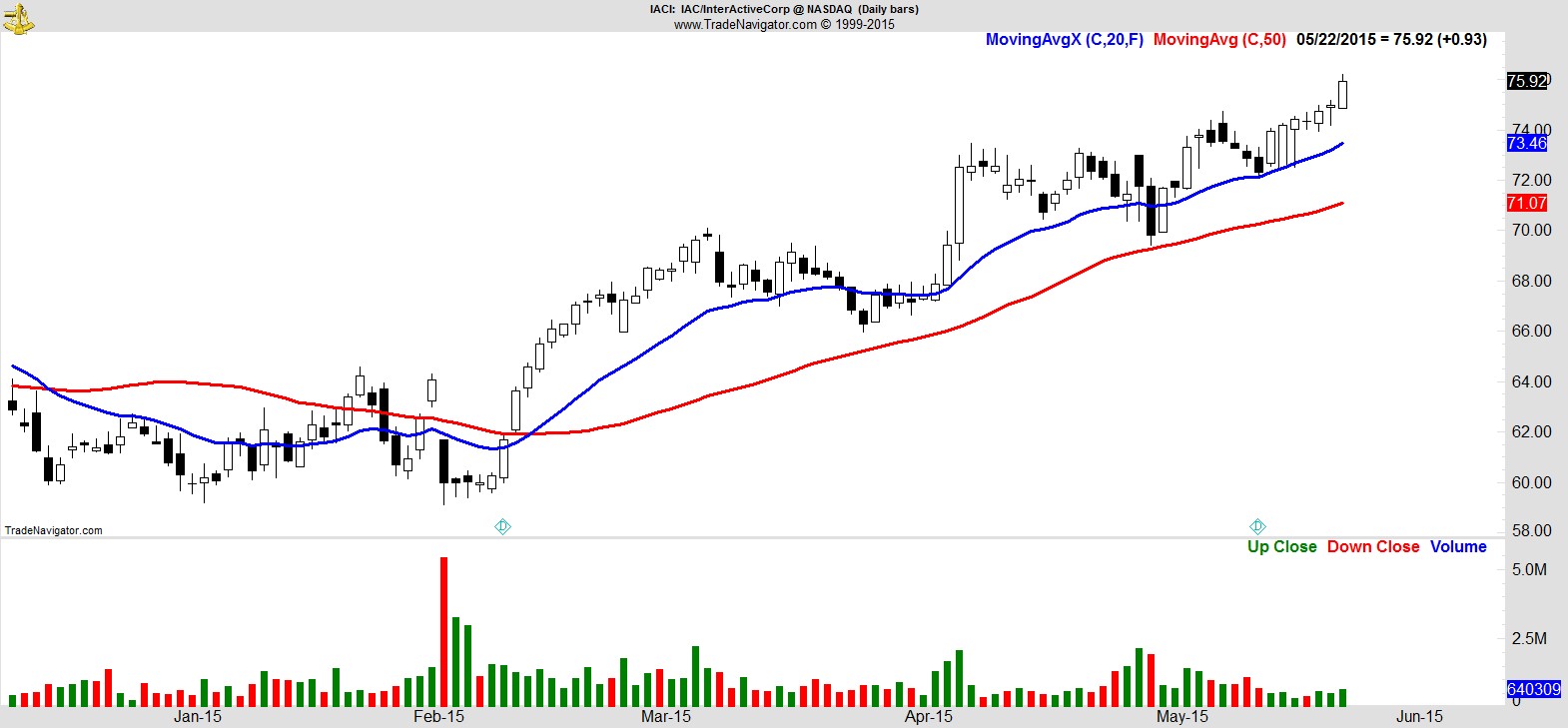

$IACI

.

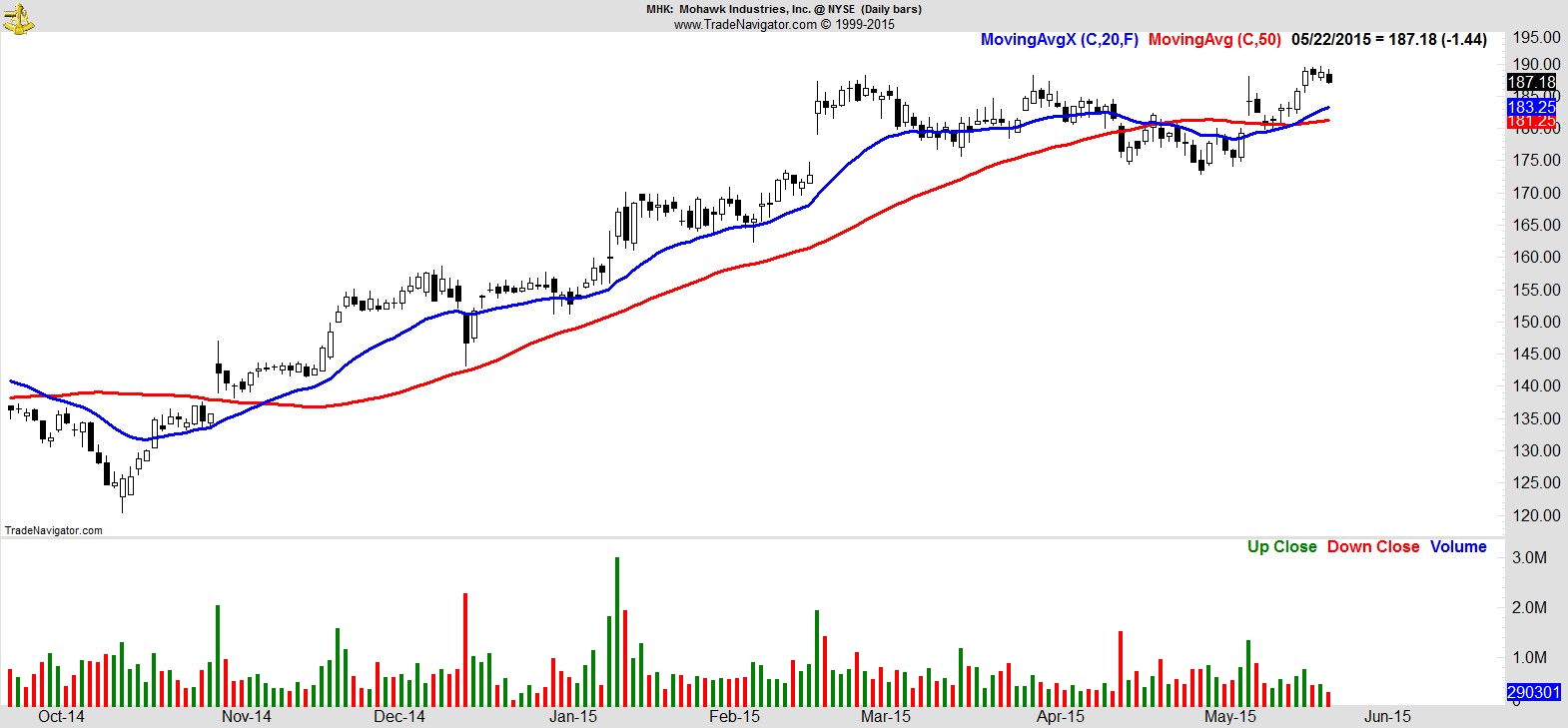

$MHK

.

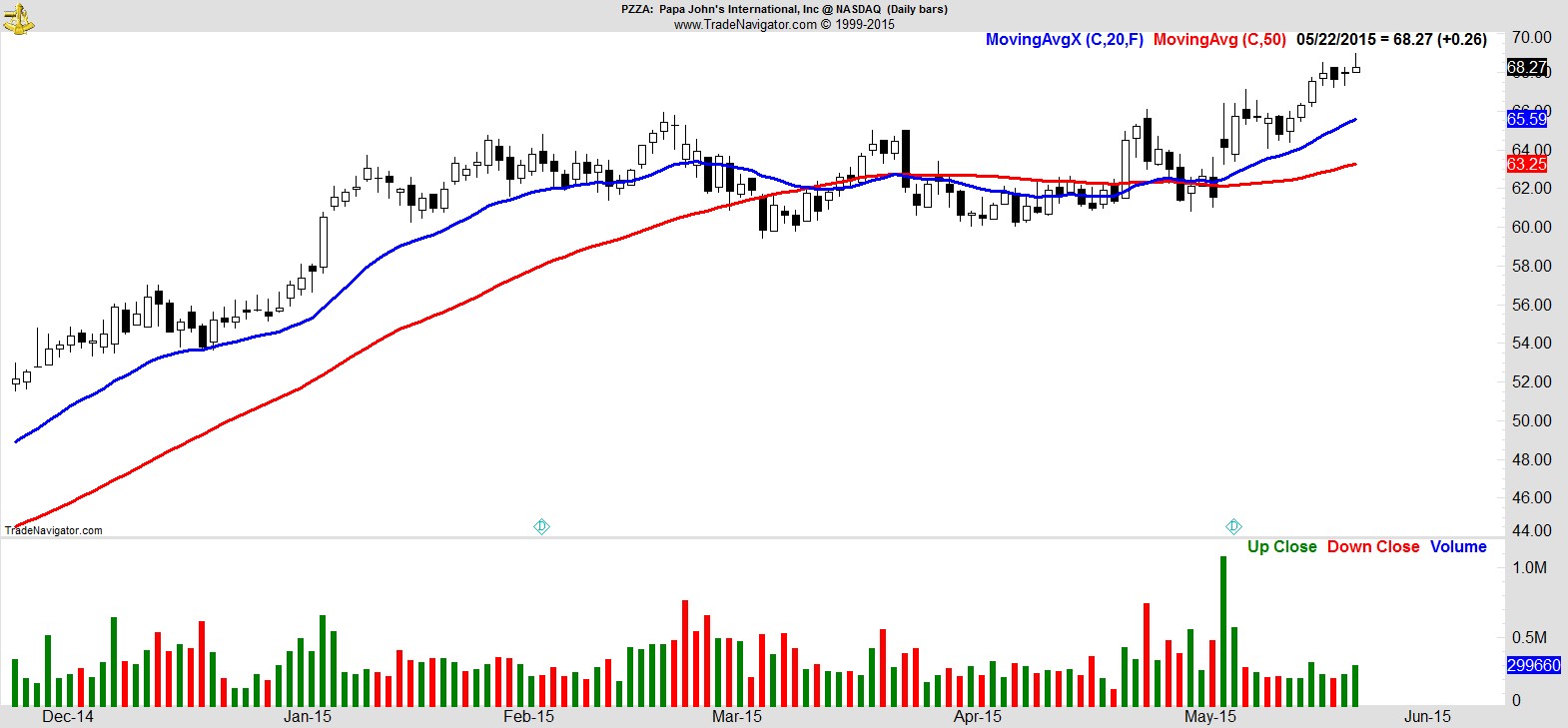

$PZZA

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17