The tone for the market this week was set before it even opened, with last Sunday's futures session at first indicating a 40-pt decline on the S&P. As the cash open approached that was reduced significantly and briefly continued in the first half hour, but as the session wore on it became a relentless grind lower, going out at session lows with a loss the Sunday night futures had accurately suggested.

For the rest of the holiday-shortened week the market managed to bounce, but it was of the dead-cat variety, over the course of three days not even managing to overcome Monday's open.

For all the headlines and drama it created, where does that leave us?

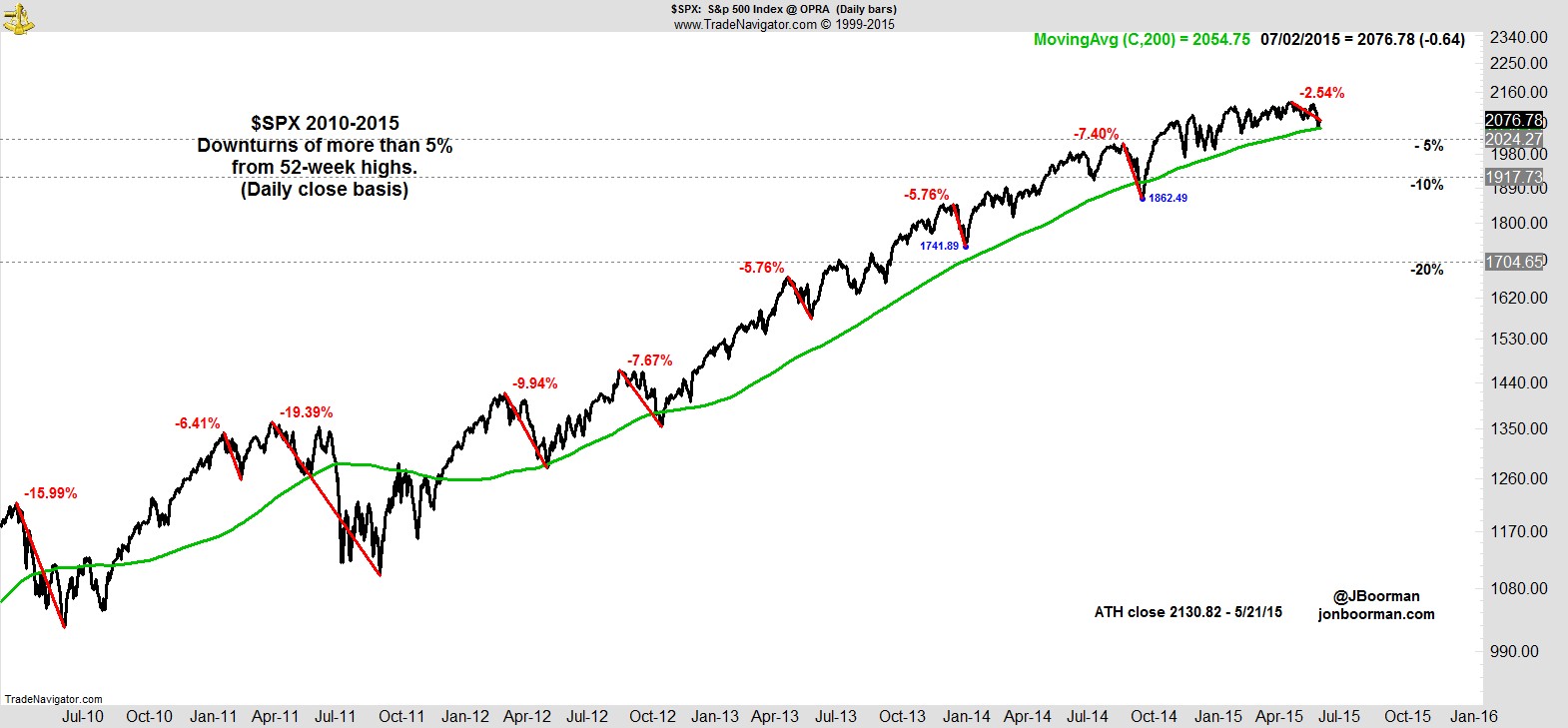

We're still just 2.5% off the highs of six weeks ago, and yet came within a few points of testing the 200-day MA in Monday's decline. The big picture hasn't changed - we're rangebound - but underneath the surface there is some cause for concern.

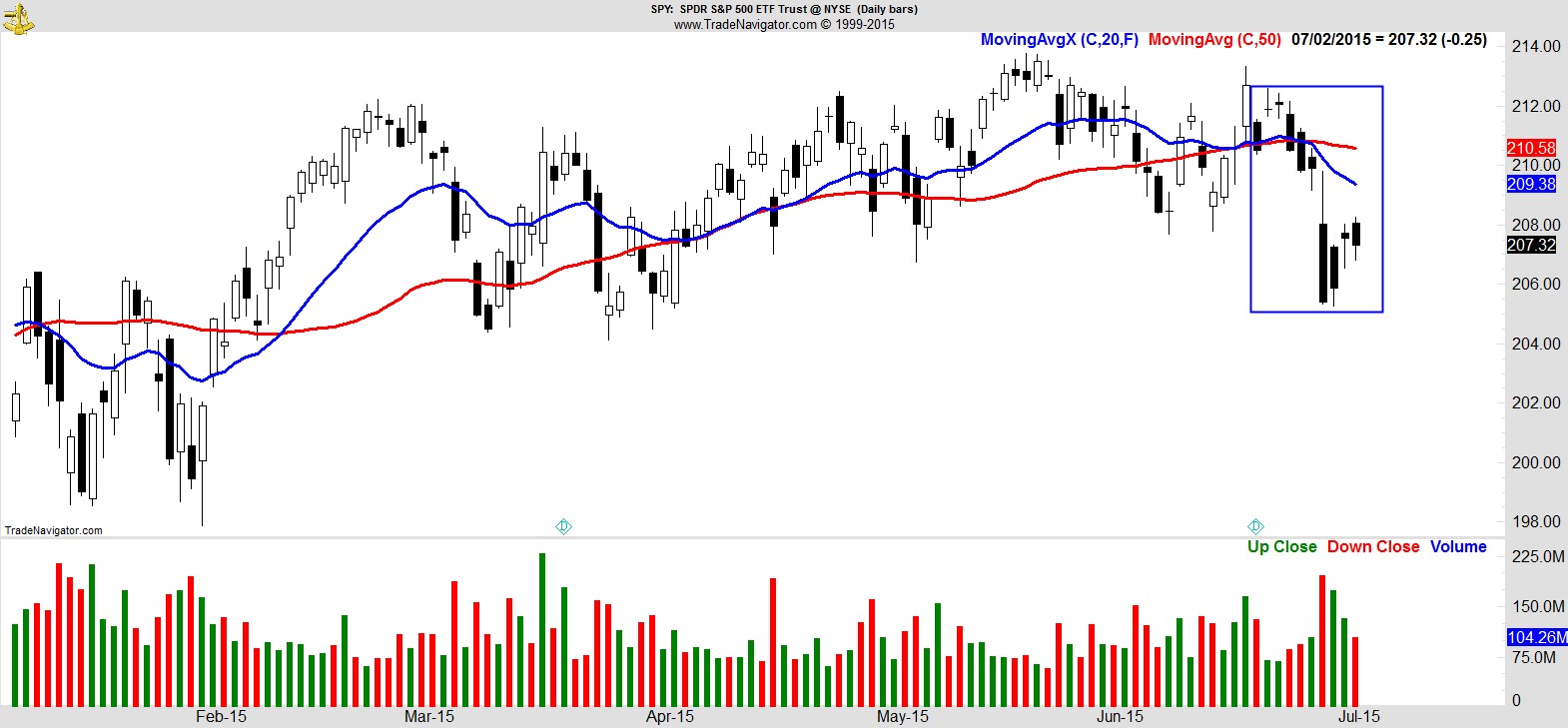

One change I've noticed is when you look at the S&P via the $SPY, which more accurately reflects the level of the futures the instant it opens rather than the cash index which adjusts as each stock opens, you can see that regardless of whether it finished up or down from the previous close, it's now had ten consecutive sessions where it closed lower than it opened. Bar one unchanged session, it's the same for $QQQ.

More specifically, you can see that days that open higher get sold into, and days where it gaps lower continue lower and go out at session lows. This kind of price action is a classic sign of distribution.

Also of note, that behavior is even more pronounced in $RSP, which equal-weights the S&P, reflecting the fact small caps gave back some of their recent relative strength this week.

.

Let's turn to the nine S&P Sector SPDRs to see the strongest and weakest areas of the market.

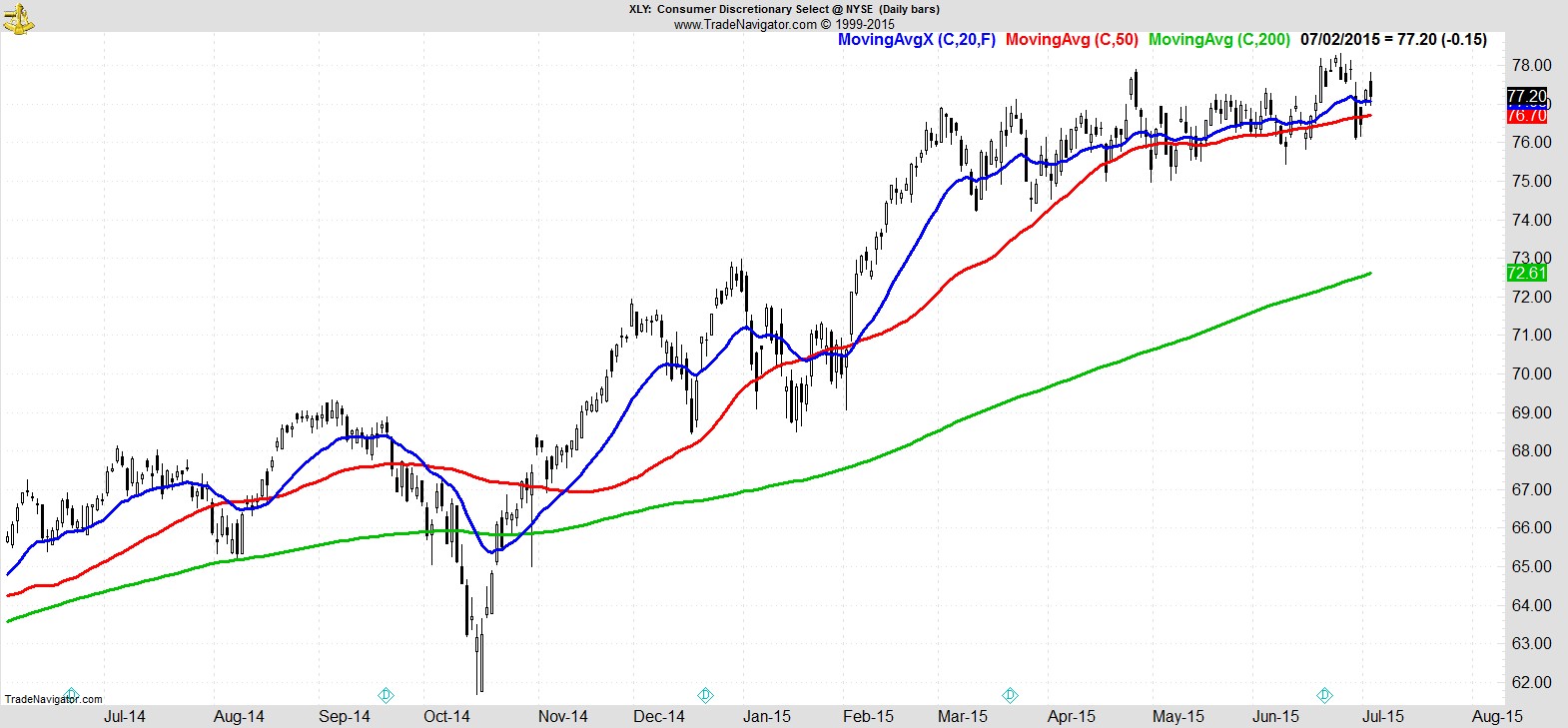

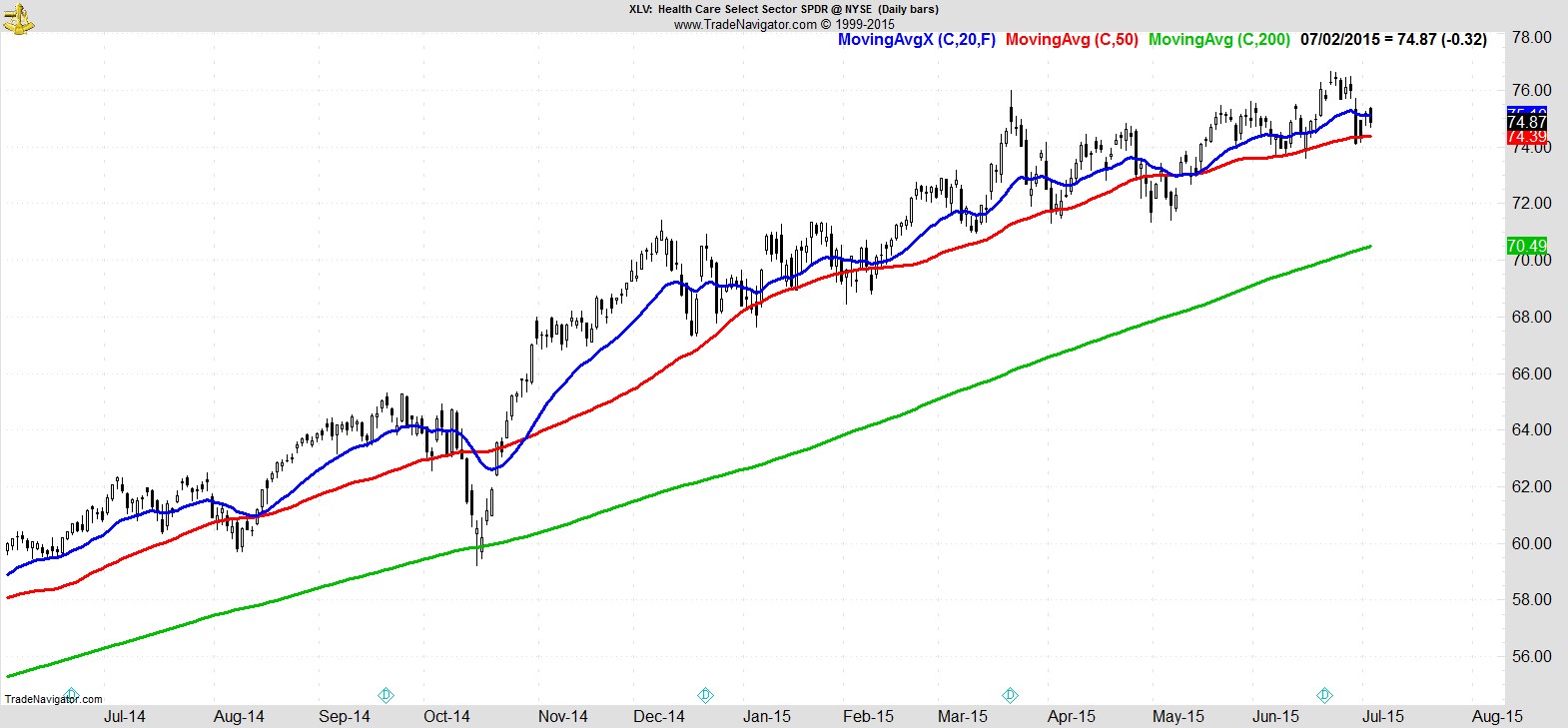

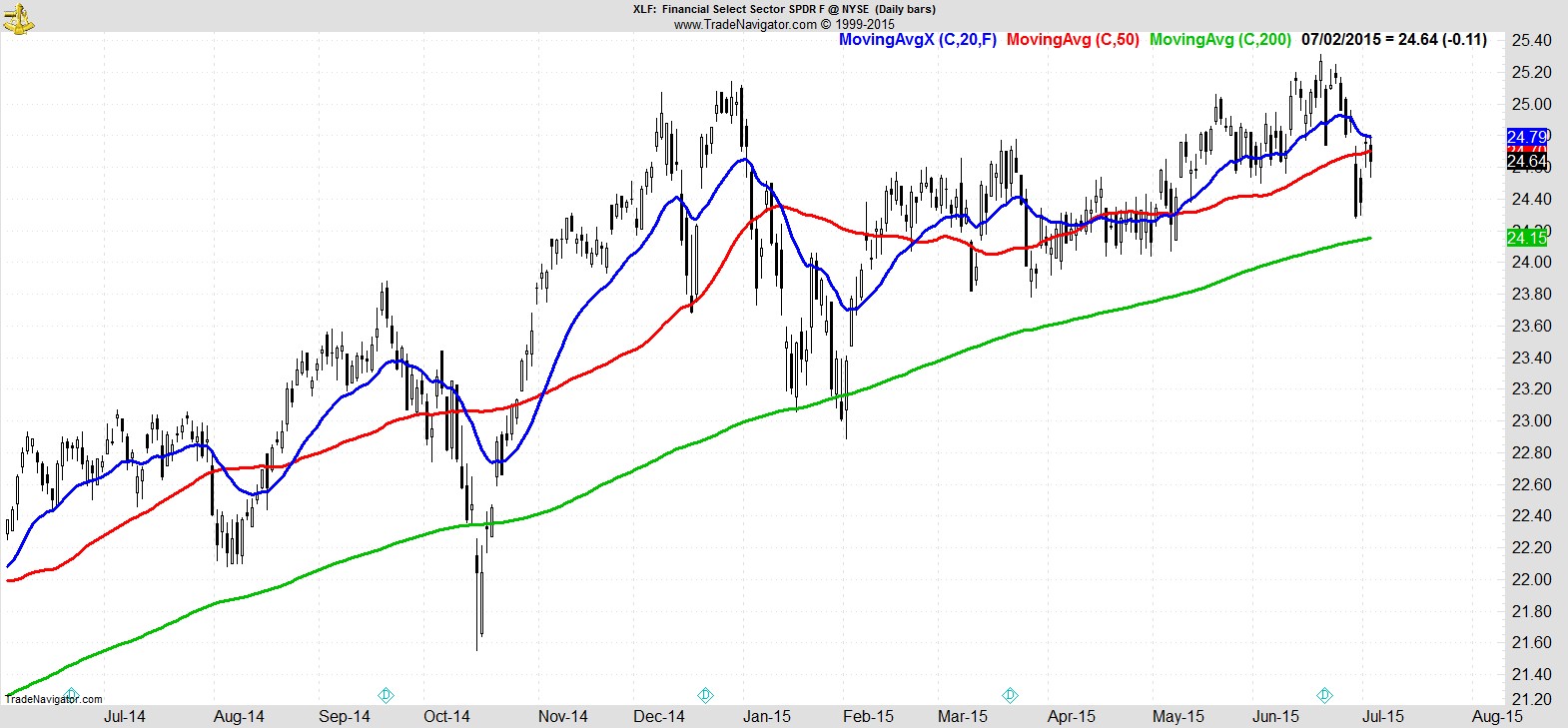

There's a slight change at the top, with Consumer Discretionary ($XLY) moving ahead of Healthcare ($XLV) which finished below its 20EMA, followed by Financials ($XLF) which despite a valiant recovery attempt midweek, still closed below its 50-day.

(The fact that the third best sector is below its 50-day tells you just how thin the leadership is getting. More on that later.)

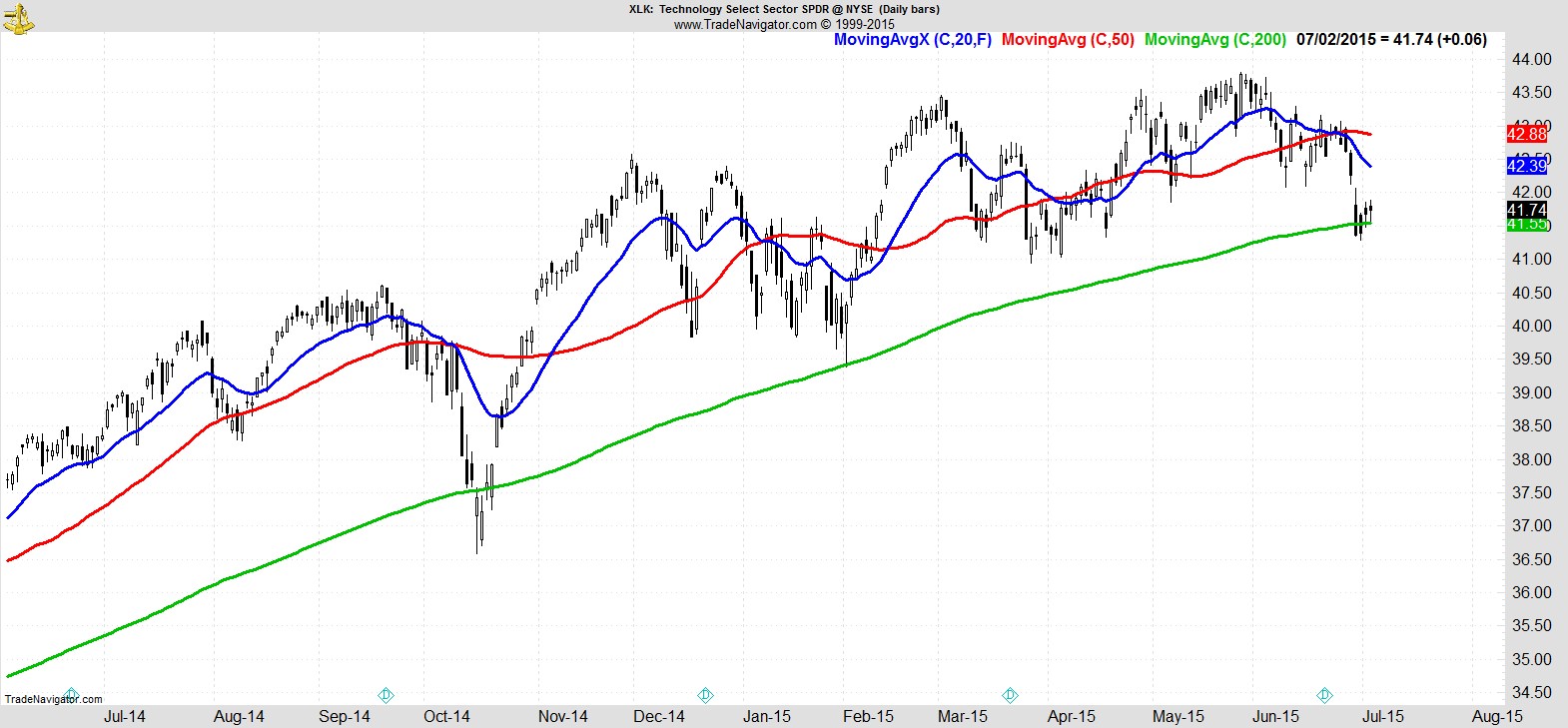

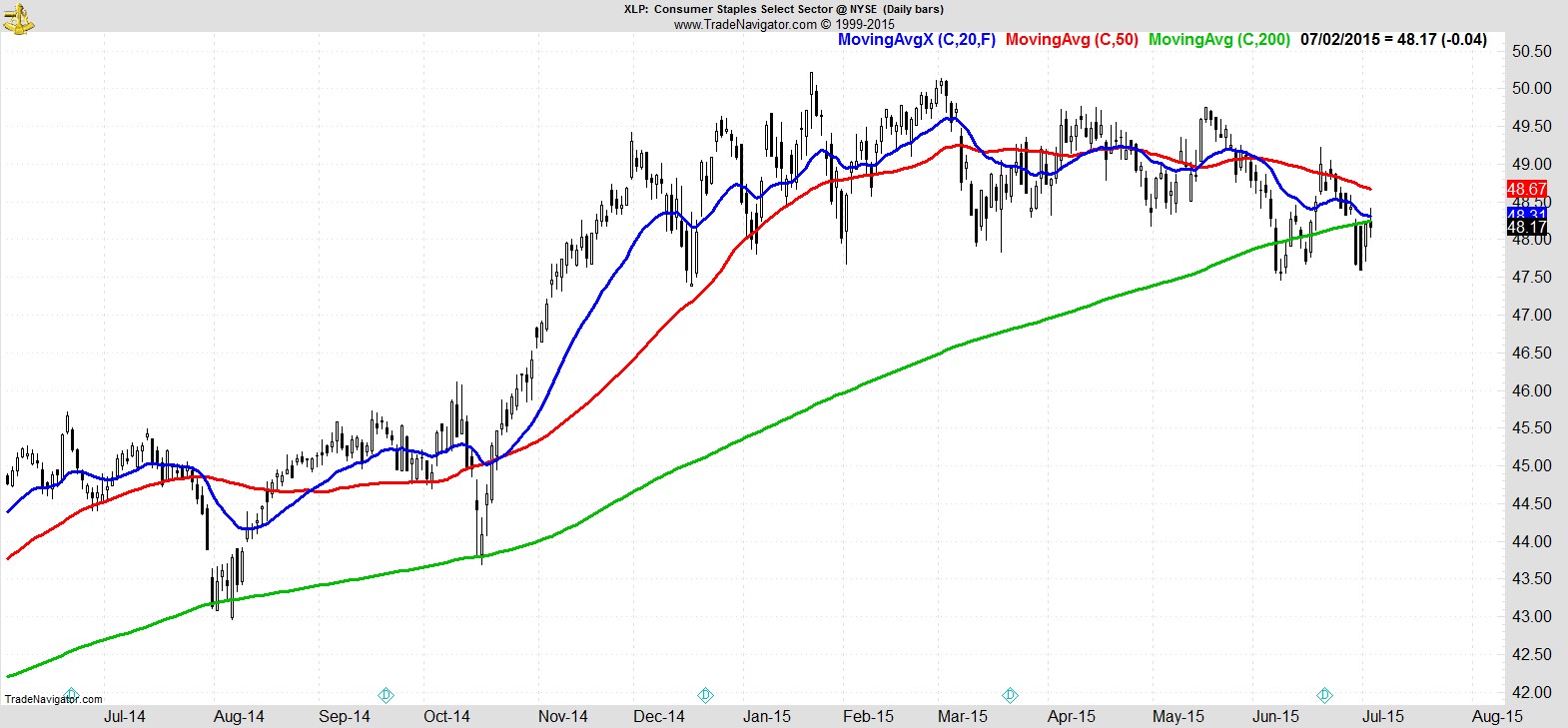

Then it's Technology ($XLK) and Consumer Staples ($XLP) which both broke their 200-day MA and barely recovered.

.

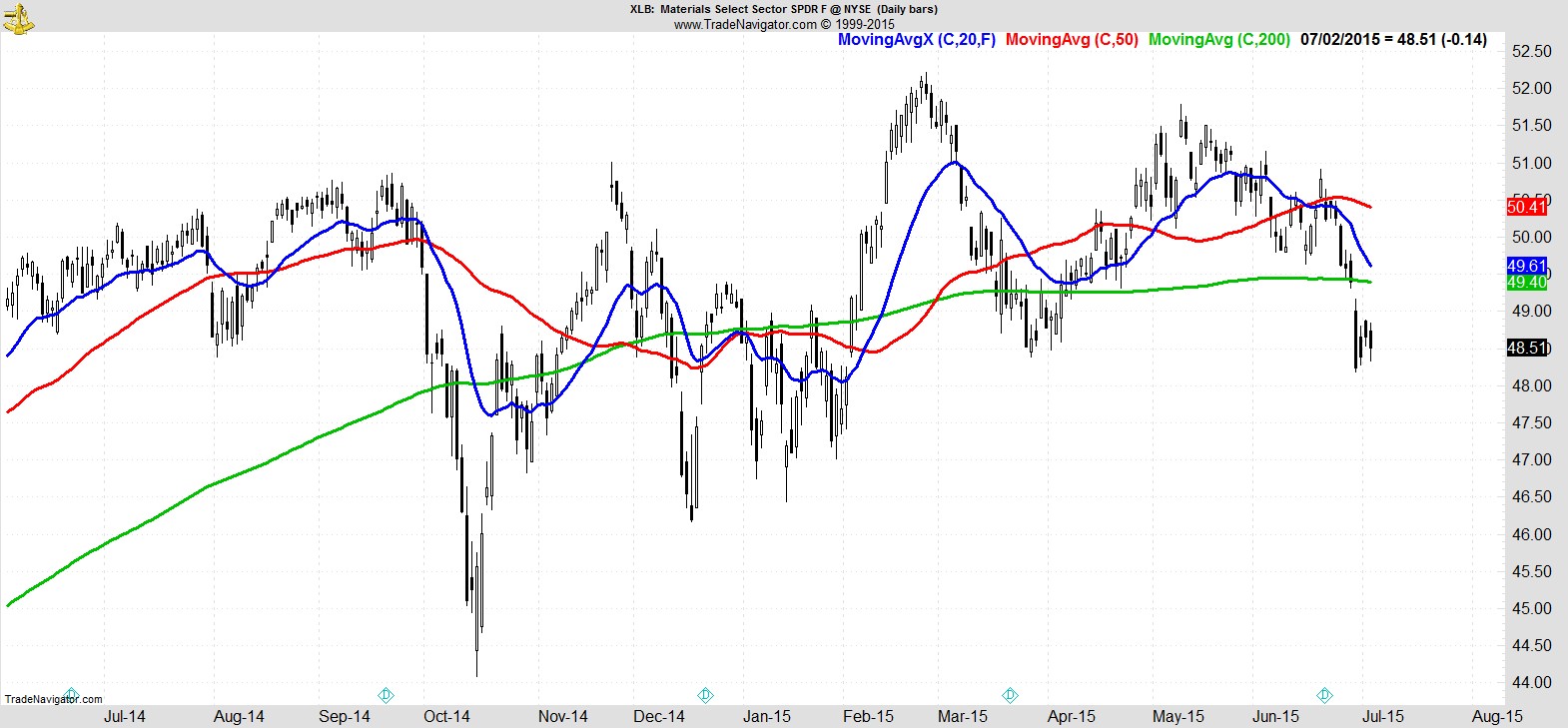

Beyond that it starts to get ugly.

WARNING - The following charts show price action which some readers may find disturbing.

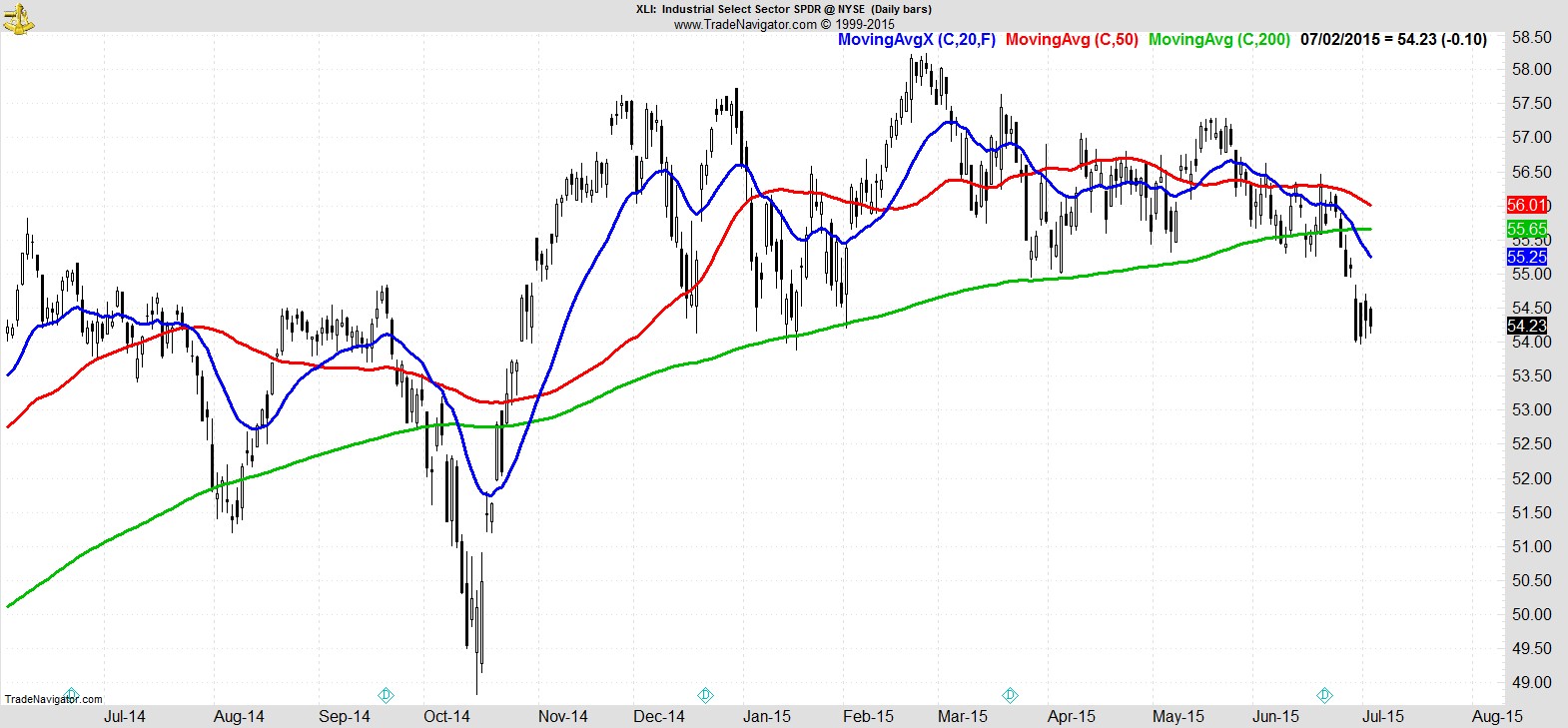

Materials ($XLB) and Industrials ($XLI) look very similar and show just how limited the bounce from Monday's mauling was.

.

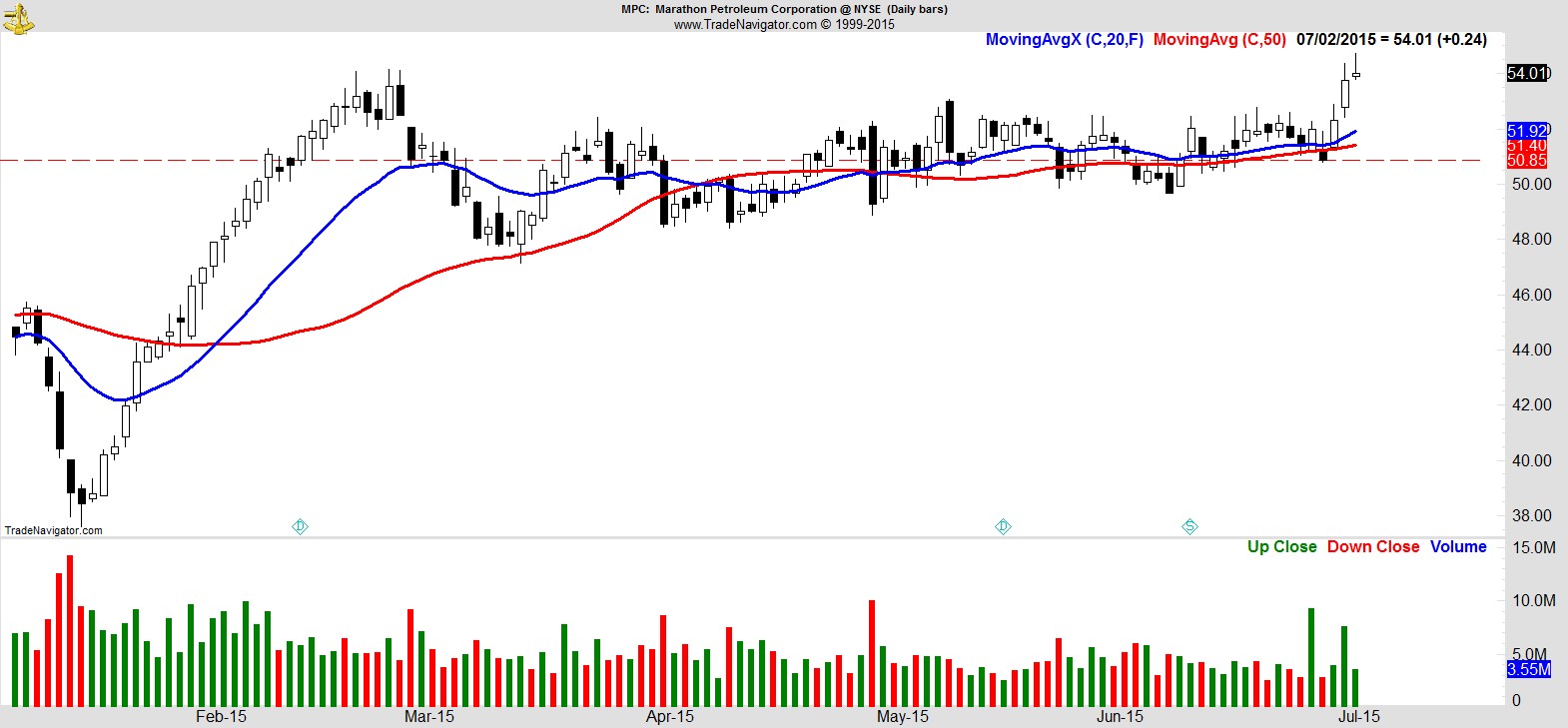

There's also a change at the bottom as Utilities ($XLU) managed to close up on the week and revisit the 20-EMA, which was enough to relegate Energy ($XLE) to last place, although I've found refiners which look good.

.

The weakness in the market certainly took its toll on our Alpha Capture portfolio which was -2.5% on the week vs -1.2% for the S&P.

It's now +10.4% YTD vs +0.9% for the S&P.

Having enjoyed a six-week run of consistent outperformance, this was our second straight week with a 2% decline. Monday's market slump triggered four exits in $ETFC, $CRM, $AXTA, and $DOW, reducing our portfolio to only five names and over 50% in cash, remarkable considering the index was still just 3.4% off its highs.

That's a result of the rangebound environment we've been in, where opportunities we've taken have had relatively close invalidation points, and those tighter stops in turn result in larger positions in terms of capital allocation and a more highly-concentrated portfolio. When the stops come all at once, it rapidly moves us to the sidelines, and in a fast headline-driven market environment, that's a good position to be in.

If the market continues lower, the impact to our portfolio is diminished. If instead it bounces like the 'V' shaped lows seen in the last year, we have the cash on hand to deploy as the strongest names trigger new entry signals.

As the week progressed, those first signals came through. Several of our trade ideas that hadn't made it into the portfolio, as there was no room when they first triggered, hit new highs this week and gave us a fresh entry signal. This time around the portfolio was able to easily accommodate them, bringing us back up to eight positions with 35% cash heading into next week. We may even have additional signals for Monday, which I'll confirm later this weekend.

Clearly, as I've already shown, some significant damage has been done to the market overall, but we don't need to trade a market view or predict what will happen. We're just going to take whatever the market gives us, whether it's more exits on continued weakness, or new entries on a recovery.

In last week's watchlist I highlighted the increased strength in consumer discretionary names, and as we've already seen, that continued this week with $XLY being the only sector SPDR that remains above its 20EMA.

There are a couple of interesting sub-sectors showing strength in otherwise beaten-up areas of the market, such as Refiners within Energy, but other than that, I'm struggling to come up with as many quality setups compared to previous weeks. Accordingly, as the leadership continues to thin out, our watchlist is down to just 20 names this week.

Here's a small sample:-

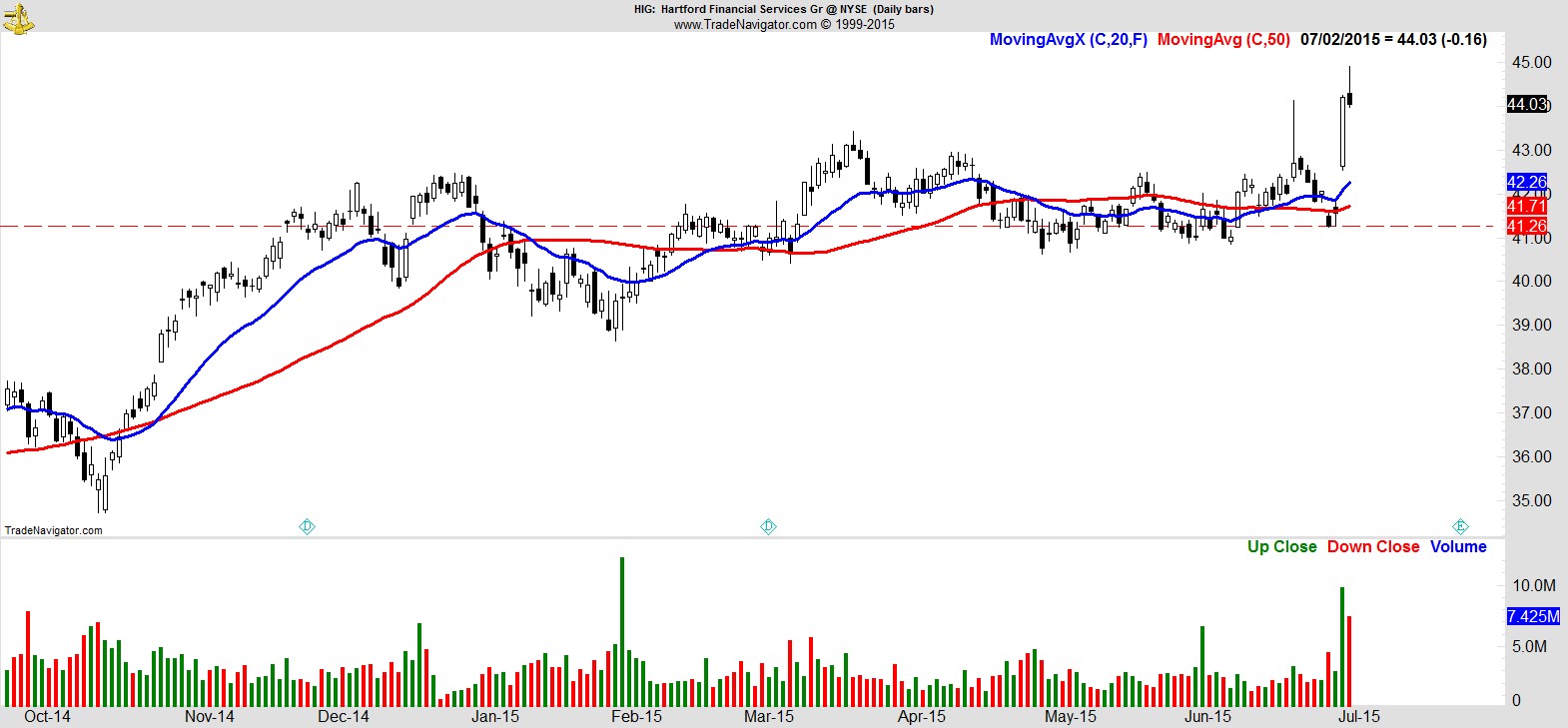

$HIG

.

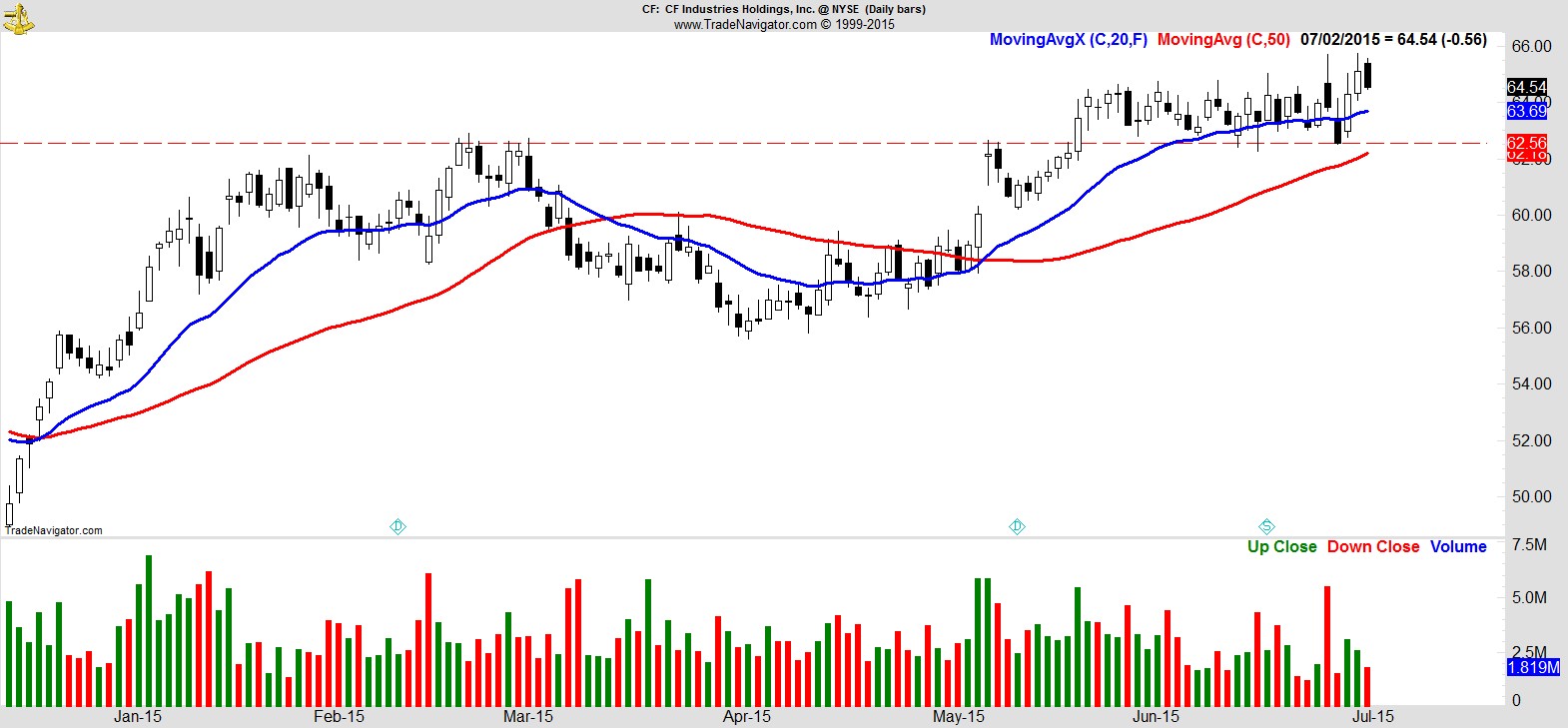

$CF

.

$MPC

.

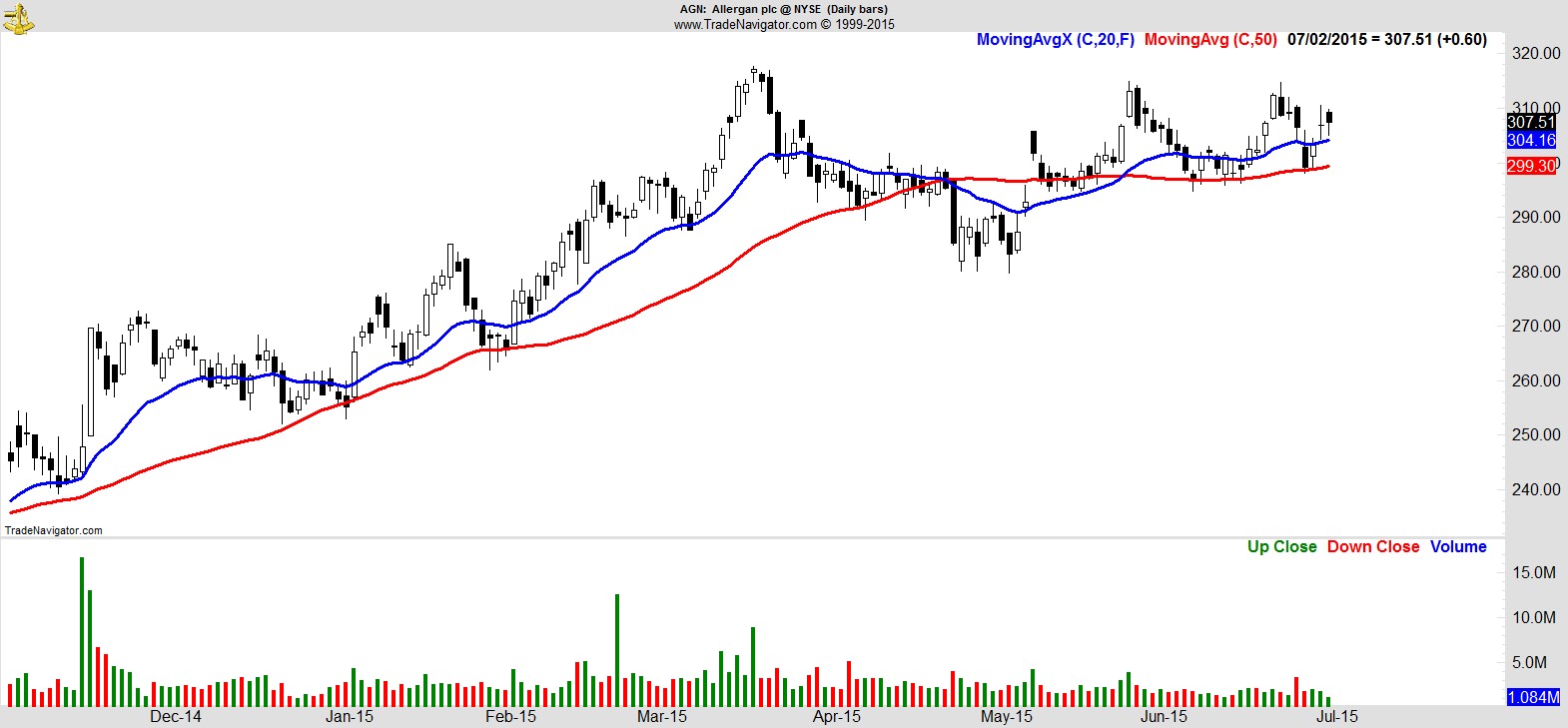

$AGN

.

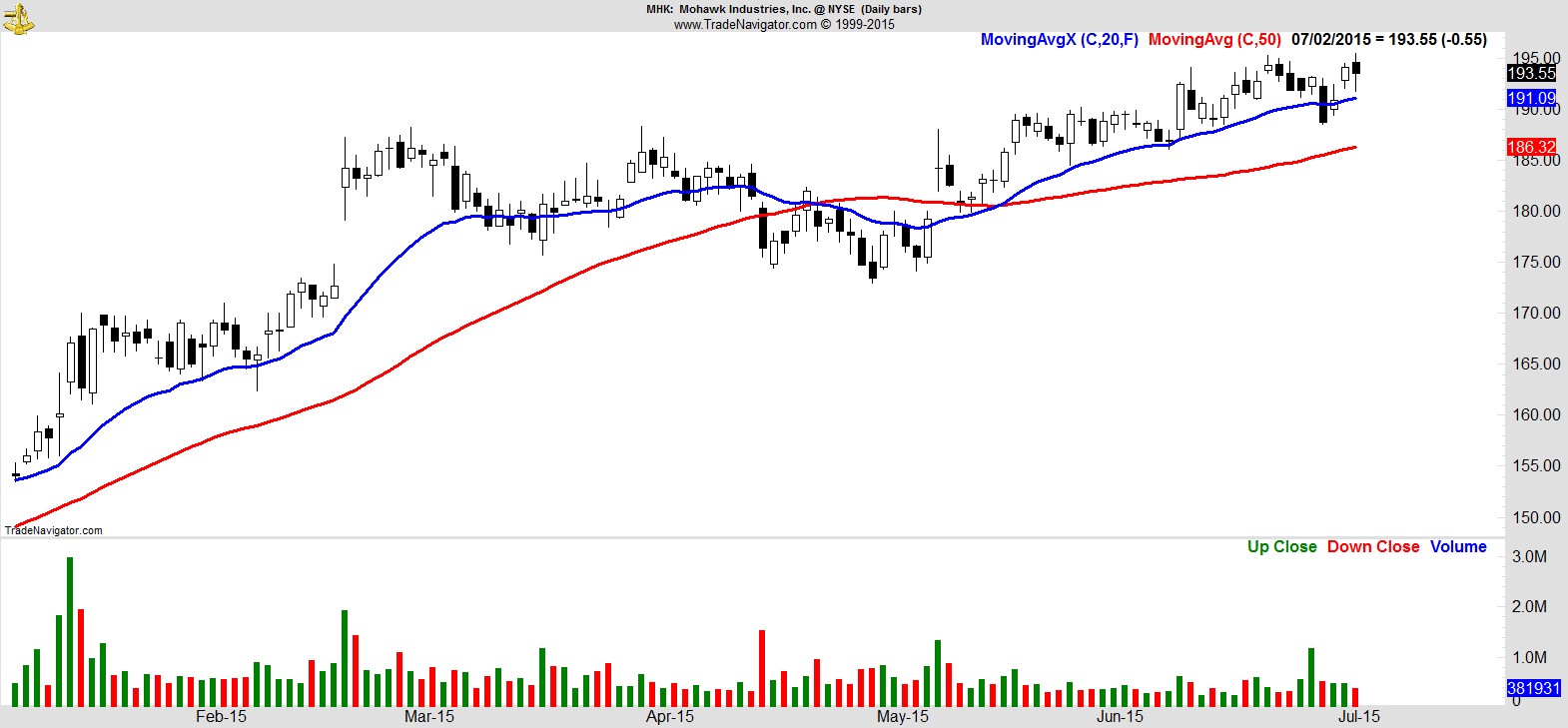

$MHK

.

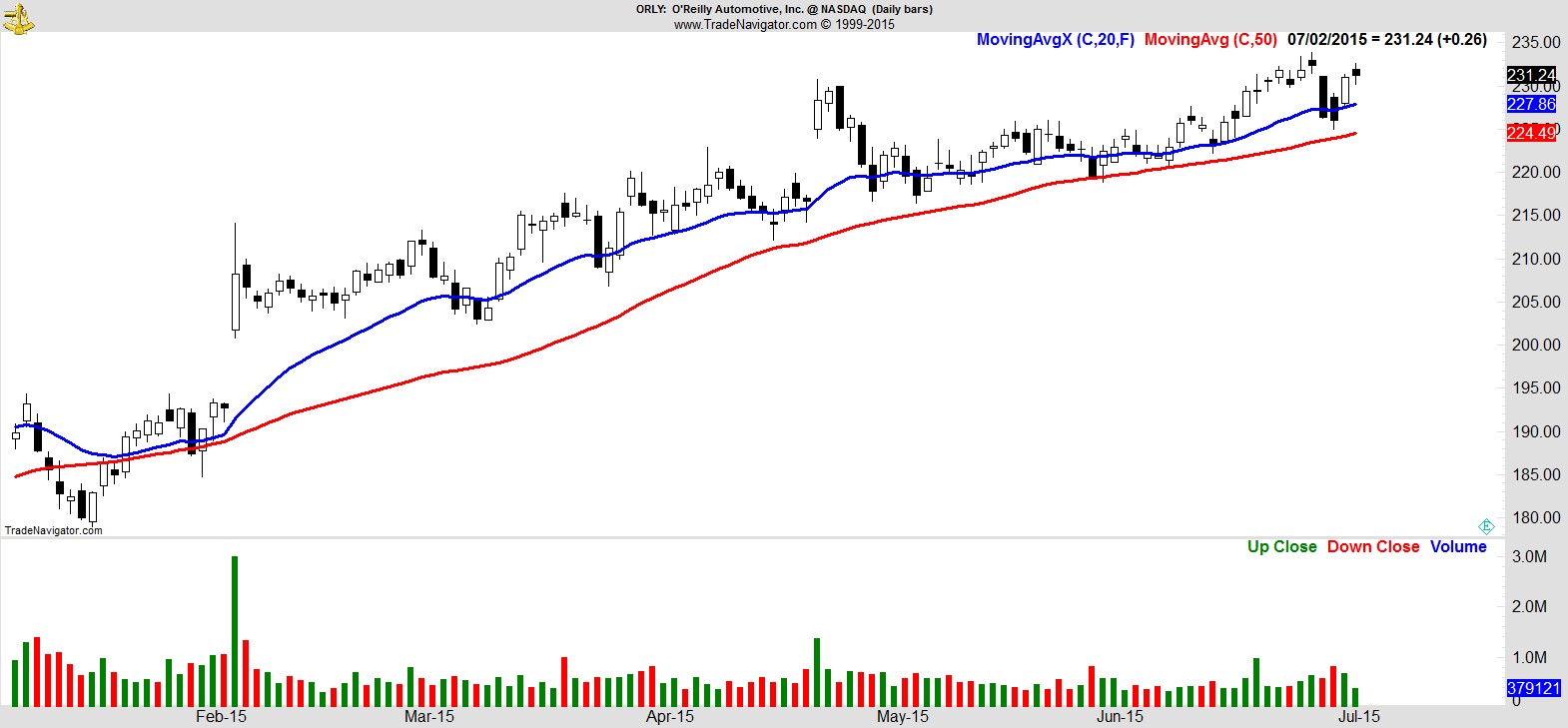

$ORLY

.

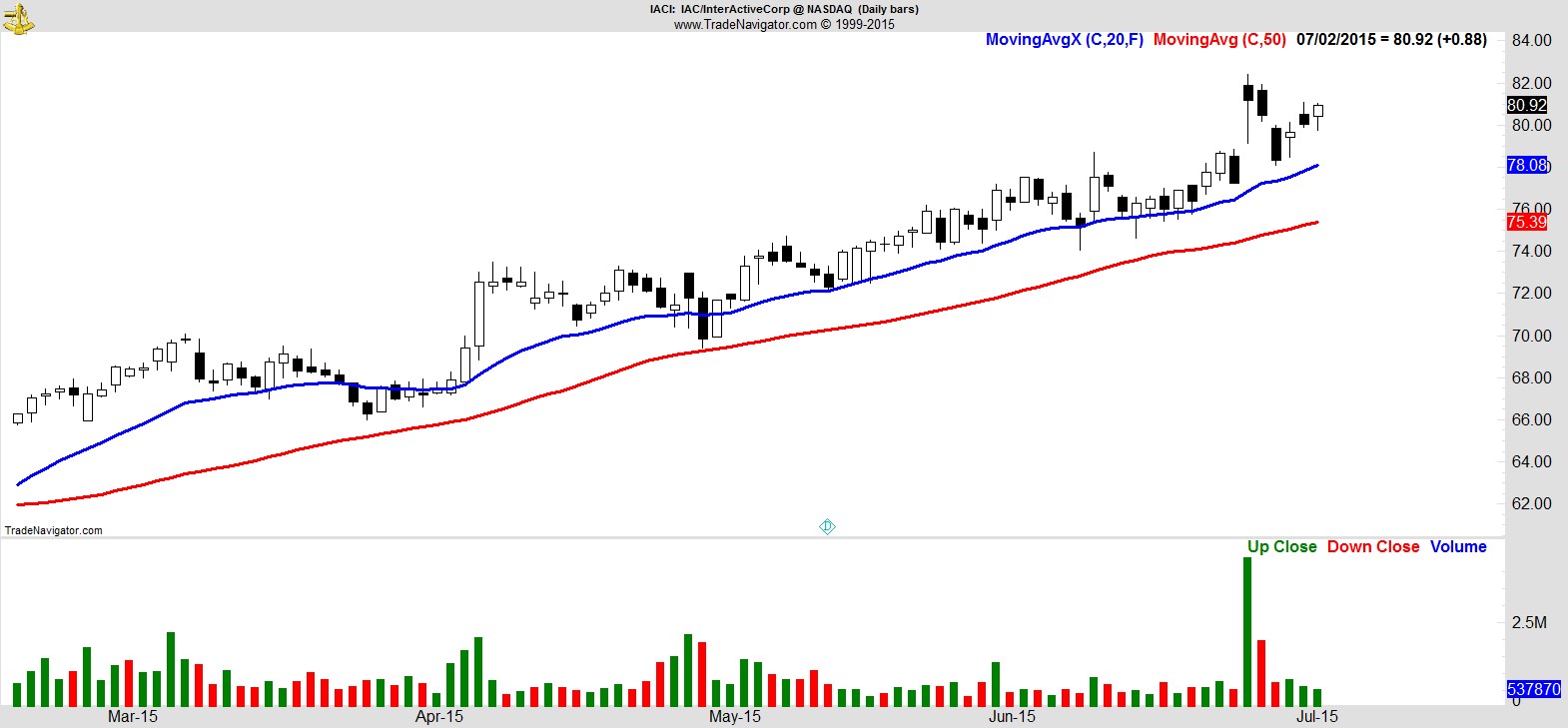

$IACI

.

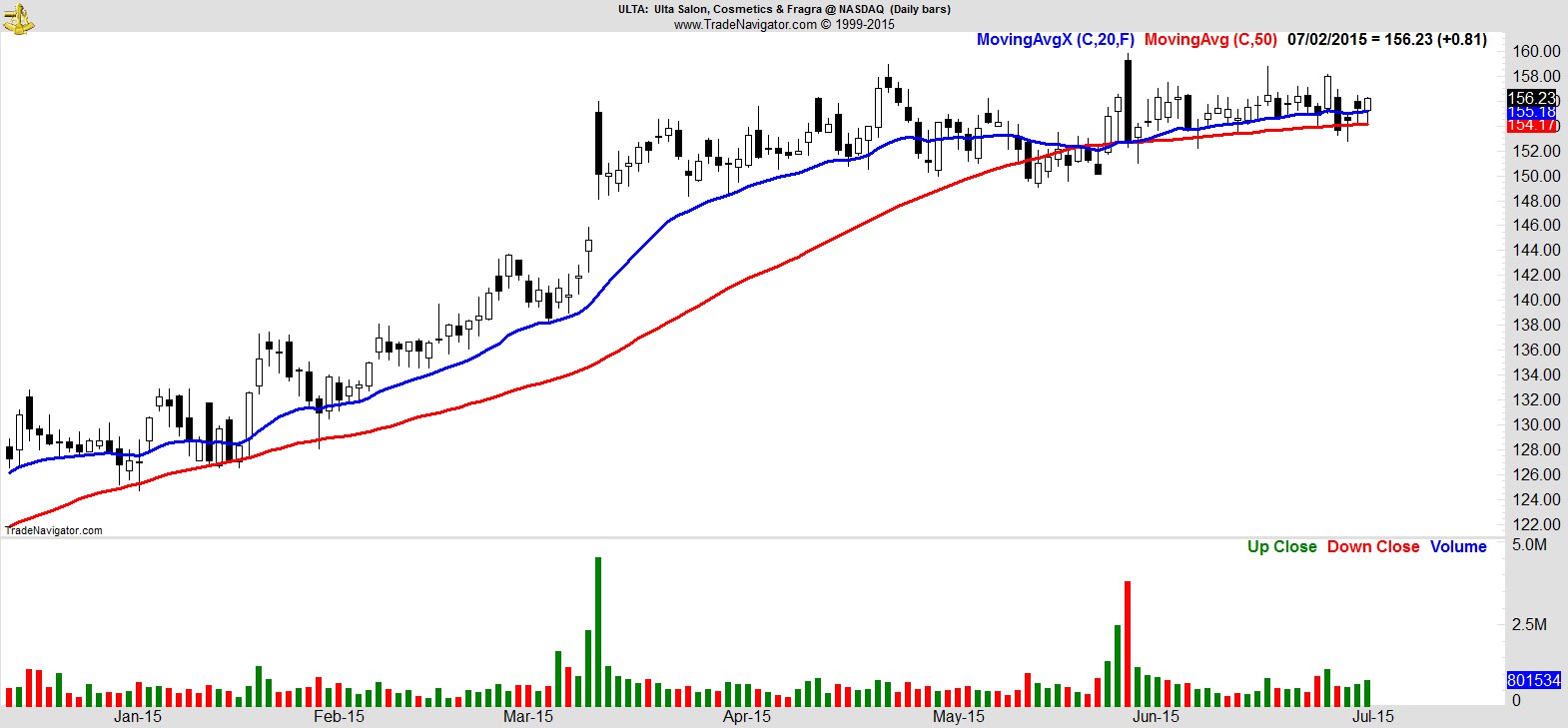

$ULTA

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17