Last weekend, in my Market Forecast, I wrote:

"For the new week, the market starts at a neutral position as the market consolidated on Friday. But, stocks may slip as the buying momentum wanes. Before the sharp drop, people were looking for a pullback. The pullback was so sharp that it brought most sectors into the correction territory in just a few days! Thus, the sharp bounce is warranted. Now, that the bounce has taken out the downside overshoot, we may see stocks slip again."

Indeed, the buying faded. Besides the bounce on Wednesday, there was not much buying. Tuesday brought a quick drop, sending the market down to test 1900. After Wednesday's bounce, selling resume on Thursday afternoon, and lingered into Friday.

We had a pretty good week keeping the Ecstatic Plays Portfolio near its all-time high, especially considering how volatile the markets were. Here are the closed trades for the week, which we had already highlighted some trades earlier (Click here to see the previous article):

To subscribe or to find out more about this product, please CLICK HERE. Come see what Ecstatic Plays offers and what we are trading next!

For the week, the Dow was down 540.63 points; SPX fell 67.65 points; Nasdaq lost 144.4 points. Oil had a strong opening on Monday, but, pulled back throughout the week. Still, it managed to close higher for the week, at around $45/barrel (WTI). Gold slid down to about $1120/ounce. Asian markets were mostly lower on Monday, as the US markets were closed in observance of Labor Day. Tonight, at the time of this writing, Asian markets were mixed. Let's see how the US markets closed on Friday:

SPX

Nasdaq

Both SPX and Nasdaq closed below their respective daily MAs. For the new week, the major indices will start out in vulnerable positions. But, the selling has slowed. It's perhaps more difficult to find reasons to buy right now. People are already worrying about China. Now, people might even ponder on the effects of Syrian refugees migrating into Europe.

On Wednesday afternoon, we will get earnings from PANW. What's perhaps more influential is the Apple event on Wednesday. Besides some other major companies, LULU also reports on Thursday. We will have to see if the markets can find reason to buy.

On the down side, SPX has support at 1900, and then 1880. On the upside, 1950 seems to have become a resistance. Above that, 1970 to 1980 is another resistance.

Oil retreated on Monday and is drifting lower this evening. If oil stocks fall back again, we are probably going to see the markets pressured.

Sector Watch

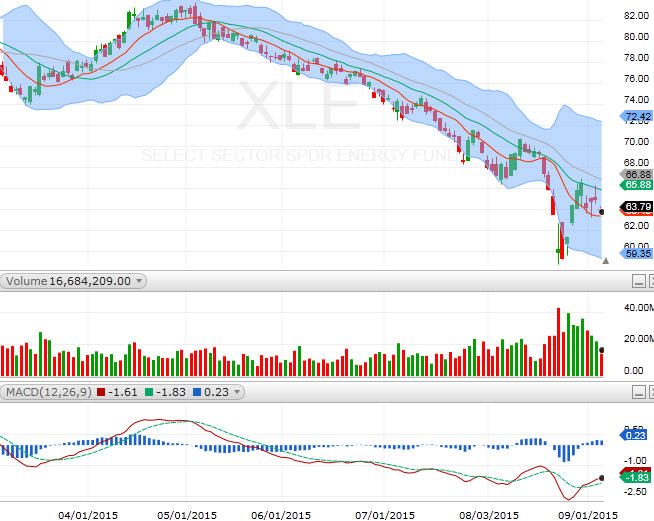

XLE (energy)

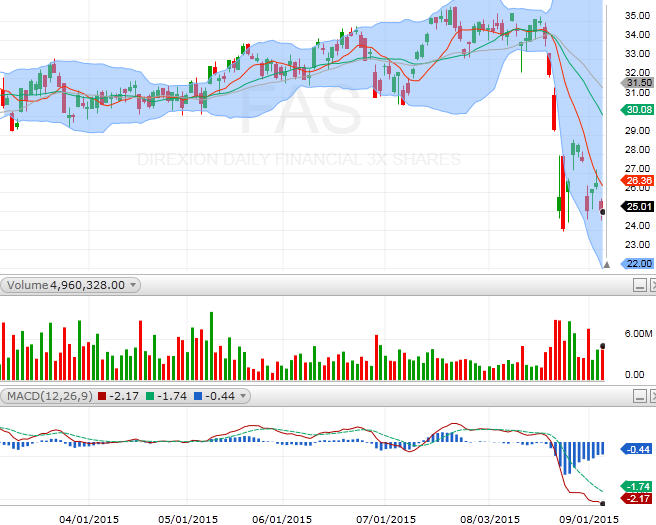

FAS (financial)

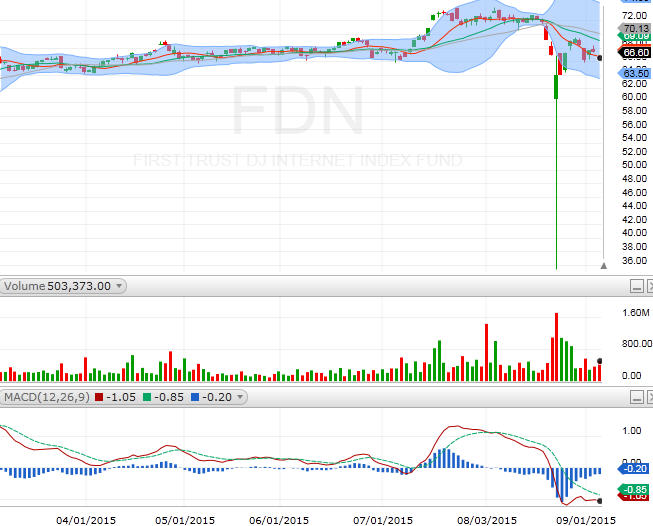

FDN (internet)

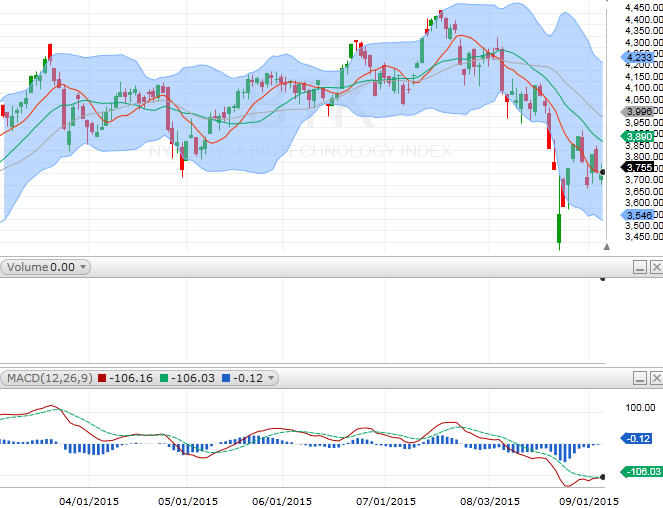

BTK (biotech)

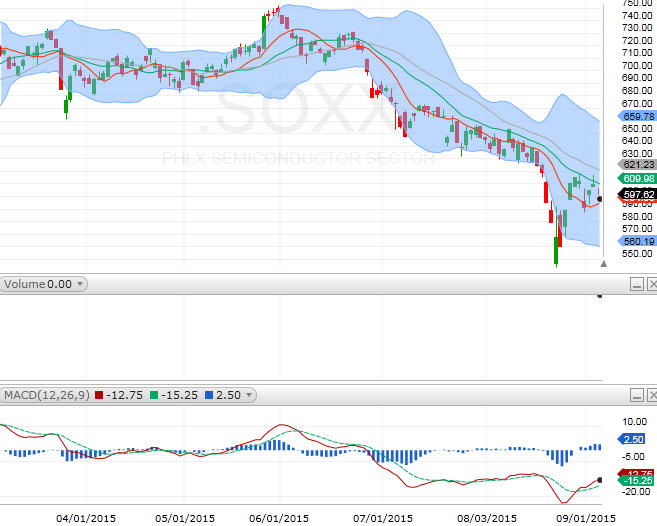

SOXX (semiconductors)

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member