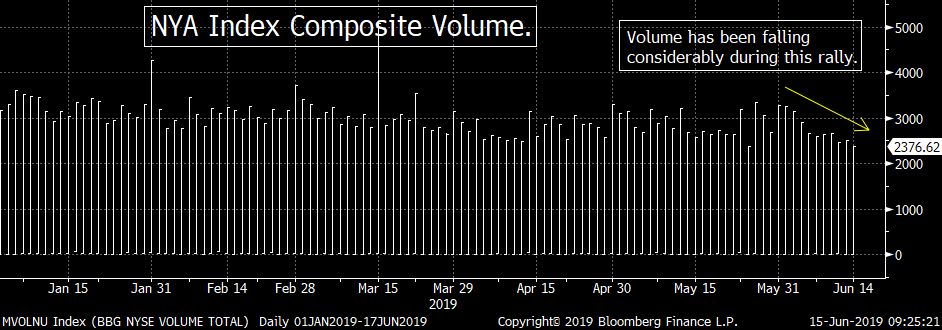

It was a relatively quiet week last week…as the major averages saw their smallest moves since the stock market began to pull-back on May 3rd. This lack of movement also came on the lowest weekly volume of the year (and the lowest weekly volume since the final week of last August). With the Fed meeting this week…and their announcement & press conference on Wednesday…it’s a good bet that things will remain pretty quiet until we hear from them.

Back in 1987, Newsweek Magazine ran a cover article that was titled, “George Bush: ”Fighting the Wimp Factor”…when George HW Bush was running for President. The article described how the then Vice President was considered a wimp in some circles because he just did what he was told to do. It’s funny…because today we’re hearing the same questions about Fed Chairman Powell. Some accuse him of caving into the President’s wishes…while others feel he is captive to institutional investors and will buckle to the pressure to keep the markets elevated under any circumstances.

Of course, it turned out that President George HW Bush was anything but a wimp…and I believe the same will be true for Chairman Powell. That’s not to say he won’t cut rates at some point in 2019, we just don’t believe he’ll buckle under to pressure from President Trump…nor do I think he will cut rates unless or until we get more stress in the markets and see more evidence of economic weakness. If he cuts rates too early, it will be irresponsible in our humble opinion. It will lead investors to believe that the Fed will not even allow small (and normal/healthy) pull-backs in the market to take place. This will (rightfully) lead investors to throw all caution to the wind…which, in turn, will lead to another bubble in risk assets. (BTW, it was great to hear last week that Eugene Ludwig…CEO & Founder of Promontory Financial Group & the former Vice Chairman of Bankers Trust & former Comptroller of the Currency under Clinton…made the same assertion about the impact of a rate cut too early…saying it would create another bubble.)

At a time when there is SO much leverage in the system (especially in the corporate bond market)…I do not think the Fed wants to inflate another bubble…so we do not think they will act “too early”. Of course, we could be dead wrong…and there are some very smart people (whom I respect greatly) who do indeed think that Mr. Powell is a wimp…so we will see how this plays out.

The good news is that we’ll find out very soon whether this is the case or not. If Powell signals that the Fed will let the calendar decide when their next rate cut is coming…and not the data or the markets…then he’ll signal this week that a rate cut is all but certain at the July meeting. If, however, he continues to say that they’ll be data dependent on their first rate cut…we’ll know that he has a little more back bone than some people realize. (I believe…due to the history of the past 10 years…that the Fed will be more “market dependent” than “data dependent”, but they’ll never come out and say that explicitly…so I’ll be listening to what he says about the “data” this week.)…..Either way, we should get some strong clues this week as to whether Mr. Powell is a wimp or not.

One thing is for certain, the fundamental back-drop for the stock market has NOT improved during this recent two-week bounce in the market. The economic data, in general, has been weaker-than-expected…and the consensus earnings estimates for the S&P 500 have come down in several spots around Wall Street. Therefore, the bounce in the market was fueled by an oversold condition two weeks ago…and the expectations about the Fed’s actions. That oversold condition has been worked of…so if we do not get the kind of overly-dovish rhetoric from the Fed this week that the stock mark has priced-in, I would expect the market to see another leg lower. In fact, I would expect it to see lower-lows than we saw on the first day of trading in June.

So the battle lines for the S&P 500 Index are well drawn. If the Fed “wimps-out”…and the stock market rallies strongly…the “double-top” high of 2940 on the S&P 500 will be the key level to watch. That is obviously VERY important resistance…and thus any meaningful break above that level will be very bullish for the stock market. However, if the market rolls-over…and breaks below its lows from March 8th and June 3th (of 2720), it should lead to another material decline……….Therefore, even if the first few days of this week remain quiet, things could (and even should) become a lot more active before long!!!

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22