Earlier this week, I was approached by Paul Rosenberg, CEO of mCig, which recently reverse merged with Lifetech Industries. He was impressed with my interview of Sterling Scott CEO of GrowLife (PHOT), and wanted to tell me his story. This is a huge benefit to being the "Cannabis Financial Analyst" at 420Investor.com!

His company is about to launch a $10 vaporizer that could become a category killer. The current symbol is LTCHD, but it will change to MCIG on 9/24. Having exchanged some emails with Rosenberg, reviewed the corporate website and the company's press releases and having read the three SEC filings, I am impressed with many aspects of the story. With Washington and Colorado getting close to implementing legal marijuana for recreational purposes, this stock could get a lot of attention. With that said, I think that the current price is too high and expect it to fall. I am sharing some initial thoughts today and plan to follow up with a more comprehensive interview with Rosenberg.

Company

mCig is based in Bellvue, Washington. CEO Rosenberg's description from its filings:

Mr. Rosenberg is a serial entrepreneur and private investor focused on the technology space with experience in procurement, outsourcing, research, and manufacturing. Previous to Lifetech, Mr. Rosenberg focused on seed-stage venture capital for private and public companies.

He has shared some more of his background with me, and I am satisfied that he is qualified to pursue his venture. I will share some of those details in the future to justify my view.

According to the company, Rosenberg approached Lifetech Industries earlier this year and was going to license its technology for use in his mCig. Rosenberg ended up buying out Benjamin Chung, who hadn't really done much over two years.

So, what is mCig?

mCig, Inc. is a technology company focused on two long-term secular trends sweeping the globe: (1) The decriminalization and legalization of marijuana for medicinal or recreational purposes (2) The adoption of electronic vaporizing cigarettes (commonly known as "eCigs") by the world's 1.2 Billion smokers. In 2013 the company will be launching its first product the mCig -- a purpose built loose leaf eCig retailing at only $9.99. Designed in the USA – the mCig provides a superior smoking experience by heating (not burning)plant material, waxes, and oils delivering a smoother inhalation experience.

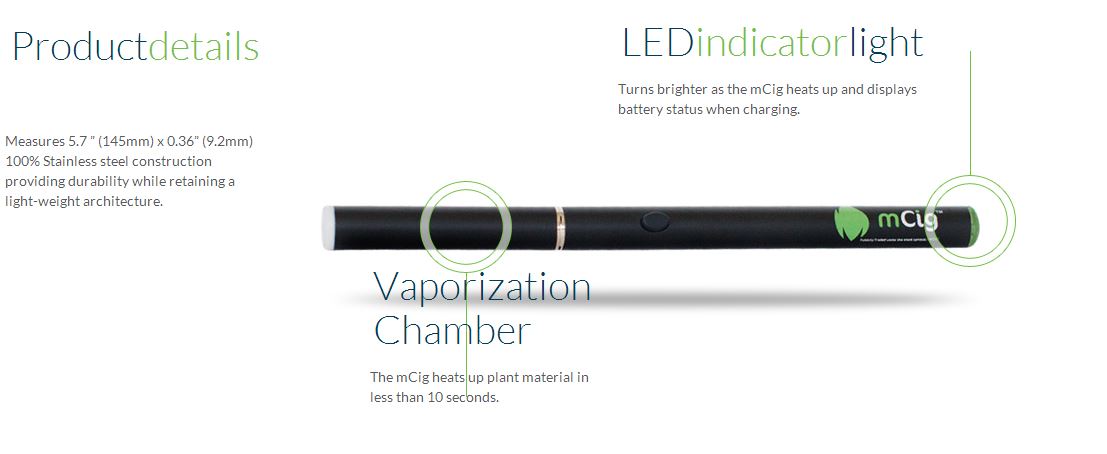

Here is a picture:

The product should launch very soon and will be available in black or white.

Here is their advertisement:

http://www.youtube.com/watch?v=bS8vgPPyqck

For a company that hasn't sold a single thing, I find this impressive:

I would note too that the company has over 5K likes on Facebook - here is a link to their page.

If you want to read a nice perspective from the company, here is their investor presentation.This is highly disruptive, given the very low price point. It's no wonder that Rapid Fire Marketing (RFMG) has been crushed!

Capital Structure

On June 18th, the former CEO of Lifetech transferred 25mm shares to Paul Rosenberg, who also invested $100K and ended with 71.4% of the voting control of the company. On July 30th, Rosenberg forgave $173K of debt owed to him by the company and then loaned $24K for operating purposes on July 31st. The company also did a 10:1 split (which was effective 8/29), such that there were 500mm shares outstanding instead of 50mm. It also increased the authorized shares from 200mm to 1 billion. The company has a small cumulative loss and showed a current equity of about -$45K. After the quarter, Rosenberg exchanged 230mm shares for a preferred stock (23mm shares that convert into 230mm shares). So the current float is 270mm common shares. According to my discussion with Rosenberg, the preferred stock, at this time, is solely voting rights, though there is a possibility that it might be converted to common stock at a later time. I look forward to the next 10-Q, which should detail the specific nature of the security.

Valuation

The way to think about the valuation of the company is to take the common shares (270mm) and convert the preferred shares (10 X 23mm = 230mm), which is possibly too conservative. This results in 500mm shares, again possibly overstated but a good "worst-case" approach. The price near $0.20, then, is $100mm for a company that hasn't even made its first sale. This is crazy, in my view.

If you had $50mm and Paul came to you and asked you to buy his company, would you? I would bet that he would sell it to you! This is how one must think, though that doesn't mean that the stock will trade at this kind of valuation (the real "value"). MJ stocks are trading expensive because the demand is high.

When I think about the valuation, I expect that the stock will trade at a very high valuation relative to where it should trade, as there are many positive attributes to the story. It's simple, and the financials are quite clean for this SEC filer. It's not hard to envision nice uptake from the mCig launch.

Before I come up with a true forecast, I need to get more information. For now, though, I will say that decent MJ biz models get at least $25mm in market cap, which would be $0.05. In this market, that would be a good entry I would estimate, but I also don't know if it gets there. The upper end of what I would expect would be $0.10-12, or $50-60mm.

With more information in the coming quarters, the valuation exercise will become less challenging. In any event, this is a start-up with extremely high risk.

Chart

The stock has exploded this month:

Keep in mind that the volume is light compared to the 270mm shares that are outstanding. The company executed a 10:1 split, and many of the holders of LTCHD likely are unaware of the huge price rise. This is just a 30-day look. It appears that there are some bag-holders already! As you can see on the left, lots of volume above .20. It's hard to call, but I would expect a dip back towards $0.10-.12. The stock was promoted four times at the beginning of the month (unpaid). I guess no one pays attention to the FINRA warnings !

Conclusion

I think that this is worth following closely. I like the CEO's background and approach. The space is very crowded, no doubt, but establishing oneself as the low-cost producer while simultaneously creating a strong brand is promising. The capital structure is friendly in my view, though the stock needs to see the old shareholders distribute their shares before I will trust the price action.

I intend to interview CEO Rosenberg in the near future and encourage you to share with me any questions you might have. I expect to learn more about the patents, additional products and product extensions, and the financial model and any goals he might share.

Free Offer

One of the key benefits to subscribers of 420Investor is access to industry leaders. I have been fortunate to have tapped into a huge network of people involved with the public companies as well as private companies or academiia. I will, of course, be sharing information with subscribers, whether it is quick comments or exclusive interviews, but I have a bunch of really dynamic people who have agreed to spend time in live presentations as well.

We will be kicking this off on October 1st at 6PM EST, and I have to admit that it may be difficult to top our first guest, Jamen Shively, founder of Diego Pellicer. In case you aren't familiar with him, he has very ambitious plans to create the leading global brand of premium marijuana. He intends to "mint more millionaires than Microsoft", where he was a corporate strategist. As excited as I am to kick off with Jamen, he is even more excited and is promising to blow everyone away as he reviews the space and updates the world on his plans to become the "Starbucks of pot". Please join us - click here to register .

Source Documents

Recent free content from Cannabis Analyst

-

Marketfy Has Evolved - We're Moving to a New Platform!

— 3/06/24

Marketfy Has Evolved - We're Moving to a New Platform!

— 3/06/24

-

420 Investor Weekly Review 12/23/22

— 12/26/22

420 Investor Weekly Review 12/23/22

— 12/26/22

-

420 Investor Weekly Review 12/16/22

— 12/16/22

420 Investor Weekly Review 12/16/22

— 12/16/22

-

420 Investor Weekly Review 12/09/22

— 12/09/22

420 Investor Weekly Review 12/09/22

— 12/09/22

-

420 Investor Weekly Review 12/02/22

— 12/02/22

420 Investor Weekly Review 12/02/22

— 12/02/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member