Traders,

I just wanted to post some notes on the year so far and my performance. Hopefully, you did not get stuck long the last 15 days or so and NOT exit on any bounce. If this is so, you have no plan. You have no strategy and you probably watch too much TV like CNBC and the talking heads that tout QE rally after QE rally. Do you buy into every dip? Buying the dip is relative to the time frame. If you followed me, you made cash. If not, check out your statement and the P/L its red.

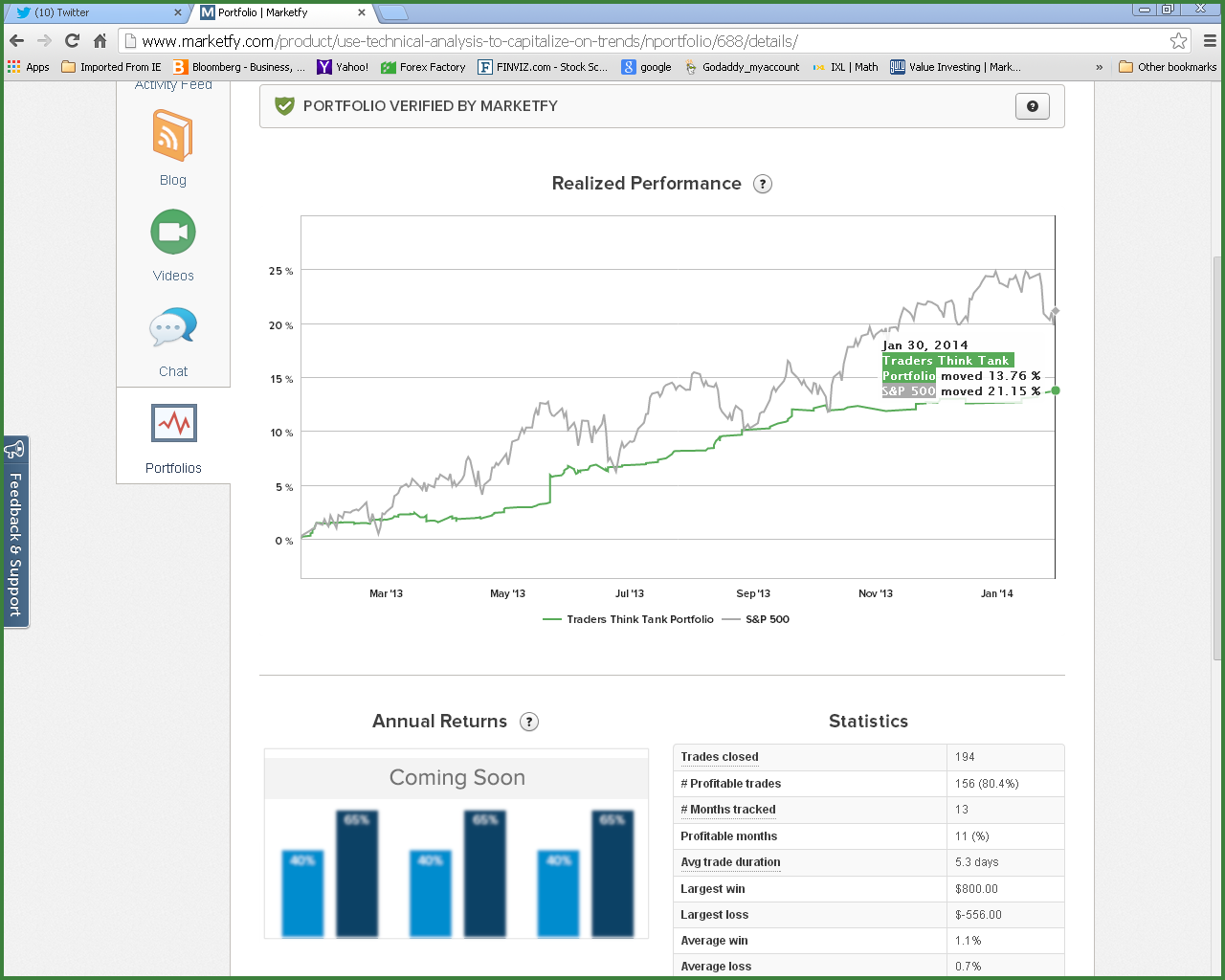

Below is the TradersThinkTank performance in a side by side relation to the $SPX.

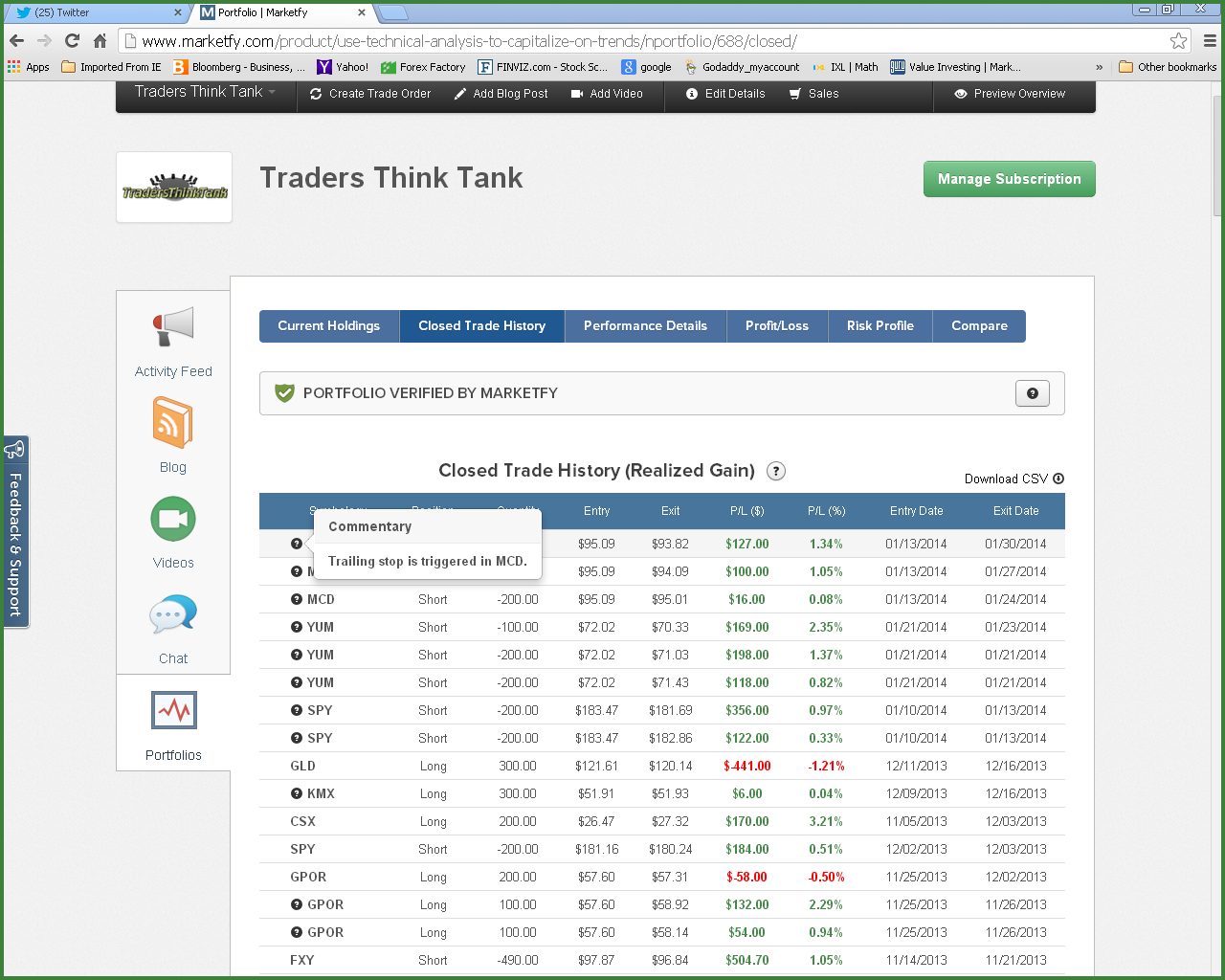

Below is the trade by trade for the TradersThinkTank Trading system model for 2014. Check out the stat page for the entire trading history.

The bottom line is you need a system to generate predictable results and more importantly, manage risk.

Stop spending cash on other peoples so called "training". Its all a back door way to get your cash without actually proving something is the correct method(s). You need direct alerts and trade ideas with specific entries, guidance with managed trades via alerts the very instant they go out. Training has got you nowhere. Most are hacks that regurgitate other hacks methods with absolutely no real results.

Have a great trading week !

Nick Pirraglia

TradersThinkTank

Recent free content from Nick Pirraglia

-

TradersThinkTank asks you: Did you make money?

— 12/23/13

TradersThinkTank asks you: Did you make money?

— 12/23/13

-

TradersThinkTank Overview of KMX

— 12/09/13

TradersThinkTank Overview of KMX

— 12/09/13

-

TradersThinkTank Updates ~ 10/21

— 10/21/13

TradersThinkTank Updates ~ 10/21

— 10/21/13

-

TradersThinkTank Overview of BMY

— 10/15/13

TradersThinkTank Overview of BMY

— 10/15/13

-

TradersThinkTank Updated system list ~ 10/13

— 10/13/13

TradersThinkTank Updated system list ~ 10/13

— 10/13/13

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member