Recap: The worst thing about today (other than my massive migraine) is that MOMOs got shellacked a la 2 weeks ago. The best thing about today is that GOOG (though down) was NOT traded like a MOMO. The end resultwas an almost boring day save for the MOMOs that drove the Nasdaq down the hardest. BUT have no fear since Apple is here. They reported and now looking to open over 560. Since it's over 10% of the index, the Nasdaq will likely lead up tomorrow.

Here are a few statements from my pre-open note and how they faired:

- Cautionary note that the 10 year is down 1% this morning and the TLT is likely to be strong. This combination has been poison to the market this month. ---->the 10yr indeed lost 1.47% & TLT +.57% still poisonous inverse pair trade (not so much the Yen though)

- I will be looking for markets to settle down and not take a big nose dive. ----> happy to see that markets in general did NOT nose dive=composed.

- The small caps are looking weak this morning so I will have them front and center all day. ----> they were tested early but rebounded. Then tested again twice and bounced twice again. So a -.7% doesn't reflect what actually happened. Like I mentioned in the morning note, markets wanted to test the 1140's. Here we almost are.

- ...I want to see if they (MOMOs) handle this pressure calmly OR will they lose 5% like they did two weeks ago. ----> they lost big so risk appetite is still weak and without conviction.

More:

- Geo-political headlines: Still absent and again traders were free to trade their tickers without having to worry about news flashes from Ukraine. (Although locally the situation is getting worse there).

- The VIX: gained a little & VIX calls still outnumber puts almost 3 to 1 =traders remain cautious.

- SPX: Still not chasing the SPX run BUT interested to see the Apple effect on it tomorrow I may short the pop via SPX credit call spreads. Click here for my detailed thoughts on this from yesterday.

- Options make up: more calls than puts in quality names = signs of optimism. 'cautiously optimistic' since markets still buying VIX calls too.

- MOMOs: super green Tuesday turned into bloodbath Wednesday. I book any profit in any momentum play as it may disappear in minutes.

- The Apple Rabbit: Lotto at the money call spread play paid (tho could have done it a little better). If they chase it I may short it (via weekly puts).

- Google: I am happy to see markets NOT treating it like a MOMO today. NFLX TSLA CRM down 5%; Google down only 1.45%. Again the GOOG performed in stride with GOOGL.

- IBM: 2 Dojis back to back = market indecision. This tells me that there should be a good move coming. I still may reload my puts.

- The 10-year: a Meh candle from 2days ago turned into significant weakness. Caution.

- TLT: ended up on the day but the danger is that it's tightening. It's trying its go at the 111.5 level and the scary part is that it's doing it from higher lows. Often enough they end up breaking through and out. Also important to note that for a while today, markets AND the TLT were trading in lock step (up and down). I don't know what to make of it yet.

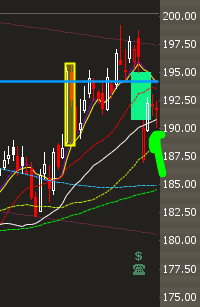

- The YEN: We are still at the bottom of my danger zone for the past 180days. Here is a visual

-

Caution is still warranted BUT the bears have definitely been de-clawed to a certain extent.

Nic.

Teaching traders make money from a relatively safe distance: Create Income with Options Spreads, a large community of Options Traders looking to create extra income by trading credit spreads. For just about the cost of a cup of coffee per day, you can get all the benefits of the CIWOS subscription, including analysis, alerts, trade recommendations, chats & video updates.

Recent free content from Nicolas Chahine

-

Crypto Update Via Ethereum.

— 6/30/22

Crypto Update Via Ethereum.

— 6/30/22

-

Update on the Oil Trade.

— 6/25/22

Update on the Oil Trade.

— 6/25/22

-

Bitcoin Update

— 6/19/22

Bitcoin Update

— 6/19/22

-

SPX Magic Late in the Day

— 6/14/22

SPX Magic Late in the Day

— 6/14/22

-

Options Tables Are Full of Clues

— 5/27/22

Options Tables Are Full of Clues

— 5/27/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member