Author: Matthew D'Addario (Tweet Matthew)

Since my last write-up in March, transformational events have occurred that have gone unrecognized by the market. This is the raison d’être for this update. These events are the DealerRewards acquisition, the first quarter financials and the prioritizing of the M&A strategy over the growth via reseller and referral partner strategy.

The DealerRewards Canada acquisition:

On May 27th, Ackroo acquired the Canadian assets of DealerRewards, namely 107 dealer locations and the exclusive license right to their platform. The purchase price was ~$1.8M comprised of $1.5M in cash payments over an 18 month period and the issuance of 769,231 common shares. At first glance, acquiring 107 locations for $1.8M with Ackroo already having 1000 merchant locations prior to the acquisition doesn’t seem like much growth. The missing piece to this puzzle is that dealer locations are high volume businesses and consequently the revenue per location is much higher. Also, the company only had 70 dealer locations preceding the purchase of DealerRewards which means the acquisition grew dealer locations by 153%. Since management could not give information on revenue as the acquisition had not yet closed and DealerRewards understandably didn’t want their numbers to be made public for competitors to see if the agreement fell through, it’s clear as a bell that the market has misunderstood this game-changing acquisition. Now that the deal has closed, the CEO has openly discussed these numbers with investors and will be mentioning them in the Q2 MD&A.

DealerRewards generates $642k in recurring revenue (or $500 in MRR/location) and $270k in one-time revenue (note: one-time revenue is mostly the period reordering of plastic cards). Since the acquisition closed in June, its contribution to Ackroo’s top line for fiscal 2015 will be around $450k. As mentioned in my initial write-up, any incremental revenue after breakeven has a 50% EBIT margin, hence a multiple of 4x EBIT was paid which is evidently cheap. What’s more, a performance pull back clause was structured into the agreement where the last payment could be pulled back if customers are churned or revenue is lost, hence protecting Ackroo from having overpaid. Furthermore, I’m glad shares were issued to the vendor as it will facilitate the acquiring of the US assets in the future. The vendor will be thinking as an Ackroo shareholder and should have no problem settling for a lower sale price as he should more than offset the reduction in sale price by share price appreciation. Based on the aforementioned facts, it’s clear that the CEO Steve Levely is a great negotiator which ties to the next significant event:

New strategy:

It’s obvious that the CEO has shifted more of his focus on the M&A strategy, throttling back a bit his attention on the reseller strategy. While the reseller efforts have been producing results, it’s more challenging than was anticipated. The company has to train resellers to essentially be a “mini Ackroo” which requires more resources (a major constraint right now for the company as it runs lean and employees all wear multiple hats) and time, making the ROI for acquisitions more compelling. Despite my preference for organic growth, there’s no denying that a well-executed roll up strategy can yield large shareholder returns as has recently been the case with Nobilis Health Corp (NHC.TO, +711% over the last 12 months) or Patient Home Monitoring (PHM.V, +336% over the last 12 months). As previously mentioned, I believe in Steve’s ability to execute properly on this game plan given his excellent performance in negotiating the last two acquisitions. What’s particularly interesting in Ackroo’s case is that the reseller and referral partners are all gravy.

The major concern with the growth by acquisition game plan is the need to raise capital and the potential dilution of shares. Evidently, the company will need to raise capital since the warrant money due in January won’t be enough for future acquisitions. The CEO has already mentioned that he plans to raise the capital when the stock will be around $1.00 which I believe is the minimum price to produce good shareholder return. While the stock has only trading at $0.35 recently, I think we’re not too far away from seeing a $1.00+ share price which brings me to my next thought:

Valuation:

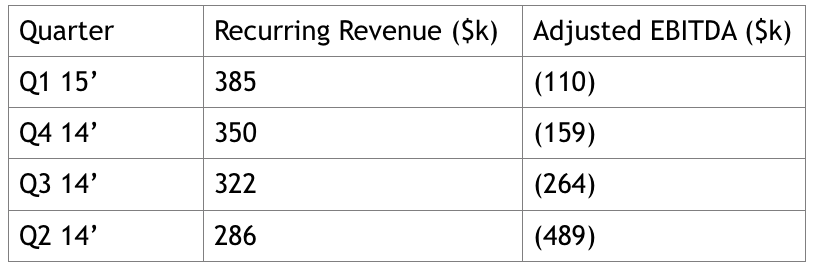

I believe the company will reach breakeven in Q3 and be profitable in Q4 based on the following quarter by quarter trend in adjusted EBITDA (which is essentially FCF since there are no significant capital expenditures, interest or taxes):

Adjustments have been made for shared-based compensation and one-time charges such as restructuring fees (a settlement charge to get out of one of their leases and a charge from arranging a convertible debt financing that ultimately fell through), and legal fees for the equity raise and the PGC acquisition. Furthermore, I adjusted for year-end audit fee in Q1 which was in the ballpark of $50k in incremental cost. I also assumed that legal fees for the private placement and acquisition were around $50k which is where the ($110k) in EBITDA for Q1 comes from.

With profitability right around the corner and the imminent release of the Q2 MD&A containing the information on DealerRewards that will allow the market to better understand the acquisition, it won’t be long till the stock price gets a significant lifting in my opinion.

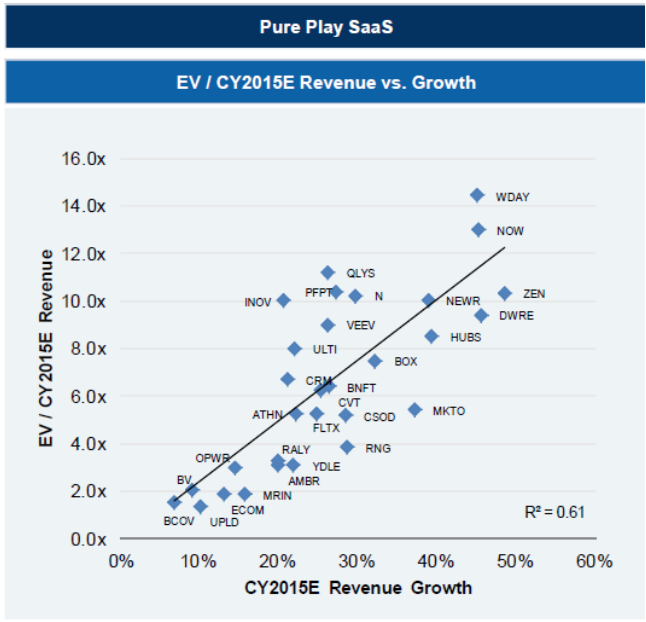

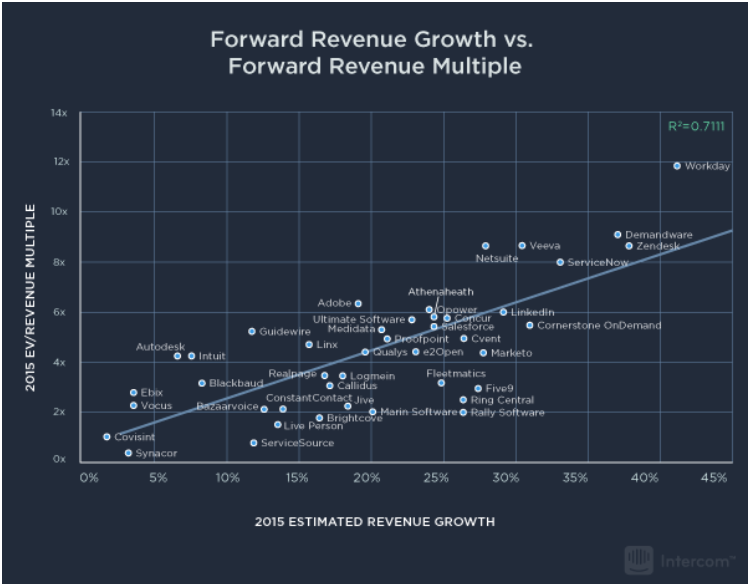

The company is conservatively expected to do $2.4M in sales for 2015 which corresponds to 84% YoY increase. For 2016 and beyond, management is targeting 50% growth. Assuming a 50% growth rate for valuation purposes, the stock should easily trade at a multiple 12x EV/2015 revenue or $1.20/share based on several reputable SaaS studies (see graphs below).

Source: http://kellblog.com/2015/04/19/one-more-time-what-...

Source : https://blog.intercom.io/a-closer-look-at-saas-val...

Conclusion:

In conclusion, I think it’s only a matter of time till the sizeable gap to $1.20 fair value per share closes given the following near-term catalysts: a) understanding of the significance of the acquisition by the market after Q2 MD&A release and b) breakeven in Q3 and profitability in Q4. As they continue to execute on their growth plan, I continue to think there is a clear path to $4.00+ share price over the next few years.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Share Now: Have a MicroCap thesis you want to share, email Tom@SecretCaps.com to see if it is a good fit for our community.

Click here to access SecretCaps latest 17 page research report on SMTP inc.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Disclosure: This article was provided strictly for informational purposes only. Nothing contained herein should be construed as an offer, solicitation, or recommendation to buy or sell any investment or security, or to provide you with an investment strategy, mentioned herein. Nor is this intended to be relied upon as the basis for making any purchase, sale or investment decision regarding any security. Rather, this merely expresses SecretCaps’ opinion, which is based on information obtained from sources believed to be accurate and reliable and has included references where practical and available. However, such information is presented "as is", without warranty of any kind, whether express or implied. SecretCaps makes no representation as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use should anything be taken as a recommendation for any security, portfolio of securities, or an investment strategy that may be suitable for you.

SecretCaps, LLC (including its members, partners, affiliates, employees, and/or consultants) (collectively, "SecretCaps") along with its clients may transact in the securities covered herein and may be long, short, or neutral at any time hereafter regardless of the initial recommendation. All expressions of opinion are subject to change without notice, and SecretCaps does not undertake to update or supplement this report or any of the information contained herein. SecretCaps is not a broker/dealer or investment advisor registered with the SEC, Financial Industry Regulatory Authority, Inc. ("FINRA") or with any state securities regulatory authority. Before making any investment decision you should conduct thorough personal research and due diligence, including, but not limited to, the suitability of any transaction to your risk tolerance and investment objectives and you should consult your own tax, financial and legal experts as warranted.

This article is strictly for informational and educational purposes only, and is not investment advice.

This post does not represent the opinions of SecretCaps, and is a guest post. SecretCaps' owners have no current position in Ackroo, long or short. Matthew D'Addario the author of this guest post is long shares of Ackroo.

Recent free content from SecretCaps PRO

-

SecretCaps: Operational Update

— 10/31/16

SecretCaps: Operational Update

— 10/31/16

-

Total Telcom: A Virtually Unknown NanoCap With A Spark

— 9/28/16

Total Telcom: A Virtually Unknown NanoCap With A Spark

— 9/28/16

-

Spindle’s Experienced Management Overhaul Has Caught Our Attention

— 8/31/16

Spindle’s Experienced Management Overhaul Has Caught Our Attention

— 8/31/16

-

MicroCaps: Seriously, The Last Frontier

— 6/30/16

MicroCaps: Seriously, The Last Frontier

— 6/30/16

-

MicroCap Digest: Atman's Acquisition and BeWhere's Insider Buys

— 6/10/16

MicroCap Digest: Atman's Acquisition and BeWhere's Insider Buys

— 6/10/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member