Overview

A couple of weeks vacation away from the day to day noise of markets can help give you some much needed perspective. I highly recommend it. Let's take a look at where things stand.

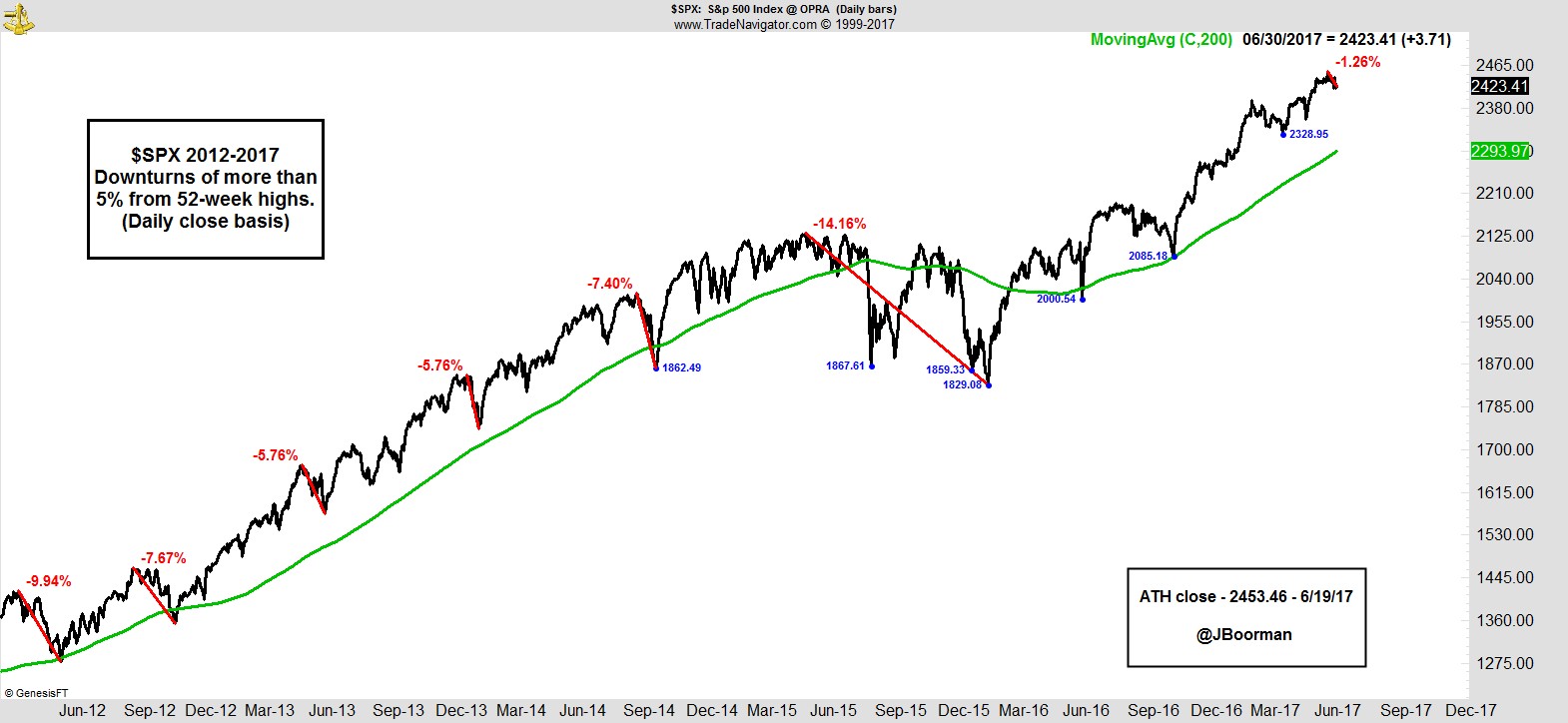

The S&P is 1.3% off its all time high of two weeks ago.

.

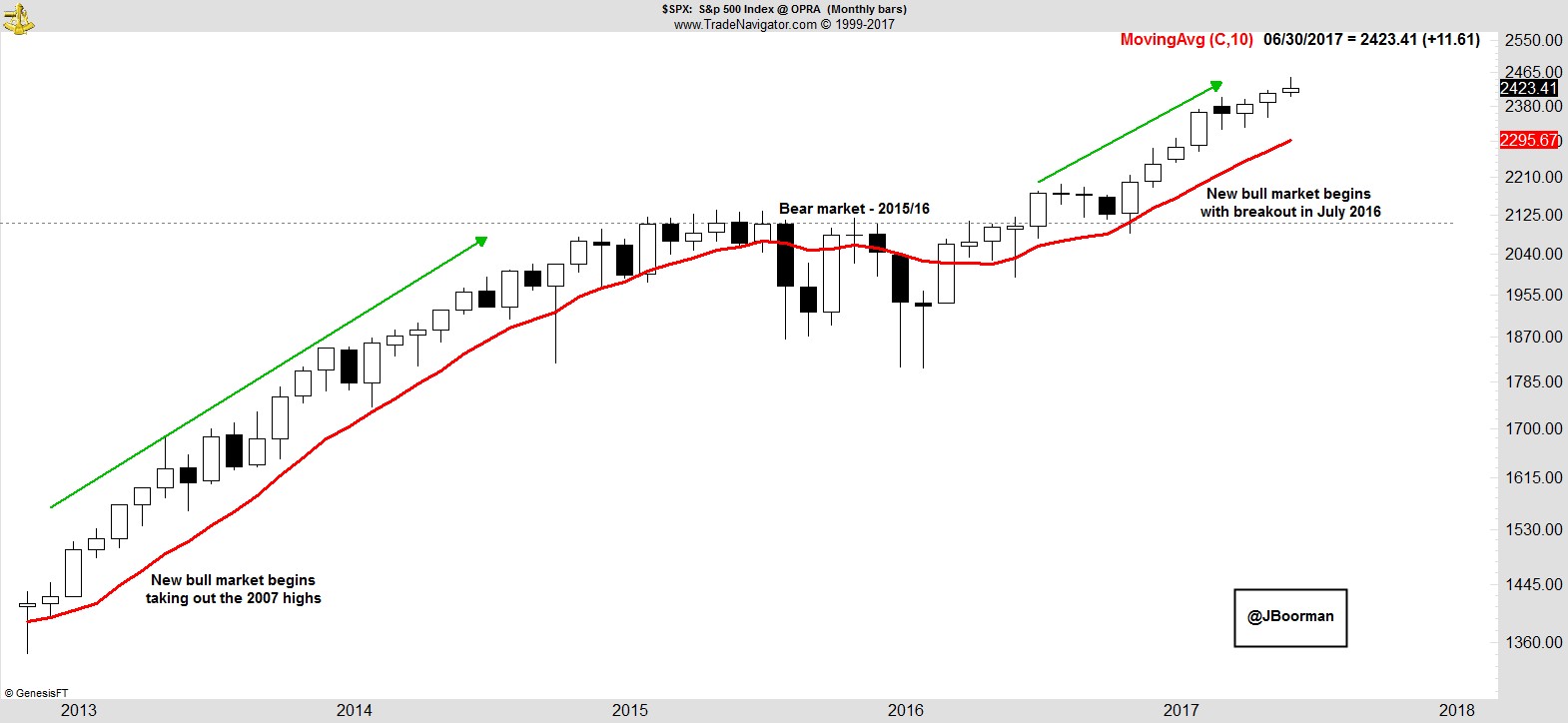

The new bull market that began in July 2016 is intact. The S&P was up for June, posting another higher high and higher low.

.

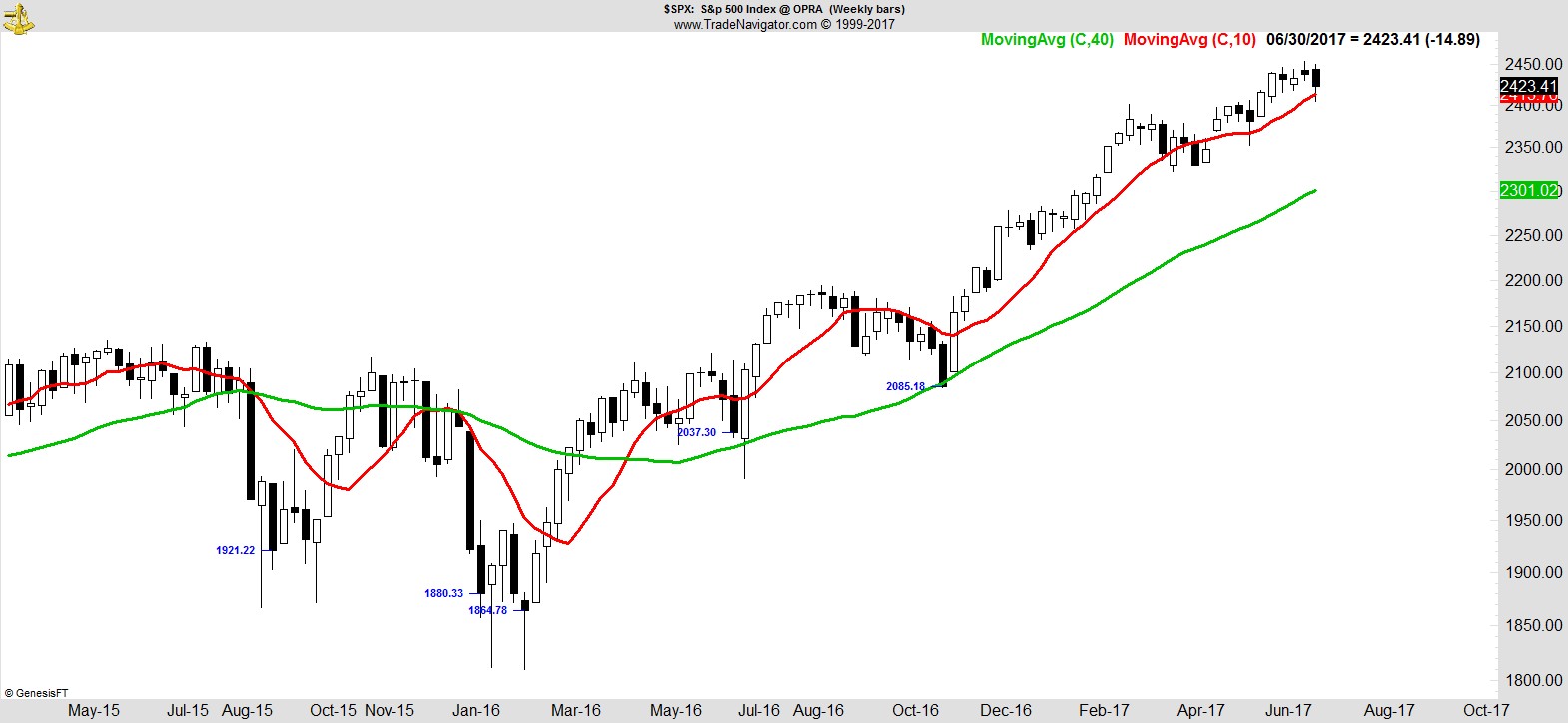

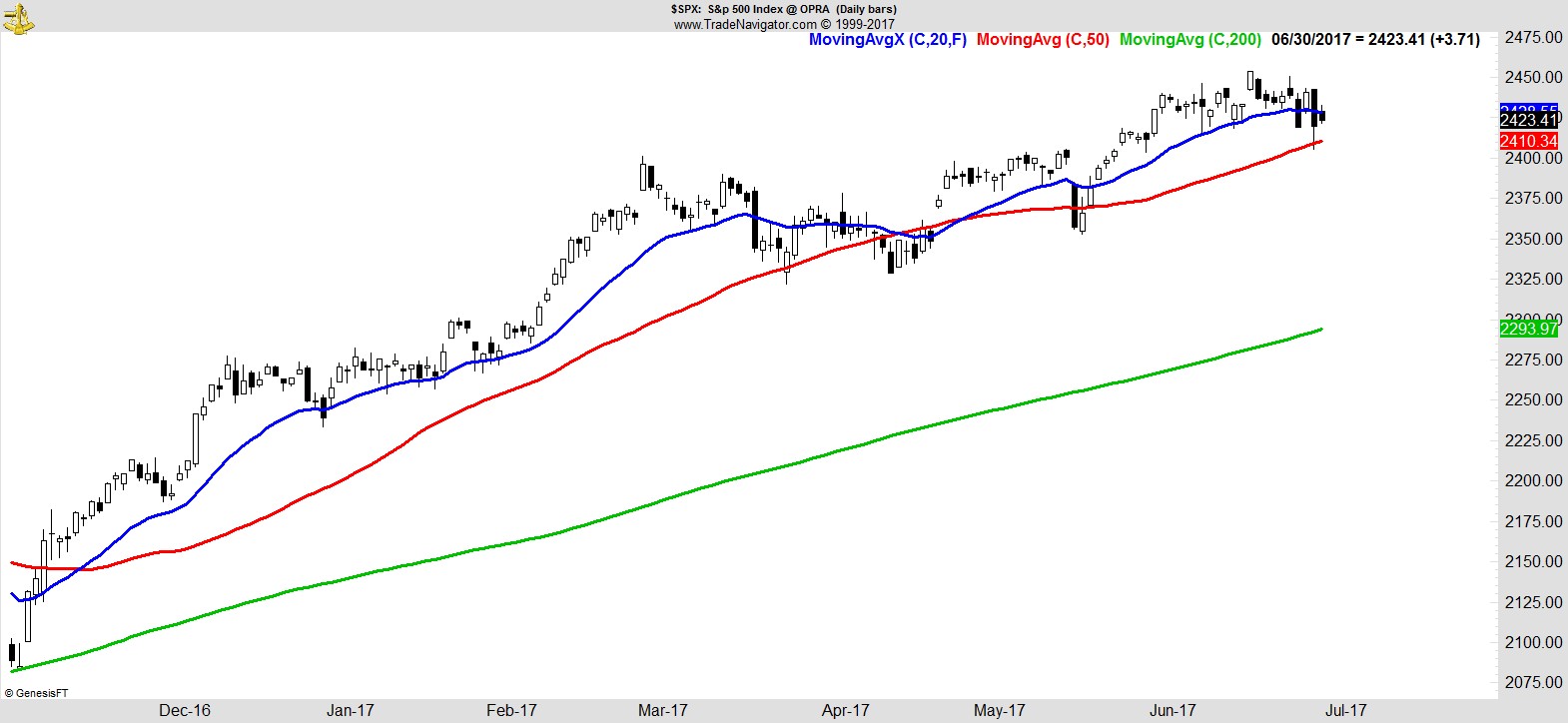

The S&P tested its 10-week and 50-day MA but ended the week above both.

.

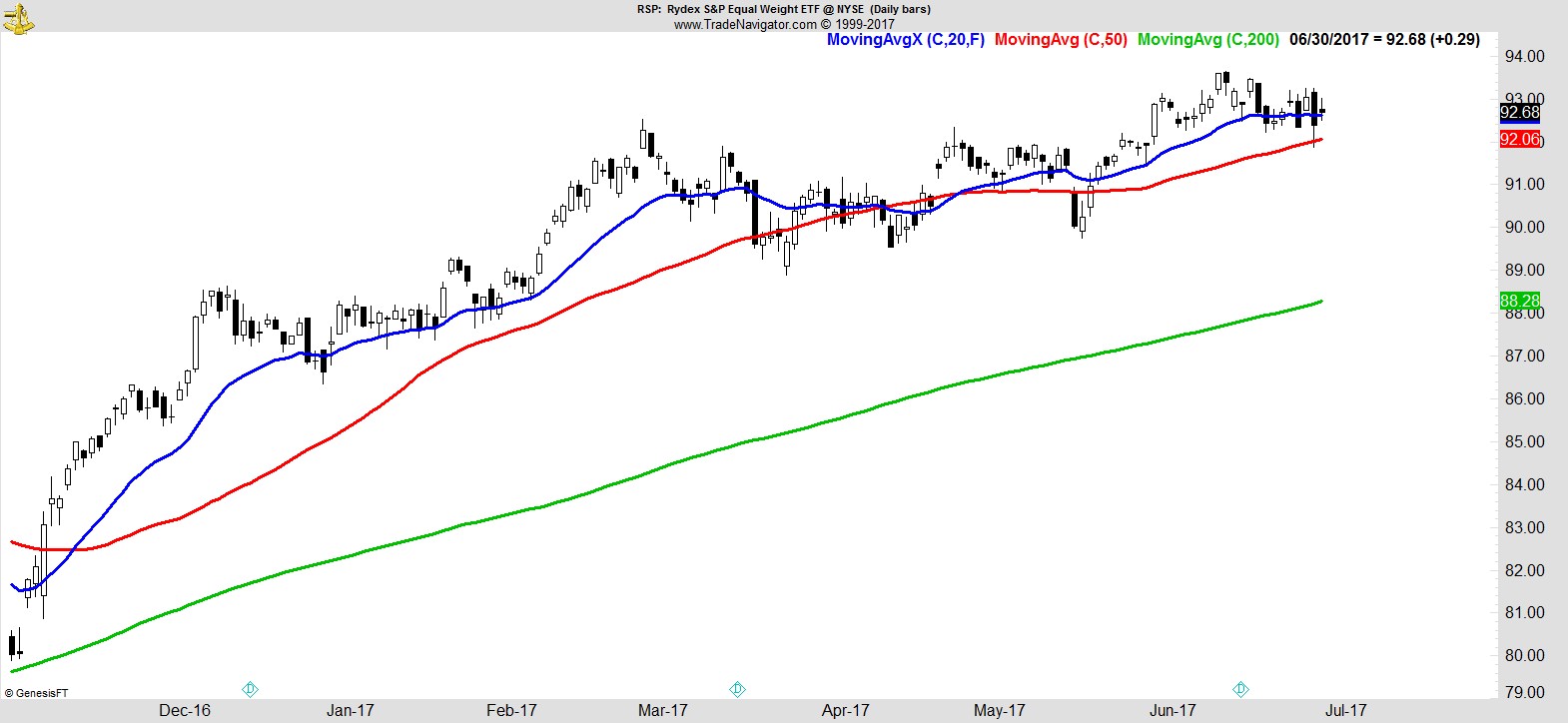

If equal-weighting it is your thing, you get the same picture.

.

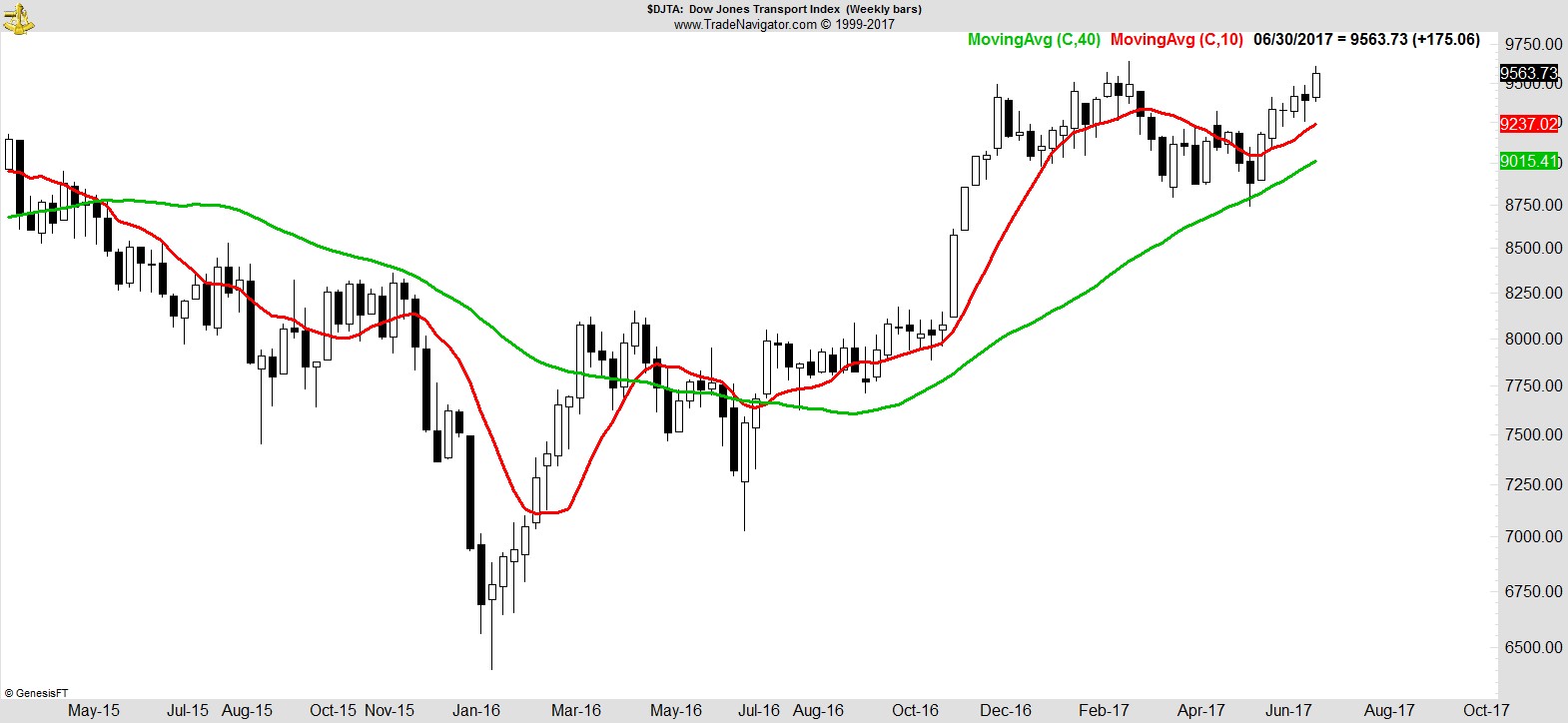

The Dow Transports is at new highs.

.

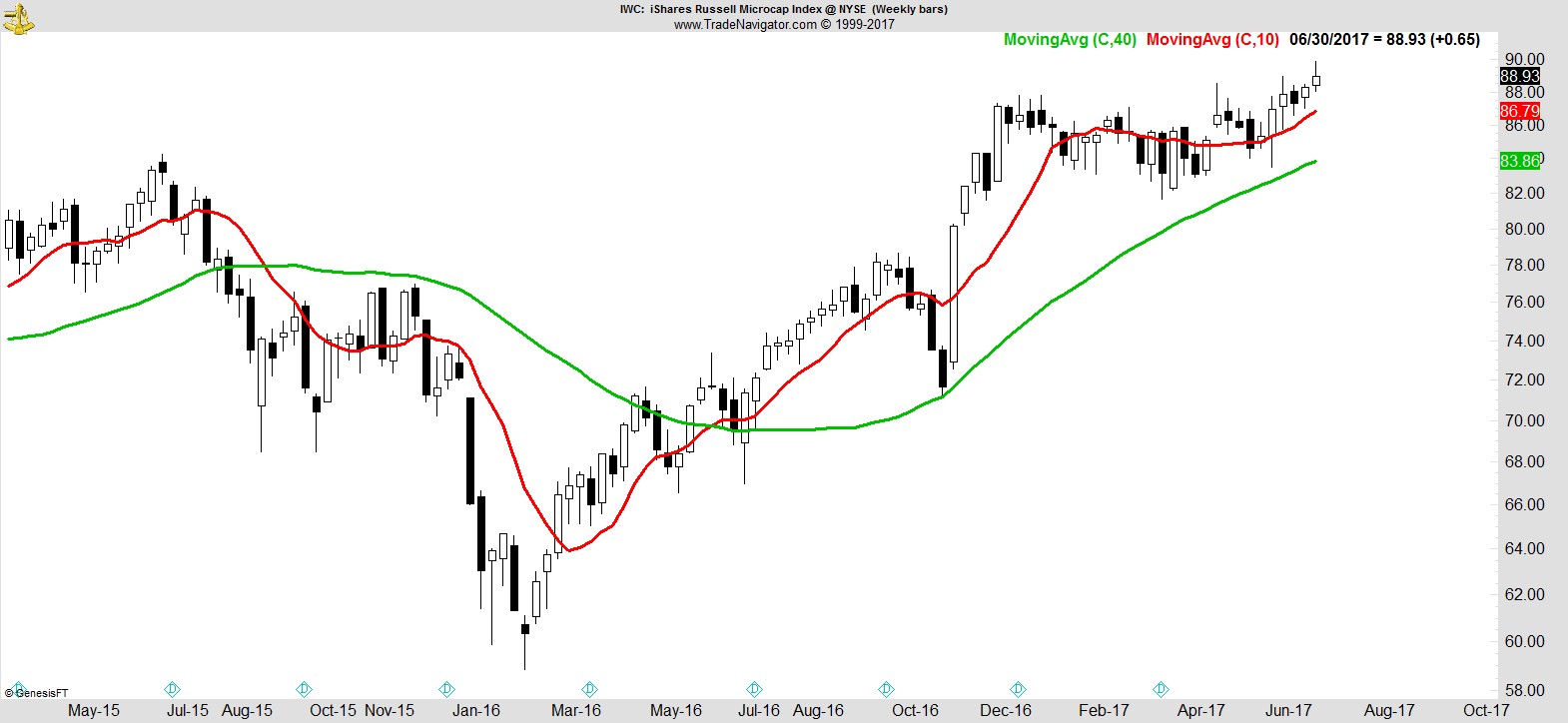

The Microcaps index is too.

.

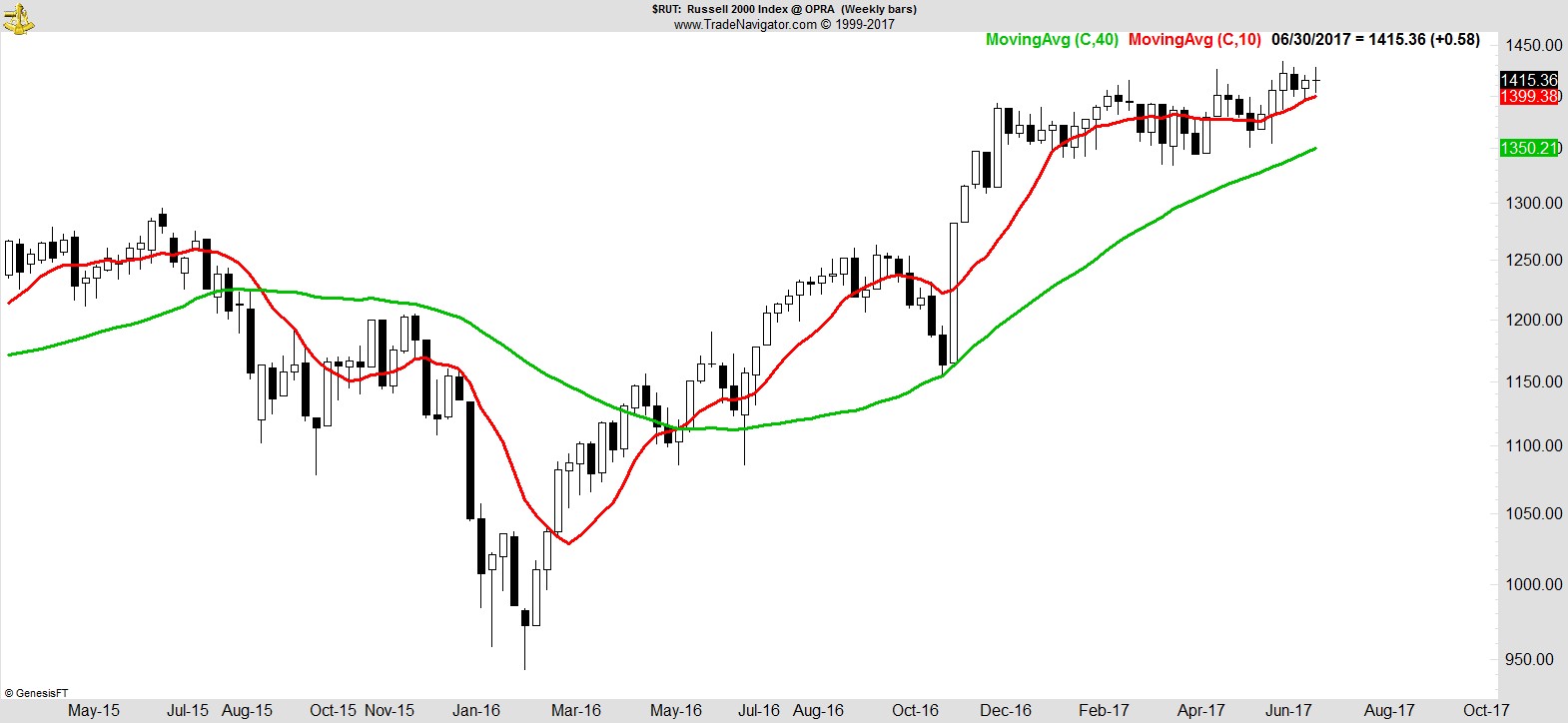

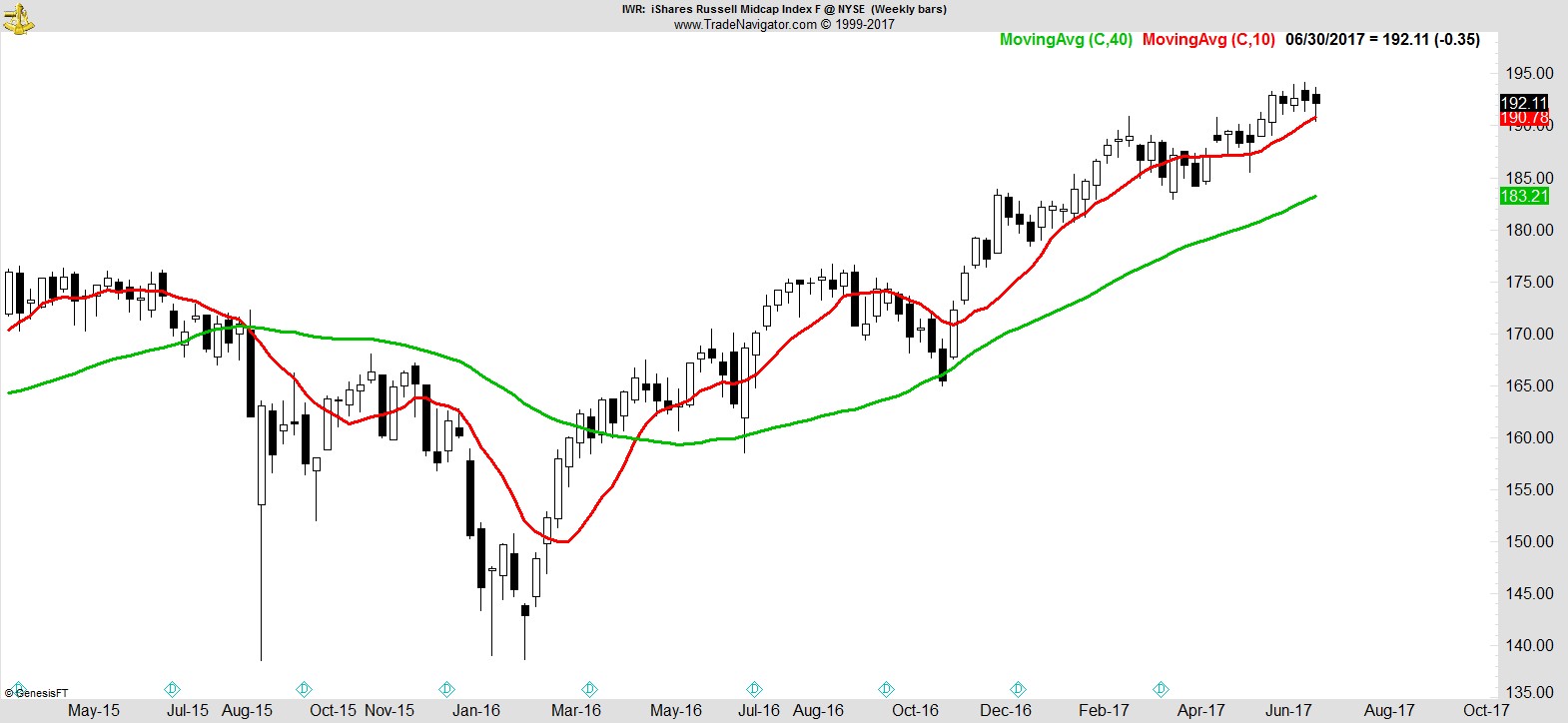

The NYSE Composite, Russell, and Midcaps aren't far behind.

.

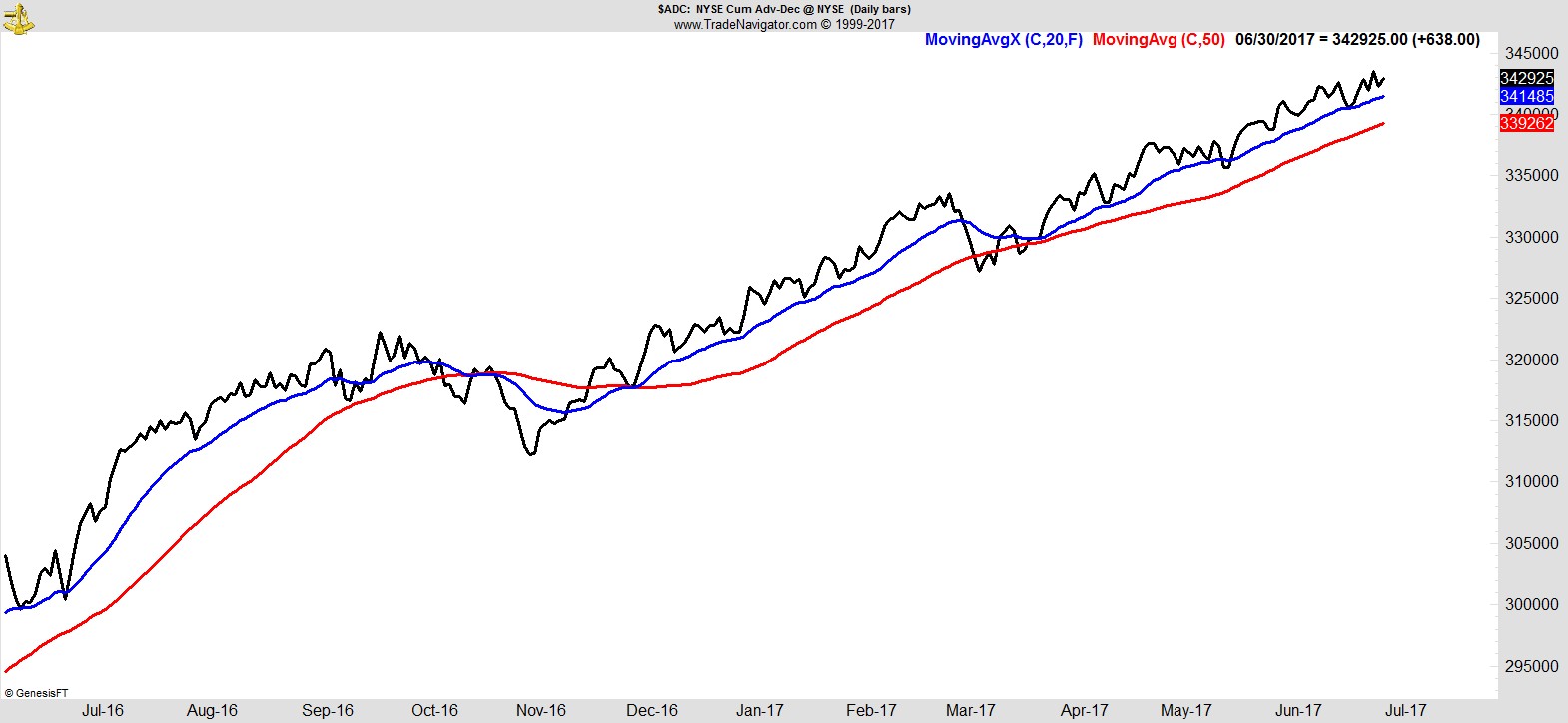

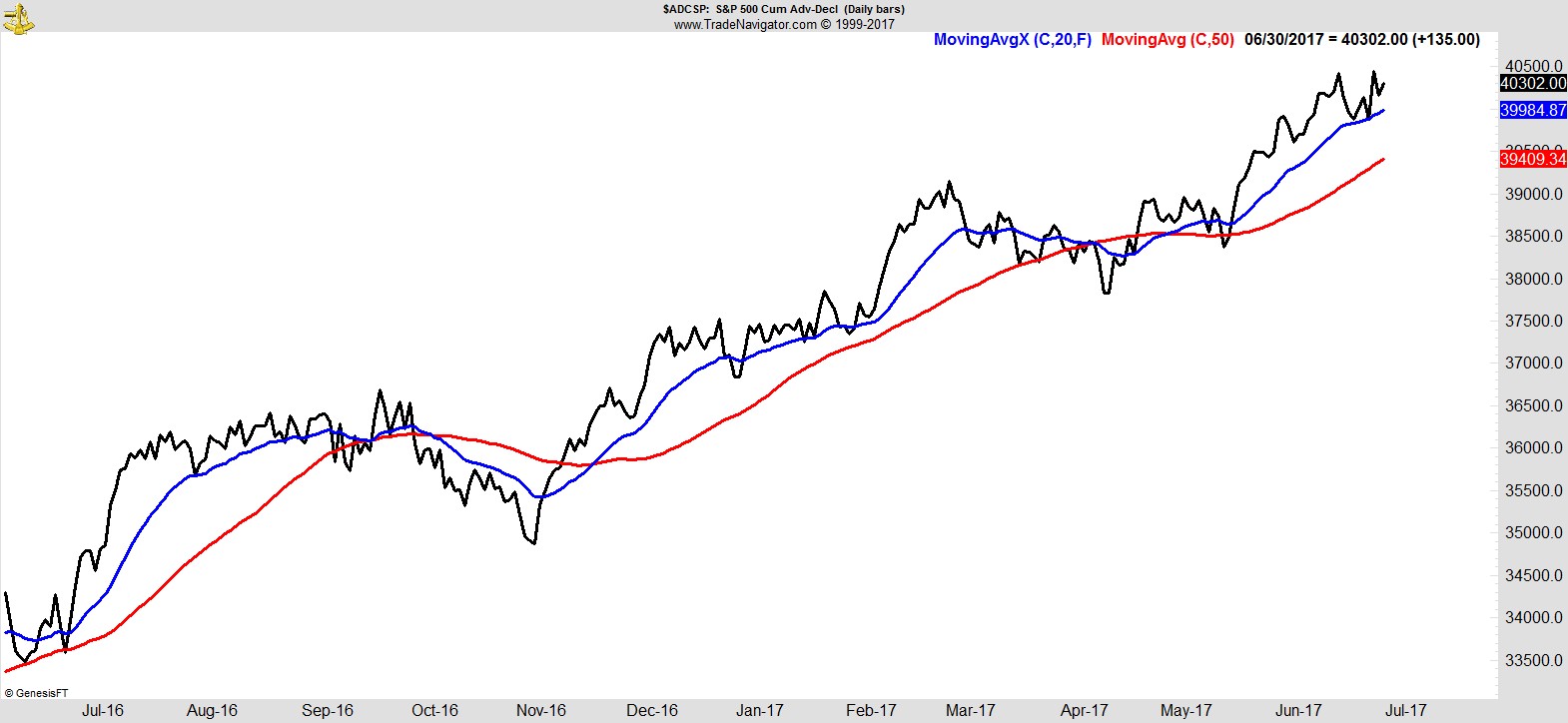

Breadth is strong, just below its highs for both the NYSE Cumulative Advance/Decline, and S&P 500 stocks only.

.

So what's everyone's problem?

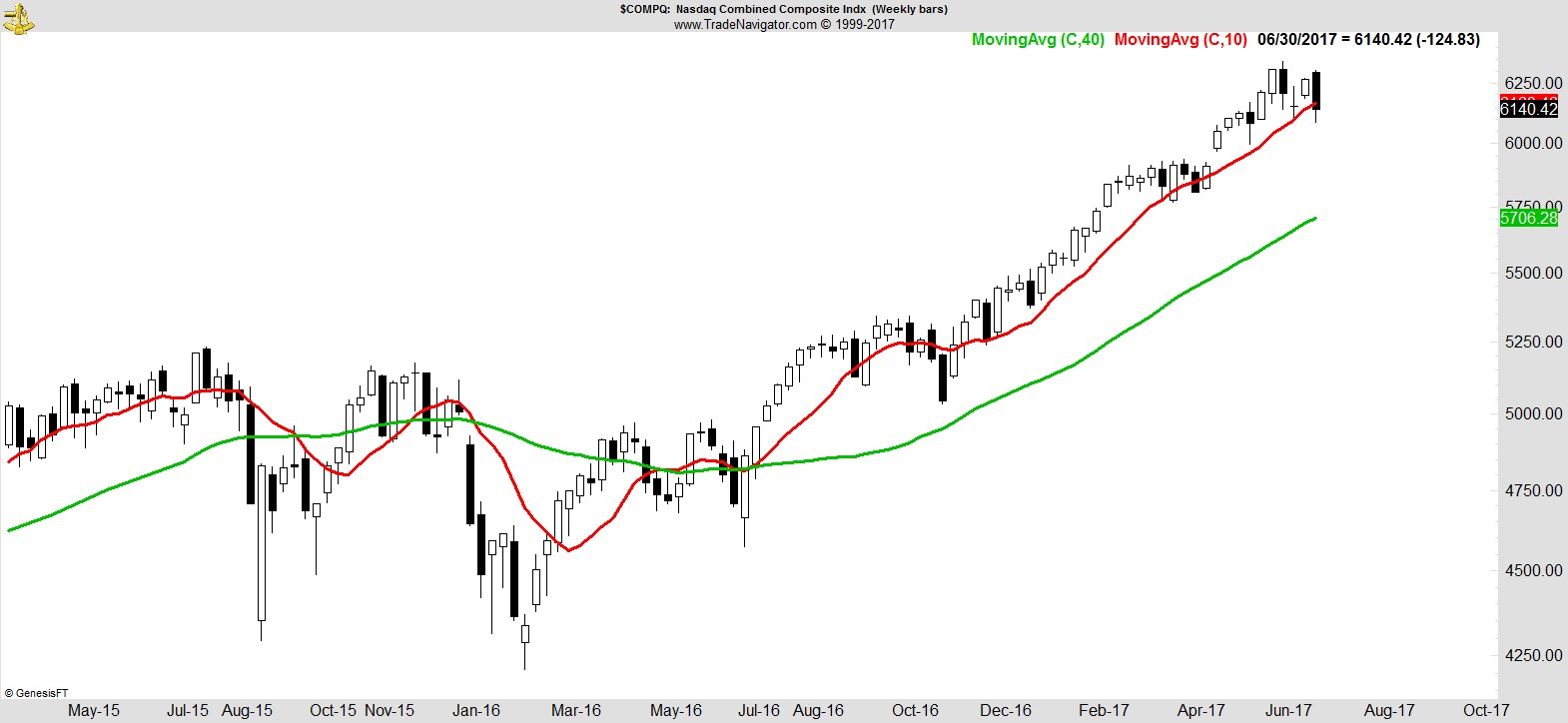

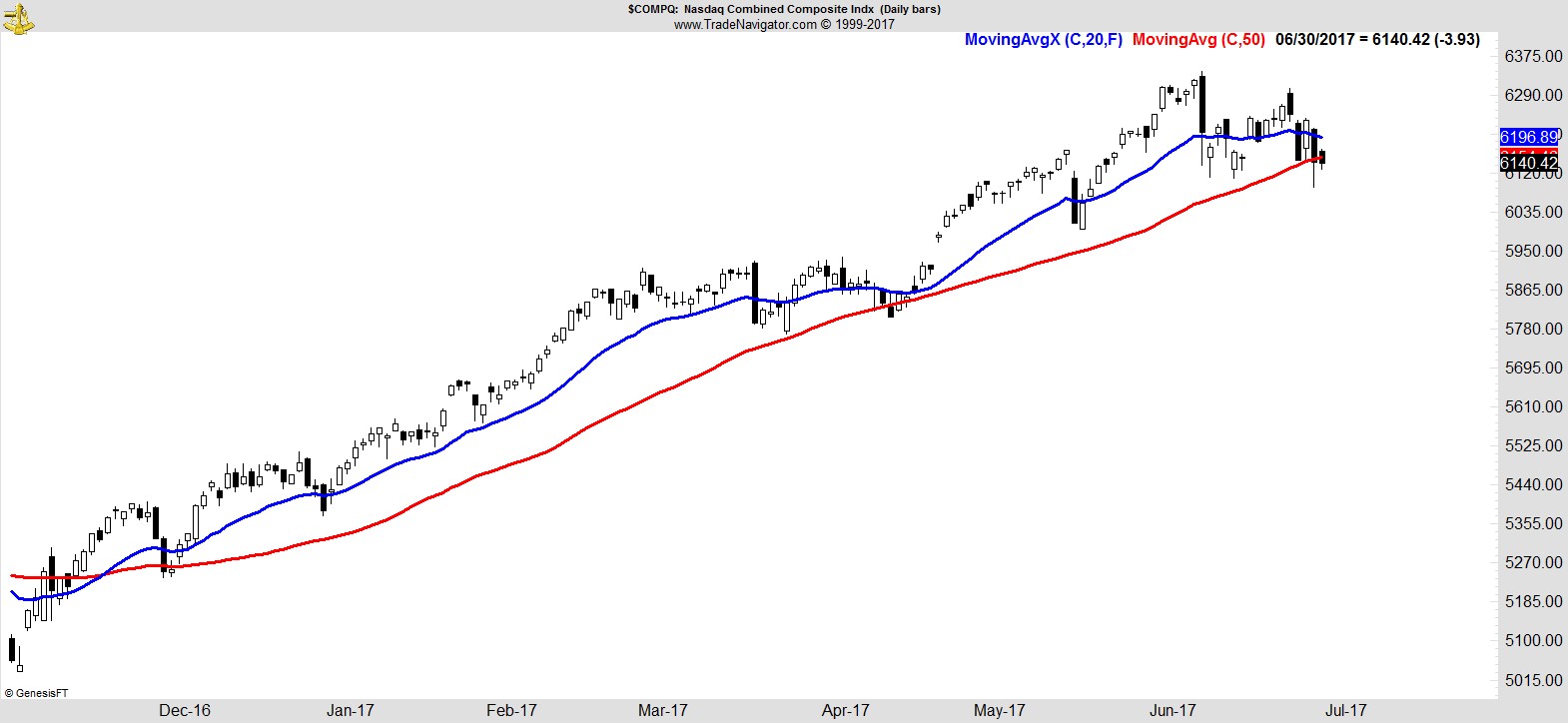

Oh, the NASDAQ.

It closed below its 10-week and 50-day MA for the first time since the last time.

.

When most indices are at or near their highs while others are testing their MAs, but breadth remains strong, the reason is very clear. This is rotation, pure and simple. It's easily and quickly felt in a highly concentrated portfolio, and can be seen clearly when looking at underlying sectors.

.

Sector Rankings

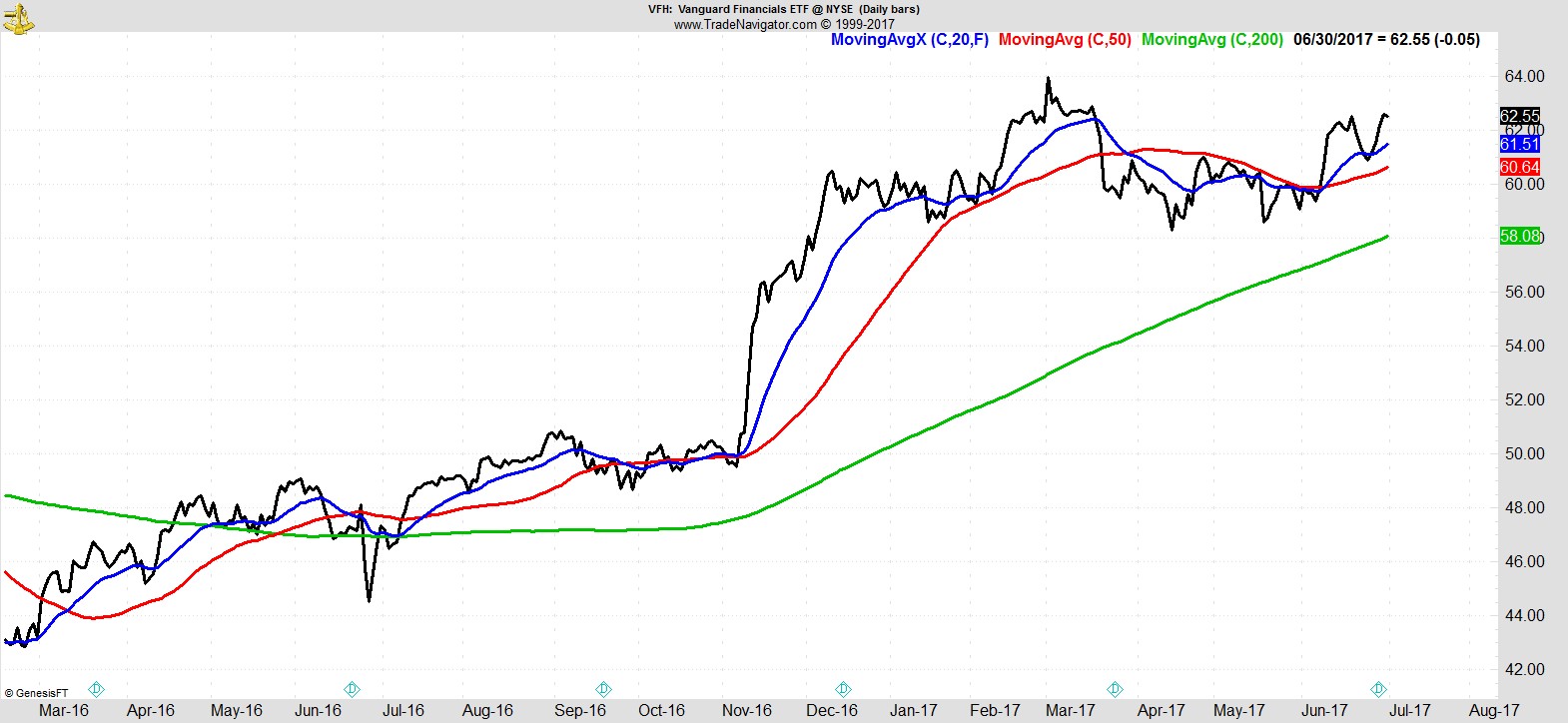

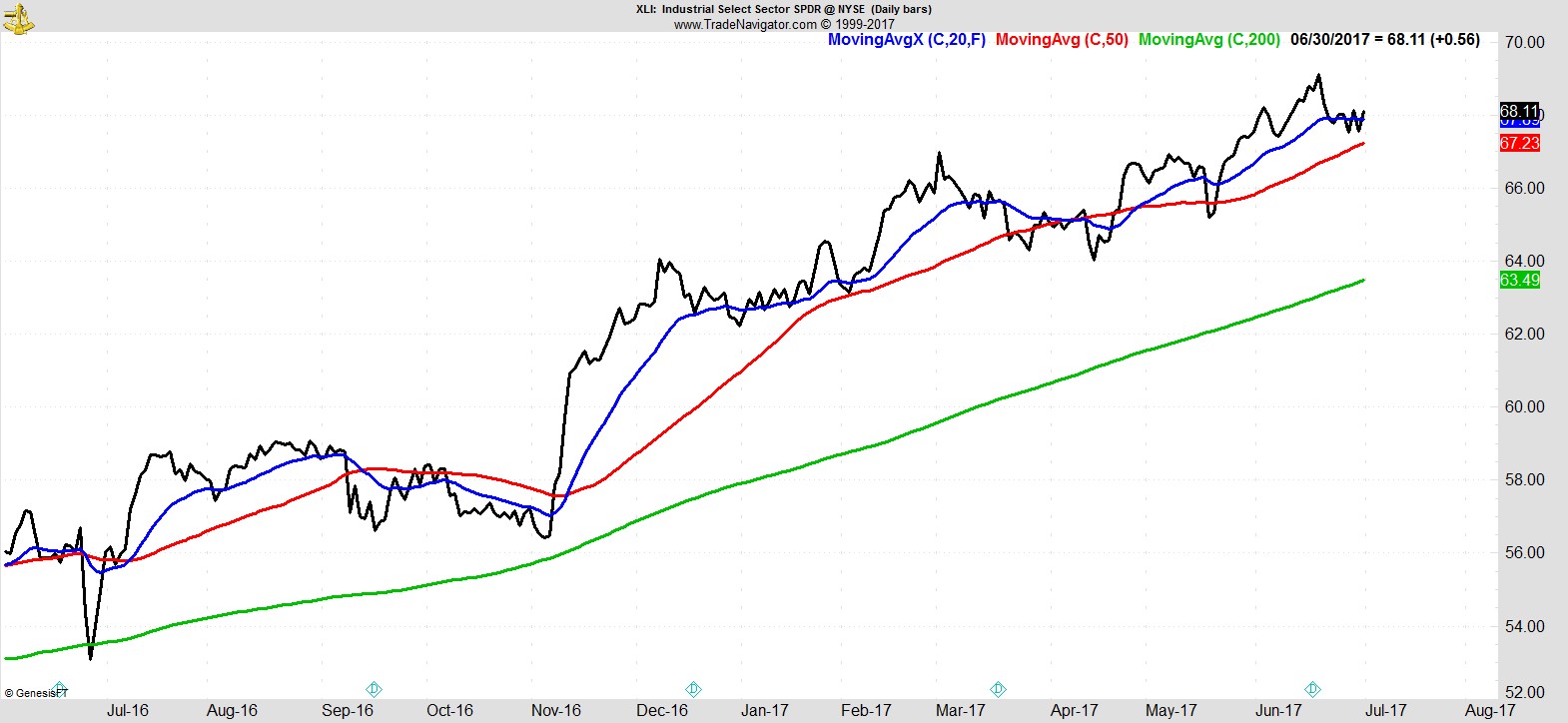

Leading the way I have Financials, Healthcare, and Industrials.

.

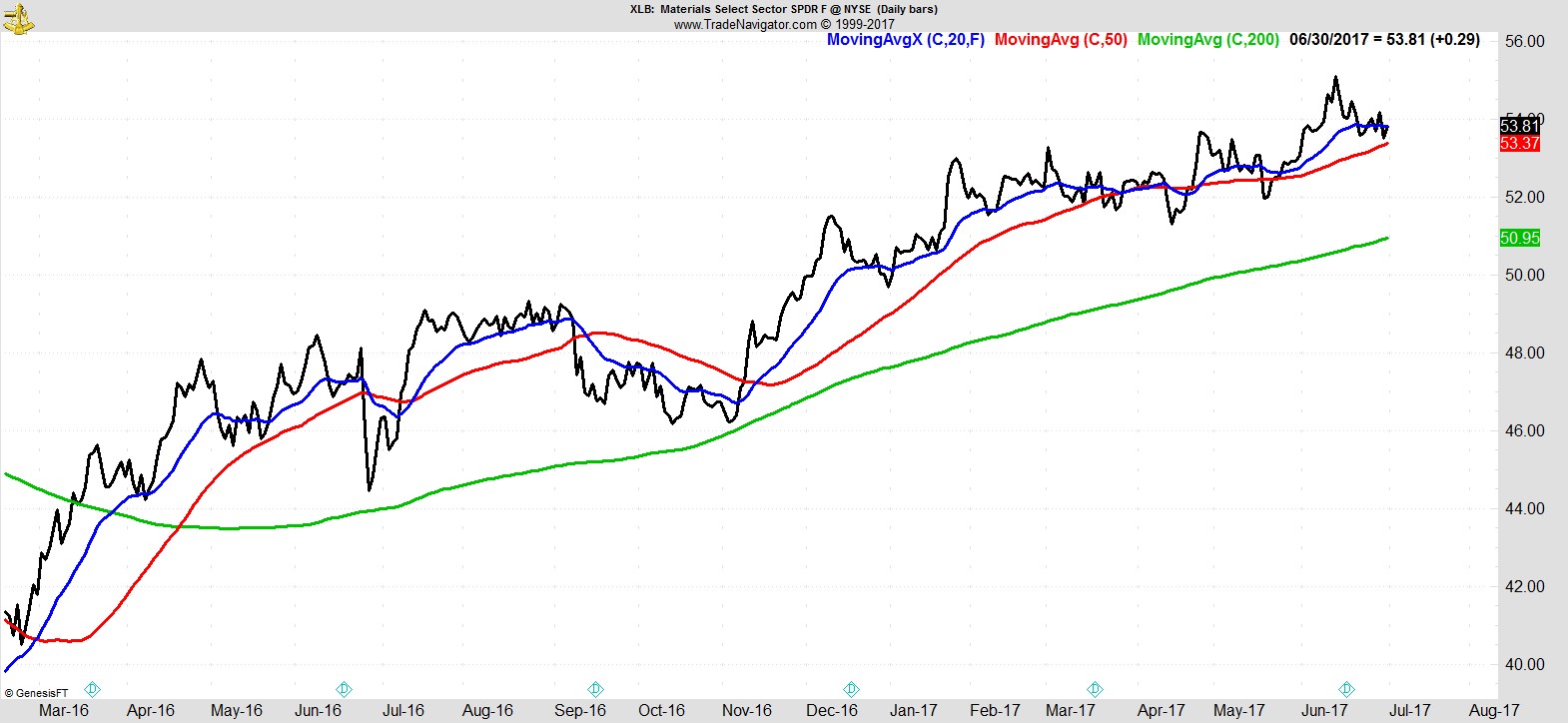

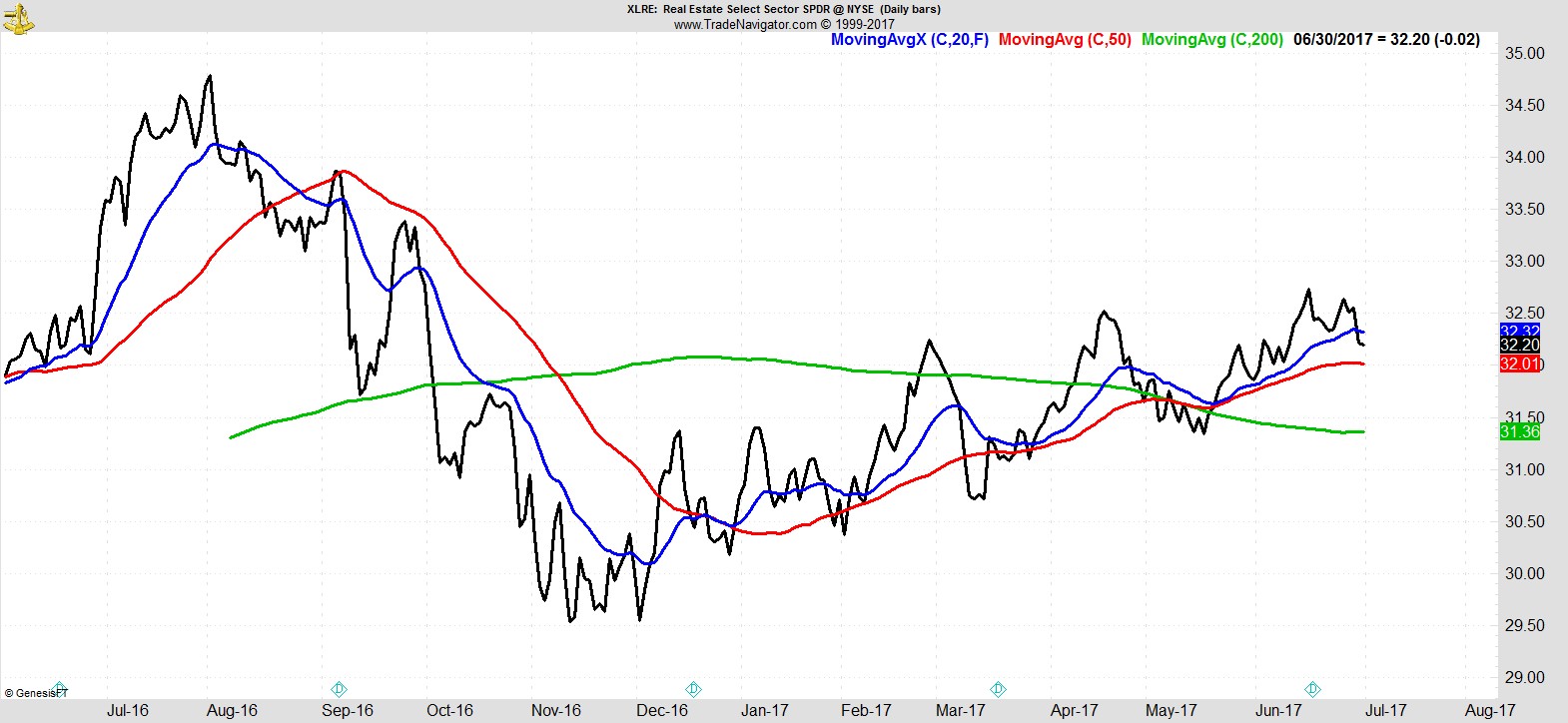

They're followed by Materials, and Real Estate.

.

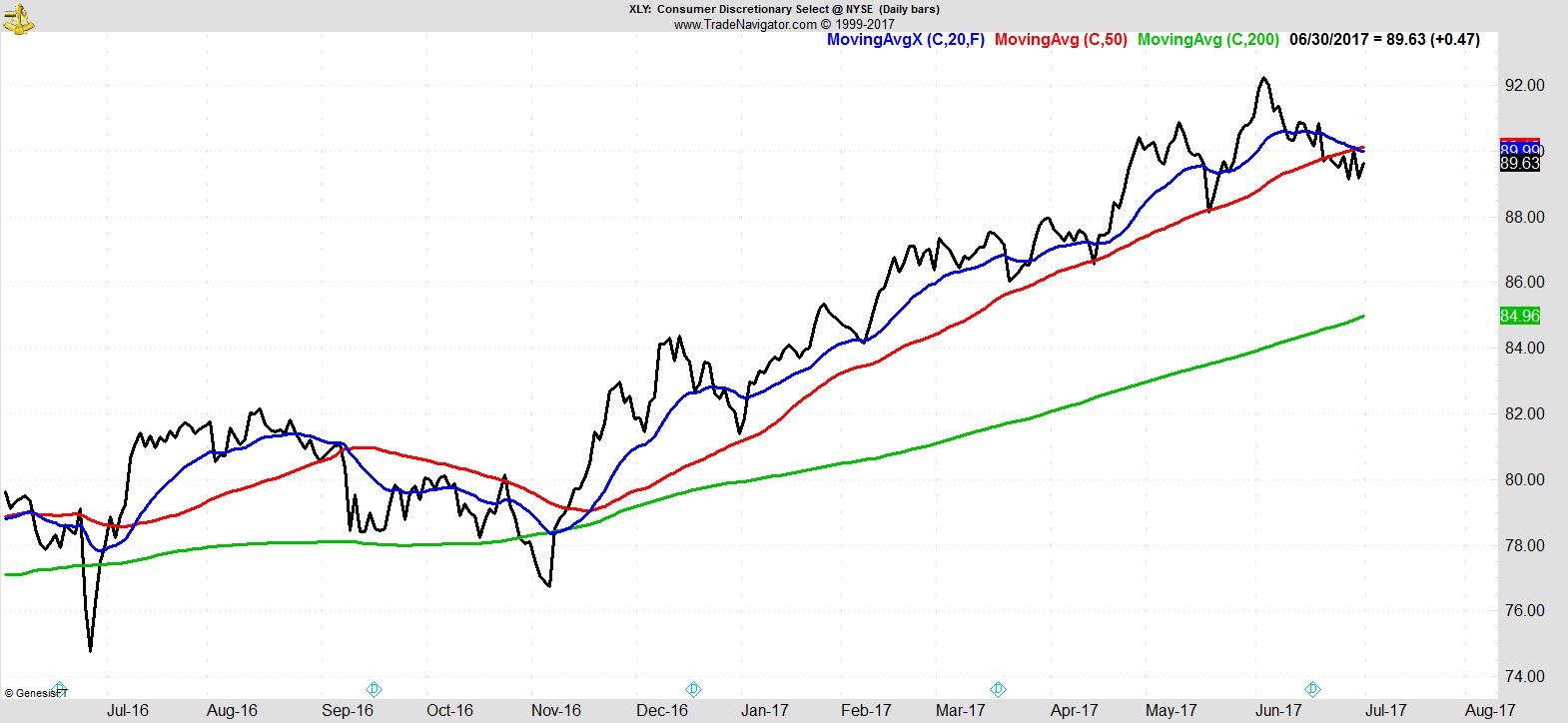

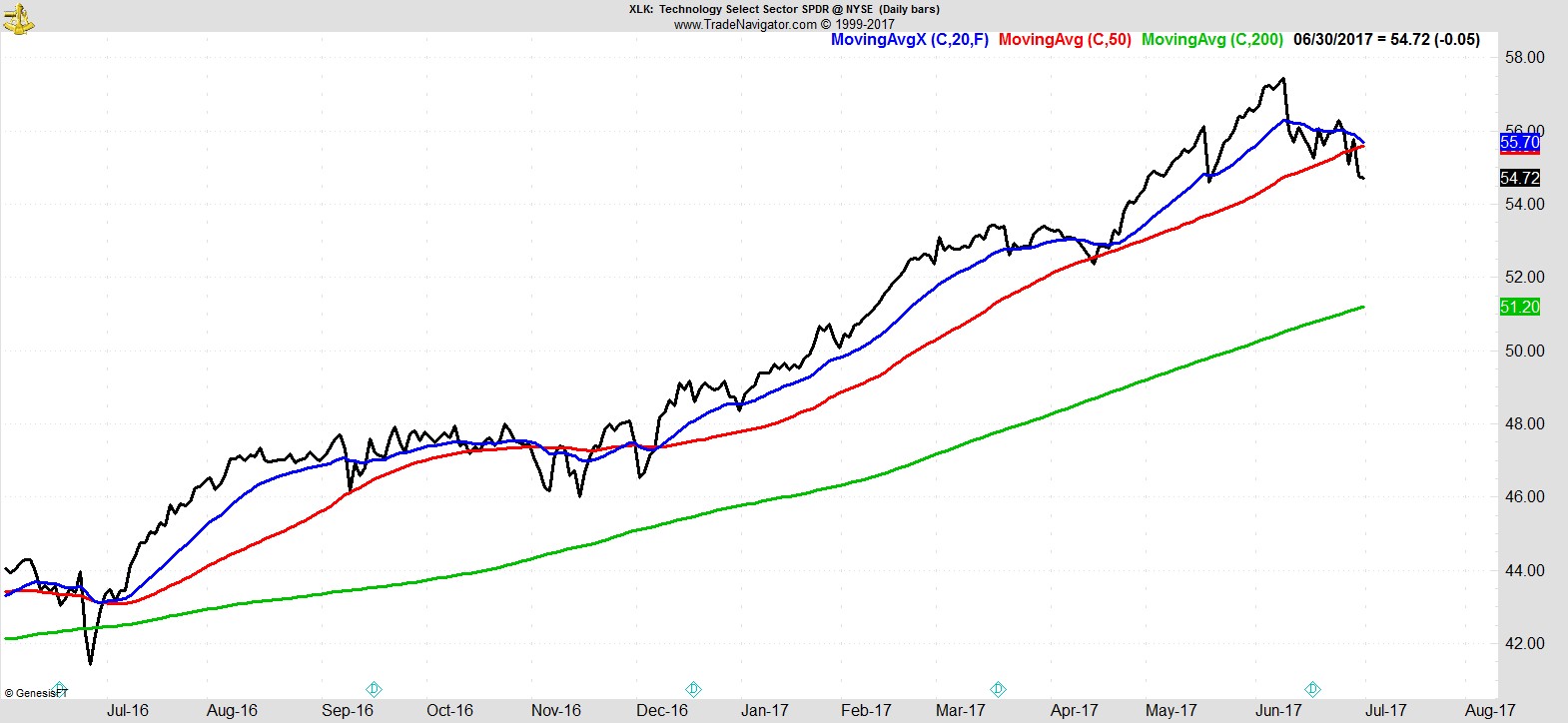

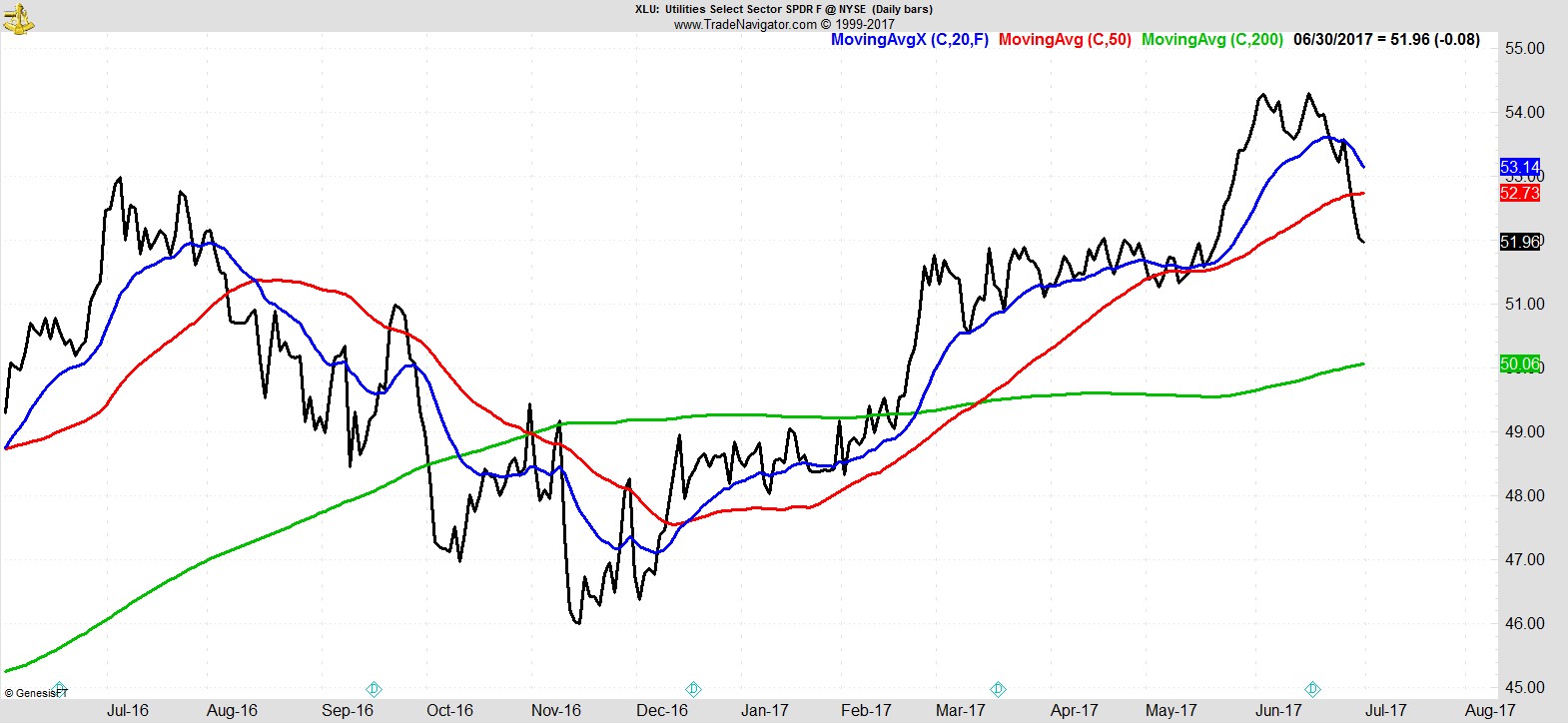

Then comes Consumer Discretionary, Technology, Staples, and Utilities, which have all pulled back below their 50-day MA.

.

Energy remains at the bottom, well below its 200-day MA, but once again showing signs of life.

.

Note, not one sector is at new highs. Some people will paint this as a negative. How do you have breadth that's strong, an index at or near its highs, but no one sector at new highs? Again, it's clear it's the result of sector rotation.

The sectors and names that led the previous advance (technology, consumer discretionary, growth names) are pulling back, while sectors that had lagged them (financials, healthcare, materials) are now recovering strongly.

.

Alpha Capture Portfolio

A rough week for our model portfolio (-2.4% vs -0.6% for the S&P), precisely for the reasons explained above. We've held some strong performers for a while, but one by one they've pulled back to trigger exits, most notably this week CGNX and IRBT, which had been with us since Feb and March respectively.

I've had a similar experience with client portfolios in the last few weeks, which were up as much as +12% YTD net of fees, but are now +6%. When you have these pullbacks and swift changes in performance (in either direction), the key question to ask is if it's within your expected parameters. In those portfolios and this one, the answer is yes. A highly concentrated portfolio will perform very differently to the index, often accentuating the current action, and periods of rotation can be frustrating; giving back gains before you can be sure the trend is over for your timeframe, while the index appears relatively unscathed.

This weekend we have two new entries, which will bring us back up to seven positions, total open risk of 4.5%, and 30% cash.

Although the leading sector is financials, I have to say I am struggling to find anything there I want to take onboard at the moment. There's nothing with the kind of setup and risk/reward I like, so we'll continue to be patient there. I much prefer the signals coming through elsewhere.

.

Watchlist

Healthcare still dominates our watchlist given the strong action recently, but there are some interesting names coming through in technology and consumer-related spaces, perhaps more readily identifiable while the broader sector comes under pressure.

Here's a small sample from the full list:-

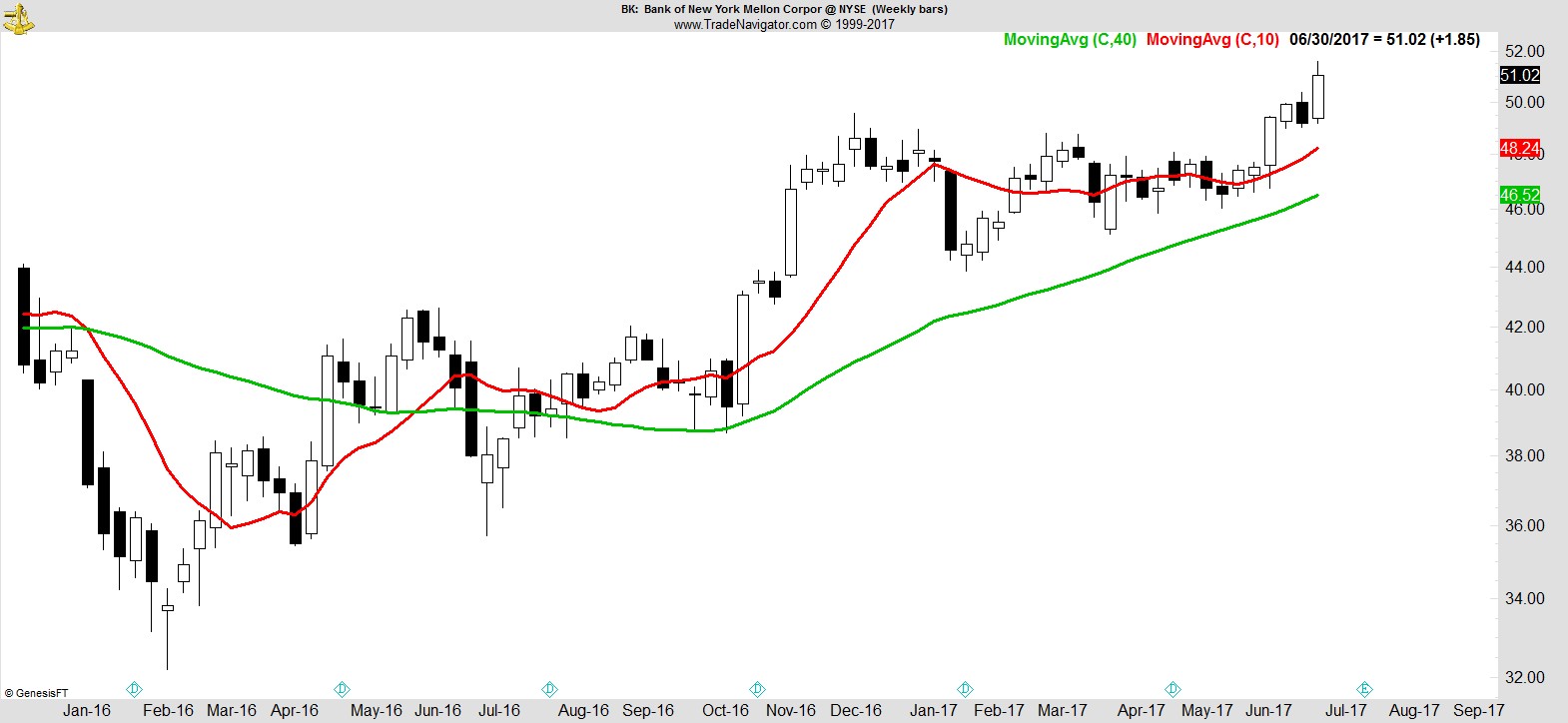

$BK

.

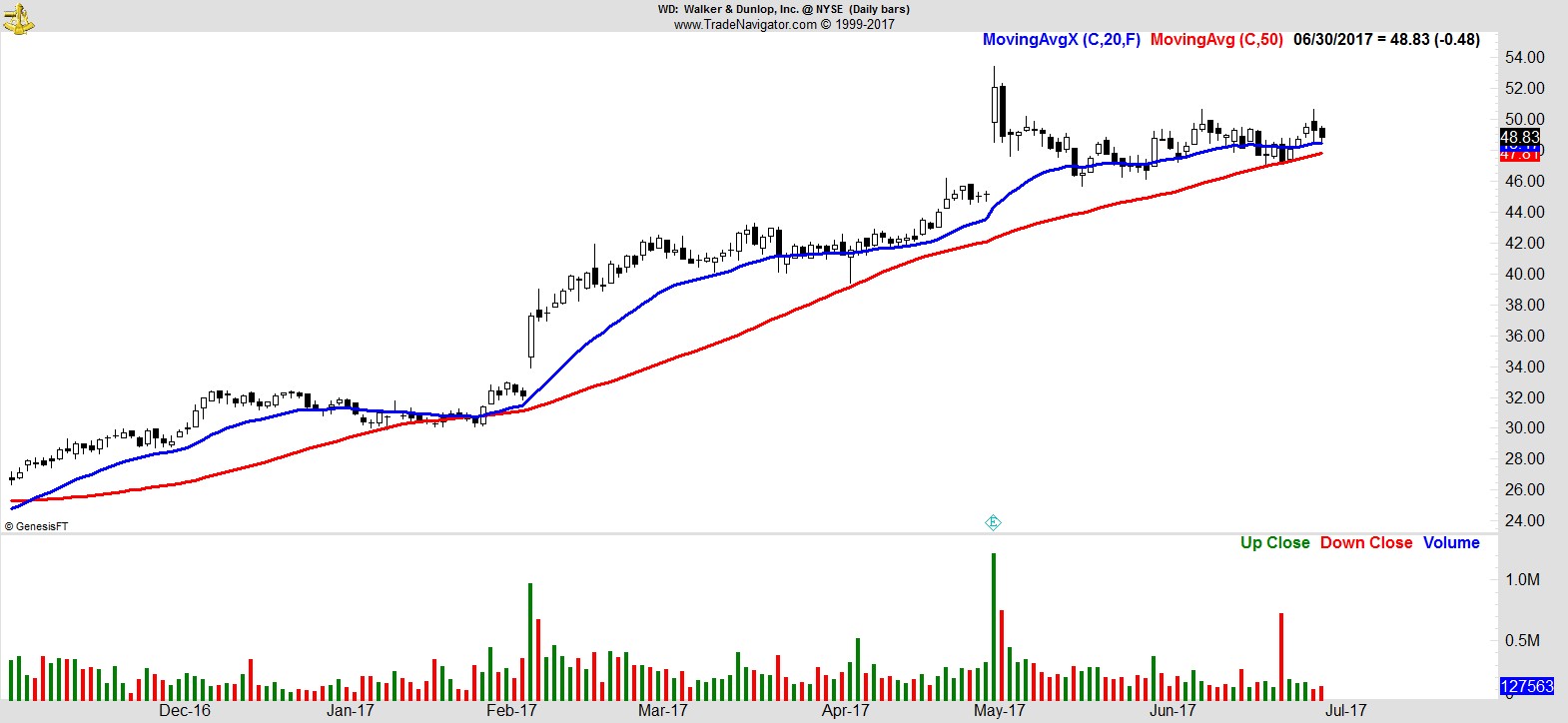

$WD

.

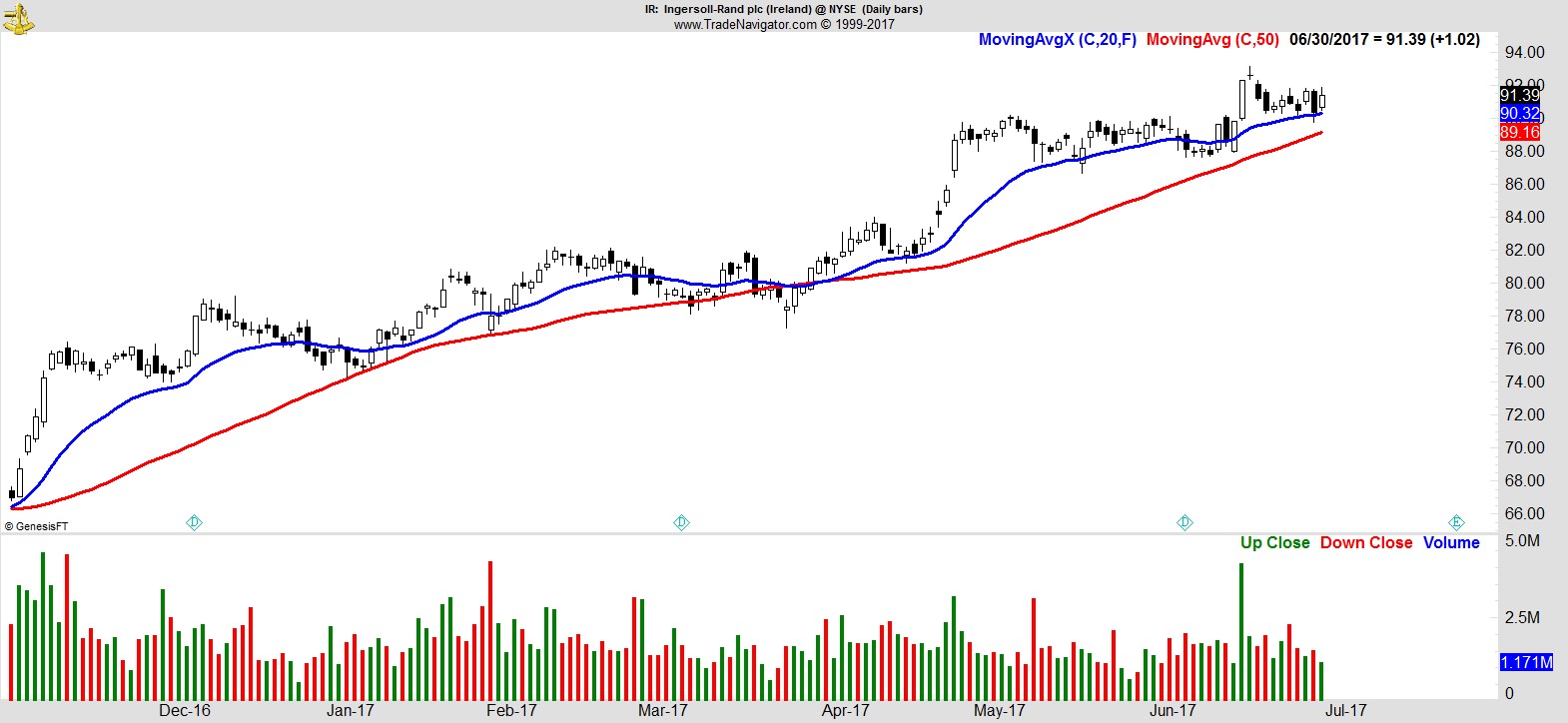

$IR

.

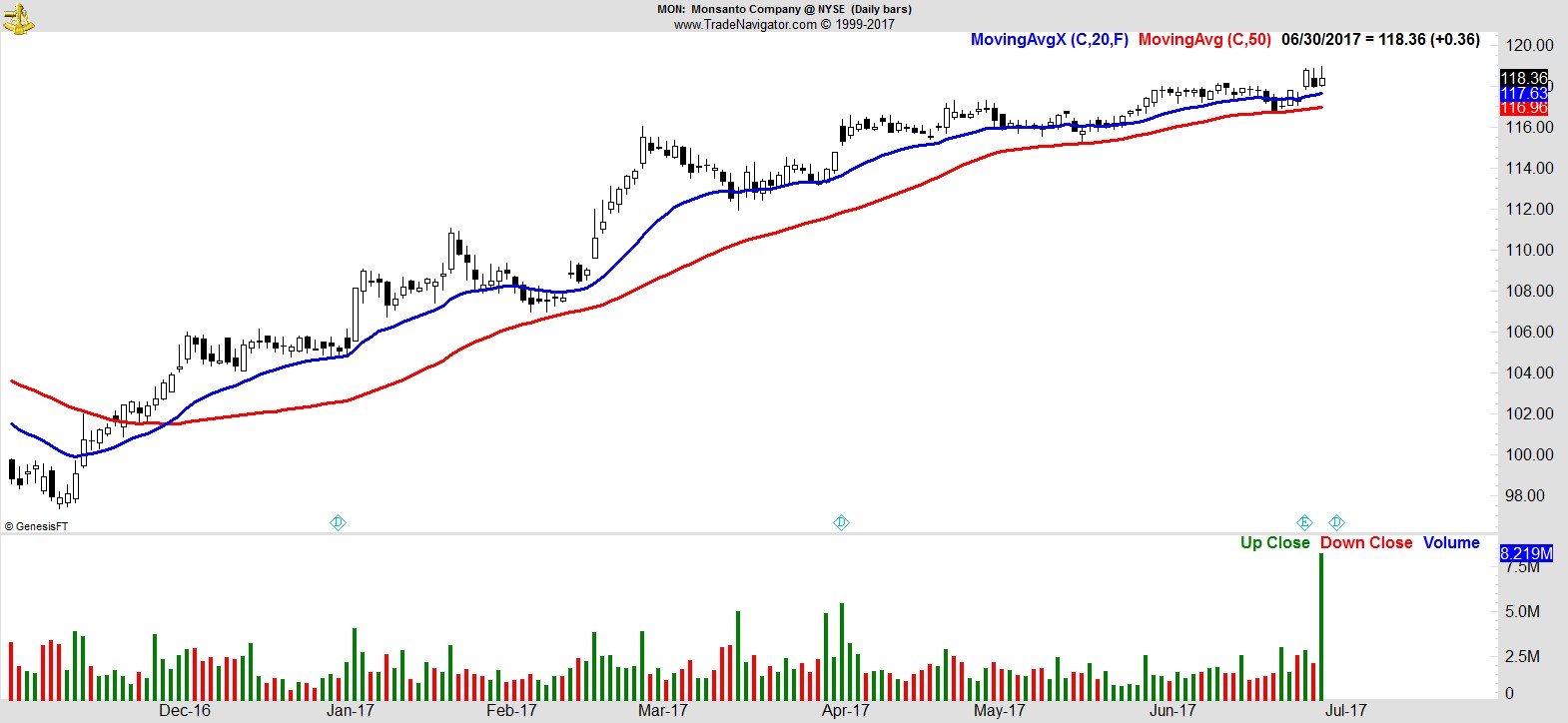

$MON

.

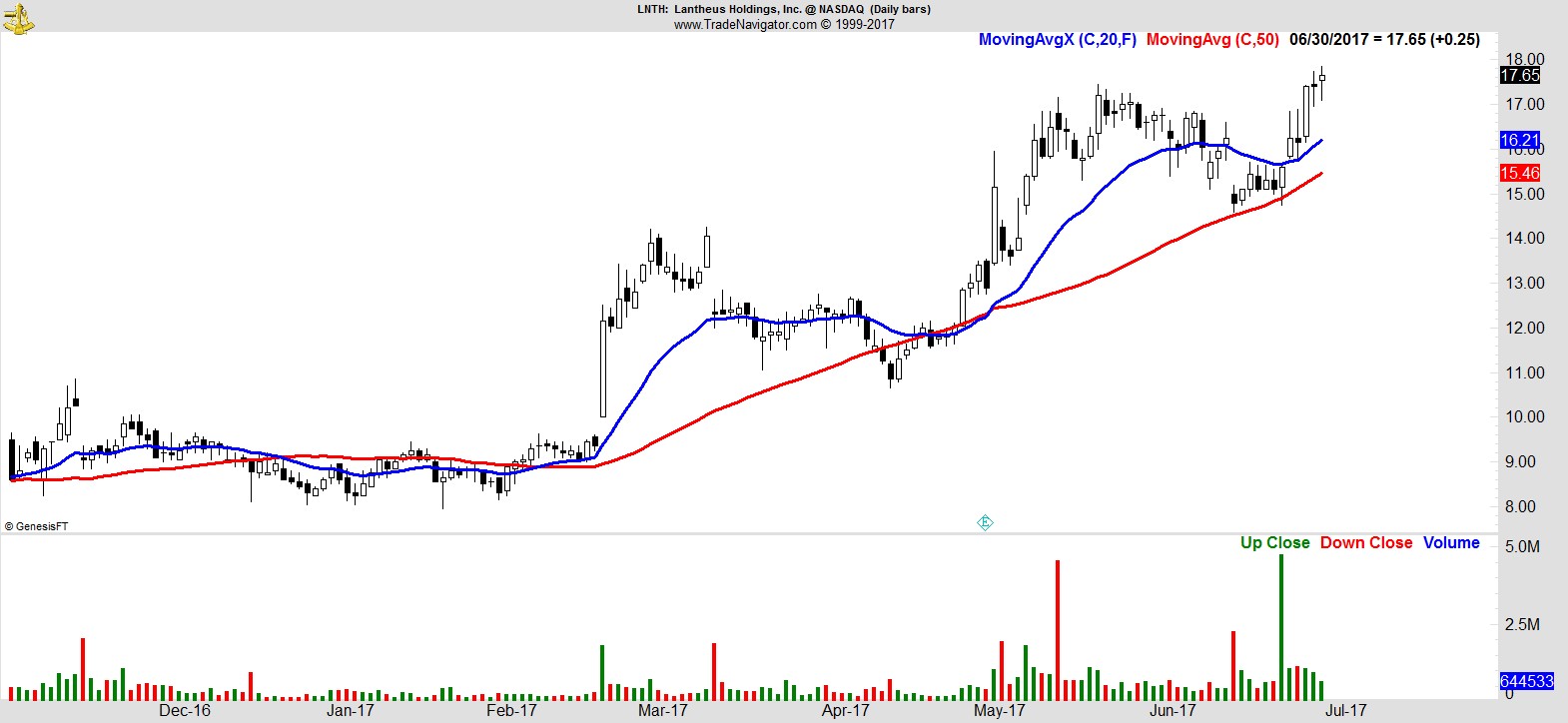

$LNTH

.

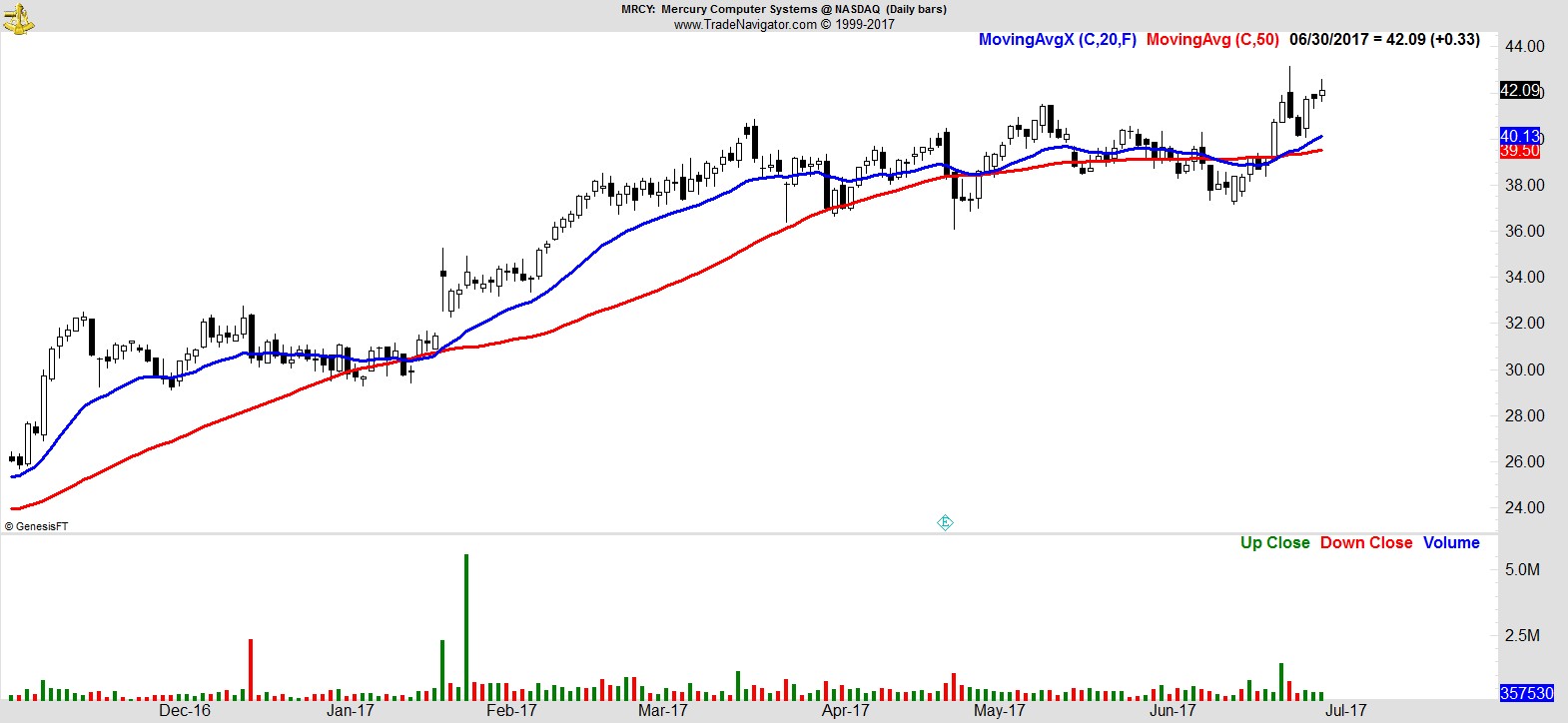

$MRCY

.

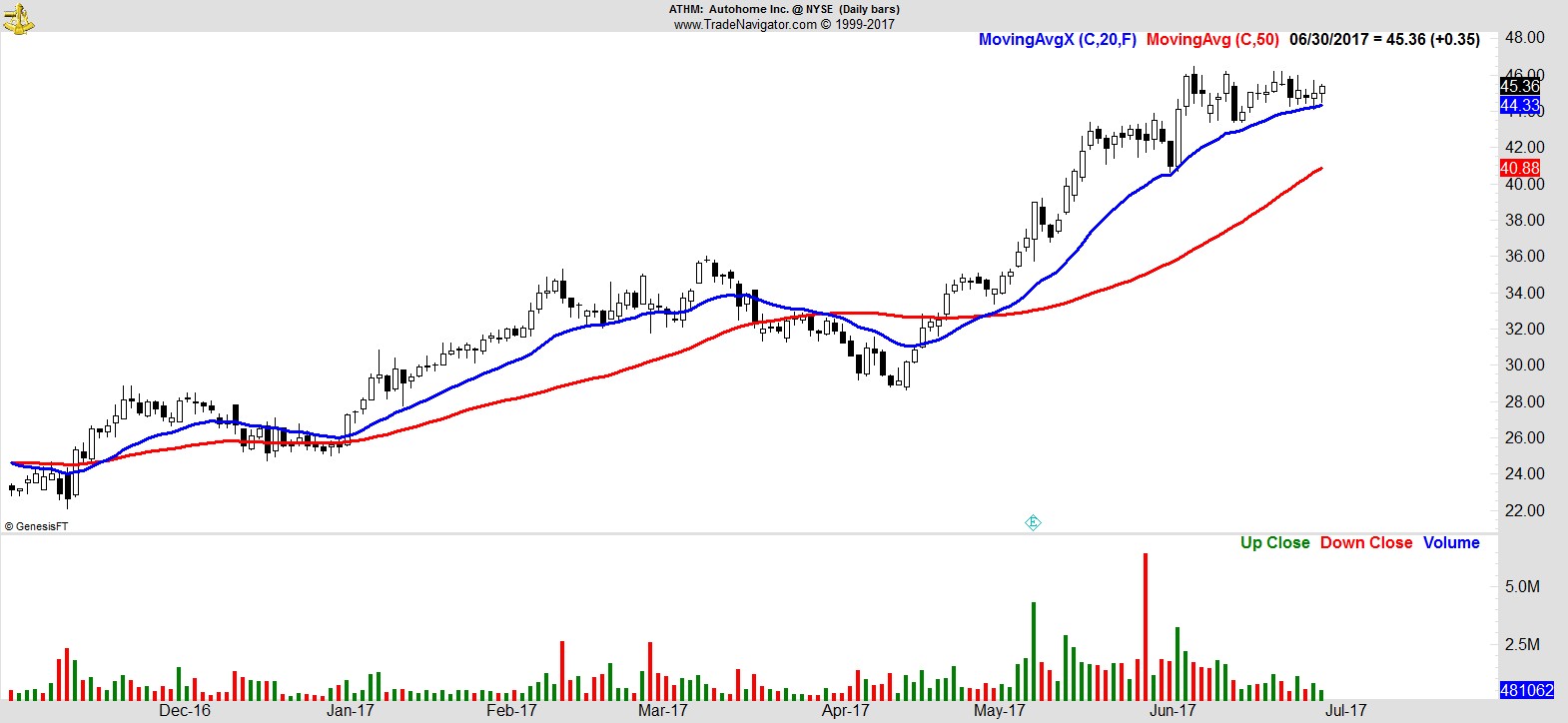

$ATHM

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17