The market was very strong last week. A quick drop on Wednesday as an initial reaction to the Fed was quickly reversed by a sharp rally that pushed SPX to above 2090. In my Market Forecast last weekend, I talked about SPX having resistance between 2080 and 2100,

"SPX has resistance from 2080 to 2100..."

SPX ended the week just shy of 2080.

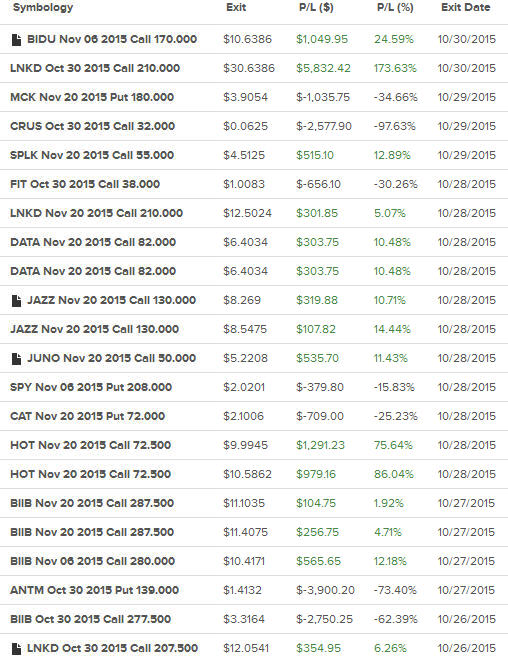

We traded well last week, hitting a big trade on LNKD calls, with a profit of +173%! We exited BIDU calls too early on Friday, which also would have been a triple-digit winner.

To subscribe or to find out more about this product, please CLICK HERE. Come see what Ecstatic Plays offers and what we are trading next!

After the month of October, the market pretty much has recovered all of its losses from the sharp drop in August. The Dow is actually above the level at which it fell in August. Again, this seems to be the new theme: Buyers are buying the big caps, especially the blue chips. In a sharp contrast, the Russell 2000, the small caps, is lagging behind and has not fully recovered from the August tumble. Will this change? Will buyers start to shift gears and drive up the small cap stocks? We will be watching. But, I think it makes more sense to stick with the big caps as the global economy is still quite unstable. China just reported soft factory numbers today.

For the week, the Dow was up +16.84 points; SPX added +4.21 points; Nasdaq gained +21.89 points. Oil (WTI) was up, ending at above $46/barrel, while gold fell to just above $1140/ounce. At the time of this writing, Asian markets were mostly down. Here's how the US markets closed on Friday:

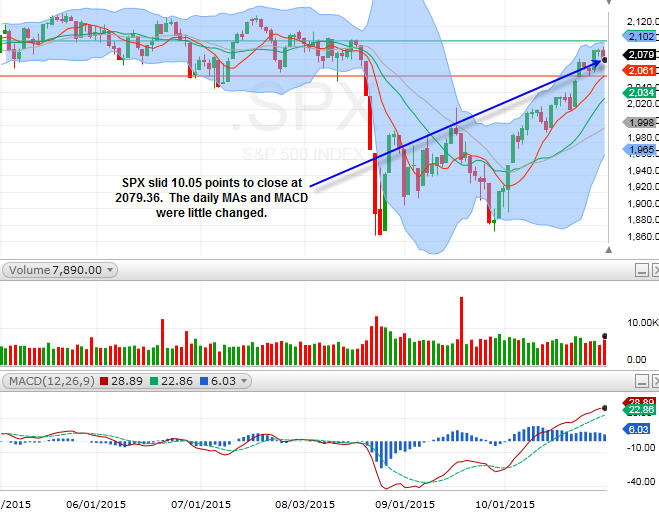

SPX

On Friday, SPX slid 10.05 points to close at 2079.36. The daily MAs and MACD were little changed.

Nasdaq

Nasdaq fell 20.53 points to close at 5053.75. Its daily MAs were up slightly.

The major indices were little changed for the week. Although we did see strong buying on Wednesday afternoon, buyers were unwilling to keep push stocks higher. For the new week, Friday's weakness should raise a caution flag. The market has rallied quite strongly in October, things may look to consolidate a bit here.

Earnings will continue to pile in:

Monday: (AM) V, CLX, DO, L; (PM) FIT, AIG, THC, QLYS, KONA

Tuesday: (AM) AMAG, K, MLM, MPG, MBLY, MOS, TASR, VMC: (PM) ATVI, CERN, HLF, JCOM, PAYC, TSLA, X

Wednesday: (AM) KORS, CHK, DDD, AGN, REGN, CTSH, SSYS, SODA, TWX; (PM) FB, QCOM, WFM, CF, RIG, SEDG, MET, PRU, FEYE

Thursday: (AM) AGIO, AGU, APA, CELG, SCOR, CROX, RGLD; (PM) ACAD, ANET, DATA, CYBR, GLUU, DIS, QRVO, SHAK, SWKS

Friday: (AM) MT, CI, HUM, HRTX

We will now watch 2100 on SPX as the resistance and 2060 as the support. One interesting sector to watch is the retail sector. Holidays are just around the corner and already I am seeing bets being made in the retail stocks!

Sector Watch

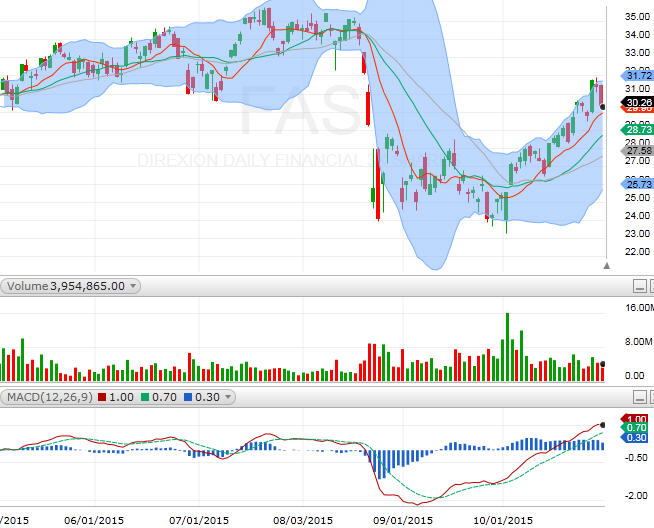

FAS (financials)

FAS pulled back on Friday, after a big pop on Wednesday following the Fed. V is reporting on Monday morning and AIG follows in the afternoon. I also like GS after the pullback on Friday.

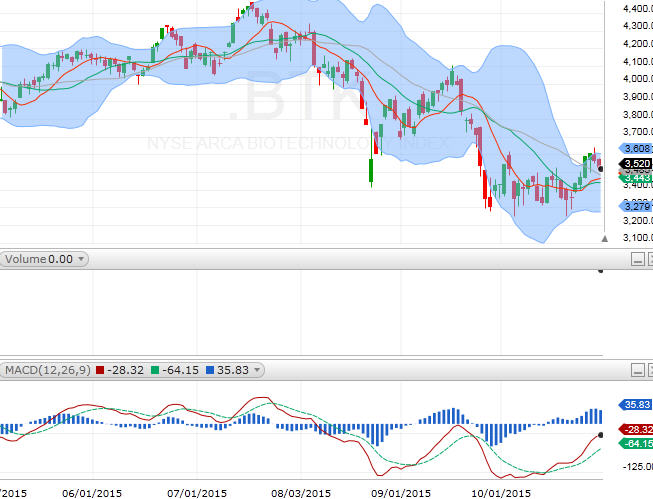

BTK (biotech)

BTK turned the corner this week. But, it will be imperative to see it push higher to truly draw the bottom. Lots of companies are reporting in this sector in the coming week. THC, AMAG, AGN, REGN, AGIO, CELG. Please refer to the table above for dates and time. Let's also watch how VRX holds up on Monday. Also, I am keeping my eyes on JAZZ and HRTX.

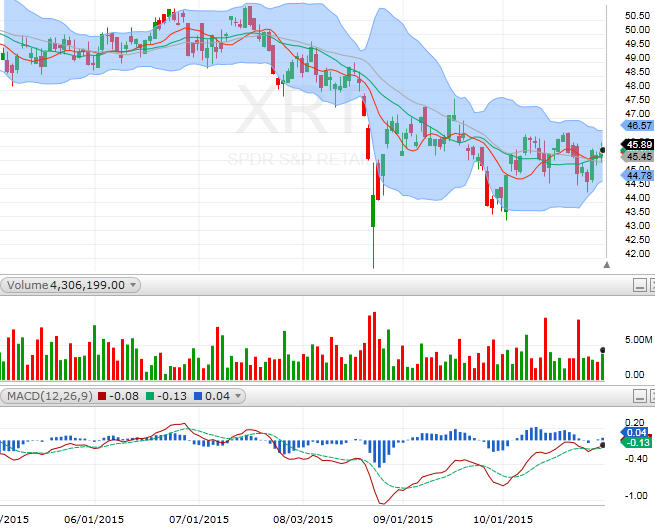

XRT (retail)

XRT is just turning the corner, closing above its daily MAs. This tells me that the fund managers are starting to place their bets for the holiday season. This also means that we will probably not see AMZN and AAPL come down any time soon, which is good news for the overall market, even though some consolidation is needed. ROST may be interesting, as thrifty shoppers will likely boost up its business. I am also watching NFLX, which is slowing climbing back up after the earnings fall.

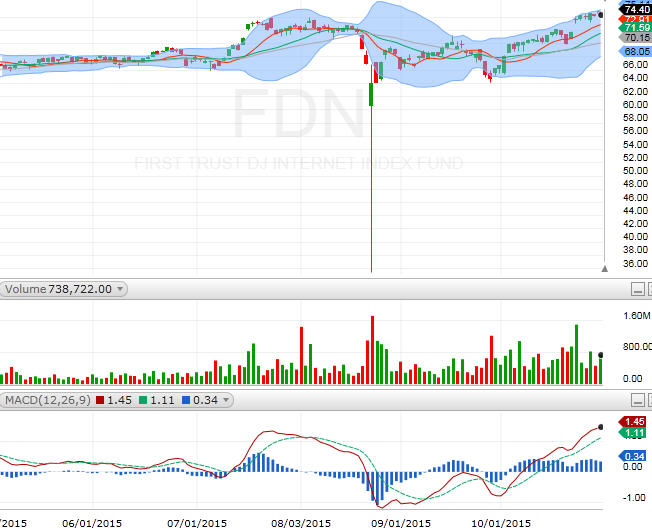

FDN (internet)

FDN is staying strong. PCLN has just made a new all-time high. LNKD reported strong earnings on Thursday and should keep going higher to test $260. FB will report on Wednesday afternoon and the business should be good, but, the stock has already come up so much. Again, NFLX seems to be the natural choice at this time.

I want to point out that BG took a big fall last week. MOS, CF, and AGU are reporting in the coming week. These may be good downside plays.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member