THE WEEKLY TOP 10

Table of Contents:

1) By far the most best item on the bullish side of the ledger? “Don’t fight the Fed.”

1a) If things turn down again, don’t blame the Fed.

2) So far, the stock market is still following the regular bear market pattern.

3) Is Sweden a good guide? We doubt it…with the (likely) future employment picture.

4) If the market DOES rally further, the wealth gap will widen…and civil unrest will grow.

5) The stock market might not bottom a long time before the economy does this time.

6) There’s always a second shoe to drop in a bear market that includes a recession.

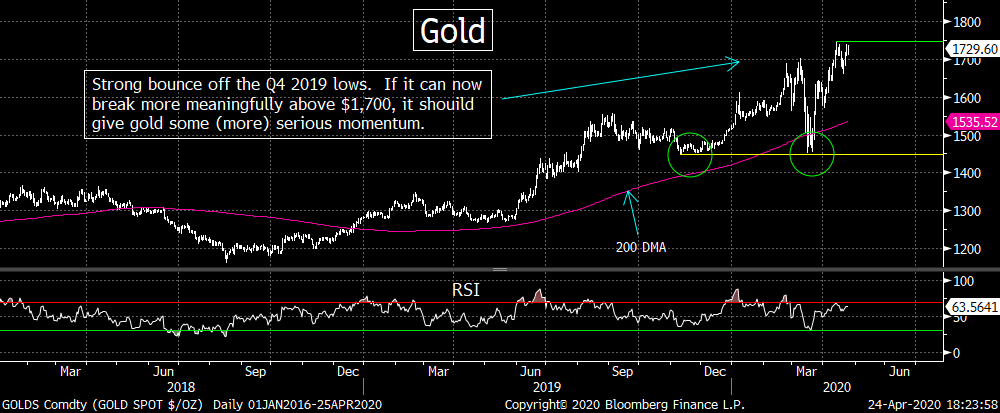

7) Any upside follow-through in gold is going to be very bullish on a technical basis.

8) Heard enough about negative oil prices? Us too…so lets look at CVX and NBL.

9) Alphabet (GOOGL) is at a KEY technical juncture.

10) Summary of our current stance.

Short Version:

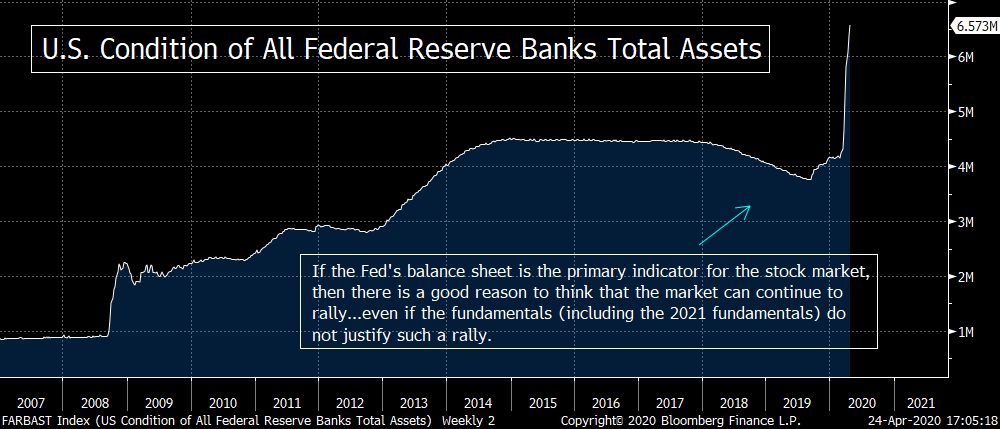

1) Let’s start on the bullish side of the ledger this weekend. First and foremost, “Don’t fight the Fed.” The Fed’s record of helping the market rally with their stimulus packages over the past 12 years is well known. Also, the short positions on the SPY are at 5-year highs, so another short squeeze is possible……..A move above the Fibonacci 61.8% retracement of the decline in the S&P 500 (at 2950) will make us rethink our current cautious stance.

1a) If, for some reason, the stock market rolls back over, investors won’t be able to blame the Fed and say that they didn’t react quickly and extensively to this healthcare crisis. However, sometimes the forces at work are just too powerful to overcome…no matter what you do or how hard you try. (The American League Championship Series of 2004 is an excellent example of this.) 😊

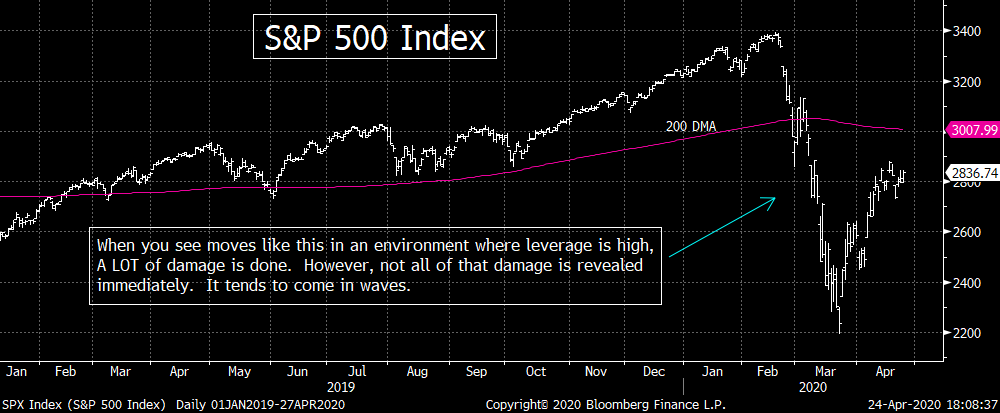

2) As much as the stock market has rallied since the March lows, it has done nothing more than it almost always done in a bear market so far. The problem is that if it continues to follow the general outline of a bear market, the next move is going to be down (in a meaningful way). Yes, the Fed has provided massive levels of stimulus, but another big part of the great bull market was company buybacks…and they’re getting cut in half.

3) When one looks at what has taken place in Sweden…and if one agrees that they’ve reached a solid level of “herd immunity”… there is a reason to think that the U.S. economy can bounce back quickly & strongly. HOWEVER, looking employment picture…and what that will mean for the U.S. consumer…we’re less optimistic. If one is depending on improving fundamentals to drive the market higher, the real question is whether the inevitable bounce-back in growth will be strong enough to justify a furtherrally in the stock market.

4) If the Fed’s liquidity programs DO work to help the stock market rally a lot further, it’s only going to widen the “wealth gap” in a material way. Civil unrest is going to rise a lot more than even the more hawkish people think if the Fed is artificially fueling a strong stock market rally…at a time that the unemployment rises well above its early 2020 levels (even after it drops significantly from its 2020 Q2 levels).

5) Markets always bottom well before the economy does. However, part of the reason for this is because the stock market always falls a lot sooner and faster than the economy does in a bear market recession. In this one, they BOTH fell very, very quickly. Therefore, even though the low in economic growth will almost certainly come this spring, there’s no guarantee that the market will bottom well before the economy doe this time around. This is especially true given the future employment picture…and the health concerns that will linger.

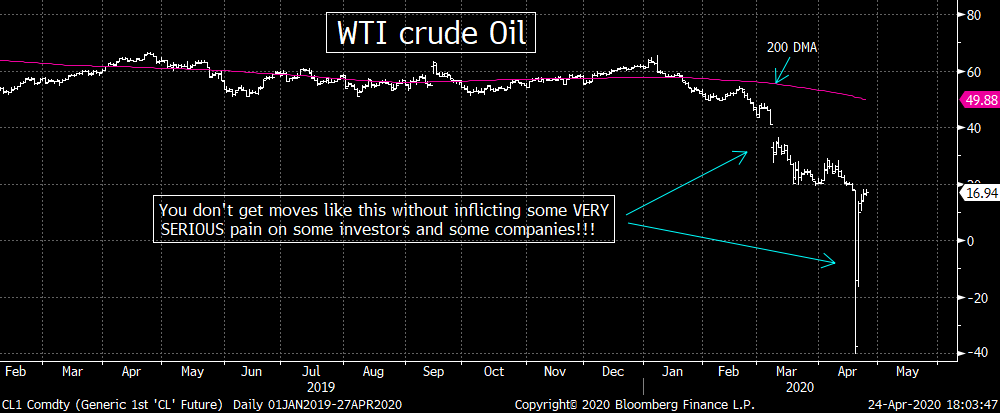

6) Probably the most important reason that we believe the stock market will see at least one more deep sell-off…and probably a retest (or even an undercut) of the March lows…is because whenever the stock market sees a MAJOR decline (especially when it comes in several different markets)…we always have a second shoe to drop from investors and the economy after the initial sell-off.

7) Gold stands at a very important resistance level…and any upside follow-through should give it another significant leg higher. In fact, a move above $1,750 should give it the momentum it needs to test its 2011 all time highs of $1,900 before long. Maybe the best part of gold’s recent action was its ability to hold its November lows when it became a source of cash in Q1, so if that “double-bottom” low can be followed by a more significant “higher-high,” it’s going to be bullish for the yellow metal.

8) Instead of rehashing what you’ve already heard a zillion times about what took place in the oil markets last week, we thought that we’d highlight two stocks in the energy sector that look poised to rally further on a technical basis. The two stocks are CVX and NBL. Of course, given the supply situation for crude, any long positions in either stock should have VERY tight stops to go along with it.

9) We’d like to highlight the chart of another FAANG stock this week. Last week it was AAPL, this week it is GOOGL. It’s actually sitting a a critical technical juncture. The $1,275 level is that level we’re watching…and whichever way it breaks from that level over the coming days and weeks should be very important for how the stock acts over the next several months.

10) Summary of our current stance…..We understand why people have become much more bullish after the stock market has rallied so strongly. It’s human nature. The problem is that when we experience a bear market (one that includes a recession), the first decline is never the only decline (like it is in a deep correction). The damage in the first decline exposes too many naked swimmers…and thus we get a series of “waves” that take the market lower…..Yes, it could be different this time given how massive the programs from the Fed and the government have been. Therefore, we do have a couple of indicators that we’re watching which, if set-off, will lead us to become more constructive on the markets. However, it’s rarely “different this time,” so we believe investors should not chase the market…or even their favorite stocks…up at these levels.

Long Version:

1) Let’s start on the bullish side of the ledger this weekend. The number one reason for anybody to be bullish right now…and thus be looking for further gains after the recent 28% rally in the stock market…has to be the stimulus being provided by the Fed and our government. As we will discuss in later points, we believe that neither the economy nor earnings are going to bounce-back to the levels they experienced in 2019 and into early 2020. Since the stock market was already overvalued at this year’s highs, it is hard to think that any thing on the fundamental side of the ledger will justify a move back towards the all-time highs.

There is absolutely nothing wrong with believing the stimulus being provided by the Fed and the government will help asset prices rally further than they already have…given that these kinds of programs have helped the markets rally in the past. The QE (and other programs) from the Fed over the past 12 years were critical for helping the markets rally in a period where both economic & earnings growth were quite mediocre (low single digits.) Similarly, the Trump tax cuts and other stimulus programs helped the markets rally as well. Therefore, it makes sense that many people would expect the massive stimulus that is being provided right now will help markets rally in the face of a dire present fundamental picture…and the mediocre future fundamental picture.

For many years, all anyone had to say was, “Don’t fight the Fed”…so maybe that’s all we have to say right now. Also, as we learned at the beginning of the week last week, the short positions on the SPY S&P 500 ETF have now moved to five year highs. If we breakout of the recent sideways range we’ve been in for the past two weeks to the upside, it could cause another short squeeze and exacerbate any rally…..Therefore, maybe we should be much more bullish than we are right now. With that in mind, we’d like to state that a move above 2950 (the Fibonacci 61.8% retracement of the Q1 decline) will lead us to at least consider changing the bearish stance we’re employing right now.

1a) As you will see, we’re not so as sure that the Fed is as omnipotent as many people think they are…and that they can force asset prices higher at will. Let’s face it, they couldn’t do it during the financial crisis until the “mark to market” rule was suspended in March of 2009.

Either way, if (repeat, IF) the stock market rolls back over and retests or undercuts its March lows, it will be very difficult for any critics of the Federal Reserve to blame them for the decline. No matter how bad things get, they would have been much, much worse if the Fed had not been SO swift and SO extensive with their stimulus. Yes, some people will say that their previous policies created a poor foundation for this crisis…and thus they should bare some of the blame…but they won’t be able to fault them at all for their actions so far in 2020.

What we’re saying is that if the stock market sees another deep decline, it will come despite what the Fed has done…not because of what they did (or because they didn’t do enough). Sometimes the forces at work are just too powerful to overcome…no matter what you do or how hard you try. (The American League Championship Series of 2004 is an excellent example of this. The NY Yankees were a very good team that year, but they just couldn’t stand up to the power of the Boston Red Sox!!! The outcome was inevitable…no matter what the Yankees tried to do!!! 😊)

2) We are certainly not ready to consider changing our cautious stance just yet…especially given that the stock market has done nothing more than it always does in a bear market. It ALWAYS sees a very strong rally early in the bear market…one that fools investors into believing that the worst is behind them…only to roll back over and burn investors quite badly in later months. In fact, the S&P has merely done EXACTLY what it did in the middle of the last two bear markets: It rallied strongly and then retraced 50% of the initial decline. Therefore, anybody who is tries to claim that the recent bounce in the stock market is a reason to believe that the bear market is over…or that the stock market is looking past the economic slow-down…are WAY off base in our opinion. It’s WAY, WAY too early to make that claim….because what we’ve seen so far in the stock market is nothing more than what is usually does just before it rolls-back over again in a powerful way during a bear market.

Don’t get us wrong, as we hinted above, there is NO QUESTION that Fed’s efforts have stabilized the credit markets (and, in turn, the stock market). Thequestion now is whether these programs will be enough to keep the markets rallying FURTHER going forward.

As we will discuss in the next point, we question if the fundamental backdrop will justify a further rally in stocks. However, we also have to remember that it wasn’t just the Fed’s stimulus that helped the stock market rally over the past 10-12 years. Company buybacks were also a HUGE source of demand in the supply/demand equation since the financial crisis. Between 2009 and the end of 2019, U.S. corporations bought back about $5 trillion dollar of stocks. According to several estimates, these buybacks will be cut by at least half going forward! So this is another reason to think that the stock market is going to have a tough time rallying much further from current levels even though the Fed has done what they needed to do to keep the markets open and trading.

3) As we mentioned in point #1, the number one item in bullish side of the bull/bear debate is stimulus. However, some people are arguing that the economy will be able to bounce-back in a substantial way…and thus they believe there are fundamental reasons to think that the S&P can rally back towards its all time highs by the end of the year or in the first half of 2021.

This is certainly not out of the question. When people look at what has taken place in Sweden, there is a reason for optimism. Instead of going into a total lock-down, the Swedes encouraged social distancing….but kept restaurants, bars, stores and schools open…(and still protected those people who were most susceptible to becoming severely ill or dying from the virus in a more forceful manner). The leadership of Sweden says that they are showing signs that they’ve reached a high level of “herd immunity”…and that they are benefiting greatly from this strategy.

We’re sure the debate about Sweden’s strategy will go-on for some time…and thus we won’t be able to draw any definitive conclusions about this issue for a while. However, if the U.S. can move out of the lock-down quickly…and people go back to doing what they were doing to the same degree they did in 2019 and early this year…the fundamental picture could improve very quickly. Therefore, the stimulus that is being provided right now…to bridge the gap…could indeed be all we need to solve this crisis.

Thus, if there are signs that the situation will quickly move to what we’re seeing in Sweden right now, we’ll have to change our stance. However, we just don’t see a path to that scenario right now.

HOWEVER, we are not as confident as many others are that the U.S. economy can or will bounce-back to the degree we just highlighted. Yes, the economy WILL bounce-back…and it WILL bounce-back VERY strongly. However, the REAL QUESTION on the fundamental side of things is NOT whether it will bounce-back strongly…but whether it will bounce-back STRONGLY ENOUGH to justify a further rally in the stock market from its current level (and its current valuation).

Just look at the employment picture. We’ve spent many, many quarters at “full employment.” Now, even though we’ll certainly see a substantial drop in the unemployment rate from whatever heights it reaches this spring, the consensus is still looking for a rate of 8%-10% as we move into 2021! Given how important the employment picture is for the consumer…and how important the consumer is to the U.S. economy…it’s hard to think that we’ll return to the same kind of growth rate that helped fuel the S&P 500 to rally towards 3400 earlier this year. It’s difficult to see how we can get there with an unemployment rate that is substantially higher than it was the last time we reached that level in the stock market.

4) We want to take a minute to look at the Fed’s liquidity programs from a different angle. We’d like to look at it from the issue of “income inequality” or “wealth inequality.” Needless to say, this has become a focal issue in the U.S. and around the world in recent years…and for good reason. However, if we are wrong about the Fed…and they do indeed want to push asset prices higher again (and if they can indeed succeed in pushing them considerably higher), it’s going to take the gap between the haves and have-nots even to a much wider level…MUCH wider.

Think about it, even the most bullish estimates for the unemployment rate in early 2021 is in the high single digits (8%-10%). In other words, even though that rate should come down considerably from whatever level it reaches this spring, it’s still going to be A LOT higher than it was as we moved into 2020 (and a lot higher than it has been in many years)!

When the unemployment rate rises significantly, the stock market usually goes down in a meaningful way. So not only do low and middle class people lose their income, but rich people lose money as well. If the Fed’s programs save companies that should have failed…and push stock prices a lot higher to further enrich those at the top of the economic ladder…at the same time that working people are losing their incomes…that gap is going to grow exponentially.

In the aftermath of the financial crisis, the unemployment rate topped out in 2010…and it fell steadily over the next 10 years. So even though the wealth gap became more pronounced over the past decade…and even though the dialogue on this issue has grown substantially…there really hasn’t been much push-back because people still had jobs. As the gap widens further…at a time when people are losing their jobs (and unable to find new ones)…the push-back is going to grow in a powerful way. In other words, the odds are VERY high that civil unrest in this country will grow significantly going forward.

This might not mean anything for the markets over near-term…or even the intermediate-term. However, at some point it’s going to have an impact on elections. When elections change the make-up of Congress (and maybe the White House), it will definitely have an impact on tax rates and regulation…and THAT will have an impact on the markets eventually………..…..Just something to keep in mind going forward.

5) Again, as we said earlier, maybe the consumer WILL make a very strong come-back…even though (as we said in the second part of that previous point) the employment picture is going continue to be rough. However, we believe it’s important to look at the current situation in another way. If you do, it will give you another reason to doubt whether the stock market can bounce significantly from its current level.

One thing we keep hearing from many pundits is that the stock market always bottoms well before the economy…and that the rally off the bottom is a strong and sustainable one. Well, when looking at past recessions, this is absolutely true. HOWEVER, this recession…and the stock market’s reaction to it…is MUCH different than any of those of the past 100 years.

Most recessions do not experience their lowest levels of growth until the recession has been in existence for quite a while. Managers don’t close factories or stores…or layoff workers…at the very first sign of weakness. Therefore, there tends to be a slow grind lower before the worst levels of economic growth are finally reached in most recessions. (The term “slow grind” is probably not the best one to use. The slow-down in growth certainly takes place much faster during a recession than the rise in growth during an expansion. What we’re saying is that the slow-down in growth during a recession usually takes many, many months…and sometimes more than a year…before it hits bottom.)

This time around, the closings and layoffs took place IMMEDIATELY, so there was no “slow grind” to the lows for growth. The lows in growth are going to take place within 1-2 months of the start of the recession! This is much, much different than the past. Of course, just because the lows in growth will come almost immediately this time does not mean the bounce-back in growth will be more gradual than usual.

However, there is still a reason to think that the bounce-back in growth WILL be quite slow. The employment picture we highlighted above in is one of them. No matter what people WANT to do, if they’re out of a job, they’re not going to consume as much (in our consumer driven economy) as they have in the past…..Also, we wonder how quickly people will want to spend even if they have a job. The desire to build a bigger “rainy day fund” will be strong. Finally, we have to wonder how confident people will be to go back to their old habits due to the lingering healthcare concerns…and the concerns about a second wave of the virus at some point in the future.

In other words, people keep saying that what we’re going through now is nothing like anything we’ve gone through before, but they’re still assuming that we’ll emerge from this bear market and recession in the same fashion…and at the same speed…that we have coming out of previous recessions (when the lowest levels of growth come after a longer period of time).

Yes, the stock market always bottom before the economy does, but that’s because it always take a fairly long time for the economy to bottom during a recession. People can sell stocks (or are “forced” to sell stocks) a lot quicker than corporate managers (or small business owners) close stores, idle factories and layoff people…and that’s how things always played-out in previous recessions. THIS TIME AROUND, these managers/owners DID close stores, restaurants & factories…and DID layoff people…at almost the exact same time and with the almost the exact same speed that investors sold stocks!!!!!.......Since we believe that the economy will be quite slow to regain anything resembling what it was experiencing a few short months ago, we believe using some of the old rules about how far in advance the market bottoms…in front of the bottom for economic growth…will be a mistake this time around.

6) Probably the most important reason that we believe the stock market will see at least one more deep sell-off…and probably a retest (or even an undercut) of the March lows is because whenever the stock market sees a MAJOR decline (like the one it saw in February and March)…and especially when several markets see a MAJOR decline…we always have a second shoe to drop from both investors and the economy after the initial sell-off.

This is what makes a bear market much different than a deep correction. A deep correction only forces the most excessively leveraged investors to liquidate some of their holdings. In a bear market, the drop is bigger…and therefore it hurts all leveraged investors (and even many with little or no leverage). On top of this, it also hurts highly leveraged companies. Today, with corporate leverage at all time highs, it had already made many of these highly leveraged companies even more vulnerable than in previous bear markets. (It’s also why some people are saying this healthcare crisis will be the catalyst that bursts the debt bubble that has built up since the financial crisis.)

Anyway, when you get a major decline in the stock market…in the area of 25% or more (instead of the 15%-20% you see in a deep correction)…the problems come in several “waves.” The initial wave is when the highly leverage investors are forced to sell assets to meet margin calls. However, the second (and sometimes 3rd or 4th) wave comes a bit later. It always comes after a sharp bounce. (The sharp bounce always takes place because an air pocket is formed the “forced selling” in the initial decline. Once that initial round of “forced selling” ends…and there’s nobody left to sell…the market sees a huge rally.)…….That rally continues for a bit longer…as investors come to believe that the worst is behind them. THEN, we get the second wave. It comes when certain investors can no longer hide their losses…and when highly leveraged companies have to come forward and admit that they can no longer stay afloat. This usually comes several weeks after the “first low” in the stock market…and sometimes a few months later.

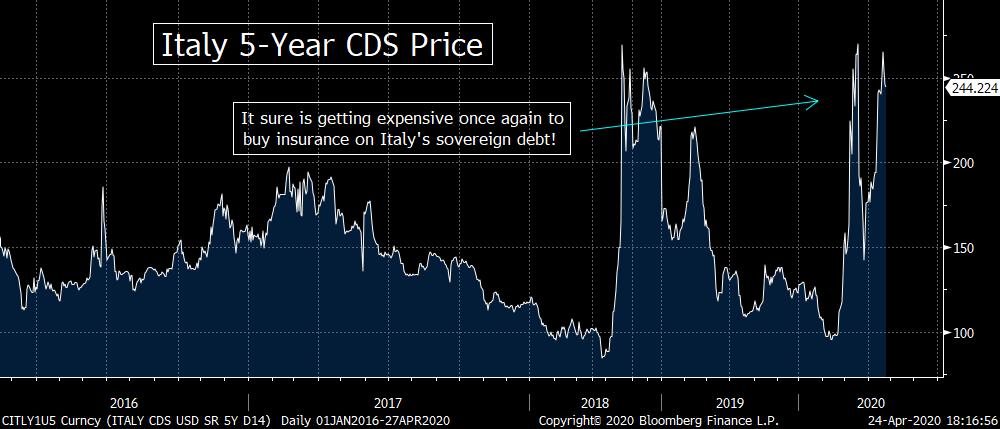

This scenario becomes even more compelling in times like these…when many different markets see major declines (as we mentioned above). Of course, some of the declines feed on one another, but either way, the fact that so many massive losses are created in so many different markets…it doesn’t take long for the chicken to come home to roost after that initial blood bath………Given the massive declines in the stock market, the oil market, the high yield market, the Brazilian markets, the repo market (last fall), the Italian credit markets, etc., it’s not much of a stretch to think that there are a lot of investors…and a decent amount of corporate executives…now know that it’s only a matter of time before the jig is up.

(BTW, have you heard any plausible explanation as to what happened in the repo market last fall? In fact, how you even heard anything except an incredibly vague description of what really happened…and why the Fed had to come to the rescue?.....That one falls into the category of “Things that make you go, hmmmmm.”)

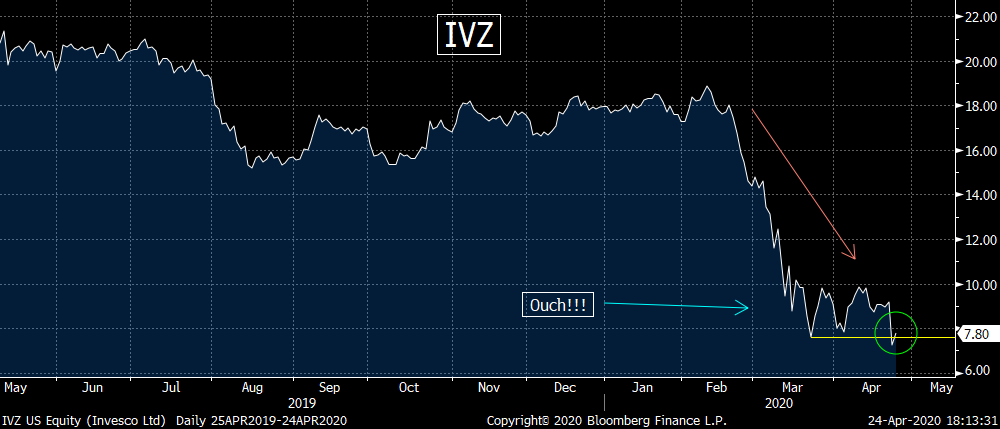

We’re already starting to see the effects of what we’re talking about…with hedge fund managers asking for bailouts…certain funds (even some mutual funds) restricting or even forbidding redemptions…and one money manager slashing its dividend in half. As we move into the month of May (and we all know the old saying about May), we strongly believe that the trickle of news releases like the ones we just mentioned will become something of a flood.

Again, bear markets (at least ones that also involve a recession) are much different than deep corrections. The deep corrections are not strong enough to expose a lot of people who have been swimming naked. (They only expose the most highly leveraged players.) However, bear markets…which see much bigger declines…expose a lot more leveraged players (and expose some illegal activity as well). However, this “exposure” comes in waves…and thus the selling comes in waves as well. Therefore, we believe that at least one more wave of selling is all but inevitable. The Fed cannot save EVERYBODY.

7) Gold stands at a very important resistance level…and any upside follow-through should give it another significant leg higher. In fact, any further rally from current levels should give it the momentum it needs to test its 2011 all time highs of $1,900 before long…..Maybe the most important development in gold this year was actually what took place when the commodity fell sharply in mid-March. If you’ll remember, we called for a sharp decline in the gold just before it rolled over from the $1,700 level and dropped well below $1,500. (Back then, we said it was overbought, over-owned and over-loved.)

However, when the yellow metal saw that 12% decline in less than two weeks just over a month ago, it was able to hold its November 2019 lows. The fact that it was able to hold that level is important because it created a very nice “double-bottom” low…which has since been followed by a nice “higher-high” (by moving above the $1700 level that provided tough resistance back in March).

Having said this, this is the second time it has rallied above $1,700 this month. Therefore, we’re going to have to see it rally a bit more before we can raise another green flag on the commodity. However, if it can pull further above the $1,725, it should give gold another boost of momentum that will take it towards its 2011 highs rather quickly. (+$1,750 should do the trick)

Of course, if that happens, it would only embolden our cautious stance on the stock market…as the strong rally in this safety trade provided a great warning signal for the equity market back in January and February.

8) Who would have thought that after the week we just had in the oil market we would not concentrate on this issue until point #8? (Although we did highlight it in point #6, it was not the focal point of that comment.) Maybe the craziest thing about last week was that despite the historic drop into negative territory for WTI crude oil on Monday and Tuesday…and the fact that it lost more 6% on the week…the energy equity stocks were the best performing group in the market last week!

So there’s absolutely no question that the energy stocks (in general) have held-up very well during this crazy week for their underlying commodity. The XLE energy stock ETF gained almost 2% during the week…while the XOP oil & gas E&P ETF gained more than 11%...and they both closed at their highest levels of the recent rally. Also, even though both of these ETFs have rallied very strongly off their lows (46% and 55% respectively), they have not become particularly overbought. In fact, if you look at their weekly RSI charts, they’re both still a lot closer to being oversold than overbought. (Given how incredibly oversold they had become in March, this shouldn’t be a big surprise to anyone.)

Having said all this, there are all sorts of reasons to question whether these groups can rally much further given the fundamental situation surrounding the oil markets. If the Saudis really want to break the back of several producers (including the U.S.), these stocks could be in for a very, very, very tough slog going forward. So the risks could/should be high for this sector. With this in mind, we thought it would be good to focus on the chart of one of the companies with the best reputations: Chevron (CVX).

The chart on this stock is very similar to that of the XLE (which is no surprise given that its 23% of that ETF). Therefore, if it can break above its recent highs of $87.20 in any meaningful way, it’s going to give it a nice “higher-high” and thus be quite positive on a technical basis. However, we’re looking at the $90 level as the more important resistance level for CVX. That was the intraday highs from earlier this month. Usually, we put much more weight on the closing levels on a chart, but in this case, the $90 helps us in another way. Not only is $90 the recent intraday high for the stock, it’s also the 50% retracement of the February/March decline comes-in. Therefore, a meaningful break above that level would be much more bullish…and give the stock more upside potential. (1st chart below.)

We’d also highlight a stock that was mentioned positively in Barron’s this weekend. Noble Energy (NBL) was one of names mentioned by Morgan Stanley (along with CVX, COP and HES) that have three things going for it: asset quality, balance sheet strength and scale…..Looking at its chart, NBL is coming off its most oversold position ever (based on both its daily & weekly RSI charts). It ha also regain the bottom end of the trend-channel it has been in since 2015….On a shorter-term basis, NBL (much like CVX) is on the cusp of making its secon

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member