The stock market has been going up since the financial debacle based on one premise: the Fed has our backs. So far the Fed did its job giving us the green light to buy up the markets. But what if they are not in control going forward? I don't want to debate backwards as to if they were ever in control. I do want to consider the mid term scenario to come. We all agree that the rates behavior fooled EVERYONE year to date. We all expected that rates would be rising a little by now. So if we admit that rates were a complete surprise, I worry about rates catching us all flat footed again - Including the Fed - and shoot up higher irregardless of what and when Yellen decides to officially cut. Furthermore, her hand could be forced by inflation as you've recently heard me say.

Today, we had record highs in the S&P and a moonshot in the NDX now calling for 4000, yet I STILL don't see a clean win for the bulls. Small caps (basket of 2000 stocks) closed closer to the low of the day than the high. Also mathematically the S&P500 would be flat to red if you neutralize a handful of major heavy weights like Apple, Citigroup, Biogen & Pepsi. So the "strength" can be misleading so don't follow blindly.

The TLT (bonds) is now back up to what used to be support in a strong up-channel trend. So it's back threatening for a breakout (usually bearish equities):

Earnings continue to provide performance. Apple surged early as if it was a delayed reaction to the earnings. I don't like that it failed lower than its recent high. The run to 100 continues and the bulls can't be happy today while the bears are wiping sweat off their brow:

Tomorrow, we should carry some momentum into the open unless we get headlines. Today we had a headline of some truce deal looming in Gaza.

The LOTTOs: Looking to re-up my NFLX short. I don't like the chart technically (nothing against its fundamentals). Today the stock price was playing with 'fire' (pun intended). It's almost never good to knock on low level from lower highs. Often the bulls get tired from defending the position and the floor gives way:

Facebook reported and the reaction caused a wild $3 wide swing. I am holding small lotto puts that is a loser at this time. this is based on a hunch. I will hold it into the week as one cannot claim money back on lotto tickets.

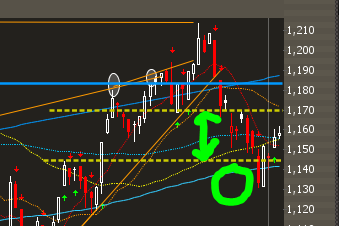

Update to my SPX trend: Today's candle is a good recovery towards the dashed lime green trend but still not there:

Momentum stocks mixed.

I will update the members in the am with all the new levels to trade this week.

Non-members, sign up and you too can get daily updates on where the markets are likely to trade. Marketfy guarantees that it's money well spent or you can take it back.

Update to my note about the small caps candle: We have recovered and now back in the dashed yellow range, which is not as scary as just below it. 1155 and lower lacks near term support. Bulls can breath a little better even though its performance today was not good.

Reiterating my disclosure: Though it sometimes sounds like it, I am not a bear. I sell spreads so I don't care where the market goes as long as it stays away from my credit spreads! I currently fear a runaway downward snowball effect more than a moonshot.

I don't see the BULL CONVICTION and neither do the bears and that's why they are not afraid. BUT if I am not already short, this is not the time to pile in on the short side. If I had short positions that were under water coming into today then I should have used the weakness to better situate them with more time on the clock.

So until further notice: Much has happened YET nothing has changed. So, selling premiums outside of the ranges continues to work. Meanwhile, it's A.G.I.S.I.B. all the way. (if you don't know what it means click here).

Nic.

Teaching traders make money from a relatively safe distance: Create Income with Options Spreads, a large community of Options Traders looking to create extra income by trading credit spreads. For just about the cost of a cup of coffee per day, you can get all the benefits of the CIWOS subscription, including analysis, alerts, trade recommendations, chats & video updates

Recent free content from Nicolas Chahine

-

Crypto Update Via Ethereum.

— 6/30/22

Crypto Update Via Ethereum.

— 6/30/22

-

Update on the Oil Trade.

— 6/25/22

Update on the Oil Trade.

— 6/25/22

-

Bitcoin Update

— 6/19/22

Bitcoin Update

— 6/19/22

-

SPX Magic Late in the Day

— 6/14/22

SPX Magic Late in the Day

— 6/14/22

-

Options Tables Are Full of Clues

— 5/27/22

Options Tables Are Full of Clues

— 5/27/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member