Greetings,

We’re sending out a flash note today in response to the wild market swings since Friday. I’ve gotten numerous emails over the past two days asking what to make of this market. For regular readers of this newsletter, it shouldn’t have been much of a surprise that something like this was coming. The combination of a major slowdown in China and the prospect of higher interest rates in the US have given stocks their worst setback since 2011. The volatility of Monday’s drop was alarming, but these “flash crashes” are now happening regularly. Maybe we shouldn’t be surprised anymore, because this will not be the last.

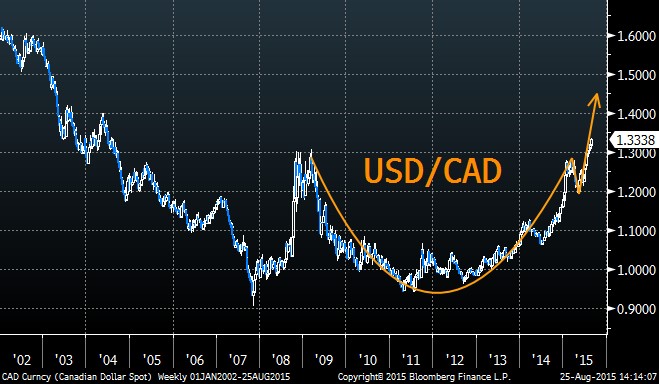

By no means do I think this volatility is over. The PBoC came out with a 25bps rate cut today, pushing the VIX back below 30 as stocks rallied (for now anyways). However, that won’t be nearly enough to get real interest rates moving lower, which is what the Chinese economy needs desperately. My best advice is to not thrash around with day trades when things get rocky. Stick to positions where you’ve got a view of at least three months. If you get stopped out, sell, but there’s no reason to be jumping in and out of positions. Especially when there are clean charts like USD/CAD still out there.

The Canadian economy is essentially a derivative of the United States, with oil being its primary export. Predictably, the Canadian Dollar (CAD) has gotten beat up over the past year, but this is plenty of room left for it to fall. USD/CAD has formed our namesake cup and handle chart formation, and it looks ready to explode higher. Notice how there’s no crazy stem like EUR or JPY from yesterday’s swings. This is a clean chart, where you’re unlikely to get shaken out of a position.

A week from today Canada will release 2Q GDP data at 8:30am EST. You may recall that 1Q GDP came in negative at -0.6% Q/Q. If the 2Q figure comes in below zero it would mean a technical recession in Canada. That’s troubling because over the last 50 years, Canada has not had two consecutive quarters of negative GDP growth without a recession in the US. A US recession would have all kinds of implications – none of them positive.

In conclusion, I still think the road ahead looks pretty rocky, especially as we enter the fall when the stock market has historically stumbled – often violently. USD/CAD is one of the best charts out there, but there are plenty of opportunities to profit from this environment. Premium subscribers know these opportunities and I hope they are capitalizing. Several positions have moved a lot already, but we’re still in the early days of tumultuous period.

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member