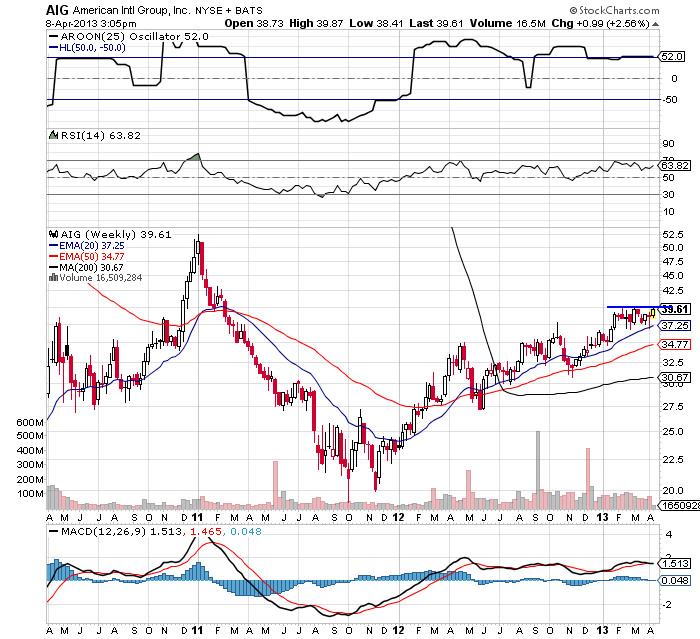

AIG has b3ecome a hedge fund favorite in 2013 as they bet on the insurers recovery. The weekly chart shows recent resistance at $40 in the bullish up-trend, with the MACD above its zero line and the RSI pointing higher. A breakout above could send prices higher to the $50 Resistance from December 2011 highs.

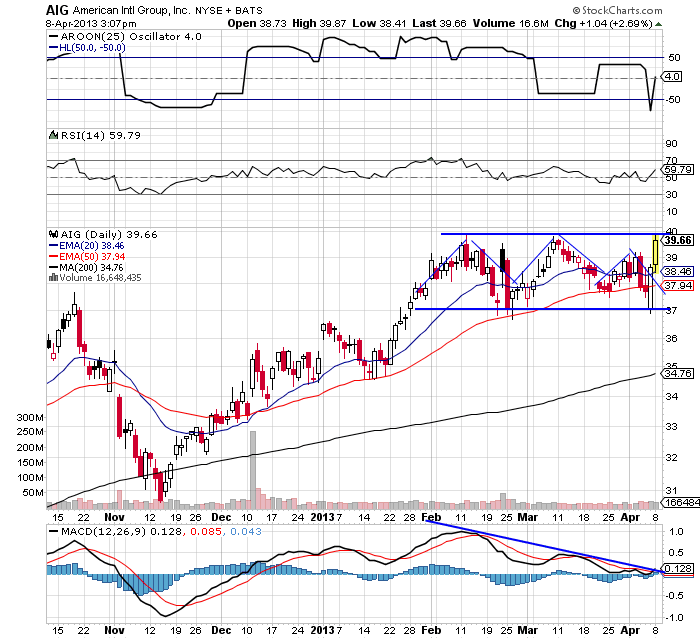

Daily chart shows a failed H$S pattern with neckline support at $37. Bearish MACD divergence is still there, but is attempting a bullish cross. A confirmed breakout above $40 would trigger a long position.

Recent free content from Zack Armstrong

-

Final Trade

— 5/06/13

Final Trade

— 5/06/13

-

Play The Channel Breakout In These Two Set-Ups

— 4/25/13

Play The Channel Breakout In These Two Set-Ups

— 4/25/13

-

Popular (BPOP) Long Set-Up

— 4/25/13

Popular (BPOP) Long Set-Up

— 4/25/13

-

Jamba Juice Trade Set-up

— 4/10/13

Jamba Juice Trade Set-up

— 4/10/13

-

Additional Trade Set-ups

— 4/09/13

Additional Trade Set-ups

— 4/09/13

No comments. Break the ice and be the first!

Error loading comments

Click here to retry

No comments found matching this filter

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member

Want to add a comment? Take me to the new comment box!