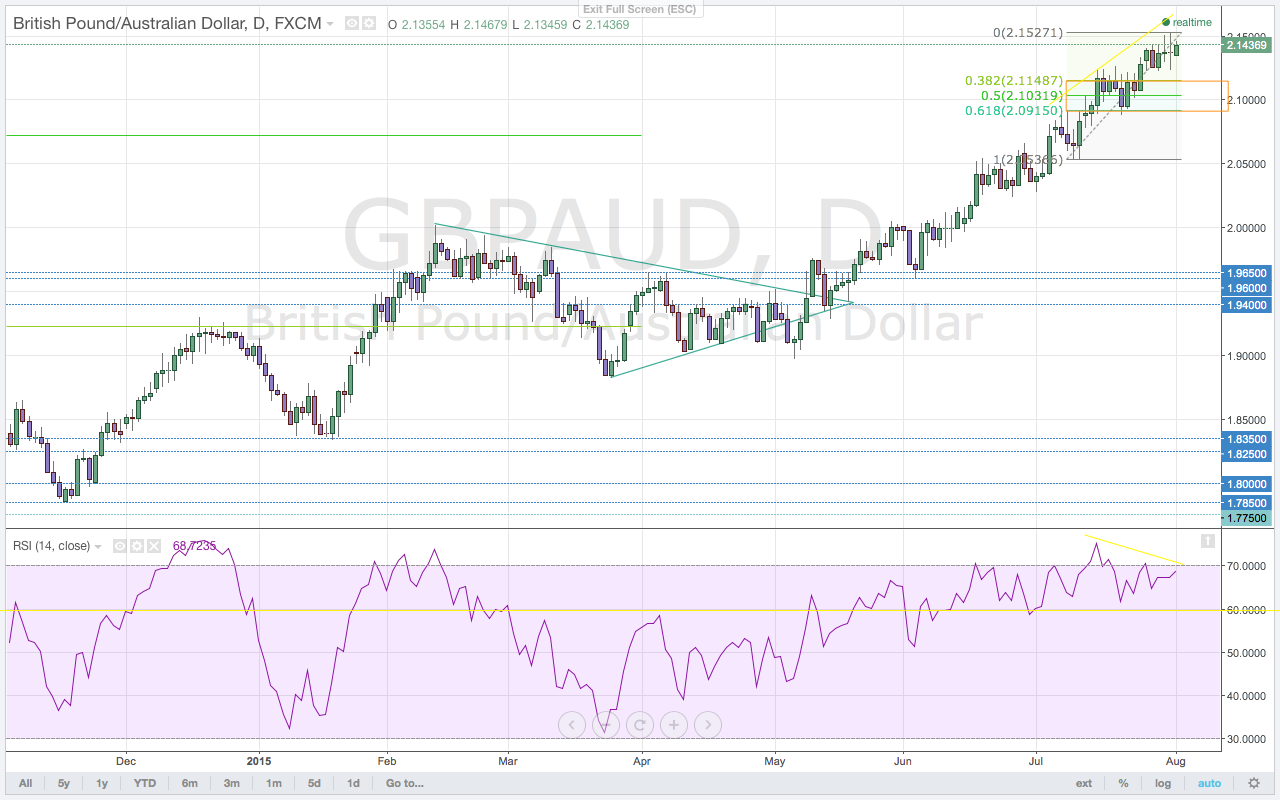

Since consolidating in a triangle pattern back in March, the GBP/AUD has extended its break of the triangle pattern to stage a breakout rally to 2.1527. This breakout above the 2.000 resistance and major psychological level to highs took out the former highs on both the daily and weekly charts. The monthly chart must be studied for the potential of a continuation higher. Having broken above the large 50% Fibonacci level at 2.0720, this breakout rally now targets the 61.8% Fibonacci level at 2.2217. The break above the 50% Fibonacci level is a very bullish development for the GBP/AUD as it signals that price will continue to move higher. A break of the 61.8% Fibonacci signals a complete reversal. The rout in commodities has been a sore spot for the Australian dollar. Iron ore and copper, two of Australia's largest exports, have suffered steep declines in price along with oil. Though the RBA did not move on monetary policy last month, they have stated that they were unlikely to ease monetary policy again this year despite its economy softening in the face of commodity weakness. Despite the RBA reducing calls for more easing, AUD selling has not abated. Copper, oil and gold have all opened the new trading week accelerating to new lows. If the RBA can stand firm with this more neutral sentiment in their interest rate announcement this week, the GBP/AUD may begin to turn lower.

The GBP/AUD completed its Fibonacci move from last week when it moved to new, multi-year highs at 2.1527. Despite the new, multi-year high in price, momentum is still diverging on the daily chart. This bearish divergence signals for another corrective price move lower in price. As the correction works price lower, momentum should find support at the 60.0 level. This level on the RSI has been a strong support for momentum during corrections in the GBP/AUD since breaking above the all-important 2.00, now turned, support level. With momentum currently out of overbought territory, price will have supportive buying momentum to move the GBP/AUD to new highs again. If momentum were to take out that support level on the RSI that would be a tentative signal that the GBP/AUD may be looking for a reversal. However, the bearish divergence alone is not enough to deter buyers. The GBP/AUD can still rally to new highs but if the RBA continues with more neutral sentiment after their interest rate announcement that could, in fact, trigger a selloff.

This is an excerpt from this week's issue of QUID REPORT. Subscribers receive my research on all major GBP pairs at the beginning of the week, including access to @faithmightfx on Twitter for daily, real-time updates to the weekly report. AVAILABLE NOW.

Recent free content from Lydia Idem Finkley

-

USD Leaves Markets in Suspense

— 6/15/16

USD Leaves Markets in Suspense

— 6/15/16

-

ECB Keeps Euro Happy

— 6/02/16

ECB Keeps Euro Happy

— 6/02/16

-

Cable is Breaking but Not Really

— 4/19/16

Cable is Breaking but Not Really

— 4/19/16

-

Remember, The Euro is a Safe Haven

— 4/17/16

Remember, The Euro is a Safe Haven

— 4/17/16

-

NEW: The Monday Morning Calls

— 4/11/16

NEW: The Monday Morning Calls

— 4/11/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member