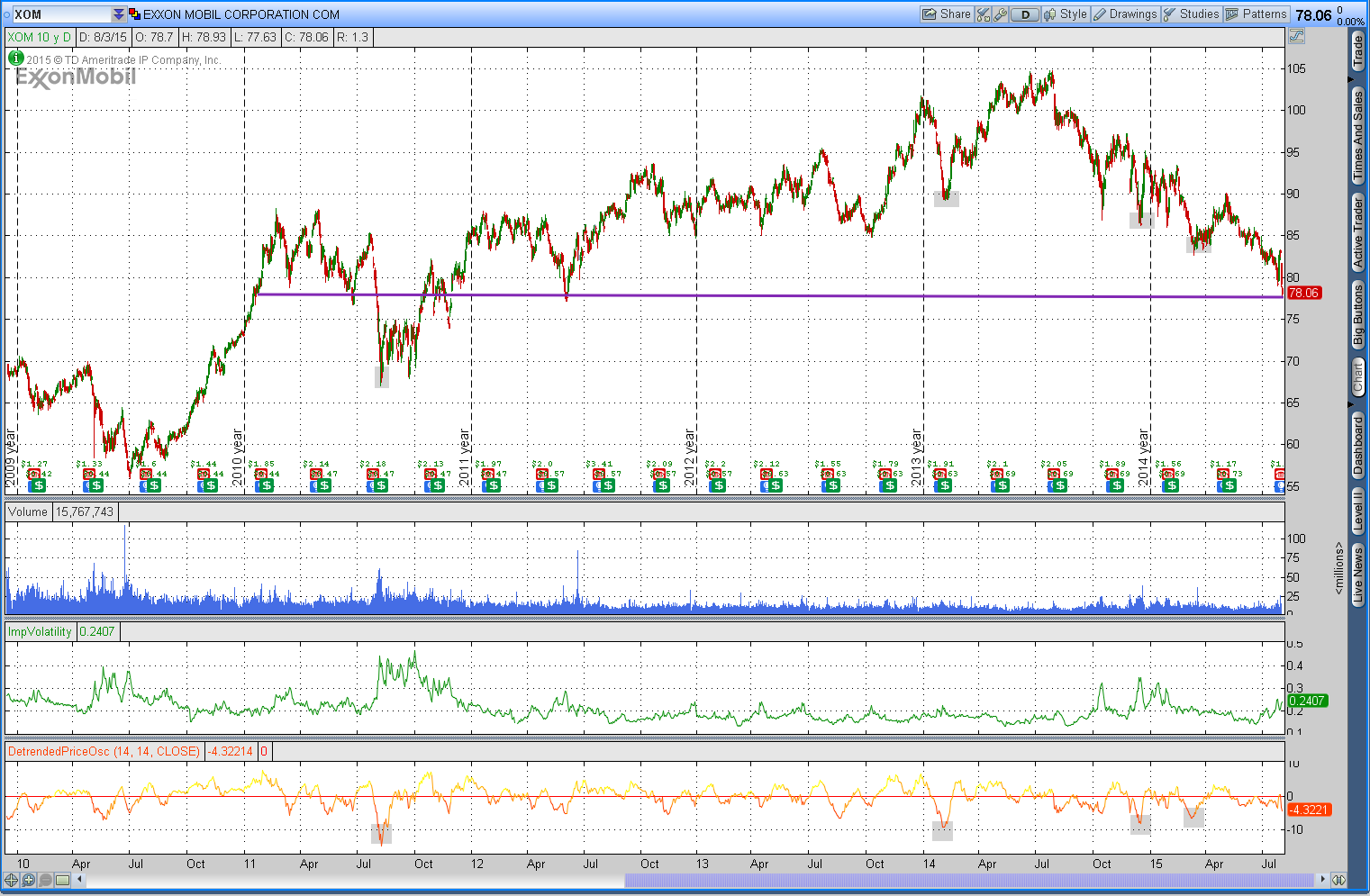

XOM is also sporting nearly a 4 percent dividend yield, which is the highest level since the height of the Financial Crisis. With the 10 year yield at 2.17 and the 30 year at 2.87, the 3.92 percent yield on XOM is at the most comparatively attractive level since 2008.

Implied volatility has shot back up post earnings, now at nearly 24.50. Put volume has increased substantially as well, so from a contrarian standpoint, this has been a good indicator of oversold readings in the past. With option prices in the 90th percentile, selling a covered call can provide a further cushion to the downside while enhancing overall yield.

Recent free content from Tim Biggam

-

Volatility Capture Trade DWAC

— 7/24/23

Volatility Capture Trade DWAC

— 7/24/23

-

Vol Capture JWN

— 4/16/23

Vol Capture JWN

— 4/16/23

-

QSR Volume and Volatility

— 3/10/19

QSR Volume and Volatility

— 3/10/19

-

Volume And Volatility SJM

— 6/30/18

Volume And Volatility SJM

— 6/30/18

-

IV reversion FTR

— 5/10/18

IV reversion FTR

— 5/10/18

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member