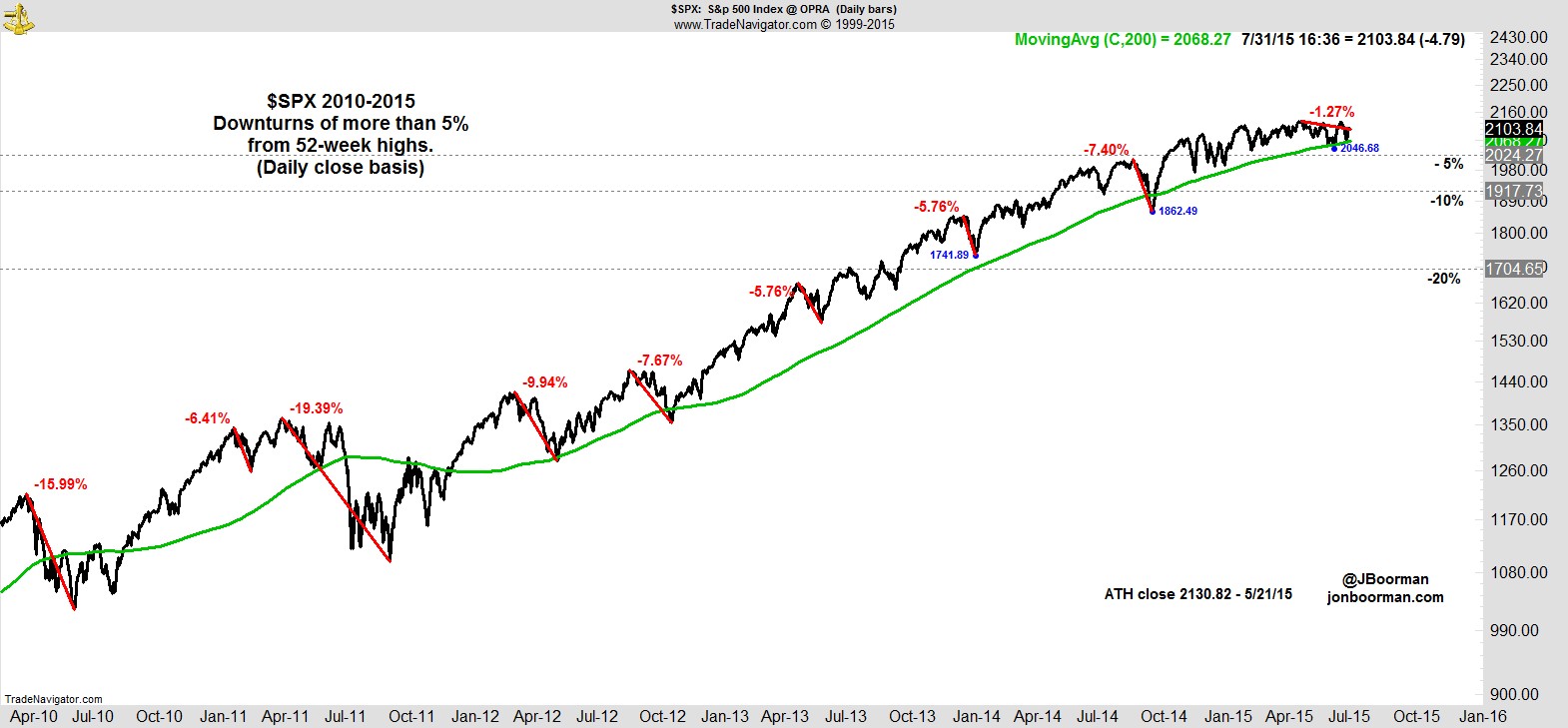

The market continues to frustrate bulls and bears alike with one of the longest but shallowest declines in years.

Like the infamous V-shaped reversals of the last two years, the shorter-term moves of the last few weeks have taken a similar form, but are lacking the relentless bid that previously followed such moves.

It's always hard to quantify the accompanying sentiment of any market activity, and anecdotal evidence of a well-placed observer may be of just as much use as the the sentiment surveys that attempt to capture such moments.

For my own part, I suspect there's fear on both sides.

For the bulls, there's a feeling that something has changed, the market should be at new highs by now. We perhaps saw that reflected in this week's AAII Sentiment Survey, with the percentage of individual investors declaring themselves 'Bullish' dropping 11.4 points to 21.1%, while 'Neutral' eased to 38.2%, and 'Bearish' surged 15.1 points to 40.7%.

For the bears, with their ranks swelling and the market there for the taking, there's the dawning realization that after all this time they're only able to enjoy isolated victories in specific sectors, and even up against a dwindling number of nervous bulls, they're still not able to land that killer blow to make any kind of dent in the long term trend.

While this range could still play out a while longer, it won't last forever. With the S&P just 1.3% off an all time high after everything that's been thrown at it, and with heavily bearish sentiment, I still believe the most likely course of action is to resume the trend that preceded this range, and the longer the stand-off continues, the larger and swifter the eventual resolution will be.

This week our portfolio slipped 0.9% vs a 1.2% advance for the S&P. That takes it to +13.4% YTD vs +2.2% for the S&P.

We had two exits in $TASR and $GILD, both for small gains. We currently have 9 names, 13% in cash, and our open risk is 4.5%.

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17