Yesterday Elon finally "launched" the Model X with a flashy demo of how the upwards-opening doors are not an issue in-between cars. I will disclose that I am not a fan of the company or its current products but that's a matter of taste. What I am addressing here is my issue with its current valuation.

To say the least, CURRENT VALUATIONS are no where near fair. Tesla is far from being profitable but it is growing sales. I understand the argument that growth companies (like Tesla) should concentrate on top line not bottom line in the initial phases of startup. This is especially true when they are trying to establish demand for something new. There-in-lies the first problem: Electric cars are not new; they have existed since the 1800s. They have always been unappealing (Tesla overcame this part) and impractical (jury still out on that) to the masses. Verdict: It's GROSSLY OVER-VALUED based on its current market conditions. It needs so much to go right for it to be profitable, on the auto side and its battery side.

Being over-valued is not always a problem. Consider Amazon - the ultimate in growth companies of our time. Up until recently, Amazon had been oft criticized for being in the red. Now it's turned over a profit and continues to dominate hundreds of industries globally. It's a beast. I was always defending Amazon same as current Tesla fans defend Tesla now. I always said that we should overlook the redness on the P&L for the sake of growth.

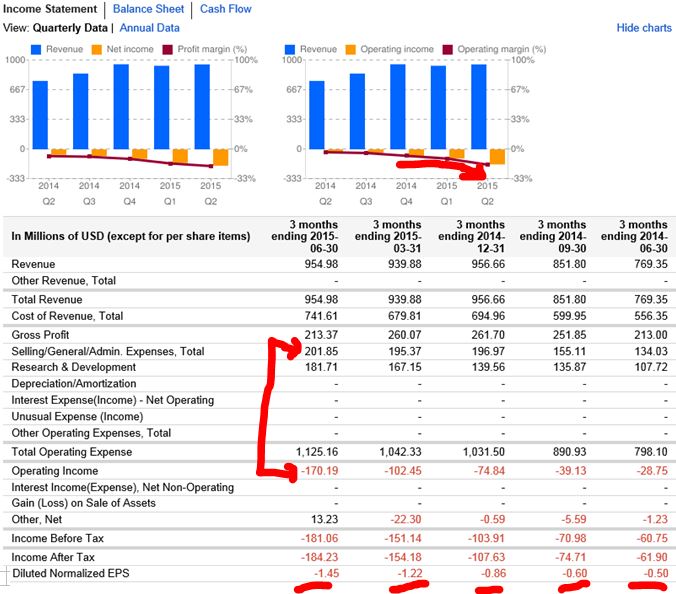

So why don't I fell the same about Tesla now? It's very simple. Amazon could have turned a profit at any point in time by simply cutting the spending on their ridiculous endeavors and they could do it without sacrificing any of its sales. Tesla cannot! It doesn't take a forensic accountant to look at the Tesla P&L and see that they have no room to cut anywhere to materially impact profit not even looking out a couple of years. They certainly can't cut R&D (an innovator needs to spend on research). That leaves Selling G&A. They are trying to expand a current niche sales effort to rival the current auto industry so they are not likely able to cut there either. So, this leaves the need to grow the top line WITHOUT commensurately increase in expenses... So you see the loop. For example: The current production facility in Fremont is physically restrictive. To expand means spending another fortune in addition to the fortune being spent to build the battery facility in Nevada... I am getting claustrophobic just writing about it.

The bottom line is that so much needs to go perfectly well, and some added extra bonus luck to boot, for Tesla to grow into the current perception of value. As a fundamental investor, I am not about to take risk on such a long shot scenario when I know I can get a much easier return from surer bets like Apple, Facebook, Google, and yes, even Amazon. These only need the globe to not fall apart and they will continue on a well established profitable path. Tesla doesn't even fit as a speculative play in my portfolio. If I want a spec play, then with high risk I would want the potential to double or triple. If Tesla is not likely to grow into its current valuation it's highly unlikely it will double or triple.

Recent free content from Nicolas Chahine

-

The Financials - The important role they play for the whole market

— 6/30/16

The Financials - The important role they play for the whole market

— 6/30/16

-

Fast Fire Update on 22 Tickers

— 5/19/16

Fast Fire Update on 22 Tickers

— 5/19/16

-

Trade results That I posted on 9/27/15 - All profitable

— 10/16/15

Trade results That I posted on 9/27/15 - All profitable

— 10/16/15

-

A little nudge

— 2/04/15

A little nudge

— 2/04/15

-

How To Set Up Trades For A Bullish 2015

— 11/12/14

How To Set Up Trades For A Bullish 2015

— 11/12/14

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member