Another bullish day BUT in disguise. While today wasn't a +1% it was even more impressive. Why? because it had the potential to be a disaster but it wasn't. The VIX agrees with me as it lost almost 6% and now back down to normal levels of 2013. Markets got lucky that they absorbed the Google and IBM debacles as if they were micro-caps.

Monday: If we get no major escalation of the situation in Ukraine, we may come into Monday with positive momentum. This of course also assumes status Quo from Asia. Any rhetoric (tough talk about military actions) from a major country will cause a freak out into Monday. I see that a lot of traders/experts are STILL expecting more selling to come; sometimes this becomes a self-fulfilling prophecy.

- Headlines: There was a chance that traders would hit the sell button ahead of a long weekend for fear of a Ukraine headline. But, politicians hit the airwaves late in the day and said that the Geneva talks went well which likely stopped traders from off loading their positions. The Ukraine struggle is a local one and no major international power has anything to gain from escalating the situation. Ukraine elections are coming in May.

- The VIX: Lost 5.78% today and now back down as I predicted on 4/11. Monday I want to see it stay at these levels and not rocket up on slight hint of headlines. Markets STILL remain cautious as call are still 3/1vs. puts.

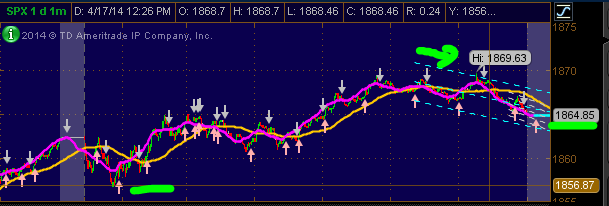

- SPX: played out perfectly to our pin AND the suggestion to short it above 1875. For education purposes on how active traders would use the level information, here are: 1) my pre-open note and 2) the SPX intraday chart:

1)

- 2)

- Options make up: Like last week, calls in major quality names outnumber puts showing signs of optimism. Maybe they are still shy about chasing rallies. Traders are still 'cautiously optimistic.'

- MOMOs: one word: CMG! WOW... from +4.5% to -5.94% in one day. What a fake out. Chasers lost 10% in minutes. To make matters worse, it was on heaviest volume in more than a year. The candle it printed today was unprecedented. For these two reasons I sent out a note that I shorted CMG via puts for next week. My thesis is that a candle this size cannot be a 1 day event. The trade is a lotto ticket. Meaning I will not be upset if I lost all the premium as it is small in size. the Stock is about $5 lower from when I sent out the note.

- The Apple Rabbit: Still holding and hit our target levels almost perfectly. As we expected, it was not able to run past 525. The resistance played out and I know that a few of you played credit call spreads above that for profits.

- Google: Yesterday I said 'IF the MOMO's can rally again tomorrow in the face of the Google miss then markets would stand a chance at a decent day.' Indeed MOMO's did (save for CMG). I believe that Google's sell-off can be a 1 or 2 day event given that everyone came out with positive notes on the company.

- IBM: IBM closed down over 3.2% (was worse intraday) and on heavy volume. I booked my profit in a debit put spread that I bought yesterday as a lotto ticket (as most of you know). I may retake it for next week on Monday. Unlike Google, I don't think that markets will rush into IBM anytime soon so may have more downside in this trade.

- The 10-year: WOW +3%. Not too much coverage was given to the fact that it was +3%. This most definitely helped offset the Google and IBM drops.

- TLT: It was down over 1% giving the markets room to run a little. Again today I saw simultaneous ticks IN THE SAME DIRECTION between the TLT, the YEN and markets (red and green). I am not sure if it's a Yellen effect or is it the beginning of the end of the hideous inverse pair trade that's plagued the markets for the last few weeks.

- The YEN: It was down a little and now at the lower end of the danger zone.

Caution is still warranted BUT the bears have been a little stunned after the last three days.

Nic.

Teaching traders make money from a relatively safe distance: Create Income with Options Spreads, a large community of Options Traders looking to create extra income by trading credit spreads. For just about the cost of a cup of coffee per day, you can get all the benefits of the CIWOS subscription, including analysis, alerts, trade recommendations, chats & video updates.

Recent free content from Nicolas Chahine

-

Crypto Update Via Ethereum.

— 6/30/22

Crypto Update Via Ethereum.

— 6/30/22

-

Update on the Oil Trade.

— 6/25/22

Update on the Oil Trade.

— 6/25/22

-

Bitcoin Update

— 6/19/22

Bitcoin Update

— 6/19/22

-

SPX Magic Late in the Day

— 6/14/22

SPX Magic Late in the Day

— 6/14/22

-

Options Tables Are Full of Clues

— 5/27/22

Options Tables Are Full of Clues

— 5/27/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member