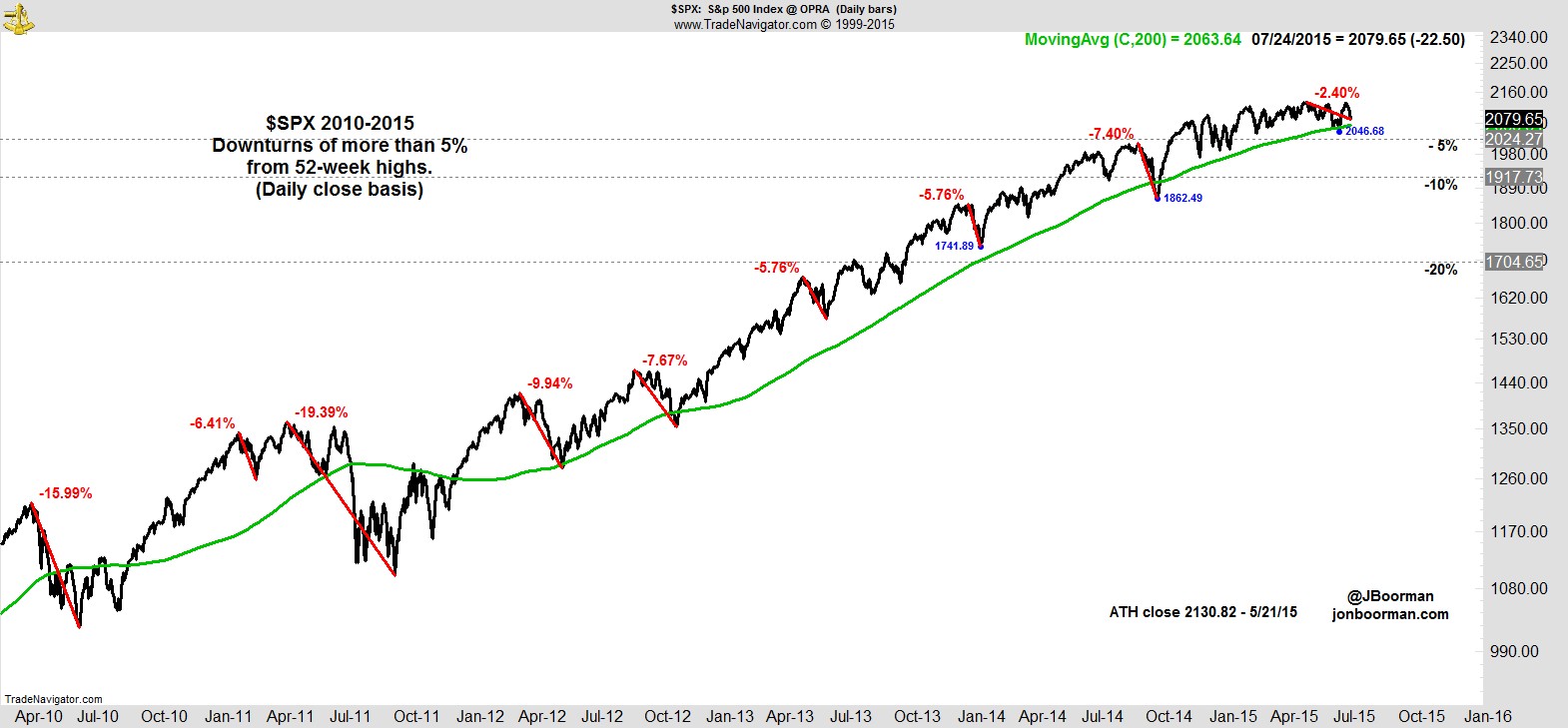

We're 2.4% off the highs.

I know.

It feels worse than that.

It always does after a down week.

That's because you watch TV, read the news, and see your social media stream magnify the emotions around each day's move.

It's good to stay on top of what's going on, but only the price action of what we actually own should determine whether we act upon it.

Our portfolio did relatively well this week -0.5% vs -2.2% for the S&P 500.

That takes it back to +14.5% YTD vs +1.0% for the S&P.

We're still fully invested in leading names, mostly from sectors such as consumer discretionary, financials, and healthcare which again held up relative to energy and materials where we have little exposure.

This week's market move felt even more like a rug-pull than usual because new highs had seemed inevitable as the week began, before the selling kicked in and intensified late in the week.

By the end of Friday's session the weakness was enough to have triggered our first exit signal in the portfolio since June 30th.

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17