Apple reported earnings last night and the street liked what they saw. Today' it's +3% and responsible for most of the pop in the broader indices. Here is a look at what today's candle (if it closes here) tells us about the trend:

- The Sentiment: The stock has had a nice year so far. It bounced off the hatred that took it undeserved lows. Now the street is back in love with the company.

- The Yack: What I don't like about this run is that it's fueled in large part by a lot of lip service from management. But the worrisome part is that it's all generalized statements of 'exciting things' coming and 'best pipeline ever' etc. This reminds me of the olden days of Microsoft's vaporware. This is a risk to the stock price in my opinion because it built up investor expectations to high levels.

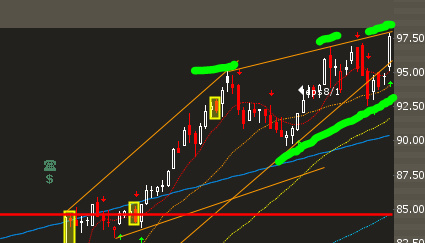

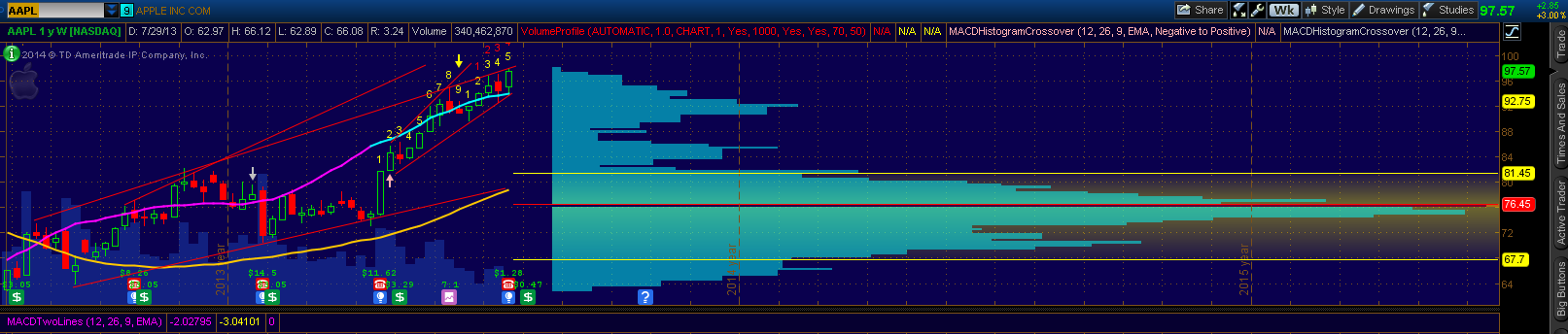

- The Technical: Short term, the trend looks strong and upward but becoming like a rising wedge. This often is a bearish pattern.

- The Verdict: This is nothing against the fundamentals of the company or its prospects in business. This is merely to say that if I have profits in Apple I would book some or at least protect them. Protection is easy via the options markets and could be free. Message me if you need to learn how to do it.

- Daily chart:

- Weekly chart to reduce noise:

Teaching traders make money from a relatively safe distance: Create Income with Options Spreads, a large community of Options Traders looking to create extra income by trading credit spreads. For just about the cost of a cup of coffee per day, you can get all the benefits of the CIWOS subscription, including analysis, alerts, trade recommendations, chats & video updates.

Recent free content from Nicolas Chahine

-

Crypto Update Via Ethereum.

— 6/30/22

Crypto Update Via Ethereum.

— 6/30/22

-

Update on the Oil Trade.

— 6/25/22

Update on the Oil Trade.

— 6/25/22

-

Bitcoin Update

— 6/19/22

Bitcoin Update

— 6/19/22

-

SPX Magic Late in the Day

— 6/14/22

SPX Magic Late in the Day

— 6/14/22

-

Options Tables Are Full of Clues

— 5/27/22

Options Tables Are Full of Clues

— 5/27/22

No comments. Break the ice and be the first!

Error loading comments

Click here to retry

No comments found matching this filter

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member

Want to add a comment? Take me to the new comment box!