Chart of the week

The last high impact news release for the FOREX market will be released tomorrow May 30, 2014 at 8:30 AM EST when CA GDP will be released. The forecast number is 0.1% (previous release 0.2%.

Tomorrow is also the last trading day of the week and month and this does not make it a great trading environment but if we should get a considerable deviation we can see a lot of volatility coming in.

I will only look if we the deviation is:

1. on the positive side, greater than the forecast number of 0.1% and previous released # of 0.2% for a BUY of CAD

2. on the negative side, less than the forecast for a SELL of CAD

Here are the charts I will be looking at tomorrow and the key areas of support and resistance.

The currency pairs below have the highest odds of follow through.

1. USD/CAD: a break of support at 1.0814 can send it lower into 1.0736 area which would be in line with the already set downtrend.

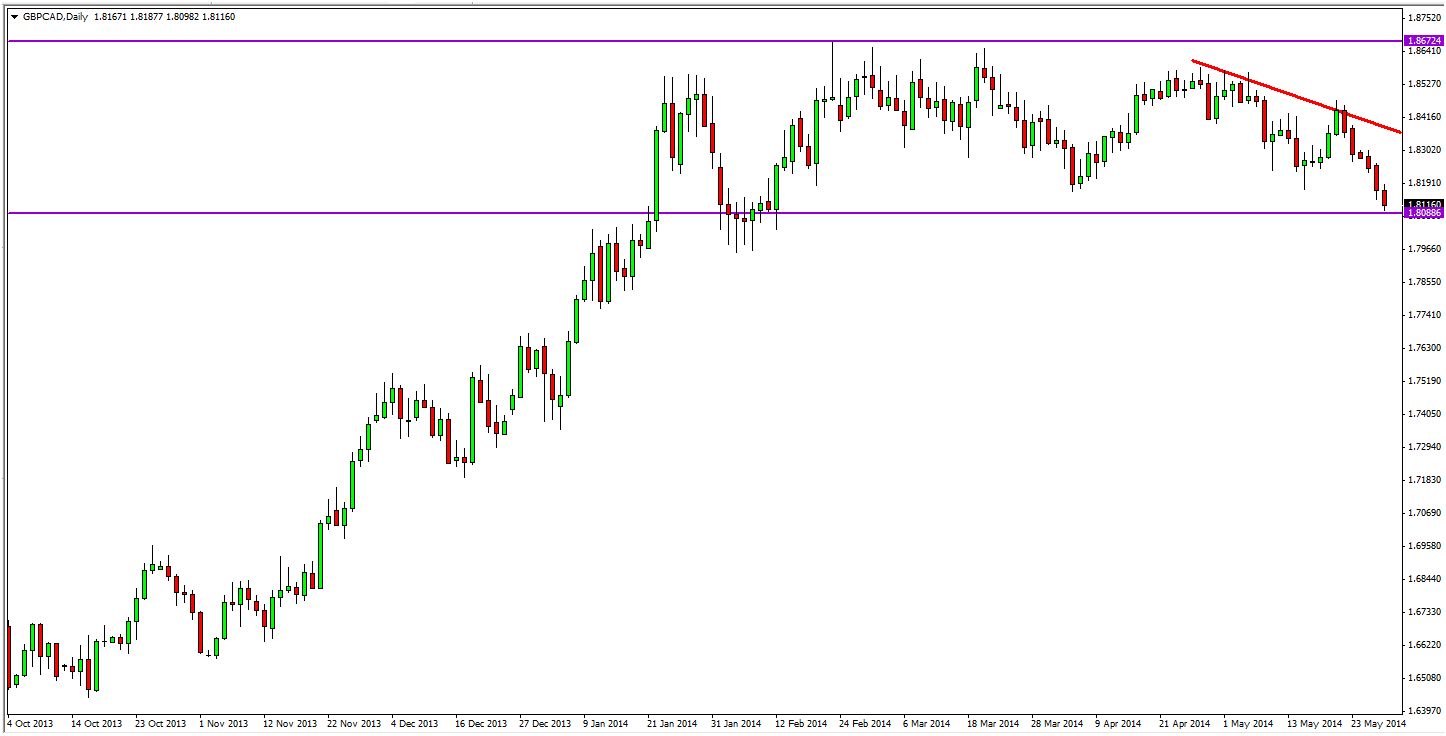

2. GBP/CAD due to the selling pressure this currency pair can continue lower in line with the strong selling pressure set in motion 6 days ago.

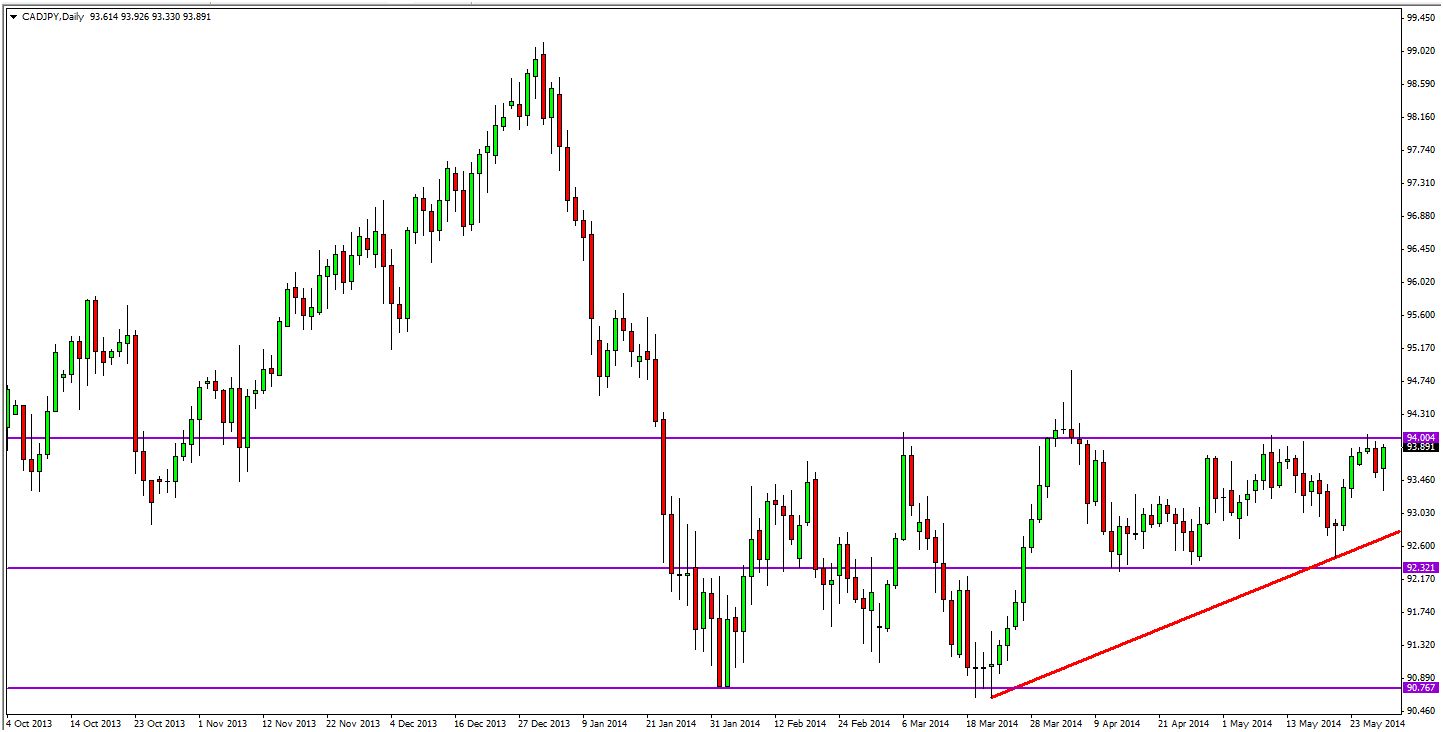

3. CAD/JPY after forming a double bottom at the beginning of the year (2014) the currency pair has formed a higher level of support above 92.00. On positive GDP numbers tomorrow a break of 94.00 is likely to occur. Target area is 94.80 (fulcrum area)

For stop loss areas I will pick the support levels on the 15 min chart at the time of the release for the long position in CAD/JPY and resistance areas on the 15 min chart for the other two above mentioned trades.

Happy Trading,

Anka Metcalf

Today's trading idea is brought to you buy Forex Trading For Maximum Profits. The fastest growing group of active swing traders and investors.

Like us on Facebook: www.Facebook.com/TradeOutLoud

Follow us on Twitter: www.Twitter.com/AnkaMetcalf

Recent free content from Anka Metcalf

-

Labor Day and our money is working for us

— 9/01/14

Labor Day and our money is working for us

— 9/01/14

-

USD/CAD - hit 3 targets in one day

— 7/25/14

USD/CAD - hit 3 targets in one day

— 7/25/14

-

Events and Hot List for the week of July 16, 2014

— 7/14/14

Events and Hot List for the week of July 16, 2014

— 7/14/14

-

FX Hot List for this week and 1 Trade Alert to start the week

— 7/07/14

FX Hot List for this week and 1 Trade Alert to start the week

— 7/07/14

-

EUR/USD Update - targets hit

— 6/29/14

EUR/USD Update - targets hit

— 6/29/14

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member