I am told that there was a problem with posting my “Weekly Top 10” last evening. Therefore, I thought I’d re-send it myself this morning. My apologies if this is a dupe. (BTW, this was written before the news that China was putting more extreme restrictions on cryptocurrencies.)……My apologies if this is a duplicate.

------------------------------------------------------------------------------------------------------------------

I will be out of the office tomorrow and away this weekend, so I am sending out this week’s weekend report tonight (Thursday night). It’s a shorter version that usual, but next week’s version will go back to normal. Thank you very much.

THE WEEKLY TOP 10

Table of Contents:

1) When major economic powers de-risk/de-lever, it eventually sends ripples around the world.

2) Evergrande is not a “Lehman moment,” but it still might be a warning signal.

3) Whether the S&P 500 can hold back above its 50-DMA or not should be important near-term.

4) The bond market is telling us that Chairman Powell was rather hawkish on Wednesday.

5) There’s still lots of liquidity being provided out there!

6) Gary Gensler has the legitimacy that will enable him to regulate cryptos soon.

7&8) Will the energy and financial stocks continue to do well? (Yes, they will.)

9) Sandra Day O’Connor

10) Summary of our current stance.

1) When the government of the world’s second largest economy decides to de-risk and de-leverage their economy in markets in a significant way, it will eventually have a negative impact on the global economy/markets…including in the U.S. This is especially true given how highly leveraged the U.S. economy and markets are today…and how expensive the stock market is as well.

To be honest, this week’s “Weekly Top 10” piece should simply have only one very short bullet point. It should simply contain a synopsis of our “Morning Comment” from Thursday morning……..China is well into the process of de-risking and de-leveraging their economy and their markets. This is causing China’s economy to slow…and it will continue to do so. To think that the de-risking and de-leveraging of China’s economy & markets (which is causing an economic slowdown in the world’s second largest economy)…won’t have a profound impact on global economy & global markets…is ridiculous. This is especially true given that the U.S. economy is very high leveraged (record level of corporate debt) and so is the stock market stock market (record level of margin debt)…and given that the stock market is extremely overvalued (22x earnings and 3.1x sales).

This situation reminds us of late-January/early-February of 2020. Back then, the global pandemic was staring us all in the face and everybody ignored it. The stock market DID see a mild pull-back in late January…only to bounce-back strongly. Then, investors finally woke up to the reality of the situation in February…and the market fell out of bed. Don’t get us wrong, we’re not saying that we’re about to see the complete shut-down of the global economy (like we saw in 2020). Also, as you will see in the next bullet point, we don’t think Evergrande is a “Lehman moment.” However, today’s market is already pricing in the kind of growth that we are very unlikely to get given what China is doing. With China slowing in a material way, it makes the expensive U.S. stock market very vulnerable.

2) The problems facing Evergrande are very unlikely to create a “Lehman moment” over the coming weeks, but this is not a reason to be bullish on the stock market. “Lehman moments” don’t come at the beginning of a crisis or in the downturn in the markets. They come when the crisis/downturn is quite mature. Therefore, the Evergande issue could still be a very negative development…if it turns out that it is signaling the beginning of bigger problems.

We understand why people want to compare the situation that has developed at Evergrande with the failure of Lehman Brothers 13 years ago. When an important company fails (or looks like it might fail), it’s human nature to raise those comparisons. However, we agree with those who say it is not a “Lehman moment,” but this is not a reason to think that there is nothing to worry about.

As we said in the previous point, the moves by China are very likely to cause some compelling problems in the U.S before long. The situation facing Evergrande might not become the CATALYST for further problems in the marketplace, BUT we still think that is a compelling SIGNAL that China is very serious about their de-risking/de-leveraging program…and that this means we’ll see growth continue to slow in China.

We’d also point out that Evergrande could never be a “Lehman moment” because “Lehman moments” don’t take place at the beginning of a downturn. In other words, if the situation with Evergrande turns out to be something bigger, it will be seen as a “Bear Sterns moment.” No, we’re not talking about the Bear Sterns failure in 2008. We’re talking about the shut-down of two of Bear Stearns hedge funds in the summer of 2007. THAT was an signal of much worse things to come.

Evergrande could be the same kind of early warning signal. No, this does NOT mean that it means we’re about to head into another financial crisis. However, it could mean that we’re at the beginning of some sort of de-risking/de-leveraging period that extends beyond China…and thus causes a lot more problems in this highly leveraged and very expensive marketplace we live in today (even if that de-risking/de-leveraging period is not anywhere near as bad as 2008).

3) The S&P 500 Index broke well below its key 50-DMA support level last week, but it was able to regain that line on Thursday. In technical analysis, “old support” frequently become “new resistance. Therefore, whether the S&P regains its 50-DMA in a more material way…or rolls back over…should be important for how the market acts over the next several weeks.

As we have all know, the 50-DMA had been providing excellent support for the stock market in 2021. However, even though it had bounced-off that line on eight occasions this year, it did fall below that line for a very short period of time back in March. However, it was able to regain that line the very next day…and it continued to rise in the following weeks and months. This past week, the S&P fell well below that 50-DMA once again (on Monday), but as it did in March, it was able to regain that line by Thursday. (Thus, it took a little longer, but not much longer.)

This is obviously a bullish development, but we want to make sure that it holds above that 50-DMA into next week. If it does, it will be quite bullish. However, if it fails…and rolls back over and falls back below the 50-DMA, it’s going to be bearish. If (repeat, IF) that happens, we’ll go back to watching the 100-DMA like a hawk. Any meaningful break below that 100-DMA and its lows from Monday would scare the hell out of people. Therefore, that kind of move over the next few weeks would be very bearish.

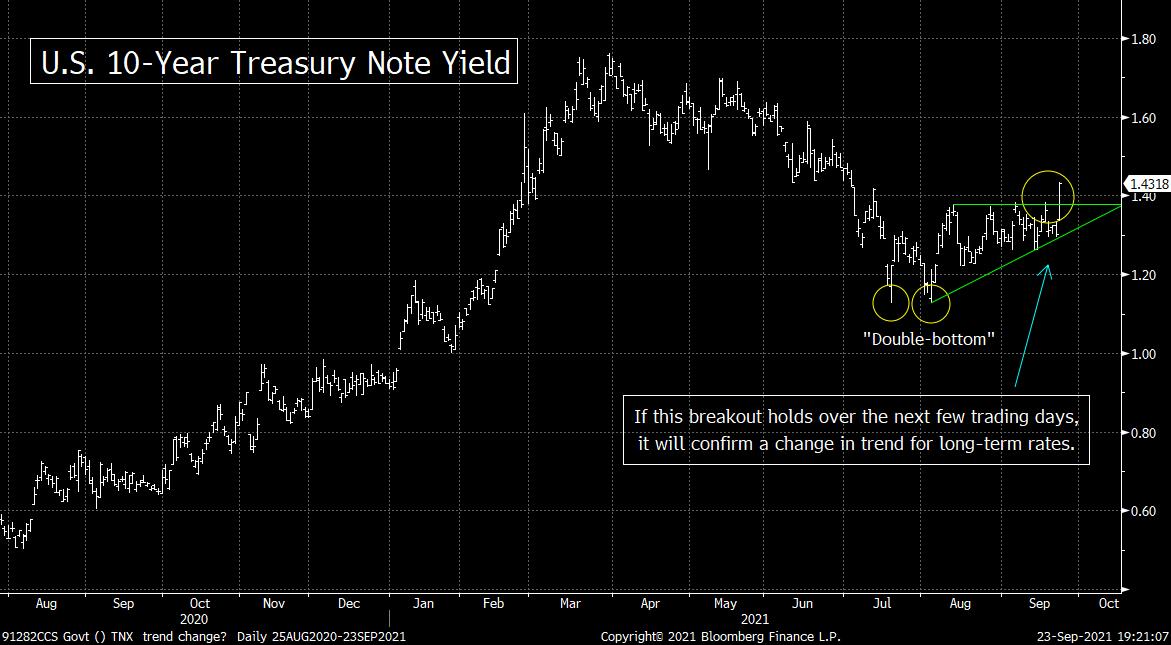

4) If you want any confirmation that Fed Chairman Powell’s comments on Wednesday were a bit more hawkish than expected, just look at the move in the Treasury market. The yield on the 10yr note…which had dropped earlier in the week on a “flight to safety” move…bounced-back on Thursday and closed at its highest level since July. This 10yr yield is on the cusp of confirming that a change in long-term interest rates has take place.

The yield on the 10yr note dropped in a significant way on Monday…on a “flight to safety” move. However, as the stock market stabilized mid-week, so did the Treasury market. However, after Chairman Powell’s press conference, yield shot higher…and continued to rise on Thursday. Mr. Powell indicated that he expects the tapering of their QE program to begin soon…and that it would end by mid-year next year. This is a more aggressive move to pull-back on their stimulus than the market was expecting…and when you combine this with his new concerns that inflation might not be as transitory as he has been thinking…and it took the yield on the 10yr note higher.

On Thursday, the yield rose once again, and this took it above the 1.37% resistance level we’ve been harping on recently. In fact, it closed above the 1.4% level that we said it would need to do to confirm the breakout. We do need to be careful about a “head fake,” so we’ll want to see the 10yr yield hold above that level for a few days.

However, there is no question Thursday’s move has the potential to be VERY important one. It gave the 10yr yield a meaningful “higher-high”…took it above its trend-line from May…and took it above its 200-DMA. This can also be seen as breaking above and “ascending triangle” pattern. Therefore, unless the 10yr yield rolls back over immediately, it will confirm that the multi-month trend of lower long-term rates that existed from March until July has come to an end. This, in turn would signal a resumption in the rise in long-term rates that began in August of 2020.

5) There are plenty of reasons to think that the stock market can continue to rally. Therefore, maybe we should throw-in the towel and turn bullish. The economy is growing nicely, money keeps flowing into the marketplace, earnings are growing and on the technical side of things, the same support level that held this time last year held once again this past week (the 100-DMA). Therefore, the stock market can certainly continue to ignore the plethora of headwinds and continue to rally quite strongly.

In the marketplace, one of the most important old sayings is, “The trend is your friend”…and the trend for the stock market this year has certainly been higher. Even with the scare on Monday, the S&P still has not fallen 5% this year (even at its intraday lows on Monday). People keep talking about how we haven’t had a decline of 5% this year, but this trend actually goes back to Election Day 2020…almost a year ago! Heck, even 2007 and 2000 had declines of more than 5% before the big ones hit later in the year! Maybe this means that we won’t get a deep decline any time soon. However, we cannot find another time when a stock market that is as overvalued as this one is today…that did not see a least some sort of 10% (or more) correction along the way. (We got some whoppers in 1997 and 1998 when the stock market was quite expensive back then.)

Okay, okay…we’ve gotten off point on this one. We’re supposed to present the bullish case…but given that the stock market has already priced-in any fundamental outcome over the next 12-24 months, it’s easy to go on a tangent. Anyway, there are two things that stand out to us on the bullish side of the ledger right now. First, even though the Fed is going to start tapering soon, they will still be providing lots of liquidity for many months to come. Therefore, the market could keep on chugging for quite some time…..Second, even though China has embarked on a rather large de-risking/de-leveraging program, they’re still providing lots of liquidity through their open market operations. Therefore, as long as there is lots of liquidity splashing around the system, the markets just might keep rallying for a while.

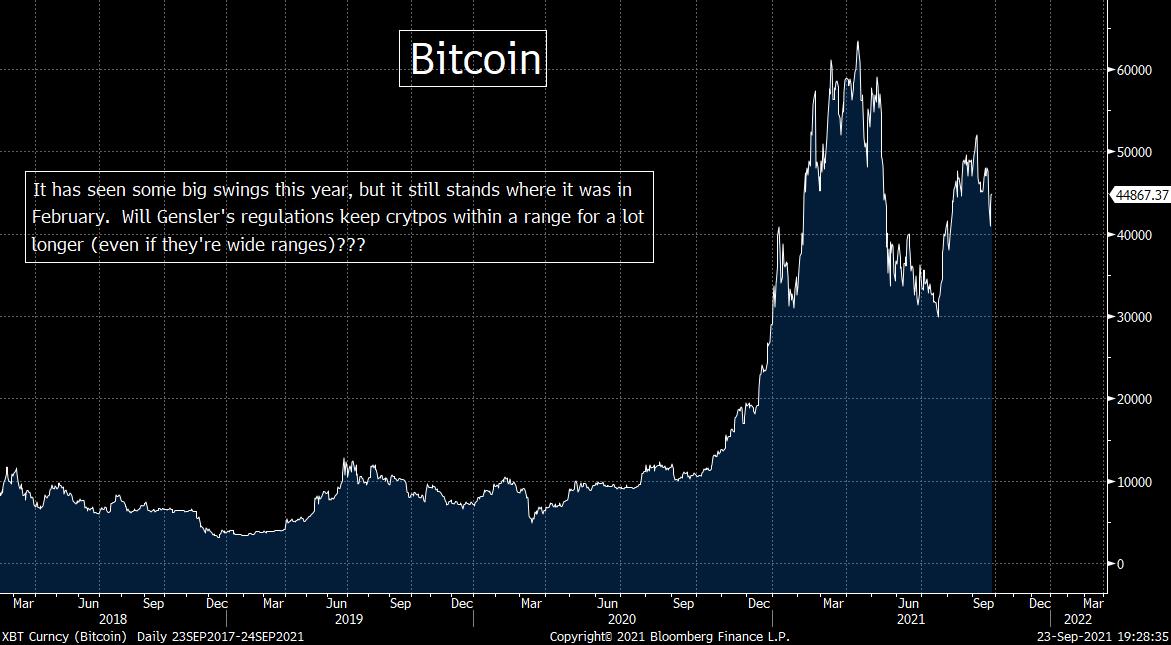

6) We have highlighted many times that we are long-term bulls on Bitcoin, Ethereum and some other cryptocurrency-related assets. However, we must admit that it is becoming more and move evident that Gary Gensler is going to create regulations that could create bigger headwinds that we’ve been thinking about until now. Therefore, we have become a bit more cautious on this asset class. (Not bearish…just more cautious.)

Gary Gensler is one of the most respected people on Wall Street. He knows the cryptocurrency asset class very well and he has even taught the subject at MIT. A lot of people said earlier in the year that since he has been an advocate for cryptocurrencies, his move to the head of the SEC is bullish for the asset class. However, Mr. Gensler continues to tell us that cryptocurrencies need more regulation…something he reiterated again this past week.

People should not take solace in Mr. Gensler’s past when it comes to crytpos. Remember, the Civil Rights Act and Voting Rights Act were passed by a President from the south…President Johnson. (It had to be advocated by a President from the south who had sided with segregationists in the past. That gave him the legitimacy to push for those civil rights bills in Congress. If a southerner pushed it, NO northern politician could possibly vote against it. Kennedy never would have gotten those bills passed in the mid-1960s.)……Similarly, Prime Minister Yitzhak Rabin had been a hero of the Israeli military in the 1967 War, and THAT gave him the legitimacy to make an agreement with Yasser Arafat when he was Prime Minister of Israel. (If somebody who had fought so hard against it…finally said enough was enough…others had to follow his lead.) Only a leader who had fought so hard against the Palestinians in the past…could possibly have had the legitimacy push the cause of peace forward to such a degree.

Again, Mr. Gensler is incredibly well respected on Wall Street…and he is seen as a pro-cryptocurrency advocate. Therefore, he has the legitimacy he needs to push for more regulation…while still telling us that he is in favor of the asset class in general. Therefore, we believe he will be successful in attaching more regulation to the cryptocurrency market in the months ahead…..Finally, if Saule Omarova becomes the comptroller of the currency (a key bank regulatory job), that’s not going to help the cryptos. She has been a critic for some time…saying that they could exacerbate tensions in the markets and the broad economy.

This does not mean that Bitcoin, Ethereum and other cryptos cannot…or will not…prosper. We believe that they can. In fact, the changes Mr. Gensler will make are likely to help this asset class in significant way on a longer-term basis. We just think the path higher might not be as steep as the path has been in recent years…as new regulations come into play.

7 & 8) This time last year…when everybody was avoiding the bank stocks and everybody HATED the energy sector…we turned bullish on both of them. (The banks came first…followed by the energy stocks a few weeks later…in mid-October.) These calls have worked out extremely well. The question now is whether the rallies in these groups will continue…now that everyone seems to be bullish on these two groups. (Hint, we think they will.)

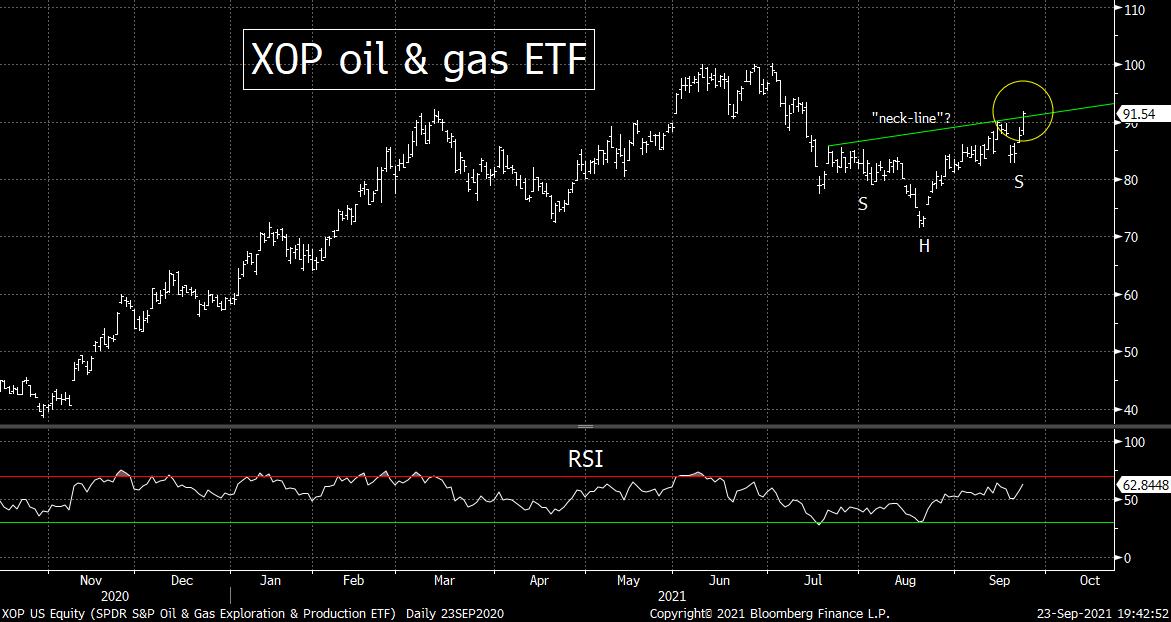

We spent enough time this year patting ourselves on the back in recent months about our calls on the bank stocks and energy stocks a year ago, so we’ll merely review our calls very quickly. We turned bullish on the bank stocks in September (after spending 2.5 years saying…correctly…that they’d underperform). Since then, the KBE bank index has rallied 83% while the S&P 500 Index has rallied “only” 37%. In mid-October, when EVERYBODY hated the energy stocks, we pounded the table and said they’d outperform going forward. Since then, the XLE energy stock ETF has rallied 72% and the XOP oil and gas E&P ETF has advanced almost 125%...compared to a rise in the S&P of 35%. (Yes, much of Wall Street joined in on the party early in the year this year, but they missed more than HALF of the 12-month rally!)

The question now is whether this outperformance can continue for these two groups…even though the sentiment for them is no longer bearish at all. We believe that they CAN continue to outperform. First of all, neither one has become “over-owned” by any means. They might not be under-owned (the way the energy stocks were in a substantial way a year ago), but they’re not over-owned. More importantly, we believe their fundamental backdrop supports further outperformance.

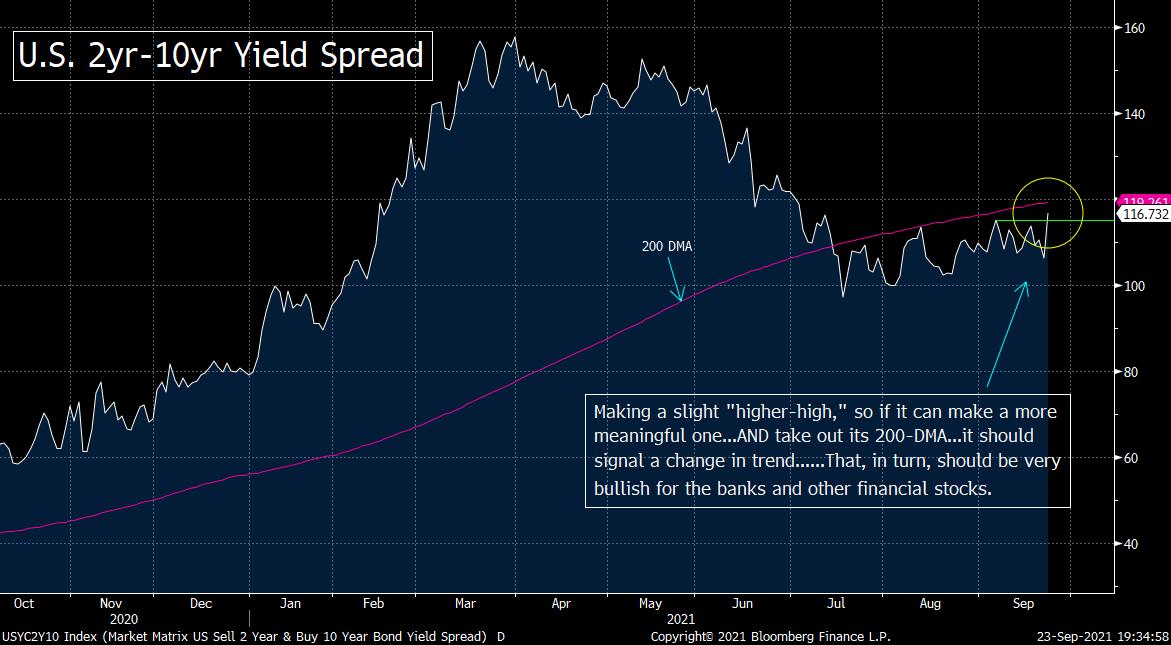

For the banks, we highlighted above how the yield on the U.S. 10yr Treasury note is on the brink of breaking out to the upside. The last time that happened (last fall), it ignited a strong rally in the group. It should do the same this time around…..We’d also note that the yield curve (the 2yr/10yr spread) has steepened and taken it to its steepest level since early July. If it can break above its 200-DMA, it will confirm the change in trend as well. THAT will be quite bullish for the bank stocks as well. (First chart below.)

As for the energy stocks, we’d note that both the XLE and XOP have broken out of the sideways ranges they were in during the last summer…and Brent oil has moved to its highest level since October of 2018. (WTI is still below those highs, but it’s very close).

Going back to the energy equities, it might be better to describe the chart on the XOP as an “inverse head & shoulders” pattern…and it has broken above the “neck-line” of that pattern. (The “arm pit” of the left shoulder doesn’t touch the neck-line so maybe this is a bit of a reach. However, it’s still following up its recent “higher-low” with a nice “higher-high,” so that’s still bullish……Second chart below.) Therefore, the technical outlook remains very bright for the energy stocks.

9) We usually use this bullet point to touch on a political issue or two. This week, we’ll take a little different tact…but still keep the discussion within Washington DC. We saw a documentary about Sandra Day O’Connor this past week. If you have not seen it, you should watch it…and learn as much as you can about her. She is a great American.

As history buffs, we’d say that probably our favorite long running TV show is the PBS series, “The American Experience.” We saw an episode this week about Sandra Day O’Connor. (We think it’s brand new, but it might be a few months old.) What an extraordinary person. She graduated from Stanford Law School third in her class in 1952 (which she completed in two years instead of three), but she could not get a job because she was a woman. Thirty years later, she became a respected leader in the highest court in the land.

Of course, being “the first” doesn’t always mean that person will do a good job. However, like it was with George Washington and Jackie Robinson, in some cases, it is ESSENTIAL that the person do it well. If the groundwork isn’t laid firmly in place for those who follow, the progress becomes much slower. In fact, the progress can come to a halt. Justice O’Connor laid an incredibly strong foundation for others to follow in her footsteps…and several people have done so already. She set the groundwork so that woman…whether they be conservatives, liberals, or somewhere in the middle…will have a strong voice on the Supreme Court forever.

However, President Washington is not considered a great American because he happened to be the first President. It’s because he did an excellent job while in office. Jackie Robinson is not considered a great American merely because he was the first African American in the Major Leagues. It’s because he did an excellent job on and off the field his entire adult life. Similarly, the reason that Justice O’Connor did such a great job at laying the groundwork for those who followed her is because she was an incredibly well respected jurist and an incredibly well respected person, not because she happened to be the first woman to sit on the Supreme Court.

Sandra Day O’Connor stayed in public life long after she retired from the bench, but she has completely stepped away in more recent years after a diagnosis of Alzheimer’s. This is a loss for all of us. May God bless her.

Smart, hardworking, and honest. That’s what the founding fathers wanted when they created the Supreme Court…and that’s what we got with Sandra Day O’Connor. President Obama awarded Justice O’Connor the Presidential Medal of Freedom in 2009. Whether you agree with her rulings or not, the Medal of Freedom was greatly deserved. She is truly a great American.

10) Summary of our current stance…..Maybe it’s different this time…..Maybe extremely high valuations are justified today. Maybe the rise in long-term interest rates from 0.5% to 1.4% in the last year doesn’t matter. Maybe a “narrowing rally” isn’t the negative sign it used to be. Maybe the massive levels of debt in the world today will never pose a problem. Maybe the massive levels of leverage in the system will never have to be unwound. Maybe the delta variant will be the last variant we experience, even though we’re just about to head into the colder months. Maybe earnings will catch up to sky-high prices, even though that has never happened when the market has become as expensive as it has today. Maybe the massive influx of individual investors to the stock market is a bullish signal this time around. Maybe GameStop or AMC will come up with the invention that replaces the smartphone. Maybe the politicians in Washington DC will get their acts together. Heck, maybe the New York Yankees can make the playoffs!

In other words, maybe the stock market could go higher for a while longer. In fact, this could be 1998 all over again…and thus it might go a lot higher. However, after well over 30 years in this business, we’ve seen this rodeo before. When situations like this arise, the pundits come up with all sorts of reasons to tell us why it’s different this time. Even very smart people do it. However, it’s never different this time…and when the piper has to be paid, A LOT of people get burned. Of course, everyone (including the ones who came up with all of those justifications) will say that they saw it coming…but only after they lost a boat load of money.

Matthew J. Maley

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member