Market Outlook

For the month of May, major equity indices put up respectable numbers: the S&P 500 managed to tack on +1% while the Russell and Nasdaq did +2.1% and +2.6% respectively.

Looking at the overall price structure it is still difficult to be bearish. The above three indices are in clear uptrends and the worst that can be said is that they remain confined within their respective consolidation patterns.

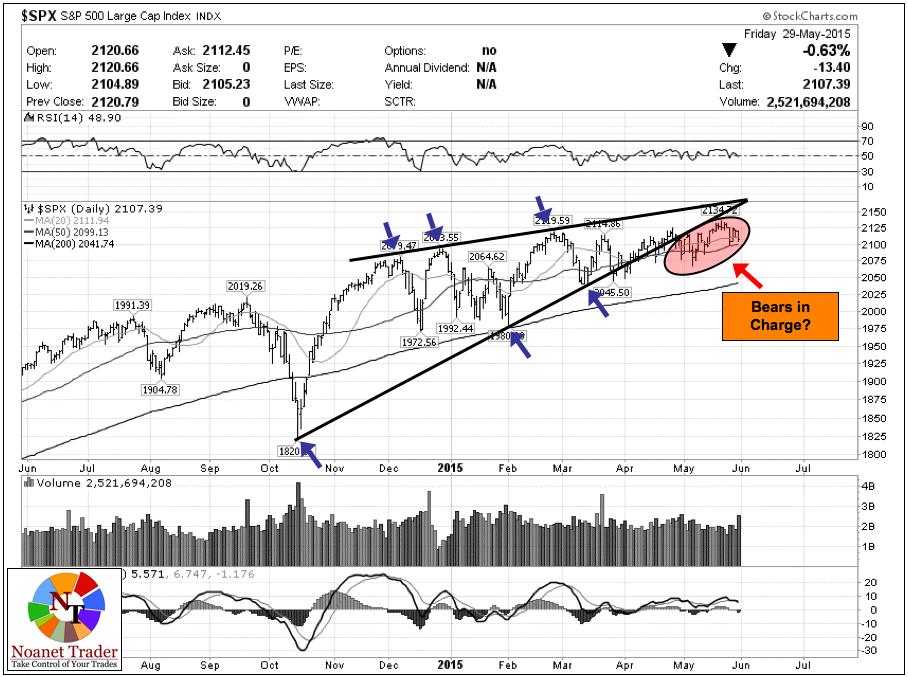

In my previous market outlook post I talked about how the price structure of the S&P seemed to be morphing from a bearish rising wedge to a bullish ascending triangle.

Fast forward two weeks and one can still make the same argument. However, the truth is that the bulls had ample time and opportunity to push the S&P toward 2150, yet failed to deliver.

This failure validates and reinforces the eight-month rising wedge: S&P's price action in May can be summed up as a bearish consolidation under the wedge's lower trendline (see below).

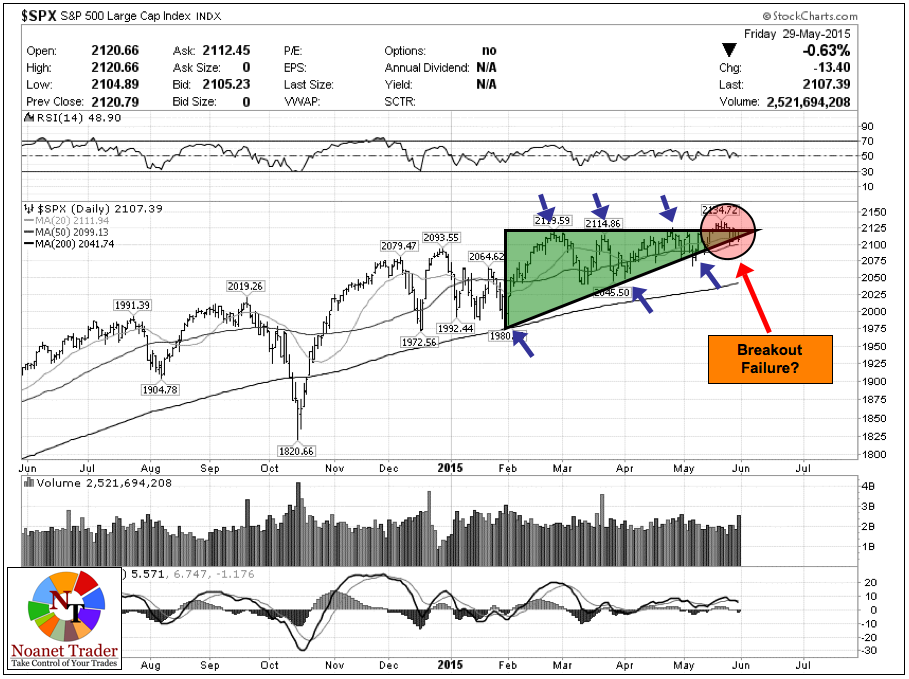

Switching to the bullish ascending triangle view, the overall pattern remains intact but the bulls seem to have squandered a good breakout opportunity: the S&P's attempt to push through 2130-2135 was rejected and the index ended the month resting at the lower trendline of the pattern.

Should the S&P 500 now fail to stay above the 2090-2100 area, the proper label for this price action would be "Breakout Failure" in my opinion and this would make the overall price structure a lot less bullish.

Adding to the bulls' problems is the weakness on the Dow index family front...

Click HERE to read the rest of this post.

Have a great Sunday.

Recent free content from Noanet Trader

-

Ignoring the Greco-German Noise

— 6/21/15

Ignoring the Greco-German Noise

— 6/21/15

-

June 18 Recap

— 6/18/15

June 18 Recap

— 6/18/15

-

All Eyes on the Russell

— 6/14/15

All Eyes on the Russell

— 6/14/15

-

Preparing for the Week of May 18

— 5/17/15

Preparing for the Week of May 18

— 5/17/15

-

Spooked by Negative Divergence?

— 5/13/15

Spooked by Negative Divergence?

— 5/13/15

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member